Archer-Daniels-Midland Co false 0000007084 0000007084 2024-12-02 2024-12-02 0000007084 us-gaap:CommonStockMember 2024-12-02 2024-12-02 0000007084 us-gaap:DeferrableNotesMember 2024-12-02 2024-12-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 2, 2024

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-44 |

|

41-0129150 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 77 West Wacker Drive, Suite 4600 |

|

|

| Chicago, Illinois |

|

60601 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (312) 634-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

ADM |

|

NYSE |

| 1.000% Notes due 2025 |

|

|

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, on December 3, 2024, Archer-Daniels-Midland Company will be hosting a live investor conference call to discuss financial results and outlook. To listen to the webcast, go to www.adm.com/webcast. A replay of the webcast will also be available for an extended period of time at www.adm.com/webcast. The presentation materials to be utilized during the webcast are attached hereto as Exhibit 99.1 and hereby incorporated into this Item 7.01 by reference.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits The following exhibits are furnished or filed, as applicable, herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

ARCHER-DANIELS-MIDLAND COMPANY |

|

|

|

|

| Date: December 2, 2024 |

|

|

|

By |

|

/s/ R. B. Jones |

| |

|

|

|

|

|

R. B. Jones |

| |

|

|

|

|

|

Senior Vice President, General Counsel, and Secretary |

Proprietary business information of ADM. Exhibit 99.1 Third Quarter 2024

Earnings Conference Call December 3, 2024 Proprietary business information of ADM.

Proprietary business information of ADM. 2 Cautionary Note Regarding

Forward-Looking Statements This presentation contains “forward-looking statements” within These forward-looking statements are not guarantees of future the meaning of the Private Securities Litigation Reform Act of performance and

involve risks, assumptions and uncertainties, 1995 that involve substantial risks and uncertainties. All including, without limitation, those that are described in the statements, other than statements of historical fact included in Company's most

recent Annual Report on Form 10-K/A and in other this presentation, are forward-looking statements. You can documents that the Company files or furnishes with the Securities identify forward-looking statements by the fact that they do not and

Exchange Commission. Should one or more of these risks or relate strictly to historical or current facts. uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated These

statements may include words such as “anticipate,” or anticipated by such forward-looking statements. “estimate,” “expect,” “project,” “plan,” “intend,” “believe,”

“may,” “outlook,” “will,” “should,” “can have,” “likely,” “forecasted”, Accordingly, you are cautioned not to place undue reliance on these “target” and

other words and terms of similar meaning in forward-looking statements, which speak only as of the date they connection with any discussion of the timing or nature of future are made. Except to the extent required by law, ADM does not operating or

financial performance or other events. All forward- undertake, and expressly disclaims, any duty or obligation to update looking statements are subject to significant risks, uncertainties publicly any forward-looking statement after the date of this

and changes in circumstances that could cause actual results and announcement, whether as a result of new information, future outcomes to differ materially from the forward-looking events, changes in assumptions or otherwise. statements.

Proprietary business information of ADM. 3 Non-GAAP Financial Measures

6. Adjusted Economic Value Added: Adjusted economic value added The Company uses certain “Non-GAAP” financial measures as defined by 3. Adjusted Return on Invested Capital (ROIC): Adjusted ROIC is is ADM’s trailing 4-quarter

economic value added for specified the Securities and Exchange Commission. These are measures of Adjusted ROIC earnings divided by adjusted invested capital. items. The Company calculates economic value added by performance not defined by accounting

principles generally accepted in Adjusted ROIC earnings is ADM’s net earnings adjusted for the comparing ADM’s trailing 4-quarter adjusted returns to its annual the United States, and should be considered in addition to, not in lieu of,

after-tax effects of interest expense on borrowings and specified WACC multiplied by adjusted invested capital. Adjusted economic GAAP reported measures. Reconciliation of these non-GAAP financial items. Adjusted invested capital is the sum of

ADM’s equity value added is a non-GAAP financial measure and is not intended measures to the most directly comparable GAAP financial measures are (excluding redeemable and non-redeemable noncontrolling to replace or be an alternative to GAAP

financial measure. included in this presentation. interests) and interest-bearing liabilities (which totals invested 7. Adjusted EBITDA: Adjusted EBITDA is defined as earnings before capital), adjusted for specified items. Management believes 1.

Adjusted net earnings and Adjusted earnings per share (EPS): Adjusted interest, taxes, depreciation, and amortization, adjusted for Adjusted ROIC is a useful financial measure because it provides net earnings reflects ADM’s reported net

earnings after removal of the specified items. The Company calculates adjusted EBITDA by investors information about ADM’s returns excluding the impacts effect on net earnings of specified items as more fully described in the removing the

impact of specified items and adding back the of specified items and increases period-to-period comparability of reconciliation tables. Adjusted EPS reflects ADM’s fully diluted EPS amounts of income taxes, interest expense on borrowings and

underlying business performance. Management uses Adjusted after removal of the effect on EPS as reported of specified items as depreciation and amortization to net earnings. Management ROIC to measure ADM’s performance by comparing Adjusted

ROIC more fully described in the reconciliation tables. Management believes believes that adjusted EBITDA is a useful measure of the to its weighted average cost of capital (WACC). Adjusted ROIC, that Adjusted net earnings and Adjusted EPS are

useful measures of Company’s performance because it provides investors additional Adjusted ROIC earnings and Adjusted invested capital are non- ADM’s performance because they provide investors additional information about the

Company’s operations allowing better GAAP financial measures and are not intended to replace or be information about ADM’s operations allowing better evaluation of evaluation of underlying business performance and better period-

alternatives to GAAP financial measures. underlying business performance and better period-to-period to-period comparability. Adjusted EBITDA is a non-GAAP financial comparability. These non-GAAP financial measures are not intended to 4. Average

ROIC: Average ROIC is ADM’s trailing 4-quarter net measure and is not intended to replace or be an alternative to net replace or be alternatives to net earnings and EPS as reported, the most earnings adjusted for the after-tax effects of

interest expense on earnings, the most directly comparable GAAP financial measure. directly comparable GAAP financial measures, or any other measures of borrowings, and changes in the LIFO reserve divided by the sum of 8. Cash Flow From Operations

Before Working Capital: Cash flow operating results under GAAP. Earnings amounts described above have ADM’s equity (excluding non-controlling interests) and interest- from operations before working capital is defined as cash flow been divided

by the company’s diluted shares outstanding for each bearing liabilities adjusted for the after-tax effect of the LIFO from operating activities excluding the changes in operating assets respective period in order to arrive at an adjusted EPS

amount for each reserve. Management uses average ROIC for investors as and liabilities as presented in the Company’s consolidated specified item. additional information about ADM’s returns. Average ROIC is a statement of cash flows.

Management believes that cash flow from non-GAAP financial measure and is not intended to replace or be 2. Total segment operating profit: Total segment operating profit is operations before working capital is a useful measure of the an alternative

to GAAP financial measures. ADM’s consolidated earnings before income taxes excluding Other Company’s cash generation. Cash flow from operations before Business, corporate items and specified items. Management believes 5. Net Debt and

Adjusted Net Debt: Net debt is ADM’s total short- working capital is a non-GAAP financial measure and is not that total segment operating profit is a useful measure because it term debt, long-term debt, and current maturities of long-term

intended to replace or be an alternative to cash from operating provides investors information about ADM’s reportable segment debt, less the sum of cash, cash equivalents, and short-term activities, the most directly comparable GAAP financial

measure. performance. Total segment operating profit is not a measure of marketable securities. Adjusted Net Debt is ADM’s Net Debt, 9. Forecasted GAAP Earnings Reconciliation: ADM is not presenting consolidated operating results under U.S.

GAAP and should not be adjusted for a portion of readily marketable inventories and forecasted GAAP earnings per diluted share, forecasted net considered an alternative to earnings before income taxes, the most accounts receivable transferred

against the securitization earnings or forecasted total debt, or a quantitative reconciliation directly comparable GAAP financial measure, or any other measure of facility. Management believes Adjusted Net Debt to be a useful of those metrics to

forecasted adjusted earnings per diluted share, consolidated operating results under U.S. GAAP. metric in the evaluation of the Company’s overall leverage forecasted adjusted EBITDA or forecasted net debt, respectively, in position. reliance

on the unreasonable efforts exemption provided under Item 10(e)(1)(i)(B) of Regulation S-K. ADM is unable to predict with reasonable certainty and without unreasonable effort the impact of any impairment and timing of restructuring-related and other

charges, along with acquisition-related expenses and the outcome of certain regulatory, legal and tax matters, as well as other potential reconciling items. The financial impact of these items is uncertain and is dependent on various factors,

including timing, and could be material to our Consolidated Statements of Earnings and Consolidated Balance Sheet

Proprietary business information of ADM. 4 Financial Highlights Q3 and

YTD 2024 (Unless Otherwise Stated) Q3 2024 Q3 2024 TRAILING 4-QUARTER 1,2 1,3 1 Adjusted Earnings Per Share Total Segment Operating Profit Average Adjusted ROIC $1.0B 8.8% $1.09 Down 28% relative to prior year ROIC lower due to lower segment Down

33% relative to prior year operating profit YTD 2024 YTD 2024 Adjusted YTD 2024 Cash Flow From Operations Before 1,2 1,3 Earnings Per Share 1,4 Total Segment Operating Profit Working Capital $3.61 $2.3B $3.2B Down 36% relative to prior year Cash

generation 39% lower due to lower Down 32% relative to prior year operating profit 1. Non-GAAP measures - see notes on page 3 2. See earnings per share, the most directly comparable GAAP measure, on page 21 3. See earning before income taxes on page

17 4. Cash from operations before working capital is cash from operating activities of $2.4 billion less the changes in working capital of $0.1 billion

Proprietary business information of ADM. 5 Accelerating actions on our

value creation priorities Expanding productivity agenda in the face of a weaker market outlook and slower recovery in Nutrition • Continuing capital discipline • Advancing strategic initiatives • Strengthening operational

leadership • Enhancing returns through share • Selectively increasing capacity • Driving simplification & optimization repurchase and dividends • Enabling Drive for Execution Excellence • Expanding opportunity

pipeline & wins • Expanding productivity agenda to • Driving demand generation and • Optimizing portfolio to release cash double expected cost savings supply chain improvements and improve ROIC • Improving operational

performance • Right sizing production to meet • Prioritizing capital expenditure to in key North America facilities dynamic demand environment focus on high return projects

Proprietary business information of ADM. 6 Summary Segment Performance

YTD 2024 versus Comparable Prior Year Period (in millions of dollars) AS&O Segment Operating Profit Carb. Solutions Segment Operating Profit Nutrition Segment Operating Profit (32)% (1)% (42)% $437 $3,113 $1,057 $1,066 $298 $1,803 YTD 2023 YTD

2024 YTD 2023 YTD 2024 YTD 2023 YTD 2024 Revenue: Up 2%; excl. M&A down (3)%; HN flat excl. Ag Services: Down ($493) million on lower South M&A as strong volumes, price, and mix in Flavors and American origination margins and volumes;

Industry Starches & Sweeteners: Up $22 million on higher H&W were offset by Specialty Ingredients related to take or pay contracts volumes and improved manufacturing costs; Lower downtime at Decatur East; AN down due to FX margins in EMEA

and ethanol headwinds, lower price/mix, and lower volumes in Pet Crushing: Down ($269) million on lower global crush Solutions margins partially offset by improved volumes; Negative Human Nutrition Operating Profit: Down ($176) mark-to-market timing

impacts million due to headwinds from unplanned downtime at Decatur East ; Improved Flavors performance offset by VCP: Down ($31) million on lower margins; Strong RPO: Down ($595) million due to negative impacts from higher costs, in-part by M&A

volumes export demand for ethanol increased pre-treatment capacity and imports of UCO; Negative mark-to-market timing impacts Animal Nutrition Operating Profit: Up $37 million on improved cost position supported improved margins

Proprietary business information of ADM. 7 Cash Flow from Operations and

Cash Deployment YTD 2024 versus YTD 2023 Solid cash position despite lower operating profit year-over-year 1 Cash Flow from Operations before Working Capital Cash flow from operations before working $3.8B capital down 39% YTD, due to lower operating

profit Solid cash position and leverage ratio (Adjusted Net Debt / Adjusted EBITDA) of 2 1.9x $2.3B $1.1 billion in capital expenditures year-to- date Returned $3.1 billion of excess cash to shareholders through dividends and share repurchases YTD

2023 YTD 2024 1. Cash from operations before working capital is cash from operating activities of $2.4 billion less the changes in working capital of $0.1 billion in YTD 2024 Cash from operations before working capital is cash from operating

activities of $1.9 billion plus the changes in working capital of $1.9 billion in YTD 2023 2. Non-GAAP measures - see notes on page 3 and calculation on page 25

Proprietary business information of ADM. 8 Consolidated Outlook Prior

Revised FY 2023 FY 2024 FY 2024 YTD 2024 Metric Actual Guidance Guidance Actual 1,3 4 4 Adjusted EPS $6.98 $5.25 – $6.25 $4.50 – $5.00 $3.61 Corporate Costs* $1.6 billion ~$1.8 billion $1.7 – $1.8 billion $1.3 billion Corporate Net

Interest Expense $431 million ~$525 million $475 – $525 million $351 million Capital Expenditures $1.5 billion ~$1.4 billion ~$1.5 billion $1.1 billion Depreciation & Amortization $1.1 billion ~$1.2 billion Unchanged $854 million Effective

Tax Rate 19.3% 18% – 21% 20% – 22% 23.3% 542 ~495 497 Diluted Weighted Avg. Shares Outstanding Unchanged million shares million shares million shares 1,2,4 Adjusted Net Debt / Adjusted EBITDA 0.9x 1.5x – 2.0x Unchanged 1.9x

*includes corporate net interest expense 1. Non-GAAP measures - see notes on page 3 2. Non-GAAP measure - see calculation on page 25 3. See earnings per share, the most directly comparable GAAP measure, on page 21 4. Forward-looking Non-GAAP

financial measure; see note 9 on page 3

Proprietary business information of ADM. 9 Key Priorities to Drive

Improvement and Enhance Return Improving Maintaining focus and execution capital discipline through stage- gated investments Procurement cost Remediating material Portfolio and network Digital transformation optimization strategy, including 1ADM

weakness optimization Maintaining strong Capex and working capital Functional excellence Driving operational cash generation effectiveness improvement

10 Appendix

Proprietary business information of ADM. 1,2 11 Adjusted Earnings Per

Share Q3 2024 and YTD 2024 versus Comparable Prior Year Periods Earnings declined primarily due to lower margins and price, partially offset by improved volumes Margins/ price: Lower in AS&O and Carb Sol in Q3; lower in AS&O YTD. Includes

negative timing of $(0.32) in Q3 and $(0.71) YTD. Volumes: Higher volumes in AS&O and Carb Sol Costs: Up due to higher manufacturing and SG&A costs in 3Q; higher manufacturing costs in Nutrition and AS&O, partially offset by lower costs

in Carb Sol YTD Corp/ Other BU: Higher costs due to legal fees, IT costs, and financing costs Other: Share repurchase benefit of $0.12 in Q3; share repurchase benefit of $0.32 YTD 1. Non-GAAP measure – see notes on page 3. 2. See earnings per

share, the most directly comparable GAAP measure, on page 21

Proprietary business information of ADM. 12 Ag Services & Oilseeds

Segment Performance Segment Operating Profit (in millions of dollars) Ag Services: Lower South American origination margins and Q3 2023 Ag Services Crushing RPO Wilmar Q3 2024Δ% volumes; Industry take or pay contracts; $48M of insurance Quarter

$ 848 $(119) $(63) $(213) $27 $480 (43)% proceeds in the prior year related to Hurricane Ida (-) SA origination (+) Global soy crush (-) Refining margins Crushing: ~$15 per ton increase in executed soy crush margins margins (-) Biodiesel margins

more than offset by lower canola crush margins and (-) Global trade (-) Canola crush margins higher manufacturing costs; Insurance proceeds of $24M for margins margins (-) ~$120 YoY net partial settlement of insurance claims at Decatur East and (+)

Global trade and (-) Manufacturing timing impacts West NA origination costs volumes (-) ~$100 YoY net timing impacts RPO: Increased pre-treatment capacity and imports of UCO negatively impacted RPO: negative timing impacts YTD 2023 Ag Services

Crushing RPO Wilmar YTD 2024Δ% Ag Services: Lower South American origination margins and volumes; Industry take or pay contracts YTD $ 3,113 $(493) $(269) $(595) $47 $1,803 (42)% (-) SA origination (-) Global crush (-) Refining margins margins

margins (-) Biodiesel Crushing: Lower global crush margins partially offset by (-) Commodity (+) Volumes margins improved volumes; Negative timing impacts Trading (-) Manufacturing (-) ~$360 YoY net (-) Global trade costs timing impacts margins (-)

~$120 YoY net (+) Global trade and timing impacts NA origination RPO: Increased pre-treatment capacity and imports of UCO volumes negatively impacted RPO; negative timing impacts Note: 2023 Ag Services & Oilseeds segment operating profits has

been restated to reflect error corrections with no change to Total Segment Operating Profit. See Note 13, Segment Information of the Company’s consolidated financial statements included in the Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024. YTD 2024 Q3 2024

Proprietary business information of ADM. 13 Carbohydrate Solutions

Segment Performance Segment Operating Profit (in millions of dollars) Q3 2023 S&S VCP Q3 2024Δ% S&S: Lower co-product, ethanol, and EMEA region margins; Quarter $ 468 $52 $(68) $452 (3)% Higher volumes and margins in NA starches &

sweeteners; Higher utilization rates across our network drove lower manufacturing costs; Insurance proceeds of $47M for the partial settlement of insurance claims at Decatur West (-) Co-product margins (+) Volumes (-) Ethanol margins (+) NA S&S

margins (+) Insurance proceeds VPC: Higher ethanol industry production and inventories YTD YTD 2023 S&S VCP 2024Δ% YTD $ 1,066 $22 $(31) $1,057 (1)% S&S: Lower margins in EMEA and ethanol; Higher volumes and improved manufacturing costs

in S&S (-) EMEA margins (+) Volumes (-) Export ethanol margins (-) Domestic ethanol margins (+) Export ethanol volumes (+) Manufacturing costs VCP: Strong export demand for ethanol Note: 2023 Carbohydrate Solutions segment operating profits has

been restated to reflect error corrections with no change to Total Segment Operating Profit. See Note 13, Segment Information of the Company’s consolidated financial statements included in the Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024. YTDY Q3 TD 20 224 024 Q3 2024

Proprietary business information of ADM. 14 Nutrition Segment

Performance Revenue & Segment Operating Profit (in millions of dollars) Revenue: Up 3%. Excluding M&A, down (2)%; Strong Q3 2023 Human Nutrition Animal Nutrition Q3 2024Δ% volumes and favorable price/mix in Flavors and H&W were

offset by negative impacts related to unplanned downtime at Revenue $ 1,784 $104 $(57) $1,831 3% Decatur East, FX headwinds in Brazil and lower price/mix in Animal Nutrition Operating Profit $130 $(32) $7 $105 (19)% Human Nutrition Operating Profit:

Flavors operating profit supported by M&A contributions; Inefficiencies due to (+) Margins unplanned downtime at Decatur east partially offset by (-) Mfg costs insurance proceeds of $25M; Lapping positive non-recurring (+) Insurance proceeds (+)

Margins items in H&W (-) Non-recurring benefits Animal Nutrition Operating Profit: Cost optimization actions (+) volumes and lower commodity prices supported higher margins YTD YTD Revenue: Up 2%. Excluding M&A, down (3)%; HN flat ex. 2023

Human Nutrition Animal Nutrition 2024Δ% M&A as strong volumes, price, and mix in Flavors and H&W were offset by Specialty Ingredients related to downtime at Revenue $5,490 $227 $(142) $5,575 2% Decatur East; AN down due to FX headwinds,

lower price/mix, and lower volumes in Pet Solutions Operating Profit $437 $(176) $37 $298 (32)% Human Nutrition Operating Profit: Headwinds from unplanned downtime at Decatur East; Improved Flavors (+) Margins performance offset by higher costs,

in-part by M&A volumes (-) Mfg costs (+) Insurance proceeds (+) Margins (-) Non-recurring benefits Animal Nutrition Operating Profit: Improved cost position supported improved margins (+) volumes Note: 2023 Nutrition segment operating profits

has been restated to reflect error corrections with no change to Total Segment Operating Profit. See Note 13, Segment Information of the Company’s consolidated financial statements included in the Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024. YTD 2024 Q3 2024

Proprietary business information of ADM. 15 Other Business Results and

Corporate Q3 2024 and YTD 2024 versus Comparable Prior Year Periods (in millions of dollars) 2023 Other Business Operating Profit 2024Δ% Q3 2024 $46 $(63) $(17) N/A YTD 2024 $229 $(29) $200 (13)% Other Business Operating Profit: Lower captive

insurance results due to $112M payout of insurance claims, with $96M related to partial settlements of the Decatur East and West claims (-) Payout of insurance claims 2023 Corporate and Other Costs 2024Δ% Q3 2024 $390 $19 $409 5% YTD 2024

$1,105 $149 $1,254 13% Corporate and Other Costs: Higher interest expense related to increased financing costs of $14M, increased unallocated cost related to 1ADM to support digital transformation and (+) Higher interest expense higher legal fees of

$28M, partially offset by lower incentive compensation (+) Costs related to 1ADM (+) Higher legal fees (-) Lower incentive comp Corporate and Other Costs Other Business Operating Profit

Proprietary business information of ADM. 16 Segment Operating Profit

Outlook Q4 2024 and FY 2024 Prior Revised Segment Q4 2024 FY 2024 FY 2024 Fourth Quarter Planning Assumptions • Strong crop supplies in North America • Expect global soybean crush margins to be ~$55/metric ton Expect to be •

High-single digit processed volume improvement, led by Spiritwood Expect to be significantly • Expect significantly lower biodiesel and refining margins, including AS&O lower versus Unchanged lower versus reversal of positive prior year

timing impacts prior year prior year • Transition to producer tax credit driving uncertainty • Expect insurance proceeds related to Decatur East and West of ~$50M • Strong volumes and lower energy costs to support margin expansion

in starches and sweeteners Expect to be • Expect lower wheat milling and EMEA S&S margins Expect to be Expect to be in- slightly lower Carbohydrate Solutions in-line versus • Robust export opportunities in ethanol, but lower domestic

line prior year versus prior prior year margins year • Expect insurance proceeds related to Decatur East and West of ~$35M • Expect low-single digit revenue growth, driven by M&A contributions, low-single digit decline excluding

M&A Expect to be Expect to be Expect to be • Continued headwinds in Specialty Ingredients business Nutrition higher versus higher versus lower versus prior year prior year prior year • Resumption of Decatur East operations expected

in Q1 2025 • Expect insurance proceeds related to Decatur East of ~$50M

Proprietary business information of ADM. 17 Total Segment Operating

Profit Reconciliation and Corporate Results Quarter Ended Sep. 30 Nine Months Ended Sep. 30 (Amounts in millions) 2024 2023 Change 2024 2023 Change Earnings before income taxes 108 1,031 (923) 1,588 3,560 (1,972) Other Business (earnings) loss 63 29

17 (46) (200) (229) Corporate 19 149 409 390 1,254 1,105 Specified items: (Gain) loss on sales of assets (1) 2 (3) (1) (10) 9 Impairment, restructuring and contingency provisions 435 327 504 69 517 190 (1) Total Segment Operating Profit $ 1,037 $

1,446 $ (409) $ 3,158 $ 4,616 $ (1,458) Segment Operating Profit: Ag Services and Oilseeds $ 480 $ 848 $ (368) $ 1,803 $ 3,113 $ (1,310) Ag Services (119) (493) 107 226 461 954 Crushing (63) (269) 187 250 632 901 Refined Products and Other 124 337

(213) 431 1,026 (595) Wilmar 27 47 62 35 279 232 Carbohydrate Solutions $ 452 $ 468 $ (16) $ 1,057 $ 1,066 $ (9) Starches and Sweeteners 52 22 455 403 1,039 1,017 Vantage Corn Processors (3) 65 (68) 18 49 (31) Nutrition $ 105 $ 130 $ (25) $ 298 $

437 $ (139) Human Nutrition (32) (176) 86 118 265 441 Animal Nutrition 7 37 19 12 33 (4) $ (409) $ (390) $ (19) $ (1,254) $ (1,105) $ (149) Corporate Results Interest expense – net (15) (25) (113) (98) (351) (326) Unallocated corporate costs

(306) (298) (8) (903) (808) (95) Other (1) (18) 10 11 16 34 Specified items: Gain (loss) on debt conversion option — (6) — — — 6 Expenses related to acquisitions — (3) 3 (4) (6) 2 Impairment, restructuring, and

settlement charges 2 (7) — (2) (12) (5) Explanatory note: The Company is revising its reconciliation and calculation of total segment operating profit. The revised reconciliation is presented in Note 13. Segment Information of the

Company’s consolidated financial statements included in the Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which presents a subtotal for total segment operating profit that is equal to the sum of the segment operating

profit reported for each of the Ag Services and Oilseeds, Carbohydrate Solutions and Nutrition segments. Amounts for Other business and specified items, which previously were reflected in the calculation of total segment operating profit, are now

reflected as reconciling items, similar to Corporate, between total segment operating profit and earnings before income taxes. 1. Non-GAAP measure - see notes on page 3

Proprietary business information of ADM. 18 Balance Sheet Highlights

September 30 (Amounts in millions) 2024 2023 (1) Cash $ 784 $ 1,498 Net property, plant, and equipment 10,828 10,218 (2) Operating working capital 9,297 11,036 - Total inventories 10,746 11,224 Total debt 10,051 8,341 - CP outstanding 1,520 10

Shareholders’ equity 21,984 25,265 Memos: Available credit capacity September 30 - CP $3.5 bil $5.0 bil - Other $5.2 bil $6.7 bil Readily marketable inventory $6.1 bil $6.0 bil 1. Cash includes cash and cash equivalents and short-term

marketable securities 2. Current assets (excluding cash and cash equivalents and short-term marketable securities) less current liabilities (excluding short-term debt and current maturities of long-term debt).

Proprietary business information of ADM. 19 Cash Flow Highlights Nine

Months Ended September 30 (Amounts in millions) 2024 2023 (1) Cash from operations before working capital changes $ 2,341 $ 3,804 Changes in working capital 127 (1,913) Purchases of property, plant, and equipment (1,071) (1,055) Net assets of

businesses acquired (936) (11) Sub-total 461 825 Other investing activities 5 5 Debt increase/(decrease) 1,627 (842) (744) Dividends (738) Stock buyback (2,327) (1,118) (15) (124) Other $ (993) $ (1,992) Increase (decrease) in cash, cash

equivalents, restricted cash, and restricted cash equivalents 1. Non-GAAP measure - see notes on page 3

Proprietary business information of ADM. 20 GAAP Statement of Earnings

Summary Quarter ended September 30 Nine Months Ended September 30 (Amounts in millions except per share data) 2024 2023 Change 2024 2023 Change Revenues $ 19,937 $ 21,695 $ (1,758) $ 64,032 $ 70,957 $ (6,925) 1,365 1,810 (445) Gross profit 4,420

5,773 (1,353) 905 815 90 Selling, general and administrative expenses 2,763 2,537 226 507 79 428 Asset impairment, exit, and restructuring charges 532 146 386 (134) (83) (51) Equity in (earnings) losses of unconsolidated affiliates (498) (408) (90)

(137) (152) 15 Interest and investment income (400) (428) 28 174 155 19 Interest expense 527 482 45 (58) (35) (23) Other (income) expense – net (92) (116) 24 108 1,031 (923) Earnings before income taxes 1,588 3,560 (1,972) 90 207 Income tax

expense (benefit) (117) 370 636 (266) 18 824 (806) Net earnings including noncontrolling interests 1,218 2,924 (1,706) — 3 (3) Less: Net earnings (losses) attributable to noncontrolling interests (15) 6 (21) $ 18 $ 821 $ (803) Net earnings

attributable to ADM $ 1,233 $ 2,918 $ (1,685) $ 0.04 $ 1.52 $ (1.48) $ 2.48 $ 5.35 $ (2.87) Earnings per share (fully diluted)

Proprietary business information of ADM. 21 Reconciliation of Adjusted

Net Earnings and Adjusted Earnings Per Share (EPS) Year ended December 31 Quarter ended September 30 Nine Months Ended September 30 2023 2023 2024 2024 2023 In millions Per share In millions Per share In millions Per share In millions Per share In

millions Per share $ 3,483 $ 6.43 $ 18 $ 0.04 $ 821 $ 1.52 $ 1,233 $ 2.48 $ 2,918 $ 5.35 Net earnings and EPS (fully diluted) as reported Adjustments — 2 — — (7) (0.02) (Gain) loss on sales of assets (12) (0.03) (1) (1) 500 1.03 54

523 1.06 152 Impairment, restructuring and contingency provisions 310 0.57 0.10 0.28 — — — — — — (6) (0.01) Gain on debt conversion option (6) (0.01) — — 3 0.01 3 0.01 5 0.01 Expenses related to

acquisitions 6 0.01 13 — — 30 3 0.01 Tax adjustment 4 0.01 0.02 0.06 $ 3,785 $ 6.98 $ 530 $ 1.09 $ 880 $ 1.63 $ 1,788 $ 3.61 $ 3,065 $ 5.62 (1) Adjusted net earnings and adjusted EPS (non-GAAP) 1. Non-GAAP measure - see notes on page

3

Proprietary business information of ADM. 22 Q3 ROIC versus WACC CY24

(1)(2) Trailing 4Q Average Adjusted ROIC 8.8 % LT ROIC Objective: 10% Annual WACC 8.0 % Trailing 4Q Average Adjusted EVA $0.3B Long-Term WACC 7.0 % (1)(3) Trailing 4Q Average ROIC 6.6 % 1. Non-GAAP measure - see notes on page 3 2. Adjusted for LIFO

and specified items – see notes on page 3 3. Adjusted for LIFO – see notes on page 3

Proprietary business information of ADM. 23 Reconciliation of Adjusted

ROIC Earnings and Adjusted ROIC ROIC Earnings (Amounts in millions) Four Quarters Quarter Ended Ended Dec. 31, 2023 Mar. 31, 2024 Jun. 30, 2024 Sep. 30, 2024 Sep. 30, 2024 Net earnings attributable to ADM $ 565 $ 729 $ 486 $ 18 $ 1,798 Adjustments

Interest expense 109 115 135 124 $ 483 Tax on interest (26) (27) (32) (30) $ (115) Total ROIC Earnings 648 817 589 112 $ 2,166 648 817 589 112 $ 2,166 Total ROIC Earnings Other adjustments 155 21 22 512 $ 710 Total Adjusted ROIC Earnings $ 803 $ 838

$ 611 $ 624 $ 2,876 Invested Capital (Amounts in millions) Trailing Quarter Ended Four Quarter Dec. 31, 2023 Mar. 31, 2024 Jun. 30, 2024 Sep. 30, 2024 Average (2) Equity $ 24,132 $ 23,219 $ 22,148 $ 21,974 $ 22,868 (3) + Interest-bearing liabilities

8,370 9,995 10,576 10,051 9,748 Total Invested Capital $ 32,502 $ 33,214 $ 32,724 $ 32,025 $ 32,616 Total Invested Capital $ 32,502 $ 33,214 $ 32,724 $ 32,025 $ 32,616 + Other adjustments (net of tax) 155 21 22 512 178 (1) Total Adjusted Invested

Capital $ 32,657 $ 33,235 $ 32,746 $ 32,537 $ 32,794 1. Non-GAAP measure – see notes on page 3 Return on Invested Capital 6.6% 2. Excludes noncontrolling interests Adjusted Return on Invested Capital 8.8% 3. Includes short-term debt, current

maturities of long-term debt, finance lease obligations, and long-term debt

Proprietary business information of ADM. 24 Reconciliation of Adjusted

Earnings Before Interest, Taxes, (1) Depreciation, and Amortization (EBITDA) (1) Adjusted EBITDA (Amounts in millions) Four Quarters Four Quarters Four Quarters Quarter Ended Ended Ended Ended Dec. 31, 2023 Mar. 31, 2024 Jun. 30, 2024 Sep. 30, 2024

Sep. 30, 2024 Sep. 30 , 2023 Dec. 31, 2023 Net earnings $ 565 $ 729 $ 486 $ 18 $ 1,798 $ 3,959 $ 3,483 Net earnings (losses) attributable to noncontrolling interests (23) (10) (5) — (38) (11) (17) Income tax expense 192 166 115 90 563 825 828

Interest expense 109 115 135 124 483 455 430 Depreciation and amortization 277 280 286 288 1,131 1,036 1,059 EBITDA 1,120 1,280 1,017 520 3,937 $ 6,264 5,783 (Gain) loss on sales of assets and businesses (7) — — (1) (8) (27) (17)

Impairment and restructuring charges and contingency provisions 172 18 7 504 701 269 367 Railroad maintenance expense 39 — 4 28 71 54 67 Expenses related to acquisitions 1 — 4 — 5 6 7 Adjusted EBITDA $ 1,325 $ 1,298 $ 1,032 $ 1,051

$ 4,706 $ 6,566 $ 6,207 1. Non-GAAP measure – see notes on page 3

Proprietary business information of ADM. 25 (1) Reconciliation of

Adjusted Net Debt to Total Debt and (1) (1) Adjusted Net Debt / Adjusted EBITDA September 30 December 31 Adjusted Net Debt (Amounts in millions) 2024 2023 2023 Short-term debt $1,733 $116 $105 Current maturities of long-term debt 725 1 1 Long-term

debt 7,578 8,224 8,259 Total Debt 10,036 8,341 8,365 Cash and cash equivalents (784) (1,498) (1,368) Net Debt $9,252 $6,843 $6,997 Adjustments: Readily marketable inventories (RMI) $(6,094) $(6,044) $(6,987) X Readily Marketable Inventory Factor 40

% 40 % 40 % RMI Adjustment (2,438) (2,418) (2,795) Accounts receivable transferred against the securitization programs facility 2,073 1,650 1,630 Total Adjustments $(365) $(768) $(1,165) Adjusted Net Debt $8,887 $6,075 $5,832 (1,2) Trailing Four

Quarters Adjusted EBITDA $4,706 $6,566 $6,207 (1) (1,2) Adjusted Net Debt / Adjusted EBITDA 1.9x 0.9x 0.9x 1. Non-GAAP measure - see notes on page 3 2. See net earnings, the most directly comparable GAAP measure, reconciliation on page 24

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_DeferrableNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

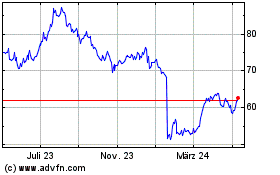

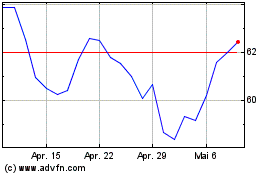

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024