Robust performance in product tankers and ocean self-unloader

fleets drive strongest first quarter in five years

Algoma Central Corporation (TSX: ALC) ("Algoma", the "Company")

today reported its results for the three months ended March 31,

2024. Algoma reported revenues of $109,214, a 2% decrease compared

to the same period in 2023. Net loss for 2024 was $17,253 compared

to a net loss of $19,640 for the same period in 2023. Prior year

first quarter results included a $3,481 after-tax gain from the

sale of two vessels in the Product Tankers segment. Excluding this

gain, the 2024 first quarter loss was 25% lower than the prior

year. Due to the closing of the canal system and the winter weather

conditions on the Great Lakes - St. Lawrence Seaway, the majority

of the Domestic Dry-Bulk fleet does not operate for most of the

first quarter. All amounts reported below are in thousands of

Canadian dollars, except for per share data and where the context

dictates otherwise.

"Algoma's first quarter results surpassed the past five years,"

said Gregg Ruhl, President and CEO of Algoma Central Corporation.

"The Ocean Self-Unloaders segment achieved its strongest first

quarter yet, while the Product Tankers segment continued its strong

earnings trend after a year of transition and growth. Our joint

ventures also made solid contributions, and we anticipate further

earnings growth with the introduction of three more newbuild

product tankers into our FureBear joint venture later this year. As

the 2024 navigation season progresses, the Algoma Bear, our newest

Equinox Class self-unloader, is scheduled to commence regular

operations in the domestic dry-bulk fleet in May, marking another

milestone for us on the Great Lakes - St. Lawrence Seaway as we

also set sail on our 125th anniversary year."

Financial Highlights: First Quarter 2024 Compared to First

Quarter 2023

- Net loss decreased 12% to $17,253 compared to $19,640 in 2023.

Basic and diluted loss per share were $0.44 compared to $0.51.

Results for 2023 included a $3,481 after-tax gain on the sale of

two vessels in the Product Tankers segment.

- EBITDA for the first three months of $(861) is near break-even

and the best first quarter EBITDA performance ever for the

Company.

- Revenue for Product Tankers increased 6% to $34,046 compared to

$32,081 in 2023, driven primarily by a 3% increase in revenue days,

largely due to having seven vessels operating at full capacity,

coupled with higher freight rates on new vessels. Segment operating

earnings increased $2,832 to $3,976.

- Although Ocean Self-Unloaders segment revenue decreased 3% to

$43,199 compared to $44,385, operating earnings increased 69% to

$8,354 compared to $4,952 in 2023, primarily due to the reduced

numbers of vessels on dry-dock this quarter.

- Domestic Dry-Bulk segment revenue decreased 10% to $31,075

compared to $34,499 in 2023, reflecting a 6% decrease in revenue

days. Operating loss increased 6% to $35,613 compared to $33,643 in

2023.

- Global Short Sea Shipping segment equity earnings were $1,832

compared to $1,998 for the prior year. Earnings were impacted by

lower rates for the mini-bulker and handy-size fleets and higher

off-hire time due to dry-dockings in the handy-size fleet. The

decrease was largely offset by increased earnings in the cement

fleet.

Consolidated Statement of Earnings

For the three months ended March 31

2024

2023

Revenue

$

109,214

$

111,604

Operating expenses

(108,998

)

(117,560

)

Selling, general and administrative

expenses

(11,641

)

(10,387

)

Depreciation and amortization

(17,128

)

(15,996

)

Operating loss

(28,553

)

(32,339

)

Interest expense

(4,659

)

(5,125

)

Interest income

908

965

Gain on sale of assets

364

4,736

Foreign exchange gain

123

370

(31,817

)

(31,393

)

Income tax recovery

11,013

9,464

Net earnings from investments in joint

ventures

3,551

2,289

Net loss

$

(17,253

)

$

(19,640

)

Basic loss per share

$

(0.44

)

$

(0.51

)

Diluted loss per share

$

(0.44

)

$

(0.51

)

EBITDA

The Company uses EBITDA as a measure of the cash generating

capacity of its businesses. The following table provides a

reconciliation of net loss in accordance with GAAP to the non-GAAP

EBITDA measure for the three months ended March 31, 2024 and 2023

and presented herein:

EBITDA(1)

For the three months ended March 31

2024

2023

Net loss

$

(17,253

)

$

(19,640

)

Depreciation and amortization

22,333

20,947

Interest and tax recovery

(5,530

)

(4,057

)

Foreign exchange loss (gain)

(63

)

(353

)

Net gain on sale of assets

(348

)

(4,736

)

EBITDA(1)

$

(861

)

$

(7,839

)

Select Financial Performance by Business Segment

For the years ended March 31

2024

2023

Domestic Dry-Bulk

Revenue

$

31,075

$

34,499

Operating loss

(35,613

)

(33,643

)

Product Tankers

Revenue

34,046

32,081

Operating earnings

3,976

1,144

Ocean Self-Unloaders

Revenue

43,199

44,385

Operating earnings

8,354

4,952

Corporate and Other

Revenue

894

639

Operating loss

(5,270

)

(4,792

)

The MD&A for the three months ended March 31, 2024 and 2023

includes further details. Full results for the three months ended

March 31, 2024 and 2023 can be found on the Company’s website at

www.algonet.com/investor-relations and on SEDAR at

www.sedarplus.ca.

2024 Business Outlook(2)

In the Domestic Dry-Bulk segment, we expect a softening in

demand for domestic dry-bulk capacity with de-icing salt volumes

dropping more than anticipated due to the record mild winter across

the Great Lakes - St. Lawrence region. Weaker markets for export

iron ore and construction raw materials are also expected to reduce

cargo volume. Consequently, Algoma has adjusted the expected

sailing dates for some of its less efficient vessels to align with

market demand. There are positive indicators that domestic iron ore

volume will increase and grain shipments are expected to hold

relatively steady with improved soil moisture levels creating

potential for a large 2024 grain crop.

In the Product Tanker segment, we anticipate customer demand to

remain steady in 2024 and for fuel distribution patterns within

Canada to support strong vessel utilization for the vessels trading

under Canadian flag throughout the year. With delivery of our first

FureBear tanker having occurred in February, nine additional new

tankers are being constructed at China Merchants Jinling Shipyard

in Yangzhou, China, with delivery expected between mid 2024 and

late 2026, including three in 2024.

Internationally, in the Ocean Self-Unloaders segment, volumes

are expected to improve modestly for the remainder of the year and

vessel utilization is expected to improve in 2024 with

substantially fewer dry-dockings compared to 2023. Two out of the

three newbuild kamsarmax-based ocean self-unloader orders are

scheduled to begin construction this year. In our Global Short Sea

Shipping segment, we expect consistent earnings from the cement

fleet with the assets largely employed on longer-term time charter

contracts. The handy-size and mini-bulker fleets in this segment

are likely to continue to face rate pressures due to ongoing global

economic and geopolitical situations, with rates softening since

the latter half of 2023. Despite the lower rates, we do not

anticipate any adverse effects on volumes and utilization.

Normal Course Issuer Bid

Effective March 21, 2024, the Company renewed its normal course

issuer bid (the "NCIB") with the intention to purchase, through the

facilities of the TSX, up to 1,975,857 of its Common Shares

("Shares") representing approximately 5% of the 39,517,144 Shares

which were issued and outstanding as at the close of business on

March 7, 2024.

Cash Dividends

The Company's Board of Directors authorized payment of a

quarterly dividend to shareholders of $0.19 per common share. The

dividend will be paid on June 3, 2024 to shareholders of record on

May 17, 2024. Following this dividend we expect an adjustment to

the conversion price of the convertible debentures, reducing it to

$14.10.

Notes

(1) Use of Non-GAAP Measures

The Company uses several financial measures to assess its

performance including earnings before interest, income taxes,

depreciation, and amortization (EBITDA), free cash flow, return on

equity, and adjusted performance measures. Some of these measures

are not calculated in accordance with Generally Accepted Accounting

Principles (GAAP), which are based on International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), are not defined by GAAP, and do

not have standardized meanings that would ensure consistency and

comparability among companies using these measures. From

Management’s perspective, these non-GAAP measures are useful

measures of performance as they provide readers with a better

understanding of how management assesses performance. Further

information on Non-GAAP measures please refer to page 2 in the

Company's Management's Discussion and Analysis for the three months

ended March 31, 2024 and 2023.

(2) Forward Looking Statements

Algoma Central Corporation’s public communications often include

written or oral forward-looking statements. Statements of this type

are included in this document and may be included in other filings

with Canadian securities regulators or in other communications. All

such statements are made pursuant to the safe harbour provisions of

any applicable Canadian securities legislation. Forward-looking

statements may involve, but are not limited to, comments with

respect to our objectives and priorities for 2024 and beyond, our

strategies or future actions, our targets, expectations for our

financial condition or share price and the results of or outlook

for our operations or for the Canadian, U.S. and global economies.

The words "may", "will", "would", "should", "could", "expects",

"plans", "intends", "trends", "indications", "anticipates",

"believes", "estimates", "predicts", "likely" or "potential" or the

negative or other variations of these words or other comparable

words or phrases, are intended to identify forward-looking

statements.

By their nature, forward-looking statements require us to make

assumptions and are subject to inherent risks and uncertainties.

There is significant risk that predictions, forecasts, conclusions

or projections will not prove to be accurate, that our assumptions

may not be correct and that actual results may differ materially

from such predictions, forecasts, conclusions or projections. We

caution readers of this document not to place undue reliance on our

forward-looking statements as a number of factors could cause

actual future results, conditions, actions or events to differ

materially from the targets, expectations, estimates or intentions

expressed in the forward-looking statements.

Algoma Central Corporation is a global provider of marine

transportation that owns and operates dry and liquid bulk carriers,

serving markets throughout the Great Lakes - St. Lawrence Seaway

and internationally. Algoma is aiming to reach a carbon emissions

reduction target of 40% by 2030 and net zero by 2050 across all

business units with fuel efficient vessels, innovative technology,

and alternate fuels. Algoma truly is Your Marine Carrier of

Choice™. Learn more at algonet.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430139896/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley E.V.P. & Chief Financial Officer

905-687-7897

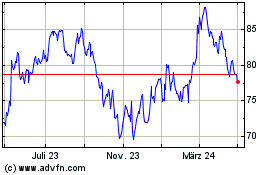

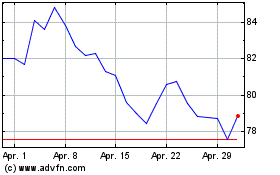

Alcon (NYSE:ALC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alcon (NYSE:ALC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024