American States Water Company Announces Favorable Ruling by the California Supreme Court Vacating the CPUC’s Prior Decision to Discontinue Use of a Full Revenue Decoupling Mechanism by Water Utilities

10 Juli 2024 - 10:30PM

Business Wire

American States Water Company (AWR: NYSE) announced today that

the California Supreme Court (the “Court”) issued a ruling on July

8, 2024 that set aside a previously issued order by the California

Public Utilities Commission (“CPUC”) in August 2020, which had

mandated the discontinuation of an existing full revenue decoupling

mechanism known as the Water Revenue Adjustment Mechanism (“WRAM”)

used by investor owned water utilities since 2008 that, in

conjunction with tiered rates, incentivizes water conservation. In

response to the CPUC’s order, AWR’s regulated water utility, Golden

State Water Company (“GSWC”), three other investor-owned water

utilities and the California Water Association each separately

filed a petition in 2021 with the Court to review the CPUC’s

decision-making processes that resulted in discontinuing the use of

the WRAM. As a result of the Court’s decision, portions of the

CPUC’s August 2020 order, including the accompanying findings and

conclusions that eliminated the water utilities’ abilities to

request the WRAM, are being vacated.

To encourage water conservation, the CPUC in 2008 recommended

that water utilities implement tiered rates, where customers pay

more per unit of water used as they use more water. In exchange for

implementing the tiered rates, the CPUC allowed water utilities,

including GSWC, to “decouple” revenue from the amount of water sold

and authorized the use of the WRAM. Since their implementation in

2008, the tiered rates and the WRAM have promoted conservation

while mitigating fluctuations in GSWC’s earnings due to changes in

water consumption by its customers. In August 2023, GSWC filed a

general rate case application for all its water regions and the

general office that will determine new water rates for the years

2025 – 2027. Among other things, GSWC had requested the

continuation of tiered rates and mechanisms to accommodate fully

decoupled revenues and sales.

“We are very pleased with the Court’s decision and its positive

impact on conservation in California,” stated Robert J. Sprowls,

President and CEO of American States Water Company. “We have seen

the favorable effects on conservation since implementing the tiered

rates and this decoupling mechanism in 2008. Water usage per

customer by GSWC customers was 41.6% lower in 2023 than in 2007,

without compromising the financial stability of GSWC. This

stability allows the company to attract capital for investments in

its infrastructure that enable us to provide safe and reliable

services to our customers, and permits continued growth of our

dividends paid to shareholders.”

Forward-Looking Statements

Certain matters discussed in this press release with regard to

the company’s expectations may be forward-looking statements that

involve risks and uncertainties. The assumptions and risk factors

that could cause actual results to differ materially include those

described in the company’s most recent Form 10-Q and Form 10-K

filed with the Securities and Exchange Commission.

About American States Water Company

American States Water Company is the parent of Golden State

Water Company, Bear Valley Electric Service, Inc. and American

States Utility Services, Inc., serving over one million people in

ten states. Through its water utility subsidiary, Golden State

Water Company, the company provides water service to approximately

264,200 customer connections located within more than 80

communities in Northern, Coastal and Southern California. Through

its electric utility subsidiary, Bear Valley Electric Service,

Inc., the company distributes electricity to approximately 24,800

customer connections in the City of Big Bear Lake and surrounding

areas in San Bernardino County, California. Through its contracted

services subsidiary, American States Utility Services, Inc., the

company provides operations, maintenance and construction

management services for water distribution, wastewater collection,

and treatment facilities located on twelve military bases

throughout the country under 50-year privatization contracts with

the U.S. government and one military base under a 15-year

contract.

American States Water Company has paid dividends to shareholders

every year since 1931, increasing the dividends received by

shareholders each calendar year for 69 consecutive years, which

places it in an exclusive group of companies on the New York Stock

Exchange that have achieved that result. The company has achieved

an 8.1% compound annual growth rate in its calendar year dividend

payments from 2013 – 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240710103189/en/

Eva G. Tang Senior Vice President-Finance, Chief Financial

Officer, Corporate Secretary and Treasurer Telephone: (909)

394-3600, ext. 707

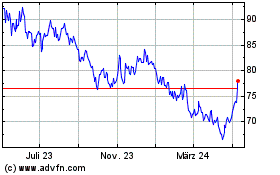

American States Water (NYSE:AWR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

American States Water (NYSE:AWR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024