- Third-quarter 2024 sales of $2.4 billion, up 6% on a

reported and constant currency1 (cc) basis

- Third-quarter 2024 diluted EPS of $0.53, up 29%, or 32% cc;

core diluted EPS2 of $0.81, up 23%, or 25% cc

- Generated $1.6 billion of cash from operations in the first

nine months of 2024; record free cash flow3 of $1.3 billion, up

$704 million, or 119%

Ad Hoc Announcement Pursuant to Art. 53 LR

Alcon (SIX/NYSE:ALC), the global leader in eye care, reported

its financial results for the three and nine month periods ending

September 30, 2024. For the third quarter of 2024, sales were $2.4

billion, an increase of 6% on a reported and constant currency

basis1, as compared to the same quarter of the previous year. Alcon

reported diluted earnings per share of $0.53 and core diluted

earnings per share2 of $0.81 in the third quarter of 2024.

"Our third quarter results reflect our broad geographic

footprint and excellent execution by our team. These elements

contributed to another quarter of compounding sales and earnings

growth and record cash generation," said David J. Endicott, Alcon's

Chief Executive Officer. "As we look to 2025 and beyond, our focus

continues to be on launching a wave of innovative products that

will be a platform for growth in the years ahead."

Third quarter and first nine months of 2024 key

figures

Three months ended September

30

Nine months ended September

30

2024

2023

2024

2023

Net sales ($ millions)

2,433

2,303

7,359

7,038

Operating margin (%)

13.6%

12.7%

13.8%

11.8%

Diluted earnings per share ($)

0.53

0.41

1.48

1.10

Core results (non-IFRS

measure)2

Core operating margin (%)

20.6%

19.5%

20.8%

20.0%

Core diluted earnings per share ($)

0.81

0.66

2.33

2.05

Cash flows ($ millions)

Net cash flows from operating

activities

1,618

937

Free cash flow (non-IFRS measure)3

1,296

592

1.

Constant currency is a non-IFRS measure. Refer to the 'Footnotes'

section for additional information.

2.

Core results, such as core operating income, core operating margin

and core diluted EPS, are non-IFRS measures. Refer to the

'Footnotes' section for additional information.

3.

Free cash flow is a non-IFRS measure. Refer to the 'Footnotes'

section for additional information.

Third quarter and first nine months of 2024 results

Sales for the third quarter of 2024 were $2.4 billion, an

increase of 6% on a reported and constant currency basis, compared

to the third quarter of 2023. Sales for the first nine months of

2024 were $7.4 billion, an increase of 5% on a reported basis and

6% on a constant currency basis, compared to the first nine months

of 2023.

The following table highlights net sales by segment for the

third quarter and first nine months of 2024:

Three months ended September

30

Change %

Nine months ended September

30

Change %

($ millions unless indicated

otherwise)

2024

2023

$

cc1

(non-IFRS measure)

2024

2023

$

cc1

(non-IFRS measure)

Surgical

Implantables

422

401

5

5

1,319

1,265

4

7

Consumables

701

661

6

6

2,123

2,031

5

6

Equipment/other

215

214

—

1

657

666

(1

)

1

Total Surgical

1,338

1,276

5

5

4,099

3,962

3

5

Vision Care

Contact lenses

664

612

8

8

1,971

1,821

8

9

Ocular health

431

415

4

4

1,289

1,255

3

5

Total Vision Care

1,095

1,027

7

7

3,260

3,076

6

7

Net sales to third parties

2,433

2,303

6

6

7,359

7,038

5

6

Surgical growth reflects strength in international markets

For the third quarter of 2024, Surgical net sales, which include

implantables, consumables and equipment/other, were $1.3 billion,

an increase of 5% on a reported and constant currency basis versus

the third quarter of 2023.

- Implantables net sales were $422 million, an increase of 5% on

a reported and constant currency basis. Growth was led by advanced

technology intraocular lenses in international markets, including a

benefit from volume-based procurement in China, partially offset by

slower market conditions in the United States.

- Consumables net sales were $701 million, an increase of 6% on a

reported and constant currency basis, driven by vitreoretinal

consumables in international markets, cataract consumables and

price increases.

- Equipment/other net sales were $215 million, in line with the

prior year period. Excluding unfavorable currency impacts of 1%,

equipment/other net sales increased 1% constant currency as the

prior year period benefited from strong demand for cataract

equipment in international markets.

For the first nine months of 2024, Surgical net sales were $4.1

billion, an increase of 3% on a reported basis and 5% on a constant

currency basis versus the first nine months of 2023.

Vision Care growth reflects strength in contact lenses

For the third quarter of 2024, Vision Care net sales, which

include contact lenses and ocular health, were $1.1 billion, an

increase of 7% on a reported and constant currency basis, versus

the third quarter of 2023.

- Contact lenses net sales were $664 million, an increase of 8%

on a reported and constant currency basis, driven by product

innovation, including our toric and multifocal modalities, and

price increases.

- Ocular health net sales were $431 million, an increase of 4% on

a reported and constant currency basis. Growth was primarily driven

by the portfolio of eye drops, including continued strength from

the Systane family of artificial tears. This growth was partially

offset by declines in contact lens care in international

markets.

For the first nine months of 2024, Vision Care net sales were

$3.3 billion, an increase of 6% on a reported basis and 7% on a

constant currency basis versus the first nine months of 2023.

Operating income

Third-quarter 2024 operating income was $332 million, compared

to $293 million in the prior year period. Operating margin

increased 0.9 percentage points, reflecting improved operating

leverage in selling, general and administration ("SG&A")

expenses from higher sales, partially offset by investment in

research and development ("R&D") in Surgical and a negative 0.2

percentage point impact from currency. The prior year period

included a $58 million benefit from the release of a contingent

liability related to an acquisition, partially offset by $30

million for the transformation program which was completed in the

fourth quarter of 2023. Operating margin increased 1.1 percentage

points on a constant currency basis.

Adjustments to arrive at core operating income2 in the current

year period were $169 million, mainly due to $167 million of

amortization. Excluding these and other adjustments, third-quarter

2024 core operating income was $501 million.

Third-quarter 2024 core operating margin was 20.6%. Core

operating margin increased 1.1 percentage points, reflecting

improved operating leverage in SG&A expenses from higher sales,

partially offset by investment in R&D in Surgical and a

negative 0.1 percentage point impact from currency. Core operating

margin increased 1.2 percentage points on a constant currency

basis.

Operating income for the first nine months of 2024 was $1.0

billion and operating margin was 13.8%, which increased 2.0

percentage points on a reported basis and 2.9 percentage points on

a constant currency basis versus the prior year period. Adjustments

to arrive at core operating income in the current year period were

$511 million, mainly due to $498 million of amortization. Excluding

these and other adjustments, core operating income was $1.5

billion.

Core operating margin for the first nine months of 2024 was

20.8%, an increase of 0.8 percentage points on a reported basis and

1.5 percentage points on a constant currency basis versus the prior

year period.

Diluted earnings per share (EPS)

Third-quarter 2024 diluted earnings per share of $0.53 increased

29%, or 32% on a constant currency basis. Core diluted earnings per

share of $0.81 increased 23%, or 25% on a constant currency basis

versus the prior year period.

Diluted earnings per share for the first nine months of 2024 of

$1.48 increased 35%, or 46% on a constant currency basis. Core

diluted earnings per share for the first nine months of 2024 of

$2.33 increased 14%, or 20% on a constant currency basis versus the

prior year period.

Cash flow highlights

The Company ended the first nine months of 2024 with a cash

position of $1.6 billion. Net cash flows from operating activities

amounted to $1.6 billion in the first nine months of 2024, compared

to $937 million in the prior year period. The current year period

includes increased collections associated with higher sales, lower

transformation payments following completion of the transformation

program in the fourth quarter of 2023 and lower taxes paid due to

the timing of payments, partially offset by associate short-term

incentive payments, which generally occur in the first quarter and

were higher than in the prior year period, and increased payments

for operating expenses. The prior period included a cash outflow

for a legal settlement. Both periods were impacted by changes in

net working capital.

Free cash flow was a record inflow of $1.3 billion in the first

nine months of 2024, compared to $592 million in the prior year

period, primarily due to increased cash flows from operating

activities.

2024 outlook

The Company updated its 2024 outlook as per the table below.

2024 outlook4

as of February

as of May

as of August

as of November

Comments

Net sales (USD)

$9.9 to $10.1 billion

$9.9 to $10.1 billion

$9.9 to $10.1 billion

$9.8 to $9.9 billion

Updated

Change vs. prior year (cc)1

(non-IFRS measure)

+6% to +8%

+7% to +9%

+7% to +9%

+6% to +7%

Updated

Core operating margin2

(non-IFRS measure)

20.5% to 21.5%

20.5% to 21.5%

20.5% to 21.5%

20.5% to 21%

Tightened range

Interest expense and

Other financial income & expense

$190 to $210 million

$180 to $200 million

$160 to $180 million

$155 to $165 million

Updated

Core effective tax rate5

(non-IFRS measure)

~20%

~20%

~20%

~19%

Updated

Core diluted EPS2

(non-IFRS measure)

$3.00 to $3.10

$3.00 to $3.10

$3.00 to $3.10

$3.00 to $3.05

Tightened range

Change vs. prior year (cc)1

(non-IFRS measure)

+13% to +16%

+15% to +18%

+15% to +18%

+15% to +17%

Tightened range

This outlook assumes the following:

- Aggregated markets grow in line with recent quarters;

- Exchange rates as of the end of October 2024 prevail through

year-end;

- Approximately 498 million weighted-averaged diluted

shares.

4.

The forward-looking guidance included in this press release cannot

be reconciled to the comparable IFRS measures without unreasonable

effort, because we are not able to predict with reasonable

certainty the ultimate amount or nature of exceptional items in the

fiscal year. Refer to the 'Footnotes' section for additional

information.

5.

Core effective tax rate, a non-IFRS measure, is the applicable

annual tax rate on core taxable income. Refer to the 'Footnotes'

section for additional information.

Webcast and Conference Call Instructions

The Company will host a conference call on November 13, 2024 at

8:00 a.m. Eastern Time / 2:00 p.m. Central European Time to discuss

its third-quarter 2024 earnings results. The webcast can be

accessed online through Alcon's Investor Relations website,

investor.alcon.com. Listeners should log on approximately 10

minutes in advance. A replay will be available online within 24

hours after the event.

The Company's interim financial report and supplemental

presentation materials can be found online through Alcon's Investor

Relations website, or by clicking on the link:

https://investor.alcon.com/news-and-events/events-and-presentations/event-details/2024/Alcons-Third-Quarter-2024-Earnings-Conference-Call-2024-Upq8pXuz3s/default.aspx

Footnotes (pages 1-4)

- Constant currency (cc) is a non-IFRS measure. Growth in

constant currency (cc) is calculated by translating the current

year’s foreign currency items into US dollars using average

exchange rates from the historical comparative period and comparing

them to the values from the historical comparative period in US

dollars. An explanation of non-IFRS measures can be found in the

'Non-IFRS measures as defined by the Company' section.

- Core results, such as core operating income, core operating

margin and core EPS, are non-IFRS measures. For additional

information, including a reconciliation of such core results to the

most directly comparable measures presented in accordance with

IFRS, see the explanation of non-IFRS measures and reconciliation

tables in the 'Non-IFRS measures as defined by the Company' and

'Financial tables' sections.

- Free cash flow is a non-IFRS measure. For additional

information regarding free cash flow, see the explanation of

non-IFRS measures and reconciliation tables in the 'Non-IFRS

measures as defined by the Company' and 'Financial tables'

sections.

- The forward-looking guidance included in this press release

cannot be reconciled to the comparable IFRS measures without

unreasonable efforts, because we are not able to predict with

reasonable certainty the ultimate amount or nature of exceptional

items in the fiscal year. Refer to the section 'Non-IFRS measures

as defined by the Company' for more information.

- Core effective tax rate, a non-IFRS measure, is the applicable

annual tax rate on core taxable income. For additional information,

see the explanation regarding reconciliation of forward-looking

guidance in the 'Non-IFRS measures as defined by the Company'

section.

Cautionary Note Regarding Forward-Looking Statements

This document contains, and our officers and representatives may

from time to time make, certain “forward-looking statements” within

the meaning of the safe harbor provisions of the US Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as “anticipate,”

“intend,” “commitment,” “look forward,” “maintain,” “plan,” “goal,”

“seek,” “target,” “assume,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “will”

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding our liquidity, revenue, gross margin, operating

margin, effective tax rate, foreign currency exchange movements,

earnings per share, our plans and decisions relating to various

capital expenditures, capital allocation priorities and other

discretionary items such as our market growth assumptions, our

social impact and sustainability plans, targets, goals and

expectations, and generally, our expectations concerning our future

performance.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties and risks that

are difficult to predict such as: cybersecurity breaches or other

disruptions of our information technology systems; compliance with

data privacy, identity protection and information security laws,

particularly with the increased use of artificial intelligence; the

impact of a disruption in our global supply chain or important

facilities, particularly when we single-source or rely on limited

sources of supply; our ability to forecast sales demand and manage

our inventory levels and the changing buying patterns of our

customers; our ability to manage social impact and sustainability

matters; our reliance on outsourcing key business functions; global

and regional economic, financial, monetary, legal, tax, political

and social change; our success in completing and integrating

strategic acquisitions; the success of our research and development

efforts, including our ability to innovate to compete effectively;

our ability to comply with the US Foreign Corrupt Practices Act of

1977 and other applicable anti-corruption laws; pricing pressure

from changes in third party payor coverage and reimbursement

methodologies; our ability to properly educate and train healthcare

providers on our products; our ability to protect our intellectual

property; our ability to comply with all laws to which we may be

subject; the ability to obtain regulatory clearance and approval of

our products as well as compliance with any post-approval

obligations, including quality control of our manufacturing; the

effect of product recalls or voluntary market withdrawals; the

accuracy of our accounting estimates and assumptions, including

pension and other post-employment benefit plan obligations and the

carrying value of intangible assets; the impact of unauthorized

importation of our products from countries with lower prices to

countries with higher prices; our ability to service our debt

obligations; the need for additional financing through the issuance

of debt or equity; the effects of litigation, including product

liability lawsuits and governmental investigations; supply

constraints and increases in the cost of energy; our ability to

attract and retain qualified personnel; legislative, tax and

regulatory reform; the impact of being listed on two stock

exchanges; the ability to declare and pay dividends; the different

rights afforded to our shareholders as a Swiss corporation compared

to a US corporation; the effect of maintaining or losing our

foreign private issuer status under US securities laws; and the

ability to enforce US judgments against Swiss corporations.

Additional factors are discussed in our filings with the United

States Securities and Exchange Commission, including our Form 20-F.

Should one or more of these uncertainties or risks materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated. Therefore, you should not

rely on any of these forward-looking statements. Forward-looking

statements in this document speak only as of the date of its

filing, and we assume no obligation to update forward-looking

statements as a result of new information, future events or

otherwise.

Intellectual Property

This report may contain references to our proprietary

intellectual property. All product names appearing in italics or

ALL CAPS are trademarks owned by or licensed to Alcon Inc. Product

names identified by a "®" or a "™" are trademarks that are not

owned by or licensed to Alcon or its subsidiaries and are the

property of their respective owners.

Non-IFRS measures as defined by the Company

Alcon uses certain non-IFRS metrics when measuring performance,

including when measuring current period results against prior

periods, including core results, percentage changes measured in

constant currency and free cash flow.

Because of their non-standardized definitions, the non-IFRS

measures (unlike IFRS measures) may not be comparable to the

calculation of similar measures of other companies. These

supplemental non-IFRS measures are presented solely to permit

investors to more fully understand how Alcon management assesses

underlying performance. These supplemental non-IFRS measures are

not, and should not be viewed as, a substitute for IFRS

measures.

Core results

Alcon core results, including core operating income and core net

income, exclude all amortization and impairment charges of

intangible assets, excluding software, net gains and losses on fund

investments and equity securities valued at fair value through

profit and loss ("FVPL"), fair value adjustments of financial

assets in the form of options to acquire a company carried at FVPL

and certain acquisition related items. The following items that

exceed a threshold of $10 million and are deemed exceptional are

also excluded from core results: integration and divestment related

income and expenses, divestment gains and losses, restructuring

charges/releases and related items, legal related items,

gains/losses on early extinguishment of debt or debt modifications,

past service costs for post-employment benefit plans, impairments

of property, plant and equipment and software, as well as income

and expense items that management deems exceptional and that are or

are expected to accumulate within the year to be over a $10 million

threshold.

Taxes on the adjustments between IFRS and core results take into

account, for each individual item included in the adjustment, the

tax rate that will finally be applicable to the item based on the

jurisdiction where the adjustment will finally have a tax impact.

Generally, this results in amortization and impairment of

intangible assets and acquisition-related restructuring and

integration items having a full tax impact. There is usually a tax

impact on other items, although this is not always the case for

items arising from legal settlements in certain jurisdictions.

Alcon believes that investor understanding of its performance is

enhanced by disclosing core measures of performance because, since

they exclude items that can vary significantly from period to

period, the core measures enable a helpful comparison of business

performance across periods. For this same reason, Alcon uses these

core measures in addition to IFRS and other measures as important

factors in assessing its performance.

A limitation of the core measures is that they provide a view of

Alcon operations without including all events during a period, such

as the effects of an acquisition, divestment, or

amortization/impairments of purchased intangible assets and

restructurings.

Constant currency

Changes in the relative values of non-US currencies to the US

dollar can affect Alcon's financial results and financial position.

To provide additional information that may be useful to investors,

including changes in sales volume, we present information about

changes in our net sales and various values relating to operating

and net income that are adjusted for such foreign currency

effects.

Constant currency calculations have the goal of eliminating two

exchange rate effects so that an estimate can be made of underlying

changes in the Consolidated Income Statement excluding:

- the impact of translating the income statements of consolidated

entities from their non-US dollar functional currencies to the US

dollar; and

- the impact of exchange rate movements on the major transactions

of consolidated entities performed in currencies other than their

functional currency.

Alcon calculates constant currency measures by translating the

current year's foreign currency values for sales and other income

statement items into US dollars, using the average exchange rates

from the historical comparative period and comparing them to the

values from the historical comparative period in US dollars.

Free cash flow

Alcon defines free cash flow as net cash flows from operating

activities less cash flow associated with the purchase or sale of

property, plant and equipment. Free cash flow is presented as

additional information because Alcon management believes it is a

useful supplemental indicator of Alcon's ability to operate without

reliance on additional borrowing or use of existing cash. Free cash

flow is not intended to be a substitute measure for net cash flows

from operating activities as determined under IFRS.

Growth rate and margin

calculations

For ease of understanding, Alcon uses a sign convention for its

growth rates such that a reduction in operating expenses or losses

compared to the prior year is shown as a positive growth.

Gross margins, operating income margins and core operating

income margins are calculated based upon net sales to third parties

unless otherwise noted.

Reconciliation of guidance for

forward-looking non-IFRS measures

The forward-looking guidance included in this press release

cannot be reconciled to the comparable IFRS measures without

unreasonable efforts, because we are not able to predict with

reasonable certainty the ultimate amount or nature of exceptional

items in the fiscal year. These items are uncertain, depend on many

factors and could have a material impact on our IFRS results for

the guidance period.

Financial tables

Net sales by region

Three months ended September

30

Nine months ended September

30

($ millions unless indicated

otherwise)

2024

2023

2024

2023

United States

1,112

46%

1,062

46%

3,402

46%

3,245

46%

International

1,321

54%

1,241

54%

3,957

54%

3,793

54%

Net sales to third parties

2,433

100%

2,303

100%

7,359

100%

7,038

100%

Consolidated Income Statement (unaudited)

Three months ended September

30

Nine months ended September

30

($ millions except earnings per share)

2024

2023

2024

2023

Net sales to third parties

2,433

2,303

7,359

7,038

Other revenues

21

26

50

65

Net sales and other revenues

2,454

2,329

7,409

7,103

Cost of net sales

(1,064

)

(1,022

)

(3,235

)

(3,092

)

Cost of other revenues

(19

)

(18

)

(47

)

(54

)

Gross profit

1,371

1,289

4,127

3,957

Selling, general & administration

(809

)

(798

)

(2,448

)

(2,415

)

Research & development

(225

)

(201

)

(644

)

(620

)

Other income

5

64

16

74

Other expense

(10

)

(61

)

(33

)

(165

)

Operating income

332

293

1,018

831

Interest expense

(49

)

(47

)

(144

)

(142

)

Other financial income & expense

10

(8

)

34

(25

)

Share of (loss) from associated

companies

(1

)

—

(1

)

—

Income before taxes

292

238

907

664

Taxes

(29

)

(34

)

(173

)

(117

)

Net income

263

204

734

547

Earnings per share ($)

Basic

0.53

0.41

1.48

1.11

Diluted

0.53

0.41

1.48

1.10

Weighted average number of shares

outstanding (millions)

Basic

494.6

493.2

494.3

492.9

Diluted

497.7

496.3

497.2

496.3

Balance sheet highlights

($ millions)

September 30, 2024

December 31, 2023

Cash and cash equivalents

1,566

1,094

Time deposits

151

—

Current financial debts

115

63

Non-current financial debts

4,575

4,676

Free cash flow (non-IFRS measure)

The following is a summary of free cash flow for the nine months

ended September 30, 2024 and 2023, together with a reconciliation

to net cash flows from operating activities, the most directly

comparable IFRS measure:

Nine months ended September

30

($ millions)

2024

2023

Net cash flows from operating

activities

1,618

937

Purchase of property, plant &

equipment

(322

)

(345

)

Free cash flow

1,296

592

Reconciliation of IFRS results to core results (non-IFRS

measure)

Three months ended September 30, 2024

($ millions except earnings per share)

IFRS results

Amortization of certain

intangible assets(1)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

1,371

166

—

1,537

Operating income

332

167

2

501

Income before taxes

292

167

2

461

Taxes(5)

(29)

(30)

—

(59)

Net income

263

137

2

402

Basic earnings per share ($)

0.53

0.81

Diluted earnings per share ($)

0.53

0.81

Basic - weighted average shares

outstanding (millions)(6)

494.6

494.6

Diluted - weighted average shares

outstanding (millions)(6)

497.7

497.7

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Three months ended September 30, 2023

($ millions except earnings per share)

IFRS results

Amortization of certain

intangible assets(1)

Transformation

costs(3)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

1,289

166

—

4

1,459

Operating income

293

167

30

(40)

450

Income before taxes

238

167

30

(40)

395

Taxes(5)

(34)

(30)

(5)

1

(68)

Net income

204

137

25

(39)

327

Basic earnings per share ($)

0.41

0.66

Diluted earnings per share ($)

0.41

0.66

Basic - weighted average shares

outstanding (millions)(6)

493.2

493.2

Diluted - weighted average shares

outstanding (millions)(6)

496.3

496.3

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Nine months ended September 30, 2024

($ millions except earnings per share)

IFRS results

Amortization of certain

intangible assets(1)

Impairments(2)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

4,127

495

—

3

4,625

Operating income

1,018

498

9

4

1,529

Income before taxes

907

498

9

4

1,418

Taxes(5)

(173)

(89)

—

—

(262)

Net income

734

409

9

4

1,156

Basic earnings per share ($)

1.48

2.34

Diluted earnings per share ($)

1.48

2.33

Basic - weighted average shares

outstanding (millions)(6)

494.3

494.3

Diluted - weighted average shares

outstanding (millions)(6)

497.2

497.2

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Nine months ended September 30, 2023

($ millions except earnings per share)

IFRS results

Amortization of certain

intangible assets(1)

Transformation

costs(3)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

3,957

499

—

13

4,469

Operating income

831

508

82

(12)

1,409

Income before taxes

664

508

82

(12)

1,242

Taxes(5)

(117)

(91)

(14)

(5)

(227)

Net income

547

417

68

(17)

1,015

Basic earnings per share ($)

1.11

2.06

Diluted earnings per share ($)

1.10

2.05

Basic - weighted average shares

outstanding (millions)(6)

492.9

492.9

Diluted - weighted average shares

outstanding (millions)(6)

496.3

496.3

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Explanatory footnotes to IFRS to core reconciliation

tables

(1)

Includes recurring amortization for all intangible assets other

than software.

(2)

Includes impairment charges related to intangible assets.

(3)

Transformation costs, primarily related to restructuring and third

party consulting fees, for the multi-year transformation program.

The transformation program was completed in the fourth quarter of

2023.

(4)

For the three months ended September 30,

2024, Operating income primarily includes the amortization of

option rights, partially offset by fair value adjustments of

financial assets.

For the three months ended September 30,

2023, Gross profit includes the amortization of inventory fair

value adjustments related to a recent acquisition. Operating income

also includes the release of a contingent liability related to an

acquisition and fair value adjustments to contingent consideration

liabilities, partially offset by integration related expenses for a

recent acquisition, fair value adjustments of financial assets and

the amortization of option rights.

For the nine months ended September 30,

2024, Gross profit includes the amortization of inventory fair

value adjustments related to a recent acquisition. Operating income

also includes the amortization of option rights and fair value

adjustments of financial assets.

For the nine months ended September 30,

2023, Gross profit includes the amortization of inventory fair

value adjustments related to a recent acquisition. Operating income

also includes the release of a contingent liability related to an

acquisition and fair value adjustments to contingent consideration

liabilities, partially offset by integration related expenses for a

recent acquisition, fair value adjustments of financial assets and

the amortization of option rights.

(5)

For the three months ended September 30,

2024, tax associated with operating income core adjustments of $169

million totaled $30 million with an average tax rate of 17.8%.

For the three months ended September 30,

2023, tax associated with operating income core adjustments of $157

million totaled $34 million with an average tax rate of 21.7%.

For the nine months ended September 30,

2024, tax associated with operating income core adjustments of $511

million totaled $89 million with an average tax rate of 17.4%.

For the nine months ended September 30,

2023, tax associated with operating income core adjustments of $578

million totaled $110 million with an average tax rate of 19.0%.

(6)

Core basic earnings per share is

calculated using the weighted-average shares of common stock

outstanding during the period. Core diluted earnings per share also

contemplate dilutive shares associated with unvested equity-based

awards as described in Note 4 to the Condensed Consolidated Interim

Financial Statements.

About Alcon

Alcon helps people see brilliantly. As the global leader in eye

care with a heritage spanning over 75 years, we offer the broadest

portfolio of products to enhance sight and improve people’s lives.

Our Surgical and Vision Care products touch the lives of people in

over 140 countries each year living with conditions like cataracts,

glaucoma, retinal diseases and refractive errors. Our more than

25,000 associates are enhancing the quality of life through

innovative products, partnerships with Eye Care Professionals and

programs that advance access to quality eye care. Learn more at

www.alcon.com.

Connect with us on Facebook LinkedIn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241109313038/en/

Investor Relations Daniel

Cravens Allen Trang + 41 589 112 110 (Geneva) + 1 817 615 2789

(Fort Worth) investor.relations@alcon.com Media Relations Steven Smith + 41 589 112 111

(Geneva) + 1 817 551 8057 (Fort Worth)

globalmedia.relations@alcon.com

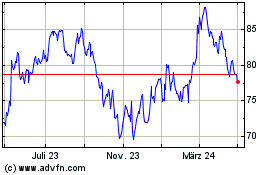

Alcon (NYSE:ALC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

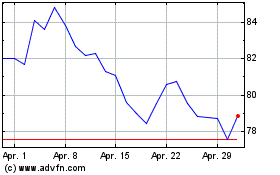

Alcon (NYSE:ALC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024