UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): June 10, 2009 (June 10, 2009)

Brown-Forman Corporation

(Exact name of registrant as specified in its charter)

Delaware 002-26821 61-0143150

(State or other (Commission (I.R.S. Employer

jurisdiction of File Number) Identification No.)

incorporation)

|

850 Dixie Highway, Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (502) 585-1100

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

Brown-Forman Corporation issued a press release today, June 10, 2009, reporting

results of its operations for the fiscal year and fiscal quarter ended April 30,

2009. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Brown-Forman Corporation Press Release dated June 10, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Brown-Forman Corporation

(Registrant)

Date: June 10, 2009 By: /s/ Nelea A. Absher

Nelea A. Absher

Vice President, Associate

General Counsel and Assistant

Corporate Secretary

|

Exhibit Index

99.1 Brown-Forman Corporation Press Release dated June 10, 2009,

reporting results of operations for the fiscal year and fiscal

quarter ended April 30, 2009

Exhibit 99.1

FOR IMMEDIATE RELEASE

BROWN-FORMAN GROWS EARNINGS PER SHARE 1% TO $2.87 - Fiscal 2009 underlying(1)

operating income increases 4%; reported operating income declines 4%

Louisville, KY, June 10, 2009 - Brown-Forman Corporation reported that diluted

earnings per share from continuing operations(2) increased 1% to $2.87 for its

year ended April 30, 2009. Reported operating income decreased 4% to $661

million for fiscal 2009. Adjusting for the items in Schedule A of this press

release, underlying operating income grew 4% for the year. Fiscal 2009 reported

operating margin (operating income as a percent of net sales) remained strong at

nearly 21%, consistent with fiscal 2008. In addition, Brown-Forman's return on

invested capital(3) approximated 16% while operating cash flows approached $500

million.

Paul Varga, the company's chief executive officer stated, "Given today's global

economy, we are pleased with our company's fiscal 2009 results. We were able to

deliver earnings growth despite significant global economic and foreign exchange

headwinds. We believe our underlying operating income growth rate continues to

be in the top tier of major wine and spirit companies. Most importantly, in an

environment where good health cannot be taken for granted, Brown-Forman remains

a strong and healthy company."

(1) Underlying growth represents the percentage growth in reported financial

results in accordance with generally accepted accounting principles (GAAP)

in the United States, adjusted for certain items. A reconciliation from

reported to underlying net sales, gross profit, advertising expense, SG&A,

and operating income (non-GAAP measures) growth for the fourth quarter and

the fiscal year, and the reasons why management believes these adjustments

to be useful to the reader, are included in Schedule A and the notes to

this press release.

(2) All per share amounts have been adjusted to reflect the October 27, 2008

Class B common stock distribution. For every four shares of Class A or

Class B common stock, one Class B share was issued. All financial and

statistical information contained in this press release relates to the

continuing operations of the company unless otherwise stated.

(3) Return on invested capital is defined as the sum of net income and

after-tax interest expense, divided by average invested capital

(defined as assets less liabilities plus interest-bearing debt).

During fiscal 2009, Brown-Forman's total shareholder returns(4) outperformed the

S&P 500's by over 20 percentage points. The company ranked at or near the top of

public spirits companies and outstripped the S&P 500 over the last five-, 10-,

and 15-year periods. Varga added, "We are proud to have a track record of

outperforming our total shareholder return benchmarks over the short term and

long term, and in good economies and bad."

Brown-Forman's reported net sales of $3.2 billion for the fiscal year ended

April 30, 2009 declined 3% when compared with fiscal 2008. Underlying net sales

grew 3% for the year. The primary brands that drove underlying net sales growth

were Jack Daniel's Tennessee Whiskey, Finlandia, Gentleman Jack, and New Mix(5).

Poland, Australia, the United Kingdom, Mexico, the United States, and Russia

were the major geographical contributors to underlying net sales growth for the

year. Despite the significant strengthening of the U.S. dollar during fiscal

2009, international revenues still contributed more than 52% of net sales.

Schedule C contains more detailed depletion(6) and net sales information by

brand.

Brown-Forman gained one percentage point of income statement leverage between

underlying sales growth of 3% and underlying operating income growth of 4%.

Benefits of price increases were partially offset by a higher cost environment

for grain and fuel. Throughout the year, the company reallocated spending and

adjusted its promotional mix to those brands, markets, and channels where it

believed the consumer and trade were most responsive to the investments during

the challenging and volatile economic environment. These adjustments included

increased spending for value-added packaging and selective consumer price

promotion programs. In addition, savings from tight management of discretionary

spending as well as lower performance-related costs, such as incentive

compensation, also contributed to the growth in operating income for the year.

(4) Refer to Schedule B for a listing of total shareholder return metrics.

(5) Tequila ready-to-drink brand acquired in January 2007 as part of

Casa Herradura.

(6) Depletions are shipments direct to retail or from distributors to wholesale

and retail customers, and are commonly regarded in the industry as an

approximate measure of consumer demand.

Brown-Forman's balance sheet remained strong and the company maintained an "A2"

rating from Moody's and an "A" rating from Standard & Poor's throughout fiscal

2009. The company's healthy balance sheet allowed it to have uninterrupted

access to commercial paper markets, to complete the sale of $250 million in

aggregate principal amount of 5% Notes in January 2009, and to repurchase $39

million of cumulative Class A and Class B Common Shares in fiscal 2009. During

fiscal 2009, Brown-Forman paid cash dividends totaling $169 million on its Class

A and Class B Common Stock representing a fiscal year increase of 7%. This marks

Brown-Forman's 63rd consecutive year of quarterly dividends and the company will

have increased its annual dividend per share for the past 25 consecutive years.

Fourth Quarter

Fiscal 2009 fourth quarter diluted earnings per share declined 19% over the same

prior year period to $0.53 and operating income decreased 10% to $121 million,

due primarily to the costs associated with the reduction in workforce and

distributor inventory reductions. Underlying operating income grew 1% for the

quarter versus the same period in fiscal 2008.

Fiscal 2010 Outlook

The company is projecting modest underlying growth in operating income for

fiscal 2010, despite an expectation that the consumer and trade environment will

continue to be challenging. Reported results are expected to be significantly

impacted by the dramatic strengthening the U.S. dollar experienced in the middle

of fiscal 2009. At recent spot rates, fiscal 2010 earnings per share would be

reduced by approximately $0.12, net of hedged foreign currency exposure. Given

the general uncertainties of the current environment, the company projects

fiscal 2010 earnings per share to be in the range of $2.60 to $3.00. The

improvement or deterioration of the global economic and consumer environment,

changes in distributor and retail inventory, and foreign exchange fluctuations

will most likely affect the company's actual performance within this range.

Commenting on the guidance, Varga said "We are assuming that the business

challenges and uncertainty of today will persist during fiscal 2010. While we

expect foreign exchange to negatively affect reported earnings and recognize the

possibility that further inventory reductions may occur, we are targeting modest

growth in underlying operating income. Longer term, we remain confident about

the growth opportunities for our brands and our company."

The following table lists the fiscal 2009 factors that the guidance assumes will

not affect fiscal 2010 earnings and illustrates the currently anticipated

factors that influence the guidance:

EPS Rollforward

Fiscal 2009 Reported EPS $2.87

Absence of Fiscal 2009 Items:

Non-cash Agave Charge 0.11

Gain on Italian Wine Divestiture (0.13)

Reduction in Workforce Charge 0.05

Fiscal 2009 Adjusted EPS(7) $2.90

Incremental Change Considering Underlying

Growth Targets and Economic Uncertainty (0.18) to 0.22

Fiscal 2010 EPS Excluding Foreign Exchange at Recent Rates $2.72 to $3.12

Estimated Foreign Exchange Impact at Recent Rates (0.12)

Fiscal 2010 EPS Guidance $2.60 to $3.00

|

Brown-Forman will host a conference call to discuss the results at 10:00 a.m.

(EDT) this morning. All interested parties in the U.S. are invited to join the

conference call by dialing 888-624-9285 and asking for the Brown-Forman call.

International callers should dial 706-679-3410 and ask for the Brown-Forman

call. No password is required. The company suggests that participants dial in

approximately ten minutes in advance of the 10:00 a.m. start of the conference

call.

A live audio broadcast of the conference call will also be available via

Brown-Forman's Internet Web site, www.brown-forman.com, through a link to

"Investor Relations." For those unable to participate in the live call, a replay

will be available by calling 800-642-1687 (U.S.) or 706-645-9291

(international). The identification code is 11887445. A digital audio recording

of the conference call will also be available on the Web site approximately one

hour after the conclusion of the conference call. The replay will be available

for at least 30 days following the conference call.

Brown-Forman Corporation is a producer and marketer of fine quality beverage

alcohol brands, including Jack Daniel's, Southern Comfort, Finlandia, Canadian

Mist, Fetzer, Korbel, Gentleman Jack, el Jimador, Tequila Herradura,

Sonoma-Cutrer, Chambord, Tuaca, Woodford Reserve, and Bonterra.

(7) We believe that excluding specific items affecting fiscal 2009 results,

which are not anticipated to impact fiscal 2010 earnings, provides helpful

information in forecasting and planning the growth expectations of the

company.

IMPORTANT NOTE ON FORWARD-LOOKING STATEMENTS:

This report contains statements, estimates, and projections that are

"forward-looking statements" as defined under U.S. federal securities laws.

Words such as "expect," "believe," "intend," "estimate," "will," "may,"

"anticipate," "project," and similar words identify forward-looking statements,

which speak only as of the date we make them. Except as required by law, we do

not intend to update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise. By their nature,

forward-looking statements involve risks, uncertainties and other factors (many

beyond our control) that could cause our actual results to differ materially

from our historical experience or from our current expectations or projections.

These risks and other factors include, but are not limited to:

- deepening or expansion of the global economic downturn or turmoil in

financial and equity markets (and related credit and capital market

instability and illiquidity; decreased consumer and trade spending; higher

unemployment; supplier, customer or consumer credit or other financial

problems; further inventory reductions by distributors, wholesalers, or

retailers; bank failures or governmental nationalizations, etc.)

- competitors' pricing actions (including price promotions, discounting,

couponing or free goods), marketing, product introductions, or other

competitive activities aimed at our brands

- trade or consumer reaction to our product line extensions or new marketing

initiatives

- further decline in consumer confidence or spending, whether related to global

economic conditions, wars, natural disasters, pandemics (such as swine flu),

terrorist attacks or other factors

- increases in tax rates (including excise, sales, corporate, individual

income, dividends, capital gains), changes in tax rules (e.g., LIFO, foreign

income deferral, U.S. manufacturing deduction) or accounting standards,

tariffs, or other restrictions affecting beverage alcohol, and the

unpredictability and suddenness with which they can occur

- trade or consumer resistance to price increases in our products

- tighter governmental restrictions on our ability to produce and market our

products, including advertising and promotion

- business disruption, decline or costs related to reductions in workforce or

other cost-cutting measures

- lower returns on pension assets, higher interest rates on debt, or

significant changes in recent inflation rates (whether up or down)

- fluctuations in the U.S. dollar against foreign currencies, especially the

British pound, euro, Australian dollar, or Polish zloty

- reduced bar, restaurant, hotel and other on-premise business; consumer shifts

to discount stores to buy our products; or other price-sensitive consumer

behavior

- changes in consumer preferences, societal attitudes or cultural trends that

result in reduced consumption of our products

- distribution arrangement changes that affect the timing of our sales or limit

our ability to market or sell our products

- adverse impacts resulting from our acquisitions, dispositions, joint

ventures, business partnerships, or portfolio strategies

- lower profits, due to factors such as fewer used barrel sales, lower

production volumes (either for our own brands or those of third parties),

or cost increases in energy or raw materials, such as grapes, grain, agave,

wood, glass, plastic, or closures

- Climatic changes, agricultural uncertainties, our suppliers' financial

hardships or other factors that reduce the availability or quality of grapes,

agave, grain, glass, closures, plastic, or wood

- negative publicity related to our company, brands, personnel, operations,

business performance or prospects

- product counterfeiting, tampering, or contamination and resulting negative

effects on our sales, brand equity, or corporate reputation

- adverse developments stemming from state, federal or other governmental

investigations of beverage alcohol industry business, trade, or marketing

practices by us, our distributors, or retailers

- impairment in the recorded value of inventory, fixed assets, goodwill

or other intangibles

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

Three Months Ended

April 30,

2008 2009 Change

------ ------ ------

CONTINUING OPERATIONS

Net sales $772.3 $683.3 (12%)

Excise taxes 165.9 146.3 (12%)

Cost of sales 205.4 178.4 (13%)

------ ------

Gross profit 401.0 358.6 (11%)

Advertising expenses 101.0 88.9 (12%)

Selling, general, and

administrative expenses 158.4 150.2 (5%)

Amortization expense 1.2 1.2

Other expense (income), net 5.0 (3.2)

------ ------

Operating income 135.4 121.5 (10%)

Interest expense, net 9.0 7.5

------ ------

Income before income taxes 126.4 114.0 (10%)

Income taxes 27.7 34.4

------ ------

Net income $ 98.7 $ 79.6 (19%)

====== ======

Earnings per share:

Basic 0.65 0.53 (19%)

Diluted 0.65 0.53 (19%)

|

DISCONTINUED OPERATIONS

Net income $ 0.4 $ --

Earnings per share:

Basic -- --

Diluted -- --

|

TOTAL COMPANY

Net income $ 99.1 $ 79.6 (20%)

Earnings per share:

Basic 0.66 0.53 (19%)

Diluted 0.65 0.53 (19%)

(more)

|

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

Year Ended

April 30,

2008 2009 Change

------ ------ ------

CONTINUING OPERATIONS

Net sales $3,282.2 $3,192.2 (3%)

Excise taxes 700.7 711.0 1%

Cost of sales 886.9 904.5 2%

------ ------

Gross profit 1,694.6 1,576.7 (7%)

Advertising expenses 415.2 383.0 (8%)

Selling, general, and

administrative expenses 591.5 547.4 (7%)

Amortization expense 5.1 5.0

Other (income), net (2.2) (19.8)

------ ------

Operating income 685.0 661.1 (4%)

Interest expense, net 41.4 31.0

------ ------

Income before income taxes 643.6 630.1 (2%)

Income taxes 204.2 195.7

------ ------

Net income $439.4 $434.4 (1%)

====== ======

Earnings per share:

Basic 2.87 2.89 1%

Diluted 2.84 2.87 1%

|

DISCONTINUED OPERATIONS

Net income $ 0.4 $ --

Earnings per share:

Basic -- --

Diluted -- --

|

TOTAL COMPANY

Net income $439.8 $434.4 (1%)

Earnings per share:

Basic 2.87 2.89 0%

Diluted 2.85 2.87 1%

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Balance Sheets

(Dollars in millions)

April 30, April 30,

2008 2009

------- -------

Assets:

Cash and cash equivalents $119 $340

Accounts receivable, net 453 367

Inventories 685 652

Other current assets 199 215

----- -----

Total current assets 1,456 1,574

Property, plant, and equipment, net 501 483

Goodwill 688 675

Other intangible assets 699 686

Other assets 61 57

----- -----

Total assets $3,405 $3,475

===== =====

Liabilities:

Accounts payable and accrued expenses $380 $326

Short-term borrowings 589 490

Other current liabilities 15 20

----- -----

Total current liabilities 984 836

Long-term debt 417 509

Deferred income taxes 89 80

Accrued postretirement benefits 121 175

Other liabilities 69 59

----- -----

Total liabilities 1,680 1,659

Stockholders' equity 1,725 1,816

----- -----

Total liabilities and stockholders' equity $3,405 $3,475

===== =====

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Statements of Cash Flows

(Dollars in millions)

Year Ended

April 30,

2008 2009

------ ------

Cash provided by operating activities $ 534 $ 491

Cash flows from investing activities:

Acquisition of brand names and trademarks (13) --

Sale of brand names and trademarks -- 17

Sale of short-term investments 86 --

Additions to property, plant, and equipment (41) (49)

Other (4) (5)

------ ------

Cash provided by (used for)

investing activities 28 (37)

Cash flows from financing activities:

Net (repayment) issuance of debt (172) (4)

Acquisition of treasury stock (223) (39)

Special distribution to stockholders (204) --

Dividends paid (158) (169)

Other 21 (4)

------ ------

Cash used for financing activities (736) (216)

Effect of exchange rate changes

on cash and cash equivalents 10 (17)

------ ------

Net (decrease) increase in

cash and cash equivalents (164) 221

Cash and cash equivalents, beginning of period 283 119

------ ------

Cash and cash equivalents, end of period $ 119 $ 340

====== ======

(more)

|

Brown-Forman Corporation

Supplemental Information (Unaudited)

(Dollars in millions, except per share amounts)

Three Months Ended

April 30,

2008 2009

------ ------

Gross margin 51.9% 52.5%

Operating margin 17.5% 17.8%

Effective tax rate 22.0% 30.2%

Cash dividends paid per common share $0.2720 $0.2875

Shares (in thousands) used in the

calculation of earnings per share

- Basic 150,962 150,050

- Diluted 152,211 150,890

Year Ended

April 30,

2008 2009

------ ------

Gross margin 51.6% 49.4%

Operating margin 20.9% 20.7%

Effective tax rate 31.7% 31.1%

Cash dividends paid per common share $1.0280 $1.1190

Shares (in thousands) used in the

calculation of earnings per share

- Basic 153,080 150,452

- Diluted 154,511 151,522

|

These figures have been prepared in accordance with the company's customary

accounting practices.

Schedule A

Brown-Forman Corporation

Continuing Operations Only

Supplemental Information (Unaudited)

Three Months Ended Twelve Months Ended

April 30, 2009 April 30, 2009

REPORTED CHANGE IN NET SALES (12%) (3%)

Australian excise tax (1%) (1%)

Impact from Italian wines divestiture 1% -

Net sales from agency brands 1% 1%

Estimated net change in distributor inventories 1% 1%

Impact of foreign currencies 10% 5%

----- -----

UNDERLYING CHANGE IN NET SALES 0% 3%

===== =====

REPORTED CHANGE IN GROSS PROFIT (11%) (7%)

Non-cash agave charge - 1%

Transition expenses from acquisitions 1% -

Gross profit from agency brands 1% 1%

Estimated net change in distributor inventories 1% 1%

Impact of foreign currencies 6% 4%

----- -----

UNDERLYING CHANGE IN GROSS PROFIT (2%) 0%

===== =====

REPORTED CHANGE IN ADVERTISING (12%) (8%)

Advertising from agency brands - 1%

Impact from Italian wines divestiture 1% 1%

Impact of foreign currencies 9% 4%

----- -----

UNDERLYING CHANGE IN ADVERTISING (2%) (2%)

===== =====

REPORTED CHANGE IN SG&A (5%) (7%)

Reduction in workforce (7%) (2%)

Transition expenses from acquisitions 1% 1%

Impact of foreign currencies 7% 3%

----- -----

UNDERLYING CHANGE IN SG&A (4%) (5%)

===== =====

REPORTED CHANGE IN OPERATING INCOME (10%) (4%)

Impact of foreign currencies (3%) 4%

Non-cash agave charge - 3%

Impact from Italian wines divestiture - (3%)

Transition expenses from acquisitions - (1%)

Operating income from agency brands 1% 1%

Estimated net change in distributor inventories 4% 2%

Reduction in workforce 9% 2%

----- -----

UNDERLYING CHANGE IN OPERATING INCOME 1% 4%

===== =====

|

Notes:

Australian excise tax - Refers to the impact of the 70% increase in excise tax

of ready-to-drink products in Australia, implemented on April 27, 2008. Since

net sales are recorded including revenues associated with excise taxes, we

believe it is important to make this adjustment to better understand our

underlying sales trends.

Italian wines divestiture - Refers to the company's December 2008 sale of its

Bolla and Fontana Candida Italian wine brands to Gruppo Italiano Vini (GIV). We

believe that excluding the net gain on the sale of, as well as the prior

incremental contribution from these Italian wine brands provides helpful

information in forecasting and planning the growth expectations of the company.

Agency brands - Refers to the impact of certain agency brands distributed in

various geographies, primarily Appleton, Amarula, Durbanville Hills, and Red

Bull, which exited Brown-Forman's portfolio during fiscal 2008.

Estimated net change in distributor inventories - Refers to the estimated

financial impact of changes in distributor inventories for the company's brands.

We compute this effect using our estimated depletion trends and separately

identify trade inventory changes in the variance analysis for our key measures.

Based on the estimated depletions and the fluctuations in distributor inventory

levels, we then adjust the percentage variances from prior to current periods

for our key measures. We believe it is important to make this adjustment in

order for management and investors to understand the results of our business

without distortions that can arise from varying levels of distributor

inventories.

Impact of foreign currencies - Refers to net gains and losses incurred by the

company relating to sales and purchases in currencies other than the U.S.

Dollar. We use the measure to understand the growth of the business on a

constant dollar basis as fluctuations in exchange rates can distort the

underlying growth of our business (both positively and negatively). To

neutralize the effect of foreign exchange fluctuations, we have historically

translated current year results at prior year rates. While we recognize that

foreign exchange volatility is a reality for a global company, we routinely

review our company performance on a constant dollar basis. We believe this

allows both management and our investors to understand better our company's

growth trends.

Non-cash agave charge - Refers to an abnormal number of agave plants identified

during the first quarter of fiscal 2009 as dead or dying. Although agricultural

uncertainties are inherent in our tequila or any other business that includes

the growth and harvesting of raw materials, we believe that the magnitude of

this item distorts the underlying trends of our business. Therefore, we believe

that excluding this non-cash charge allows for a better understanding of profit

trends.

Transition expenses from acquisitions - Refers to transition related expenses,

including a required GAAP inventory write-up, from the acquisition of the Casa

Herradura brands in January 2007, thus making comparisons difficult to

understand. We believe that excluding transition expenses related to the

acquisition provides helpful information in forecasting and planning the growth

expectations of the company.

Reduction in workforce - Refers to the $12 million of charges associated with

the 8% reduction in the global workforce, including the early retirement

program, during April 2009. We believe that excluding these costs provides

investors a better understanding of the continuing cost base of the company.

The company cautions that non-GAAP measures may be considered in addition to,

but not as a substitute for, the company's reported GAAP results.

Schedule B

Annualized Total Shareholder Returns

(Dividends Reinvested)

Period Ending April 30, 2009 1-Year 5-Year 10-Year 15-Year

Brown-Forman (Class B) (13%) 7% 7% 12%

Index Benchmarks:

S&P 500 (35%) (3%) (2%) 6%

S&P 500 Consumer Staples (20%) 1% 2% 9%

|

Major Public Wine & Spirits Competitors:

Campari

U.S. Dollar (24%) 10% NA NA

Local Currency (10%) 8& NA NA

Constellation (Class A) (37%) (7%) 6% 9%

Diageo

U.S. Dollar (39%) 1% 4% 7%

Local Currency (18%) 5% 5% 7%

Fortune Brands (40%) (9%) 3% 8%

Pernod Ricard

U.S. Dollar (44%) 6% 13% 11%

Local Currency (34%) 4% 11% 10%

Remy Cointreau

U.S. Dollar (44%) 3% 10% 2%

Local Currency (34%) 1% 8% 1%

Source: Bloomberg

|

Schedule C

Brown-Forman Corporation

Supplemental Information (Unaudited)

Fiscal 2009

Net Sales % Change vs. Fiscal 2008

Nine-Liter Depletion % Change ----------------------------------

Brand Cases (000's) vs. Fiscal 2008 Reported Constant Currency(8)

Jack Daniel's Family

of Whiskey Brands(9) 9,830 1% (2%) 4%

New Mix RTD 4,635 7% 4% 13%

Jack Daniel's RTD(10) 3,405 4% 3% 15%

Finlandia 3,030 7% 10% 12%

Southern Comfort 2,335 (5%) (11%) (3%)

Fetzer Valley Oaks 2,295 (3%) (5%) (3%)

Canadian Mist 1,850 (2%) (1%) (1%)

Korbel Champagne 1,290 (1%) (3%) (3%)

el Jimador 1,050 3% (3%) 3%

Super-Premium Other(11) 1,190 2% 1% 3%

|

Additional Commentary:

- For the Jack Daniel's Family of Whiskey Brands, depletion gains in Australia,

France, the U.S., Poland, Romania, Canada, and Mexico were partially offset

by declines in Spain, Germany, Italy, South Africa and the travel retail

channel.

- Depletions for Jack Daniel's Tennessee Whiskey showed slight growth for

fiscal 2009; reported net sales declined 3% while constant currency net sales

grew 3%.

- Gentleman Jack's net sales grew at a double-digit rate on both a reported and

constant currency basis for fiscal 2009.

- Jack Daniel's & Cola reported and constant currency net sales increases were

primarily driven by the increase in Australian ready-to-drink taxes.

- Finlandia's strong performance for depletions and net sales (on both

a reported and a constant currency basis) in Eastern Europe continued.

- Southern Comfort continued to be affected by a weak on-premise environment,

particularly in the U.S. and the U.K., as well as reductions in distributor

and trade inventory levels.

- Although super-premium priced brand performance reflected growth, depletion

growth trends slowed, particularly in the second half of the fiscal year

as they were affected by the weak consumer environment, a soft on-premise

channel, consumer trading down to lower priced products, and reductions in

distributor and retail inventory levels.

(8) Constant currency represents reported net sales with the affect of a

stronger U.S. dollar removed. Management uses the measure to understand

the growth of the business on a constant dollar basis as fluctuations in

exchange rates can distort the underlying growth of the business both

positively and negatively.

(9) Includes Jack Daniel's Tennessee Whiskey, Gentleman Jack, and Jack Daniel's

Single Barrel

(10) Refers to all ready-to-drink line extensions of Jack Daniel's such as

Jack Daniel's & Cola and Jack Daniel's Country Cocktails

(11) Includes Bonterra, Chambord, Herradura, Sonoma-Cutrer, Tuaca,

and Woodford Reserve

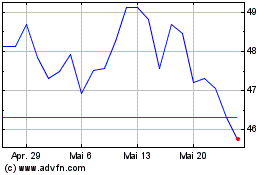

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024