Form 8-K - Current report

09 September 2024 - 12:40PM

Edgar (US Regulatory)

0001424182false00014241822024-09-092024-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 09, 2024 |

BROADSTONE NET LEASE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-39529 |

26-1516177 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

207 High Point Drive Suite 300 |

|

Victor, New York |

|

14564 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 585 287-6500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.00025 par value |

|

BNL |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 9, 2024, Broadstone Net Lease, Inc. (the “Company”) issued a press release that included an update on recent business activity and announces participation at the Wells Fargo 13th annual net lease REIT forum. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

A press release related to the matters described in Item 2.02 of this Current Report on Form 8-K is furnished herewith as Exhibit 99.1 and hereby incorporated in this Item 7.01 by reference.

The information in Exhibit 99.1 of this Current Report on Form 8-K is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

INDEX TO EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BROADSTONE NET LEASE, INC. |

|

|

|

|

Date: |

September 9, 2024 |

By: |

/s/ John D. Callan, Jr. |

|

|

|

Name: John D. Callan, Jr.

Title: Senior Vice President, General Counsel and Secretary |

For Immediate Release

September 9, 2024

|

|

Company Contact: Brent Maedl Director, Corporate Finance & Investor Relations brent.maedl@broadstone.com 585.382.8507 |

|

Broadstone Net Lease Provides an Update on Recent Business Activity and Announces Participation at the Wells Fargo 13th Annual Net Lease REIT Forum

VICTOR, N.Y. – Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the “Company,” “we,” “our,” or “us”), today provided an update on its recent business activity through September 8, 2024. Additionally, the Company announced that BNL’s CEO, John Moragne, and CFO, Kevin Fennell, will be participating in the Wells Fargo 13th Annual Net Lease REIT Forum in New York, NY, on Monday, September 9, 2024.

SEPTEMBER 2024 BUSINESS UPDATE

•Invested $375.6 million year-to-date, including $234.3 million in new property acquisitions, $86.1 million in development fundings, $52.2 million in transitional capital, and $3.0 million in revenue generating capital expenditures. Total investments consist of $248.6 million in industrial properties, $124.0 million in retail and restaurant properties, and $3.0 million in an animal health services property.

•Committed $453.7 million to fund developments and $8.0 million to fund revenue generating capital expenditures with existing tenants as of September 8, 2024. Our commitments to fund developments include $446.0 million of industrial properties and $7.7 million of restaurant properties with varying construction start dates through 2024. We anticipate delivery and corresponding rent commencement by the end of 2025 for approximately one-third of those commitments, with the remaining two-thirds occurring in the first half of 2026.

•In conjunction with our growing development funding pipeline, we sold, on a forward basis, 2.0 million shares of our common stock for gross proceeds of approximately $36.5 million under our at-the-market common equity offering (“ATM Program”), none of which has settled. These sales may be settled, at our discretion, at any time prior to September 2025.

•Commenced contractually scheduled rent with our build-to-suit tenant, United Natural Foods, Inc. (“UNFI”), based on the substantial completion of construction in early September 2024. On a pro forma basis, including up to approximately $25.1 million of additional development closeout expenses expected to be funded during the fourth quarter of 2024, UNFI will become our number two tenant based on annualized base rent.

•Resolved ongoing negotiations with Red Lobster in connection with its bankruptcy proceedings, resulting in the assumption of our master lease agreement and continued operation of all 18 of our Red Lobster locations, representing 1.6% of ABR as of June 30, 2024.

MANAGEMENT COMMENTARY

“BNL’s positive momentum continues to build with an attractive, long-term investment pipeline and accretive capital through our ATM program,” said John Moragne, BNL’s Chief Executive Officer. “Our $453.7 million development funding pipeline will provide accretive growth in 2025 and beyond and is a critical piece of our differentiated strategy to maximize current and future earnings for our investors through our four core building blocks of growth: best-in-class portfolio rent escalations, revenue generating capital expenditures with existing tenants, development funding opportunities, and a diversified acquisition pipeline. I’m proud of what we have accomplished to date and excited for what we are building for the future.”

About Broadstone Net Lease, Inc.

BNL is an industrial-focused, diversified net lease REIT that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. Utilizing an investment strategy underpinned by strong fundamental credit analysis and prudent real estate underwriting, as of June 30, 2024, BNL’s diversified portfolio consisted of 777 individual net leased commercial properties with 770 properties located in 44 U.S. states and seven properties located in four Canadian provinces across the industrial, restaurant, healthcare, retail, and office property types.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our plans, strategies, and prospects, both business and financial. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “expect,” “intends,” “anticipates,” “estimates,” “plans,” “would be,” “believes,” “continues,” or the negative version of these words or other comparable words. Forward-looking statements, including our 2024 guidance and assumptions, involve known and unknown risks and uncertainties, which may cause BNL’s actual future results to differ materially from expected results, including, without limitation, risks and uncertainties related to general economic conditions, including but not limited to increases in the rate of inflation and/or interest rates, local real estate conditions, tenant financial health, property investments and acquisitions, and the timing and uncertainty of completing these property investments and acquisitions, and uncertainties regarding future distributions to our stockholders. These and other risks, assumptions, and uncertainties are described in Item 1A “Risk Factors” of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 22, 2024, which you are encouraged to read, and will be available on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company assumes no obligation to, and does not currently intend to, update any forward-looking statements after the date of this press release, whether as a result of new information, future events, changes in assumptions, or otherwise.

Document And Entity Information

|

Sep. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 09, 2024

|

| Entity Registrant Name |

BROADSTONE NET LEASE, INC.

|

| Entity Central Index Key |

0001424182

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39529

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

26-1516177

|

| Entity Address, Address Line One |

207 High Point Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Victor

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14564

|

| City Area Code |

585

|

| Local Phone Number |

287-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.00025 par value

|

| Trading Symbol |

BNL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

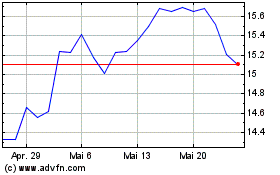

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

Von Feb 2024 bis Feb 2025