Earnings Season Gains Pace as S&P 500 Holds Ground In 2023

23 Januar 2023 - 11:06AM

Finscreener.org

The stock markets rallied for the

third straight week as the

S&P 500, Dow Jones

Industrial Average, and Nasdaq Composite have now surged by 3.9%, 0.72%, and 7.2%,

respectively. However, analysts believe the rally will be

short-lived, and the CEO of KKM Financial, Jeff Kilburg stated,

“We’re having a more emotional reaction that expected. A lot of

people got so pessimistic and we saw parabolic moves to kick off

the year. Now, as expected, the markets aren’t going in a straight

line.”

He added, “We are finding a way

to continue to move and have higher lows. The higher lows put a

little bit of confidence in the bulls. However, the technicals are

still favoring the bears and selling rallies.”

One of the largest movers in the

last week was Netflix which gained 8.5% following its impressive

results. The streaming giant missed analyst earnings estimates, but

it expanded its subscriber base at an accelerated pace compared to

consensus forecasts.

There is a good chance for

beaten-up tech stocks to regain momentum in the near term,

especially if they post better-than-expected Q4 results. Shares of

Alphabet (NASDAQ: GOOG)

also surged over 5% after the company announced it would reduce its

workforce by 12,000.

Let’s see what investors can

expect from Wall Street in the next week.

Earnings season heats up

The upcoming week will see

companies such as Microsoft (NASDAQ:

MSFT),

AT&T (NYSE: T), Tesla (NASDAQ: TSLA), Boeing (NYSE:

BA),

Intel (NASDAQ:

INTC),

Visa (NYSE:

V), Mastercard

(NYSE:

MA),

Chevron (NYSE:

CVX), and American Express

(NYSE:

AXP) report Q3 earnings. Analysts expect S&P

500 to report a year-over-year decline of 3.9% for Q3, down from

their previous decline of 4.1%, estimated at the start of 2023,

according to data from FactSet.

Wall Street expects earnings to

decline for three consecutive quarters. However, the bottom line

for corporates might improve as we head into the second half of

2023.

Macroeconomic data remains crucial

The BEA or Bureau of Economic

Analysis will release advance estimates of the gross domestic

numbers for Q4 this Thursday. It will be interesting to see if the

U.S. economy expanded in the last three months of 2022.

Economists project the U.S.

economy to grow by 2.5% in Q4 on a seasonally-adjusted annual rate

after a 3.2% expansion in Q3. The U.S. economy contracted in the

first half of 2022, and GDP growth might decelerate in Q4 due to a

slowdown in consumer spending, which contributes to 70% of the

total U.S. GDP.

The BEA will also release the

report for the PCE (Personal Consumption Expenditures) price index

on Friday, which is a key indicator for inflation. The PCE is

expected to gain 0.1% in December, down from the 0.4% gain in

November. On an annual basis, price growth is expected to

decelerate to 5.1% in December, compared to 5.5% in November and

lower than the 7% high experienced in June 2022.

Core prices, excluding fuel and

energy costs, are estimated to rise 4.4% year over year in

December, compared to a 4.7% gain a month earlier.

There is a good chance for the

Federal Reserve to reduce interest rate hikes at the upcoming FOMC

meeting later this month. A report from Investopedia states, “It

would also add to recent data showing consumer and producer

prices

decelerated in

December, with the annual

rate of consumer inflation

falling to its lowest level in over

a year.”

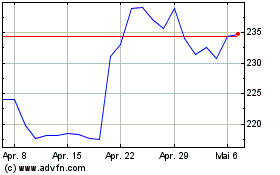

American Express (NYSE:AXP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

American Express (NYSE:AXP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024