false000114598600011459862024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 12, 2024 |

ASPEN AEROGELS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36481 |

04-3559972 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

30 Forbes Road Building B |

|

Northborough, Massachusetts |

|

01532 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (508) 691-1111 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ASPN |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2024, Aspen Aerogels, Inc. announced its financial results for the fourth quarter and fiscal year 2023, which ended December 31, 2023, and also discussed business developments. A copy of the press release containing such announcement is attached hereto as Exhibit 99.1.

The information set forth in the press release, except for the information set forth under the heading “2024 Financial Outlook” and under the heading “About Aspen Aerogels, Inc.,” together with the forward-looking statement disclaimer at the end of the press release, is incorporated by reference into this Item 2.02 of this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

The information set forth under the heading “2024 Financial Outlook” and under the heading “About Aspen Aerogels, Inc.,” together with the forward-looking statement disclaimer at the end of the press release, is incorporated by reference into this Item 7.01 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The press release may contain hypertext links to information on our website. The information on our website is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of this Form 8-K.

The information contained in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Aspen Aerogels, Inc. |

|

|

|

|

Date: |

February 12, 2024 |

By: |

/s/ Ricardo C. Rodriguez |

|

|

Name: |

Ricardo C. Rodriguez |

|

|

Title: |

Chief Financial Officer and Treasurer |

Exhibit 99.1

Aspen Aerogels, Inc. Reports Fourth Quarter and Fiscal Year 2023 Financial Results and Recent Business Highlights

For Immediate Release

$84.2 million quarterly revenue enabled gross margins of 35% and adjusted EBITDA of $9.1 million

NORTHBOROUGH, Mass., February 12, 2024 — Aspen Aerogels, Inc. (NYSE: ASPN) (“Aspen” or the “Company”), a technology leader in sustainability and electrification solutions, today announced financial results for the fourth quarter and full year 2023, which ended December 31, 2023, and discussed recent business developments.

Total revenue for the fourth quarter of 2023 was $84.2 million, compared to $59.6 million in the fourth quarter of 2022. Net loss was $0.5 million, compared to a net loss of $9.6 million in the fourth quarter of 2022. Net loss per share was $0.01, compared to a net loss per share of $0.20 in the fourth quarter of 2022.

Total revenue for the full year 2023 was $238.7 million, compared to $180.4 million in 2022. Net loss for the year was $45.8 million, compared to a net loss of $82.7 million in 2022. Net loss per share for the year was $0.66, compared to $2.10 in 2022.

Fourth Quarter 2023 Financial Highlights

•Record Company revenues of $84.2 million, up 39% quarter-over-quarter (QoQ) and 41% year-over-year (YoY)

➣Thermal Barriers: $52.9 million of revenue, up 61% QoQ and 110% YoY

➣Energy Industrial: $31.3 million of revenue, up 12% QoQ and supply constrained to a 9% YoY reduction

•Delivered gross margins of 35%, a twelve-percentage point improvement QoQ

•Adjusted EBITDA of $9.1 million, a $16.4 million improvement QoQ and $13.6 million improvement YoY

•Operating Income of $1.4 million, a $16.0 million improvement QoQ and $11.0 million improvement YoY

•Net loss of $0.5 million, a $12.6 million improvement QoQ and $9.1 million improvement YoY

Full Year 2023 Financial Highlights

•Total revenue of $238.7 million, up by 32% YoY and 1.96X versus 2021 revenues

➣Thermal Barriers: $110.1 million of revenue, up 98% YoY

➣Energy Industrial: Supply constrained to $128.6 million of revenue, up 3% YoY

•Delivered gross margins of 24%, a twenty-one-percentage point improvement over 2022, with a quarterly progression from 11% in Q1 to 17% in Q2, 23% in Q3, and 35% in Q4

•Adjusted EBITDA of $(22.9) million, a $37.7 million YoY improvement and a $12.1 million improvement from midpoint of the outlook range of $(30.0) million to $(40.0) million provided on October 23rd, 2023

•Net loss of $45.8 million, a $36.9 million improvement YoY

•Capital expenditures of $175.5 million, a $2.5 million reduction versus 2022

•Ended the year with cash and equivalents of $139.7 million

•Initial 2023 outlook comparison:

|

|

|

|

($ in millions, except per share amounts) |

Metric |

Initial 2023 Outlook (2/15/2023) |

Full Year 2023 Results |

Improvement vs Midpoint |

Revenue |

$200 to $250 |

$238.7 |

$13.7 |

Adjusted EBITDA |

$(60) to $(50) |

$(22.9) |

$32.1 |

Net (Loss) |

$(102) to $(92) |

$(45.8) |

$51.2 |

Net (Loss) Per Share |

$(1.46) to $(1.31) |

$(0.66) |

$0.72 |

CAPEX |

$350 to $400 |

$175.5 |

$199.5 |

A reconciliation of net loss to non-GAAP Adjusted EBITDA is provided in the financial schedules that are part of this press release. An explanation of this non-GAAP financial measure is also included below under the heading "Non-GAAP Financial Measures."

Recent Business Developments

•Successfully delivered $3.1 million in Energy Industrial products to customers through its supplemental supply in the fourth quarter of 2023

•PyroThin vehicle platform award from The Automotive Cells Company ("ACC"), a battery cell joint venture between Stellantis N.V., Saft-Total Energies, and Mercedes-Benz, to supply the Stellantis STLA Medium vehicle platform with an expected start of production in 2025, as previously announced on December 5th, 2023

•Invited into the formal due diligence and term sheet negotiation phase by the U.S. Department of Energy ("DOE") Loan Programs Office ("LPO") in connection with the company’s pending application seeking a loan pursuant to the DOE LPO's Advanced Technology Vehicles Manufacturing Loan Program for the construction of our planned Second Aerogel Plant in Statesboro, GA, as previously announced on December 5th, 2023

•Completed $75 million registered direct offering of common stock at $12.375 per share in December 2023

•In connection with General Motors' Supplier Pledge, Aspen's sustainability performance was re-assessed by EcoVadis and, for the second consecutive year, Aspen was awarded a Silver Medal rating in February 2024 for its overall sustainability scorecard, placing Aspen in the 85th percentile of companies assessed by EcoVadis

“Our team has effectively delivered on the main execution milestones that we targeted for 2023 while building a company that can rapidly scale to profitability. We believe that further diversifying our EV Thermal Barrier customer base will drive our growth beyond 2024 and validate our recent investments in this segment. Energy Industrial demand is strong, and the successful launch of our supplemental supply is enabling the team to deliver the current and growing demand,” commented Don Young, Aspen’s President and CEO. "We believe that our Q4 results show that we are on the right path towards now building a $650 million revenue capacity business that can deliver 35% gross profit and 25% adjusted EBITDA margins.”

2024 Financial Outlook

Aspen issues its 2024 full year outlook as follows:

•Total revenue is expected to be at least $350 million, with approximately $150 million in Energy Industrial revenues, and $200 million in Thermal Barrier revenues

•Adjusted EBITDA is expected to be at least $30 million

•Net loss is expected to be under $23 million

•Net loss per share is expected to be under $0.30

•Capital Expenditures, excluding investments in Plant II, are expected to be $50 million

•Capital Expenditures for Plant II in the first half of 2024 are expected to be $30 million, with an additional $15 million for the second half of 2024, assuming continued construction right-timing

The Company's 2024 outlook assumes depreciation and amortization of $30 million, stock-based compensation expense of $14 million, interest expense of $9 million and weighted average shares outstanding of 76.5 million for the full year.

A reconciliation of net loss to non-GAAP Adjusted EBITDA for the 2024 financial outlook is provided in the financial schedules that are part of this press release. An explanation of this non-GAAP financial measure is also included below under the heading “Non-GAAP Financial Measures.”

Ricardo C. Rodriguez, Chief Financial Officer and Treasurer noted, “We’re increasingly optimistic about our EV customers’ ability to ramp up production in 2024 and see meaningful upside potential to our outlook. In the meantime, we remain focused on gearing the business for sustained profitability that isn’t dependent on outsized revenue growth. We will continue managing our fixed cost base within clear targets, right-timing capital investments, and increasing our focus on cash conversion. The last quarter of 2023 gave us a glimpse of what our asset base can deliver, and our team is energized to drive additional scale in 2024.”

Aspen may incur, among other items, additional charges, realize gains or losses, incur financing costs or interest expense, or experience other events in 2024, including those related to the planned capacity expansion, supply chain disruptions, or further cost inflation, that could cause actual results to vary materially from this outlook. See Special Note Regarding Forward-Looking and Cautionary Statements below.

Conference Call and Webcast Notification

A conference call with Aspen management to discuss fourth quarter and fiscal 2023 results and recent business developments will be held Tuesday, February 13, 2024 at 8:30 a.m. EST. During the call, management will respond to questions concerning, but not limited to, Aspen's financial performance, business conditions, and financial outlook. Management's discussion and responses could contain information that has not been previously disclosed.

Shareholders and other interested parties may call +1 (833) 470-1428 (domestic) or +1 (929) 526-1599 (international) and reference conference ID "939782" to participate in the conference call. In addition, the conference call and an accompanying slide presentation will be available live as a listen-only webcast hosted at the Investors section of Aspen's website, www.aerogel.com.

Following the live event, an archived version of the webcast will be available on Aspen's website for convenient on-demand replay for at least a year. A copy of this press release is posted in the Investors section on Aspen's website.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Aspen provides an additional financial metric that is not prepared in accordance with GAAP ("non-GAAP"). The non-GAAP financial measure included in this press release is Adjusted EBITDA. Management uses this non-GAAP financial measure, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Aspen's core operating performance. In addition, management uses Adjusted EBITDA (i) for planning purposes, including the preparation of Aspen's annual operating budget, (ii) to allocate resources to enhance the financial performance of its business, and (iii) as a performance measure under its bonus plan.

Management believes that this non-GAAP financial measure reflects Aspen's ongoing business in a manner that allows for meaningful comparisons and analysis of trends in its business, as it excludes expenses and gains not reflective of Aspen's ongoing operating results or that may be infrequent and/or unusual in nature. Management also believes that this non-GAAP financial measures provides useful information to investors in understanding and evaluating Aspen's operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies. This non-GAAP measure may not be comparable to similarly titled measures presented by other companies.

The non-GAAP financial measure does not replace the presentation of Aspen's GAAP financial results and should only be used as a supplement to, not as a substitute for, Aspen's financial results presented in accordance with GAAP. In this press release, Aspen has provided a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure. Management strongly encourages investors to review Aspen's financial statements and publicly filed reports in their entirety and not rely on any single financial measure.

About Aspen Aerogels, Inc.

Aspen is a technology leader in sustainability and electrification solutions. The Company's aerogel technology enables its customers and partners to achieve their own objectives around the global megatrends of resource efficiency, e-mobility and clean energy. Aspen's PyroThin® products enable solutions to thermal runaway challenges within the electric vehicle ("EV") market. Aspen Battery Materials, the Company's carbon aerogel initiative, seeks to increase the performance of lithium-ion battery cells to enable EV manufacturers to extend the driving range and reduce the cost of EVs. The Company's Cryogel® and Pyrogel® products are valued by the world's largest energy infrastructure companies. Aspen's strategy is to partner with world-class industry leaders to leverage its Aerogel Technology Platform® into additional high-value markets. Headquartered in Northborough, Mass., Aspen manufactures its products at its East Providence, R.I. facilities. For more information, please visit www.aerogel.com.

Special Note Regarding Forward-Looking and Cautionary Statements

This press release and any related discussion contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties that could cause actual results to be materially different from historical results or from any future results expressed or implied by such forward-looking statements, including statements relating to Aspen’s 2024 financial outlook. These statements are not historical facts but rather are based on Aspen’s current expectations, estimates and projections regarding Aspen's business, operations and other factors relating thereto, including with respect to Aspen’s 2024 financial outlook. Words such as "may," "will," "could," "would," "should," "anticipate," "predict," "potential," "continue," "expects," "intends," "plans," "projects," "believes," "estimates," "outlook," “assumes,” “targets,” “opportunity,” and similar expressions are used to identify these forward-looking statements. Such forward-looking statements include statements regarding, among other things, Aspen’s expectations about capacity, revenue, revenue capacity, backlog, costs, expenses, profitability, cash flow, gross profit, gross margin, operating margin, net loss, Adjusted EBITDA, Adjusted EBITDA margin and related decreases, improvements, timing, variability or trends; beliefs about higher than expected demand from the EV market and how it may enable a path to profitability, expectations about improvement in ability to absorb fixed costs and reduction of conversion costs as a percentage of sales and the same leading to target revenue capacity and gross margins and Adjusted EBITDA margins; Aspen’s expectations regarding the planned second manufacturing plant in Georgia (“Plant II”), the extended construction and commissioning timeframe for Plant II, Aspen’s efforts to manage the construction of Plant II to align with our expectations of demand from EV customers, and the use of contract manufacturers to meet demand from Energy Industrial customers; beliefs about the general strength, weakness or health of Aspen’s business; acceleration in demand; beliefs about current or future trends in the energy, energy infrastructure, chemical and refinery, LNG, sustainable building materials, EV thermal barrier, EV battery materials or other markets and the impact of these trends on Aspen’s business; beliefs about the strength, effectiveness, productivity, costs, profitability or other fundamentals of Aspen’s business; beliefs about the role of Aspen’s technology and opportunities in the electric vehicle market; beliefs about Aspen’s ability to provide and deliver products and services to electric vehicle customers; beliefs about content per vehicle, revenue, costs, expenses, profitability, investments or cash flow associated with Aspen’s electric vehicle opportunities, including the EV thermal barrier business; beliefs about revenue growth and profitability; beliefs about the performance of PyroThin® including its ability to mitigate the propagation of thermal runaway in electric vehicles; beliefs about Aspen’s ability to expand the market for PyroThin®, to achieve design wins, to commence shipments of

production parts, and to become an industry standard solution for thermal runaway management; beliefs about Aspen’s thermal barrier design, prototype, quoting and assembly activities; and expectations about the cost of the capital projects, including Plant II; and beliefs about the Company’s pending application with the DOE seeking a loan

pursuant to the DOE LPO's ATVM. All such forward-looking statements are based on management’s present expectations and are subject to certain factors, risks and uncertainties that may cause actual results, outcome of events, timing and performance to differ materially from those expressed or implied by such statements. These risks and uncertainties include, but are not limited to, the following: inability to execute the growth plan, inability to continue construction of Plant II and to do so at a cost consistent with Aspen’s estimates and aligned with Aspen’s expectations of demand from our EV customers; the right of EV thermal barrier customers to cancel contracts with Aspen at any time and without penalty; any costs, expenses, or investments incurred by Aspen in excess of projections used to develop pricing under the contracts with EV thermal barrier customers; Aspen’s inability to create customer or market opportunities for, including PyroThin®; any other battery performance and safety products, battery materials or for other new products developed from Aspen’s aerogel technology; any disruption or inability to achieve expected capacity levels in any of the three existing production lines in East Providence, RI or the Mexico assembly facility or at any contract manufacturer; any failure to enforce any of Aspen’s patents; the general economic conditions and cyclical demands in the markets that Aspen serves; and the other risk factors discussed under the heading “Risk Factors” in Aspen’s Annual Report on Form 10-K for the year ended December 31, 2022 and filed with the Securities and Exchange Commission (“SEC”) on March 16, 2023, as well as any updates to those risk factors filed from time to time in Aspen’s subsequent periodic and current reports filed with the SEC. All statements contained in this press release are made only as of the date of this press release. Aspen does not intend to update this information unless required by law.

Investor Relations & Media Contacts:

Neal Baranosky

Phone: (508) 691-1111 x 8

nbaranosky@aerogel.com

Georg Venturatos / Jared Gornay

Gateway Group

ASPN@gateway-grp.com

Phone: (949) 574-3860

ASPEN AEROGELS, INC.

Condensed Consolidated Balance Sheets

(Unaudited and in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(In thousands) |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

139,723 |

|

|

$ |

281,335 |

|

Restricted cash |

|

|

248 |

|

|

|

1,226 |

|

Accounts receivable, net |

|

|

69,995 |

|

|

|

57,350 |

|

Inventories |

|

|

39,189 |

|

|

|

22,538 |

|

Prepaid expenses and other current assets |

|

|

17,176 |

|

|

|

7,236 |

|

Total current assets |

|

|

266,331 |

|

|

|

369,685 |

|

Property, plant and equipment, net |

|

|

417,227 |

|

|

|

259,223 |

|

Operating lease right-of-use assets |

|

|

17,212 |

|

|

|

11,990 |

|

Other long-term assets |

|

|

2,278 |

|

|

|

2,518 |

|

Total assets |

|

$ |

703,048 |

|

|

$ |

643,416 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

51,094 |

|

|

$ |

54,728 |

|

Accrued expenses |

|

|

22,811 |

|

|

|

16,003 |

|

Deferred revenue |

|

|

2,316 |

|

|

|

5,846 |

|

Operating lease liabilities |

|

|

1,874 |

|

|

|

2,368 |

|

Total current liabilities |

|

|

78,095 |

|

|

|

78,945 |

|

Convertible note - related party |

|

|

114,992 |

|

|

|

103,580 |

|

Operating lease liabilities long-term |

|

|

21,906 |

|

|

|

13,456 |

|

Total liabilities |

|

|

214,993 |

|

|

|

195,981 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Total stockholders’ equity |

|

|

488,055 |

|

|

|

447,435 |

|

Total liabilities and stockholders’ equity |

|

$ |

703,048 |

|

|

$ |

643,416 |

|

ASPEN AEROGELS, INC.

Consolidated Statements of Operations

(Unaudited and in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(In thousands, except

share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

84,219 |

|

|

$ |

59,611 |

|

|

$ |

238,718 |

|

|

$ |

180,364 |

|

Cost of revenue |

|

|

54,601 |

|

|

|

45,277 |

|

|

|

181,797 |

|

|

|

175,388 |

|

Gross profit |

|

|

29,618 |

|

|

|

14,334 |

|

|

|

56,921 |

|

|

|

4,976 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

4,075 |

|

|

|

4,197 |

|

|

|

16,356 |

|

|

|

16,930 |

|

Sales and marketing |

|

|

8,782 |

|

|

|

7,848 |

|

|

|

33,008 |

|

|

|

28,792 |

|

General and administrative |

|

|

15,378 |

|

|

|

11,955 |

|

|

|

56,760 |

|

|

|

38,499 |

|

Total operating expenses |

|

|

28,235 |

|

|

|

24,000 |

|

|

|

106,124 |

|

|

|

84,221 |

|

Loss from operations |

|

|

1,383 |

|

|

|

(9,666 |

) |

|

|

(49,203 |

) |

|

|

(79,245 |

) |

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, convertible note - related party |

|

|

(2,904 |

) |

|

|

(1,007 |

) |

|

|

(5,328 |

) |

|

|

(5,110 |

) |

Interest income, net |

|

|

1,002 |

|

|

|

1,064 |

|

|

|

6,534 |

|

|

|

1,617 |

|

Income from Employee Retention Credits |

|

|

- |

|

|

|

- |

|

|

|

2,186 |

|

|

|

- |

|

Total other income (expense), net |

|

|

(1,902 |

) |

|

|

57 |

|

|

|

3,392 |

|

|

|

(3,493 |

) |

Net loss |

|

$ |

(519 |

) |

|

$ |

(9,609 |

) |

|

$ |

(45,811 |

) |

|

$ |

(82,738 |

) |

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.66 |

) |

|

$ |

(2.10 |

) |

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

70,018,243 |

|

|

|

49,200,713 |

|

|

|

69,439,034 |

|

|

|

39,363,114 |

|

Analysis of Cash Flow

The following table summarizes our cash flows for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2023 |

|

|

|

(In thousands) |

|

Net cash provided by (used in): |

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities |

|

$ |

(24,651 |

) |

|

$ |

(7,680 |

) |

|

$ |

(7,502 |

) |

|

$ |

(2,779 |

) |

Investing activities |

|

|

(49,378 |

) |

|

|

(66,012 |

) |

|

|

(32,279 |

) |

|

|

(27,786 |

) |

Financing activities |

|

|

(364 |

) |

|

|

142 |

|

|

|

126 |

|

|

|

75,573 |

|

Net (decrease) increase in cash |

|

|

(74,393 |

) |

|

|

(73,550 |

) |

|

|

(39,655 |

) |

|

|

45,008 |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

282,561 |

|

|

|

208,168 |

|

|

|

134,618 |

|

|

|

94,963 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

208,168 |

|

|

$ |

134,618 |

|

|

$ |

94,963 |

|

|

$ |

139,971 |

|

Square Foot Operating Metric

The following chart sets forth Energy Industrial product shipments in square feet associated with recognized revenue.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Industrial product shipments in square feet |

|

|

6,055 |

|

|

|

8,824 |

|

|

|

28,392 |

|

|

|

32,589 |

|

Reconciliation of Non-GAAP Financial Measures

The following tables present a reconciliation of the non-GAAP financial measure included in this press release to the most directly comparable GAAP measure:

Reconciliation of Adjusted EBITDA to Net loss

We define Adjusted EBITDA as net income (loss) before interest expense, taxes, depreciation, amortization, stock-based compensation expense and other items, which occur from time to time and which we do not believe are indicative of our core operating performance.

For the three and twelve months ended December 31, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(In thousands) |

|

Net loss |

|

$ |

(519 |

) |

|

$ |

(9,609 |

) |

|

$ |

(45,811 |

) |

|

$ |

(82,738 |

) |

Depreciation and amortization |

|

|

4,561 |

|

|

|

2,530 |

|

|

|

15,318 |

|

|

|

9,222 |

|

Stock-based compensation |

|

|

3,188 |

|

|

|

2,672 |

|

|

|

10,954 |

|

|

|

9,385 |

|

Other (income) expense |

|

|

1,902 |

|

|

|

(57 |

) |

|

|

(3,392 |

) |

|

|

3,493 |

|

Adjusted EBITDA |

|

$ |

9,132 |

|

|

$ |

(4,464 |

) |

|

$ |

(22,931 |

) |

|

$ |

(60,638 |

) |

For the 2024 full year financial outlook:

|

|

|

|

|

|

|

Year Ending |

|

|

|

December 31, 2024 |

|

|

|

Baseline |

|

|

|

(In thousands) |

|

Net loss |

|

$ |

(23,000 |

) |

Depreciation and amortization |

|

|

30,000 |

|

Stock-based compensation |

|

|

14,000 |

|

Other (income) expense |

|

|

9,000 |

|

Adjusted EBITDA |

|

$ |

30,000 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

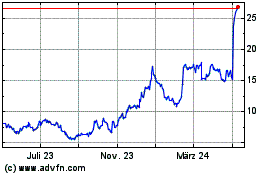

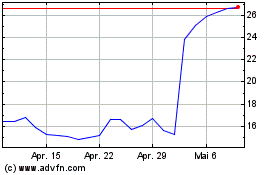

Aspen Aerogels (NYSE:ASPN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Aspen Aerogels (NYSE:ASPN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024