BOEING COfalse0000012927929 Long Bridge DriveArlingtonVA703465-350000000129272024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 30, 2024

| | | | | | | | |

| THE BOEING COMPANY |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-442 | | 91-0425694 | |

| (State or other jurisdiction of

incorporation or organization) | | (Commission file number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | |

929 Long Bridge Drive, Arlington, VA | | 22202 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(703) 465-3500 |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

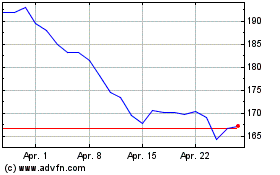

| Common Stock, $5.00 Par Value | | BA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 30, 2024, the Board of Directors (the “Board”) of The Boeing Company (the “Company”) elected Robert K. (Kelly) Ortberg to serve as President and Chief Executive Officer and as a member of the Board, in each case effective as of August 8, 2024 (the “Transition Date”).

Mr. Ortberg, 64, has more than 35 years of aerospace leadership. He joined Rockwell Collins, Inc. in 1987 as a program manager and held leadership positions of increasing responsibility at the company, including as Executive Vice President, Chief Operating Officer of Commercial Systems from 2006 to 2010; Executive Vice President, Chief Operating Officer, Government Systems from 2010 to 2012; President from 2012 to 2013; President and Chief Executive Officer from 2013 to 2015; and Chairman, President and Chief Executive Officer from 2015 to 2018. Following the integration of Rockwell Collins with United Technologies Corporation, he served as the Chief Executive Officer of Collins Aerospace, a United Technologies company, from December 2018 to February 2020. Following his retirement from Collins Aerospace, Mr. Ortberg served as a special advisor to the office of the Chief Executive Officer for RTX Corporation (formerly Raytheon Technologies Corporation) until March 2021. He earned a bachelor’s degree in mechanical engineering from the University of Iowa. Mr. Ortberg also serves on the board of Aptiv PLC, and during the past five years served on the board of RTX Corporation.

In connection with Mr. Ortberg’s election, the Board approved the following compensation elements: (i) an annual base salary rate of $1,500,000, effective as of the Transition Date; (ii) an annual incentive award target of $3,000,000 for 2025; and (iii) a long-term incentive award target of $17,500,000 for 2025. The Board also approved relocation benefits under the Company’s relocation program, as well as certain perquisites and benefits consistent with those historically provided to the position of the Company’s Chief Executive Officer, as most recently described in the Compensation Discussion and Analysis section of the Company’s proxy statement for its 2024 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on April 5, 2024.

The Board also approved the following awards for Mr. Ortberg, which will be granted as of the Transition Date:

•A cash award of $1,250,000, payable in December 2024 subject to Mr. Ortberg’s continued employment through the payment date;

•An award of restricted stock units valued at approximately $8,000,000, which will vest in three annual installments on each of the first, second and third anniversaries of the grant date, subject to Mr. Ortberg’s continued employment through the applicable vesting dates (except in the case of earlier termination due to retirement after one year of service, layoff, death or disability, in which case, either full or partial vesting will apply); and

•An award of a performance option valued at approximately $8,000,000, which will vest in three installments of 25%, 25%, and 50% on each of the second, third and fourth anniversaries of the grant date, subject to Mr. Ortberg’s continued employment through the applicable vesting dates (except in the case of earlier termination due to layoff, death or disability, in which case, full vesting will apply), and be exercisable for a per-share exercise price of 120% of the fair value of a share of Company common stock on the grant date.

These awards were granted under The Boeing Company 2023 Incentive Stock Plan and are subject to the terms and conditions set forth in the applicable notice of terms, the forms of which are filed as Exhibits 10.1, 10.2 and 10.3 and are incorporated herein by reference.

The Board also determined that Mr. Ortberg will not be subject to the Company’s mandatory retirement policy until April 1, 2031. However, there is no fixed term associated with his employment.

Mr. Ortberg has no family relationships with any director or executive officer of the Company, and there are no arrangements or understandings with any person pursuant to which he was selected as a director or officer of the Company. In addition, there are no related person transactions between Mr. Ortberg and the Company that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

Mr. Ortberg succeeds David L. Calhoun, who on July 30, 2024 tendered his resignation as President and Chief Executive Officer and as a director, effective as of the Transition Date. Mr. Calhoun will continue to be an employee of the Company and serve as a senior advisor to the Board until his retirement on March 1, 2025.

Item 7.01. Regulation FD Disclosure

A copy of the Company’s press release related to the announcements set forth under Item 5.02 is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| THE BOEING COMPANY |

| |

| By: | /s/ Dana E. Kumar |

| Dana E. Kumar |

| Assistant Corporate Secretary and Chief Counsel |

| |

| Dated: July 31, 2024 |

EXHIBIT 10.1

U.S. Notice of Terms

Cash-Based Award

To: «Participant Name»

BEMSID: «Employee_ID»

Grant Date: «Grant Date»

The Boeing Company (the “Company”) has awarded you a Cash-Based Award (the “Award”) pursuant to The Boeing Company 2023 Incentive Stock Plan, as amended and restated from time to time (the “Plan”), and the provisions contained herein (the “Notice”). Capitalized terms not otherwise defined in this Notice shall have the meaning ascribed to them in the Plan. Your Award is subject to the terms of the Plan. If there is any inconsistency between the terms of this Notice and the terms of the Plan, the Plan’s terms shall control. You are required to accept and acknowledge the terms and conditions of the Award, through the mechanism and procedures determined by the Company, as a condition to receiving the Award. The terms and conditions of the Award are as follows:

1. Cash-Based Award. Your Award is valued at $1,250,000 and is subject to the terms of the Plan. If there is any inconsistency between the terms of this Notice and the terms of the Plan, the Plan’s terms will control. Your Award is not transferable.

2. Payment of Cash-Based Award. Your Award will be paid in December 2024, subject to your continued employment through the payment date. The Company will deduct from the distribution of your Award any withholding or other taxes required by law and may deduct any amounts due from you to the Company or to any Related Company.

3. Clawback and Forfeiture Policy.

3.1 This Award is subject to the Clawback Policy adopted by the Company’s Board of Directors, as amended from time to time (the “Policy”). The Policy provides (among other things) that an Award may be subject to clawback and forfeiture (meaning that the Award must be promptly returned to the Company if already distributed, or that you will lose your entitlement to an Award if it has not yet been distributed) in the discretion of the Committee, if the Committee determines that you have (i) violated, or engaged in negligent conduct in connection with the supervision of someone who violated, any Company policy, law, or regulation that has compromised the safety of any of the Company’s products or services and has, or reasonably could be expected to have, a material adverse impact on the Company, the Company’s customers or the public; or (ii) engaged in fraud, bribery, or illegal acts like fraud or bribery, or knowingly failed to report such acts of an employee over whom you had direct supervisory responsibility. The Policy further contains provisions regarding the recovery of certain “covered compensation” (as defined in the Policy) as required pursuant to New York Stock Exchange listing standards and the Section 10D of the Securities Exchange Act of 1934, as amended, and any rules, regulations, or listing standards issued to implement the foregoing from time to time. In accepting this Award, you acknowledge that you have read the Policy, available at https://www.boeing.com/resources/boeingdotcom/principles/ethics_and_compliance/pdf/clawback-policy.pdf, that you understand its applicability to you, and that you agree to comply with the terms and conditions of the Policy as they may be applied to you.

3.2 In addition, subject to applicable law, or except as may be otherwise provided in the Addendum, this Award is subject to clawback and forfeiture in the event you engage in any of the following conduct, as determined by the Company or its delegate in its sole discretion, prior to the second anniversary of your receipt of payment of the Award: you (i) plead or admit to, are convicted of, or are otherwise found guilty of a criminal or indictable offense involving theft, fraud, embezzlement, or other similar unlawful acts against the Company or against the Company’s interests; (ii) directly or indirectly engage in competition with any aspect of Company business with which you were involved or about which you gained Company proprietary or confidential information; (iii) induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives or consultants to terminate, discontinue or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party; (iv) disparage

or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit any individual from reporting, in good faith, suspected unlawful conduct in the workplace; or (v) take, misappropriate, use or disclose Company proprietary or confidential information. Clawback can, if possible and where permitted by local law, be made by deducting payments that will become due in the future (including salary, bonuses, or share awards). Your acceptance of this Award shall constitute your acknowledgement and recognition that your compliance with this Section 3 is a condition for your receipt of this Award. For purposes of this Section 3, the Company shall include the Company and all Related Companies.

3.3 Nothing in this Section 3 will apply to legally protected communications to government agencies or statements made in the course of sworn testimony in administrative, judicial or arbitral proceedings.

4. Miscellaneous.

4.1 No Right to Continued Employment or Service. This Notice shall not confer upon you any right to continuation of employment by the Company or any Related Company nor shall this Notice interfere in any way with the Company’s or any Related Company’s right to terminate your employment at any time, except to the extent expressly provided otherwise in a written agreement between you and the Company or a Related Company.

4.2 Discretionary Nature of Plan; No Vested Rights. You acknowledge and agree that the Plan is discretionary in nature and limited in duration, and may be amended, canceled, or terminated by the Company, in its sole discretion, at any time. The grant of the Award under the Plan is a one-time benefit and does not create any contractual or other right to receive other awards or benefits in lieu of awards in the future. Future awards, if any, will be at the sole discretion of the Company, including, but not limited to, the timing of any grant, the form of award and the vesting provisions.

4.3 Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Award or other awards granted to you under the Plan by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company.

4.4 Section 409A. This Award is intended to be exempt from or otherwise comply with Section 409A of the Internal Revenue Code and the regulations and guidance issued thereunder (“Section 409A”), and shall be interpreted and construed consistently with such intent. If you are a Specified Employee (as defined by the Company for purposes of Section 409A) upon your separation from service (as defined under Section 409A), any payments that are subject to the requirements of Section 409A and payable upon such separation from service shall be delayed until six months after the date of the separation from service, to the extent required under Section 409A. Nothing in the Plan or this Notice shall be construed as a guarantee of any particular tax treatment. The Company makes no representation that the Plan, this Notice or the Award comply with Section 409A and in no event shall the Company be liable for the payment of any taxes and penalties that you may incur under Section 409A.

4.5 Employee Data Privacy. By accepting this Award, you:

(a)consent to the collection, use and transfer, in electronic or other form, of any of your personal data that is necessary to facilitate the implementation, administration and management of the Award and the Plan;

(b)understand that the Company and your employer may, for the purpose of implementing, administering and managing the Plan, hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title and details of all awards granted to you under the Plan or otherwise (“Data”);

(c)understand that Data may be transferred to any third parties assisting in the implementation, administration and management of the Plan, including any broker with whom the shares issued

on vesting of the Award may be deposited, and that these recipients may be located in your country or elsewhere, and that the recipient's country may have different data privacy laws and protections than your country; and

(d)authorize the Company, its Related Companies and its agents to store and transmit such Data in electronic form.

This notice is supplemental to the Boeing Employee Privacy Notice available here:

http://globalprivacyoffice.web.boeing.com/index.aspx?com=1&id=469

4.6 Requirements of Law. The Award and payment thereof shall be subject to, and conditioned upon, satisfaction of all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

4.7 Addendum to Notice. Notwithstanding any provisions of this Notice to the contrary, the Award shall be subject to such special terms and conditions for the state in which you reside as the Company may determine in its sole discretion and which shall be set forth in an addendum to these terms and conditions (the “Addendum”). In all circumstances, the Addendum shall constitute part of this Notice.

4.8 Governing Law. All questions concerning the construction, validity and interpretation of this Notice and the Plan shall be governed and construed according to the laws of the State of Delaware, without regard to the application of the conflicts of laws provisions thereof, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum. Any disputes regarding this Award or the Plan shall be brought only in the state or federal courts of the State of Delaware, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum.

4.9 No Interest on Distributions. No interest will accrue or be paid on any portion of a distribution with respect to your Award, regardless of when paid.

4.10 Agreement to Terms of Plan, Notice and Addendum. By accepting this Award, you acknowledge that you have read and understand this Notice, the Addendum to this Notice, and the Plan, and you specifically accept and agree to the provisions contained therein.

Addendum to U.S. Notice of Terms

Cash-Based Award

The following provisions shall modify Section 3 of the Notice for employees who reside in or are otherwise subject to the laws of California:

Clause (ii) of Section 3.2 shall not apply.

Clause (iii) of Section 3.2 shall be removed and replaced with the following: (iii) during your employment with the Company, induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives, or consultants to terminate, discontinue, or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party.

Clause (iv) of Section 3.2 shall be removed and replaced with the following: (iv) disparage or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful.

The following shall be appended to Section 3.2:

To the extent expressly required by the laws of the State of California, all questions concerning the construction, validity, and interpretation of Section 3 shall be governed and construed according to the laws of the State of California, without regard to the application of the conflicts of laws provisions thereof.

The following provisions shall modify Section 3 of the Notice for employees who reside in or are otherwise subject to the laws of Colorado or Massachusetts:

Clause (ii) of Section 3.2 shall not apply.

The following provisions shall modify Section 3 of the Notice for employees who reside in or are otherwise subject to the laws of Illinois:

The following shall be appended to Section 3.2:

For purposes of clause (ii) above, “engage in competition” shall mean, during your employment with the Company and for a period of twelve months following your last day of employment with the Company (the “Restricted Period”), providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your last day of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of Illinois or any state or territory within the United States in which you performed responsibilities for the Company and/or where the Company conducts substantial business.

A new Section 3.4 is added as follows:

You understand that the non-competition obligations under Section 3.2(ii) shall only apply to you if you earn the statutory minimum compensation set by Illinois statute (e.g., between January 1, 2021 and January 2, 2027, the statutory threshold is at least $75,000 per year).

A new Section 3.5 is added as follows:

You agree that before being required to accept and acknowledge this Notice, the Company provided you with fourteen calendar days to review it. The Company advises you to consult with an attorney before accepting and acknowledging this Notice.

A new Section 3.6 is added as follows:

You understand that if you are separated from employment with the Company due to COVID-19 or “circumstances that are similar to the COVID-19 pandemic” the Company may not enforce Section 3.2(ii) unless it pays you the compensation equivalent to your base salary at the time of your last day of employment for the Company for the Restricted Period minus any compensation you earn through subsequent employment during the Restricted Period.

The following provisions shall modify Section 3.2 of the Notice for employees who reside in or are otherwise subject to the laws of South Carolina:

The following shall be appended to Section 3.2:

For purposes of this Section 3.2, “engage in competition” shall mean providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your termination of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of South Carolina or any state or territory within the United States in which the Company conducts substantial business.

The following provisions shall modify Section 3 of the Notice for employees who reside in or are otherwise subject to the laws of Virginia:

By agreeing to the terms set forth in this Notice, you acknowledge and agree that the Award does not constitute wages for time worked.

For purposes of clause (ii) above, “engage in competition” shall mean, during your employment with the Company and for a period of twelve months following your last day of employment with the Company (the “Restricted Period”), providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same as or similar in function or purpose to the services you provided to the Company during the two years prior to your last day of employment with the Company and with respect to which you gained Company proprietary or confidential information, regardless of the geographic location. By agreeing to the terms set forth in this Notice, you acknowledge and agree that (x) the Company conducts business globally and (y) if you provided the foregoing services to a competitor during the Restricted Period you would pose a competitive threat to the Company regardless of the location of such competitor or the location from which you provide such services. Further, clause (ii) above shall not apply if you qualify as a low-wage employee pursuant to Virginia Code Section 40.1-28.7:8.

Clause (iii) shall only apply during the Restricted Period, as defined above.

The following shall replace Section 3.2 of the Notice for employees who reside in or are otherwise subject to the laws of Washington:

In addition, this Award and any gross proceeds resulting from the vesting of this Award are subject to clawback and forfeiture in the event you engage in any of the following conduct, as determined by the Company or its delegate in its sole discretion, during the Restricted Period: you (i) plead or admit to, are convicted of, or are otherwise found guilty of a criminal or indictable offense involving theft, fraud, embezzlement, or other similar unlawful acts against the Company or against the Company’s interests; (ii) directly or indirectly engage in competition; (iii) induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives or consultants to terminate, discontinue or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party; (iv) disparage or defame the Company or its products or current or former employees provided that this clause shall not be construed to prohibit any individual from reporting, in good faith, or otherwise discussing or disclosing suspected unlawful conduct in the workplace; or (v) take, misappropriate, use, or disclose Company proprietary or confidential information. Clawback can, if possible and where permitted by local law, be made by deducting payments that will become due in the future (including salary, bonuses, or share awards). Your acceptance of this Award shall constitute your acknowledgement and recognition that your compliance with this Section 3 is a condition for your receipt of this Award. For purposes of this Section 3, the Company shall include the Company and all Related Companies.

For purposes of this Section 3.2, “Restricted Period” shall mean, with respect to clauses (i), (iii), (iv), and (v) above, the period commencing on the date of the Award and ending on the second anniversary of the later of the final Vesting Date or receipt of payment of the Award, and with respect to clause (ii) above, the period commencing on the date of the Award and ending eighteen months after the later of the final Vesting Date or the receipt of payment of the Award. Notwithstanding anything herein to the contrary, clause (ii) shall not apply to you (x) following any termination of your employment by reason of layoff, or (y) during any year if you had annualized W-2 total earnings from the Company of $100,000 (or such dollar amount following adjustment for inflation as required by applicable Washington law) or less during the prior year, determined in accordance with applicable Washington law. For purposes of this Section 3.2, “engage in competition” shall mean providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your termination of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of Washington or any state or territory within the United States in which the Company conducts substantial business.

All questions concerning the construction, validity, and interpretation of clause (ii) above shall be governed and construed according to the laws of the State of Washington, without regard to the application of the conflicts of laws provisions thereof. Any disputes regarding the construction, validity and interpretation of clause (ii) above shall be brought only in the state or federal courts of the State of Washington.

Acknowledgement and Acceptance

I acknowledge that I have read and understand this Notice, the Addendum, and the Plan, and I accept and agree to the provisions contained therein.

Name: ______________________________________________

Signature: ______________________________________________

Date: ______________________________________________

EXHIBIT 10.2

U.S. Notice of Terms

Supplemental Restricted Stock Units

To: «Participant Name»

BEMSID: «Employee_ID»

Grant Date: «Grant Date»

The Boeing Company (the “Company”) has awarded you a Supplemental Restricted Stock Unit award (the “Award”) pursuant to The Boeing Company 2023 Incentive Stock Plan, as amended and restated from time to time (the “Plan”), and the provisions contained herein (the “Notice”). Capitalized terms not otherwise defined in this Notice shall have the meaning ascribed to them in the Plan. Your Award is subject to the terms of the Plan. If there is any inconsistency between the terms of this Notice and the terms of the Plan, the Plan’s terms shall control. You are required to accept and acknowledge the terms and conditions of the Award, through the mechanism and procedures determined by the Company, as a condition to receiving the Award. The terms and conditions of the Award are as follows:

1. RSU Award. You have been awarded «RSU #» Supplemental Restricted Stock Units (“RSUs”). Each RSU corresponds to one share of Common Stock.

2. RSU Account. The Company will maintain a record of the number of awarded RSUs in an account established in your name.

3. Vesting of RSUs. Subject to Sections 6 and 7, your RSUs will vest in three installments of 33%, 33%, and 34% on each of the first, second, and third anniversaries of the Grant Date (or, if any such date is not a date on which the New York Stock Exchange is open for trading, the next following trading day) (each such date on which vesting may occur, a “Vesting Date”). As soon as reasonably practicable following the applicable Vesting Date, you shall receive a number of shares of Common Stock equal to the aggregate number of RSUs that vest as of such date, subject to the requirements of Section 9. Subject to the terms and conditions outlined under Sections 6 and 7, this Award is granted on the condition that you remain continuously employed by the Company or a Related Company from the Grant Date through the applicable Vesting Date(s).

4. Dividend Equivalents.

4.1 While RSUs are in your account, they will earn dividend equivalents in the form of additional RSUs. Specifically, as of each dividend payment date for Common Stock, your RSU account will be credited with additional RSUs (“dividend equivalent RSUs”) equal in number to the number of shares of Common Stock that could be bought with the cash dividends that would be paid on the RSUs in your account if each RSU were one share of Common Stock on the applicable dividend payment date.

4.2 The number of shares of Common Stock that could be bought with the cash dividends will be calculated to two decimal places and will be based on the “Fair Market Value” of a share of Common Stock on the applicable dividend payment date. For purposes of this Award, “Fair Market Value” means the average of the high and the low per share trading prices for Common Stock as reported by The Wall Street Journal for the specific dividend payment date, or by such other source as the Company deems reliable.

4.3 Dividend equivalent RSUs will vest at the same time and in the same manner as the RSUs with which they are associated and will be subject to the same terms as the RSUs. All references to RSUs in this Notice shall be deemed to include any credited dividend equivalent RSUs, except where the context clearly indicates otherwise.

5. Adjustment in Number of RSUs. The number of RSUs in your account will be adjusted proportionately for any increase or decrease in the number of issued shares of Common Stock resulting from any stock split, combination or exchange of Common Stock, consolidation, spin-off or recapitalization of Common Stock, or any similar capital adjustment or the payment of any stock dividend.

6. Impact of Certain Terminations.

6.1 In the event your employment is terminated prior to a Vesting Date by reason of retirement or layoff on or after attaining age 62 with at least one year of service, and provided (in the case of retirement) that you have given the Company sufficient advance notice of your retirement (i.e., at least 60 days), you will remain eligible to vest in, and receive distribution of, your unvested RSUs in accordance with Section 3 as though you had continued employment through that Vesting Date.

6.2 In the event your employment is terminated prior to a Vesting Date by reason of layoff prior to attaining at least age 62 with at least one year of service, your unvested RSUs will be prorated based on the number of full and partial calendar months you spent on the active payroll during the applicable vesting period (beginning with the first full calendar month after the Grant Date), and you will remain eligible to vest in, and receive distribution of, your unvested prorated RSUs in accordance with Section 3 as through you had continued employment through that Vesting Date.

6.3 In the event your employment is terminated prior to a Vesting Date by reason of death or disability, you will immediately vest in your unvested RSUs, and distribution will occur as soon as reasonably practicable following your termination of employment. For purposes of this Award, “disability” means a disability entitling you to benefits under any long-term disability policy sponsored by the Company or a Related Company.

7. Forfeiture Upon Other Terminations. In the event your employment is terminated prior to a Vesting Date for any reason (including for cause and resignation) other than those reasons described in Section 6, all unvested RSUs shall immediately be forfeited and canceled without consideration.

8. Leave of Absence. Unless otherwise required by applicable law, in the event that you take a leave or leaves of absence during the vesting period and such aggregate leave period exceeds 180 days in duration, your unvested RSUs will be subject to proration based on the number of leave days during the vesting period that exceed 180 days, as compared against the total number of days during the vesting period.

9. RSU Award Payable in Stock.

9.1 Distribution from your RSU account will be made as soon as reasonably practicable after the applicable Vesting Date, except as otherwise provided in Section 6. The number of shares distributed will be equal to the number of vested RSUs in your account, subject to deductions described in Section 9.2.

9.2 The Company will deduct from your vested RSUs any withholding or other taxes required by applicable law and may deduct any amounts due from you to the Company or to any Related Company.

9.3 In the event you transfer from the US based payroll to a country in which RSUs are not settled in shares of Common Stock and you are scheduled for an RSU payout under Section 3 or 6 above while in such country, your distribution will be paid in cash based on an applicable currency conversion methodology or policy as may be established by the Company from time to time.

9.4 Neither you nor any person claiming under or through you will have any of the rights or privileges of a shareholder of the Company in respect of any shares of Common Stock deliverable

under this Notice unless and until shares have been issued and recorded on the records of the Company or its transfer agents or registrars.

10. Transferability. RSUs are not transferable except by will or by laws of descent and distribution. You may designate a beneficiary to receive your Award in the event of your death. To be valid, a beneficiary designation with respect to your Award must be properly submitted through the Stock Plan Administrator in accordance with the Stock Plan Administrator’s procedures. The current Stock Plan Administrator is Fidelity Stock Plan Services, LLC and certain of its affiliated entities.

11. Clawback and Forfeiture Policy.

11.1 This Award and any gross proceeds resulting from the vesting of this Award are subject to the Clawback Policy adopted by the Company’s Board of Directors, as amended from time to time (the “Policy”). The Policy provides (among other things) that an Award may be subject to clawback and forfeiture (meaning that the Award or gross proceeds thereof must be promptly returned to the Company if already distributed, or that you will lose your entitlement to an Award if it has not yet been distributed) in the discretion of the Committee, if the Committee determines that you have (i) violated, or engaged in negligent conduct in connection with the supervision of someone who violated, any Company policy, law, or regulation that has compromised the safety of any of the Company’s products or services and has, or reasonably could be expected to have, a material adverse impact on the Company, the Company’s customers or the public; or (ii) engaged in fraud, bribery, or illegal acts like fraud or bribery, or knowingly failed to report such acts of an employee over whom you had direct supervisory responsibility. The Policy further contains provisions regarding the recovery of certain “covered compensation” (as defined in the Policy) as required pursuant to New York Stock Exchange listing standards and the Section 10D of the Securities Exchange Act of 1934, as amended, and any rules, regulations, or listing standards issued to implement the foregoing from time to time. In accepting this Award, you acknowledge that you have read the Policy, available at https://www.boeing.com/resources/boeingdotcom/principles/ethics_and_compliance/pdf/clawback-policy.pdf, that you understand its applicability to you, and that you agree to comply with the terms and conditions of the Policy as they may be applied to you.

11.2 In addition, subject to applicable law, or except as may be otherwise provided in the Addendum, this Award and any gross proceeds resulting from the vesting of this Award are subject to clawback and forfeiture in the event you engage in any of the following conduct, as determined by the Company or its delegate in its sole discretion, prior to the second anniversary of the later of the final Vesting Date or receipt of payment of the Award: you (i) plead or admit to, are convicted of, or are otherwise found guilty of a criminal or indictable offense involving theft, fraud, embezzlement, or other similar unlawful acts against the Company or against the Company’s interests; (ii) directly or indirectly engage in competition with any aspect of Company business with which you were involved or about which you gained Company proprietary or confidential information; (iii) induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives or consultants to terminate, discontinue or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party; (iv) disparage or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit any individual from reporting, in good faith, suspected unlawful conduct in the workplace; or (v) take, misappropriate, use or disclose Company proprietary or confidential information. Clawback can, if possible and where permitted by local law, be made by deducting payments that will become due in the future (including salary, bonuses, or share awards). Your acceptance of this Award shall constitute your acknowledgement and recognition that your compliance with this Section 11 is a condition for your receipt of this Award. For purposes of this Section 11, the Company shall include the Company and all Related Companies.

11.3 Nothing in this Section 11 will apply to legally protected communications to government agencies or statements made in the course of sworn testimony in administrative, judicial or arbitral proceedings.

12. Miscellaneous.

12.1 No Right to Continued Employment or Service. This Notice shall not confer upon you any right to continuation of employment by the Company or any Related Company nor shall this Notice interfere in any way with the Company’s or any Related Company’s right to terminate your employment at any time, except to the extent expressly provided otherwise in a written agreement between you and the Company or a Related Company.

12.2 Discretionary Nature of Plan; No Vested Rights. You acknowledge and agree that the Plan is discretionary in nature and limited in duration, and may be amended, canceled, or terminated by the Company, in its sole discretion, at any time. The grant of the Award under the Plan is a one-time benefit and does not create any contractual or other right to receive other awards or benefits in lieu of awards in the future. Future awards, if any, will be at the sole discretion of the Company, including, but not limited to, the timing of any grant, the form of award and the vesting provisions.

12.3 Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Award or other awards granted to you under the Plan by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company.

12.4 Section 409A. This Award is intended to be exempt from or otherwise comply with Section 409A of the Internal Revenue Code and the regulations and guidance issued thereunder (“Section 409A”), and shall be interpreted and construed consistently with such intent. If you are a Specified Employee (as defined by the Company for purposes of Section 409A) upon your separation from service (as defined under Section 409A), any payments that are subject to the requirements of Section 409A and payable upon such separation from service shall be delayed until six months after the date of the separation from service, to the extent required under Section 409A. Nothing in the Plan or this Notice shall be construed as a guarantee of any particular tax treatment. The Company makes no representation that the Plan, this Notice or the RSUs comply with Section 409A and in no event shall the Company be liable for the payment of any taxes and penalties that you may incur under Section 409A.

12.5 Employee Data Privacy. By accepting this Award, you:

(a)consent to the collection, use and transfer, in electronic or other form, of any of your personal data that is necessary to facilitate the implementation, administration and management of the Award and the Plan;

(b)understand that the Company and your employer may, for the purpose of implementing, administering and managing the Plan, hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title and details of all awards or entitlement to the Common Stock granted to you under the Plan or otherwise (“Data”);

(c)understand that Data may be transferred to any third parties assisting in the implementation, administration and management of the Plan, including any broker with whom the shares issued on vesting of the Award may be deposited, and that these recipients may be located in your country or elsewhere, and that the recipient's country may have different data privacy laws and protections than your country; and

(d)authorize the Company, its Related Companies and its agents to store and transmit such Data in electronic form.

This notice is supplemental to the Boeing Employee Privacy Notice available here:

http://globalprivacyoffice.web.boeing.com/index.aspx?com=1&id=469

12.6 Requirements of Law. The Award and payment thereof shall be subject to, and conditioned upon, satisfaction of all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

12.7 Addendum to Notice. Notwithstanding any provisions of this Notice to the contrary, the Award shall be subject to such special terms and conditions for the state in which you reside as the Company may determine in its sole discretion and which shall be set forth in an addendum to these terms and conditions (the “Addendum”). In all circumstances, the Addendum shall constitute part of this Notice.

12.8 Governing Law. All questions concerning the construction, validity and interpretation of this Notice and the Plan shall be governed and construed according to the laws of the State of Delaware, without regard to the application of the conflicts of laws provisions thereof, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum. Any disputes regarding this Award or the Plan shall be brought only in the state or federal courts of the State of Delaware, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum.

12.9 No Interest on Distributions. No interest will accrue or be paid on any portion of a distribution with respect to your Award, regardless of when paid.

12.10 Agreement to Terms of Plan, Notice and Addendum. By accepting this Award, you acknowledge that you have read and understand this Notice, the Addendum to this Notice, and the Plan, and you specifically accept and agree to the provisions contained therein.

Addendum to U.S. Notice of Terms

Supplemental Restricted Stock Units

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of California:

Clause (ii) of Section 11.2 shall not apply.

Clause (iii) of Section 11.2 shall be removed and replaced with the following: (iii) during your employment with the Company, induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives, or consultants to terminate, discontinue, or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party.

Clause (iv) of Section 11.2 shall be removed and replaced with the following: (iv) disparage or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful.

The following shall be appended to Section 11.2:

To the extent expressly required by the laws of the State of California, all questions concerning the construction, validity, and interpretation of Section 11 shall be governed and construed according to the laws of the State of California, without regard to the application of the conflicts of laws provisions thereof.

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of Colorado or Massachusetts:

Clause (ii) of Section 11.2 shall not apply.

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of Illinois:

The following shall be appended to Section 11.2:

For purposes of clause (ii) above, “engage in competition” shall mean, during your employment with the Company and for a period of twelve months following your last day of employment with the Company (the “Restricted Period”), providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your last day of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of Illinois or any state or territory within the United States in which you performed responsibilities for the Company and/or where the Company conducts substantial business.

A new Section 11.4 is added as follows:

You understand that the non-competition obligations under Section 11.2(ii) shall only apply to you if you earn the statutory minimum compensation set by Illinois statute (e.g., between January 1, 2021 and January 2, 2027, the statutory threshold is at least $75,000 per year).

A new Section 11.5 is added as follows:

You agree that before being required to accept and acknowledge this Notice, the Company provided you with fourteen calendar days to review it. The Company advises you to consult with an attorney before accepting and acknowledging this Notice.

A new Section 11.6 is added as follows:

You understand that if you are separated from employment with the Company due to COVID-19 or “circumstances that are similar to the COVID-19 pandemic” the Company may not enforce Section 11.2(ii) unless it pays you the compensation equivalent to your base salary at the time of your last day of employment for the Company for the Restricted Period minus any compensation you earn through subsequent employment during the Restricted Period.

The following provisions shall modify Section 11.2 of the Notice for employees who reside in or are otherwise subject to the laws of South Carolina:

The following shall be appended to Section 11.2:

For purposes of this Section 11.2, “engage in competition” shall mean providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your termination of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of South Carolina or any state or territory within the United States in which the Company conducts substantial business.

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of Virginia:

By agreeing to the terms set forth in this Notice, you acknowledge and agree that the Award does not constitute wages for time worked.

For purposes of clause (ii) above, “engage in competition” shall mean, during your employment with the Company and for a period of twelve months following your last day of employment with the Company (the “Restricted Period”), providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same as or similar in function or purpose to the services you provided to the Company during the two years prior to your last day of employment with the Company and with respect to which you gained Company proprietary or confidential information, regardless of the geographic location. By agreeing to the terms set forth in this Notice, you acknowledge and agree that (x) the Company conducts business globally and (y) if you provided the foregoing services to a competitor during the Restricted Period you would pose a competitive threat to the Company regardless of the location of such competitor or the location from which you provide such services. Further, clause (ii) above shall not apply if you qualify as a low-wage employee pursuant to Virginia Code Section 40.1-28.7:8.

Clause (iii) shall only apply during the Restricted Period, as defined above.

The following shall replace Section 11.2 of the Notice for employees who reside in or are otherwise subject to the laws of Washington:

In addition, this Award and any gross proceeds resulting from the vesting of this Award are subject to clawback and forfeiture in the event you engage in any of the following conduct, as determined by the Company or its delegate in its sole discretion, during the Restricted Period: you (i) plead or admit to, are convicted of, or are otherwise found guilty of a criminal or indictable offense involving theft, fraud, embezzlement, or other similar unlawful acts against the Company or against the Company’s interests; (ii) directly or indirectly engage in competition; (iii) induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives or consultants to terminate, discontinue or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party; (iv) disparage or defame the Company or its products or current or former employees provided that this clause shall not be construed to prohibit any individual from reporting, in good faith, or otherwise discussing or disclosing suspected unlawful conduct in the workplace; or (v) take, misappropriate, use, or disclose Company proprietary or confidential information. Clawback can, if possible and where permitted by local law, be made by deducting payments that will

become due in the future (including salary, bonuses, or share awards). Your acceptance of this Award shall constitute your acknowledgement and recognition that your compliance with this Section 11 is a condition for your receipt of this Award. For purposes of this Section 11, the Company shall include the Company and all Related Companies.

For purposes of this Section 11.2, “Restricted Period” shall mean, with respect to clauses (i), (iii), (iv), and (v) above, the period commencing on the date of the Award and ending on the second anniversary of the later of the final Vesting Date or receipt of payment of the Award, and with respect to clause (ii) above, the period commencing on the date of the Award and ending eighteen months after the later of the final Vesting Date or the receipt of payment of the Award. Notwithstanding anything herein to the contrary, clause (ii) shall not apply to you (x) following any termination of your employment by reason of layoff, or (y) during any year if you had annualized W-2 total earnings from the Company of $100,000 (or such dollar amount following adjustment for inflation as required by applicable Washington law) or less during the prior year, determined in accordance with applicable Washington law. For purposes of this Section 11.2, “engage in competition” shall mean providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your termination of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of Washington or any state or territory within the United States in which the Company conducts substantial business.

All questions concerning the construction, validity, and interpretation of clause (ii) above shall be governed and construed according to the laws of the State of Washington, without regard to the application of the conflicts of laws provisions thereof. Any disputes regarding the construction, validity and interpretation of clause (ii) above shall be brought only in the state or federal courts of the State of Washington.

Acknowledgement and Acceptance

I acknowledge that I have read and understand this Notice, the Addendum, and the Plan, and I accept and agree to the provisions contained therein.

Name: ______________________________________________

Signature: ______________________________________________

Date: ______________________________________________

EXHIBIT 10.3

U.S. Notice of Terms

Performance Non-Qualified Stock Option

To: «Participant Name»

BEMSID: «Employee_ID»

Grant Date: «Grant Date»

The Boeing Company (the “Company”) has awarded you an option to purchase shares of the Company’s common stock (the “Option”) pursuant to The Boeing Company 2023 Incentive Stock Plan, as amended and restated from time to time (the “Plan”), and the provisions contained herein (the “Notice”). Capitalized terms not otherwise defined in this Notice shall have the meaning ascribed to them in the Plan. Your Option is subject to the terms of the Plan. If there is any inconsistency between the terms of this Notice and the terms of the Plan, the Plan’s terms shall control. You are required to accept and acknowledge the terms and conditions of the Option, through the mechanism and procedures determined by the Company, as a condition to receiving the Option. The terms and conditions of the Option are as follows:

1. Number of Shares Subject to Option. The Option gives you the right to purchase up to «Option #» shares of the Company’s common stock (the “Common Stock”) at the exercise price and on the terms set forth in this Notice.

2. Exercise Price. The exercise price per share is $«Exercise Price1».

3. Type of Option. The Option is granted as a non-qualified stock option. Non-qualified stock options are considered ordinary income when exercised and are taxed accordingly. The amount of ordinary income is the difference between the exercise price and the price on the date the Option or a portion of it is exercised.

4. Vesting and Exercisability of Option. The Option will vest and become exercisable as follows:

•With respect to 25% of the shares subject to the Option, on the second anniversary of the Grant Date, provided that you have remained continuously employed by the Company through the applicable vesting date (any such date on which vesting may occur, a “Vesting Date”).

•With respect to an additional 25% of the shares subject to the Option, on the third anniversary of the Grant Date, provided that you have remained continuously employed by the Company through the Vesting Date.

•With respect to the remaining 50% of the shares subject to the Option, on the fourth anniversary of the Grant Date, provided that you have remained continuously employed by the Company through the Vesting Date.

5. Adjustment in Number of Shares Subject to Option. The number of shares subject to the Option will be adjusted proportionately for any increase or decrease in the number of issued shares of Common Stock resulting from any stock split, combination or exchange of Common Stock, consolidation, spin-off or recapitalization of Common Stock, or any similar capital adjustment or the payment of any stock dividend.

6. Impact of Certain Terminations.

6.1 In the event your employment is terminated prior to a Vesting Date by reason of layoff, death, or disability, any unvested portion of your Option will vest in full on your termination date. For purposes of this Option, “disability” means a disability entitling you to benefits under any long-term disability policy sponsored by the Company or a Related Company.

1 Will be calculated as 120% of the average of the high and low trading prices of a share of Common Stock on the Grant Date.

6.2 In the event your employment is terminated prior to a Vesting Date for any reason (including for cause and resignation) other than those reasons described in Section 6.1, any unvested portion of your Option and all rights to exercise the Option will immediately be forfeited and canceled without consideration.

7. Expiration of Vested Option. As long as you remain employed by the Company or a Related Company, any vested portion of your Option will expire after the tenth anniversary of the Grant Date.

7.1 If your employment with the Company terminates due to layoff, disability, or death, any vested portion of your Option will expire at the earlier of five years from your termination date or the tenth anniversary of the Grant Date.

7.2 If your employment with the Company is involuntarily terminated for cause, any vested portion of your Option will expire upon your termination and immediately become unexercisable.

7.3 If your employment with the Company terminates for any reason other than those reasons described above in this Section 7, any vested portion of your Option will expire at the earlier of 90 days from your termination date or the tenth anniversary of the Grant Date.

8. Method of Exercise.

8.1 You may exercise the Option by giving written notice to the Company, in form and substance satisfactory to the Company, which will state your election to exercise the Option and the number of whole shares for which you are exercising the Option, and by completing such other documents and procedures as may be required by the Company for exercise of the Option. The notice must be accompanied by full payment of the exercise price for the number of shares you are purchasing. Except as may be prohibited by applicable law, you may make this payment in any one or combination of the following:

(a) wire transfer;

(b) tendering by attestation shares of Common Stock you already own that on the day prior to the exercise date have a Fair Market Value equal to the aggregate exercise price of the shares being purchased under the Option;

(c) delivery of a properly executed exercise notice, together with irrevocable instructions to a brokerage firm designated or approved by the Company to deliver promptly to the Company the aggregate amount of sale or loan proceeds to pay the Option exercise price and any tax withholding obligations that may arise in connection with the exercise, all in accordance with the regulations of the Federal Reserve Board; or

(d) any other method as the Committee may permit in its sole discretion.

8.2 It is your responsibility to be aware of your Option’s expiration date so that you may consider whether or not to exercise the Option before it expires. Notwithstanding the foregoing, if on the Option’s expiration date the closing price of one share of the Common Stock exceeds the per share Exercise Price, you have not exercised the Option and the Option has not expired, you will be deemed to have exercised the Option on such day with payment made by withholding the shares otherwise issuable in connection with the exercise of the Option. In such event, the Company shall deliver to you the number of shares for which the Option was deemed exercised, less the number of shares required to be withheld for the payment of the total purchase price and required withholding taxes. For the avoidance of doubt, this provision shall not apply to any Option that expires and immediately becomes unexercisable pursuant to Section 7.2.

9. Withholding Taxes. As a condition to the exercise of any portion of an Option, you must make such arrangements as the Company may require for the satisfaction of any federal, state, provincial, local or foreign withholding tax obligations that may arise in connection with such exercise.

10. Transferability. The Option is not transferable except by will or by laws of descent and distribution and during your lifetime the Option may be exercised only by you, your guardian or your legal representative. The Plan permits exercise of the Option by the personal representative of your estate or the beneficiary thereof following your death. The Option may not be exercised for less than a

reasonable number of shares at any one time, as determined by the Compensation Committee. You may designate a beneficiary who may exercise the Option after your death. To be valid, a beneficiary designation with respect to your Option must be properly submitted through the Stock Plan Administrator in accordance with the Stock Plan Administrator’s procedures. The current Stock Plan Administrator is Fidelity Stock Plan Services, LLC and certain of its affiliated entities.

11. Clawback and Forfeiture Policy.

11.1 This Option and any gross proceeds resulting from the vesting of this Option are subject to the Clawback Policy adopted by the Company’s Board of Directors, as amended from time to time (the “Policy”). The Policy provides (among other things) that an Option may be subject to clawback and forfeiture (meaning that the Option or gross proceeds thereof must be promptly returned to the Company if already exercised, or that you will lose your entitlement to an Option if it has not yet been exercised) in the discretion of the Committee, if the Committee determines that you have (i) violated, or engaged in negligent conduct in connection with the supervision of someone who violated, any Company policy, law, or regulation that has compromised the safety of any of the Company’s products or services and has, or reasonably could be expected to have, a material adverse impact on the Company, the Company’s customers or the public; or (ii) engaged in fraud, bribery, or illegal acts like fraud or bribery, or knowingly failed to report such acts of an employee over whom you had direct supervisory responsibility. The Policy further contains provisions regarding the recovery of certain “covered compensation” (as defined in the Policy) as required pursuant to New York Stock Exchange listing standards and the Section 10D of the Securities Exchange Act of 1934, as amended, and any rules, regulations, or listing standards issued to implement the foregoing from time to time. In accepting this Option, you acknowledge that you have read the Policy, available at https://www.boeing.com/resources/boeingdotcom/principles/ethics_and_compliance/pdf/clawback-policy.pdf, that you understand its applicability to you, and that you agree to comply with the terms and conditions of the Policy as they may be applied to you.

11.2 In addition, subject to applicable law, or except as may be otherwise provided in the Addendum, this Option and any gross proceeds resulting from the vesting or exercise of this Option are subject to clawback and forfeiture in the event you engage in any of the following conduct, as determined by the Company or its delegate in its sole discretion, prior to the second anniversary of the later of the Vesting Date or the latest date on which the Option was exercised: you (i) plead or admit to, are convicted of, or are otherwise found guilty of a criminal or indictable offense involving theft, fraud, embezzlement, or other similar unlawful acts against the Company or against the Company’s interests; (ii) directly or indirectly engage in competition with any aspect of Company business with which you were involved or about which you gained Company proprietary or confidential information; (iii) induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives or consultants to terminate, discontinue or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party; (iv) disparage or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit any individual from reporting, in good faith, suspected unlawful conduct in the workplace; or (v) take, misappropriate, use or disclose Company proprietary or confidential information. Clawback can, if possible and where permitted by local law, be made by deducting payments that will become due in the future (including salary, bonuses, or share awards). Your acceptance of this Option shall constitute your acknowledgement and recognition that your compliance with this Section 11 is a condition for your receipt of this Option. For purposes of this Section 11, the Company shall include the Company and all Related Companies.

11.3 Nothing in this Section 11 will apply to legally protected communications to government agencies or statements made in the course of sworn testimony in administrative, judicial or arbitral proceedings.

12. Miscellaneous.

12.1 No Right to Continued Employment or Service. This Notice shall not confer upon you any right to continuation of employment by the Company or any Related Company nor shall this Notice interfere in any way with the Company’s or any Related Company’s right to terminate your employment

at any time, except to the extent expressly provided otherwise in a written agreement between you and the Company or a Related Company.

12.2 Discretionary Nature of Plan; No Vested Rights. You acknowledge and agree that the Plan is discretionary in nature and limited in duration, and may be amended, cancelled, or terminated by the Company, in its sole discretion, at any time. The grant of the Option under the Plan is a one-time benefit and does not create any contractual or other right to receive other awards or benefits in lieu of awards in the future. Future awards, if any, will be at the sole discretion of the Company, including, but not limited to, the timing of any grant, the form of award and the vesting provisions.

12.3 Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Option or other awards granted to you under the Plan by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company.

12.4 Section 409A. This Option is intended to be exempt from or otherwise comply with Section 409A of the Internal Revenue Code and the regulations and guidance issued thereunder (“Section 409A”), and shall be interpreted and construed consistently with such intent. If you are a Specified Employee (as defined by the Company for purposes of Section 409A) upon your separation from service (as defined under Section 409A), any payments that are subject to the requirements of Section 409A and payable upon such separation from service shall be delayed until six months after the date of the separation from service, to the extent required under Section 409A. Nothing in the Plan or this Notice shall be construed as a guarantee of any particular tax treatment. The Company makes no representation that the Plan, this Notice or the Option comply with Section 409A and in no event shall the Company be liable for the payment of any taxes and penalties that you may incur under Section 409A.

12.5 Employee Data Privacy. By accepting this Option, you:

(a)consent to the collection, use and transfer, in electronic or other form, of any of your personal data that is necessary to facilitate the implementation, administration and management of the Option and the Plan;

(b)understand that the Company and your employer may, for the purpose of implementing, administering and managing the Plan, hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title and details of all awards or entitlement to the Common Stock granted to you under the Plan or otherwise (“Data”);

(c)understand that Data may be transferred to any third parties assisting in the implementation, administration and management of the Plan, including any broker with whom the shares issued on exercise of the Option may be deposited, and that these recipients may be located in your country or elsewhere, and that the recipient's country may have different data privacy laws and protections than your country; and

(d)authorize the Company, its Related Companies and its agents to store and transmit such Data in electronic form.

This notice is supplemental to the Boeing Employee Privacy Notice available here:

http://globalprivacyoffice.web.boeing.com/index.aspx?com=1&id=469

12.6 Requirements of Law. The Option and exercise thereof shall be subject to, and conditioned upon, satisfaction of all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

12.7 Addendum to Notice. Notwithstanding any provisions of this Notice to the contrary, the Option shall be subject to such special terms and conditions for the state in which you reside as the Company may determine in its sole discretion and which shall be set forth in an addendum to these

terms and conditions (the “Addendum”). In all circumstances, the Addendum shall constitute part of this Notice.

12.8 Governing Law. All questions concerning the construction, validity and interpretation of this Notice and the Plan shall be governed and construed according to the laws of the State of Delaware, without regard to the application of the conflicts of laws provisions thereof, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum. Any disputes regarding this Option or the Plan shall be brought only in the state or federal courts of the State of Delaware, except as may be expressly required by other applicable law or as may be otherwise provided in the Addendum.

12.9 Agreement to Terms of Plan, Notice and Addendum. By your acceptance of the Option as described above, you acknowledge that you have read and understand this Notice, the Addendum to this Notice, and the Plan, and you specifically accept and agree to the provisions contained therein.

Addendum to U.S. Notice of Terms

Performance Non-Qualified Stock Option

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of California:

Clause (ii) of Section 11.2 shall not apply.

Clause (iii) of Section 11.2 shall be removed and replaced with the following: (iii) during your employment with the Company, induce or attempt to induce, directly or indirectly, any of the Company’s employees, representatives, or consultants to terminate, discontinue, or cease working with or for the Company, or to breach any contract with the Company, in order to work with or for, or enter into a contract with, you or any third party.

Clause (iv) of Section 11.2 shall be removed and replaced with the following: (iv) disparage or defame the Company or its products or current or former employees, provided that this clause shall not be construed to prohibit you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful.

The following shall be appended to Section 11.2:

To the extent expressly required by the laws of the State of California, all questions concerning the construction, validity, and interpretation of Section 11 shall be governed and construed according to the laws of the State of California, without regard to the application of the conflicts of laws provisions thereof.

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of Colorado or Massachusetts:

Clause (ii) of Section 11.2 shall not apply.

The following provisions shall modify Section 11 of the Notice for employees who reside in or are otherwise subject to the laws of Illinois:

The following shall be appended to Section 11.2:

For purposes of clause (ii) above, “engage in competition” shall mean, during your employment with the Company and for a period of twelve months following your last day of employment with the Company (the “Restricted Period”), providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your last day of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of Illinois or any state or territory within the United States in which you performed responsibilities for the Company and/or where the Company conducts substantial business.

A new Section 11.4 is added as follows:

You understand that the non-competition obligations under Section 11.2(ii) shall only apply to you if you earn the statutory minimum compensation set by Illinois statute (e.g., between January 1, 2021 and January 2, 2027, the statutory threshold is at least $75,000 per year).

A new Section 11.5 is added as follows:

You agree that before being required to accept and acknowledge this Notice, the Company provided you with fourteen calendar days to review it. The Company advises you to consult with an attorney before accepting and acknowledging this Notice.

A new Section 11.6 is added as follows:

You understand that if you are separated from employment with the Company due to COVID-19 or “circumstances that are similar to the COVID-19 pandemic” the Company may not enforce Section 11.2(ii) unless it pays you the compensation equivalent to your base salary at the time of your last day

of employment for the Company for the Restricted Period minus any compensation you earn through subsequent employment during the Restricted Period.

The following provisions shall modify Section 11.2 of the Notice for employees who reside in or are otherwise subject to the laws of South Carolina:

The following shall be appended to Section 11.2:

For purposes of this Section 11.2, “engage in competition” shall mean providing services to a competitor of the Company (whether as an employee, independent contractor, consultant, officer, or director) that are the same or similar in function or purpose to the services you provided to the Company during the two years prior to your termination of employment with the Company and with respect to which you gained Company proprietary or confidential information, in the State of South Carolina or any state or territory within the United States in which the Company conducts substantial business.