Regulatory News:

PSA Peugeot Citroën (Paris:UG):

- PSA Peugeot Citroën unit sales up

4.3% to 2,939 million vehicles in 2014 compared to 2013

- China now the Group’s largest

market, with unit sales up 31.9% to 734,000

- Strong growth in Europe, with

1,761,000 vehicles sold, for an increase of 8.1%

- Worldwide success for the entire

PEUGEOT product range: globalisation of models that end in 8

and successful move upmarket with a strong contribution from the

PEUGEOT 308 and the PEUGEOT 2008 and 3008 crossovers

- Good performance from CITROËN-brand

models: the new CITROËN C4 Picasso is the European leader in

the MPV segment, the CITROËN C4 Cactus has exceeded objectives

since launch and the C-Elysée has been resounding success in China,

where it is Dongfeng Peugeot Citroën Automobile’s (DPCA’s)

best-selling model with more than 100,000 units sold

- Global launch of DS as the Group’s

premium brand

- Tangible results from the Group’s

inventory reduction initiatives, with inventories at

end-December significantly lower than initially expected

Europe

The Group sustained its results in a growing, yet fragile

market.

- Group sales in Europe rose 8.1%

year-on-year to 1,761,000 units, reflecting the favourable market

reaction to the Peugeot 308, voted 2013 car of the year (56,900

units sold), and the positive results of the C4 Cactus (more than

36,800 orders booked as of 31 December 2014).

- Registrations of PEUGEOT-brand

vehicles increased by 6.2% to 952,000 units. The range’s updated

and consistent model line-up, combined with the dealership

network’s management of net pricing and a high standard of service

quality enhanced the brand’s attractiveness and helped it deliver

robust, profitable growth. Peugeot gained 0.3 points in the

consumer sales channel, a benchmark indicator.

- CITROËN outperformed the market

while focusing on the most profitable distribution channels, with

registrations up 7.2% to 689,000 units and market share gains in

France, the United Kingdom, Spain and Germany. This positive

momentum was driven by the brand’s successful product offensive,

headed in particular by the new C4 Picasso, the European MPV leader

with 120,000 units sold in 2014, and the year’s three successful

model launches: the new Jumper introduced in April (31,000 units

sold), the new C1 (41,000 units sold) and the C4-Cactus introduced

in June (42,000 units sold).

- DS registrations in Europe

totalled 85,900 units. The brand is concentrating on profitable

sales channels to preserve its models’ long-term resale value. In

addition, 61 dedicated points of sale (58 DS Salons and three DS

Stores) have been opened. The year was shaped by a technological

offensive that included the introduction of six new powertrains and

a new Xenon Full-LED signature.

China and Southeast Asia

The PEUGEOT, CITROËN and DS brands all set new sales records

in China, which is now the Group's largest market.

- The Chinese market again expanded

significantly, with demand up 11,5%. The Group achieved unit sales

of 734,000, lifting its market share to 4.4% from 3.6% in

2013.

- The PEUGEOT brand had another

record year with unit sales rising 43.1% to 386,565, the strongest

increase among the market’s top 20 players. The PEUGEOT 3008 and

2008 fully benefited from growth in the SUV segment and accounted

for a third of Dongfeng Peugeot’s sales. In the C segment, which

represents 52% of the Chinese passenger car market, the new Peugeot

408 got off to a quick start with 30,943 units sold in four months.

The brand also added 100 dealerships to its network in 2014.

- CITROËN also outpaced the

market, setting a new sales record with growth of 14.3% to 320,000

units sold. China now accounts for more than one out of four

CITROËN sold worldwide and has confirmed its status as the brand’s

leading market, ahead of France. This performance was driven in

part by the success of recent launches, including the new CITROËN

C-Elysée, Dongfeng Citroën’s best-selling model with more than

100,000 units sold in 2014, and the Citroën C4-L, which sold 66,000

units during the year. The brand extended its line-up in December

with the introduction of the C3-XR SUV. The year’s performance was

also supported by Dongfeng Citroën’s increasingly tight-knit and

well-respected dealership network, which ranked first in JD Power’s

2014 China Sales Satisfaction Index (SSI) study.

- Sales of DS-brand models have taken off

in China, for a total of 26,000 units in 2014, thanks to a premium

line-up comprising three models produced in Shenzhen and launched

just one year ago: the DS5, the DS 5LS and the DS 6. At the same

time, the brand has actively developed its distribution network

with 80 DS Stores covering China's 60 largest cities. China now

accounts for 22% of the brand’s worldwide registrations, versus 2%

in 2013.

Eurasia, Latin America, Middle-East &

Africa, Asia-Pacific

In the rest of the world, the market environment was

difficult in 2014 due to a decline in automobile sales and

unfavourable exchange rates. As a result, PSA Peugeot Citroën

focused on profitability by applying a rigorous pricing policy.

- In Eurasia, the Group put an

emphasis on local production of the PEUGEOT 408 and the CITROËN C4

Sedan, which together captured 8% of their segment in Russia with

6,500 and 9,000 units sold, respectively.

- In Latin America, in a difficult

economic environment, the Group recorded 200,000 units sold and

strengthened its position in Argentina, achieving a market share in

that country of 15.1%. Recent launches delivered results, with

49,000 units sold for the PEUGEOT 208 and more than 13,000 units

sold for the CITROËN C4 Lounge. Sales of the Citroën C3 held up

well, at 35,300 units.

- In the Middle-East & Africa,

priority was given to improving profitability in an unfavourable

currency environment. The Group maintained strong positions in

numerous countries, leading the market in Tunisia and France's

overseas departments and ranking second in Morocco. Peugeot was the

second best-selling brand in Algeria and achieved strong growth in

Egypt, with unit sales up 77%.The PEUGEOT 301 and CITROËN C-Elysée

were again the leading models in 2014, with 30,400 and 14,800 units

sold, respectively. Launched during the course of the year, the

flagship PEUGEOT 2008 and PEUGEOT 308 achieved unit sales of 8,400

for the first and 7,400 for the second. Sales of light commercial

vehicles increased year on year.

- The India-Pacific region saw an

increase in sales with the successful launches of the PEUGEOT 2008

(1,000 orders in 3 months), the PEUGEOT 308 (3,200 units sold) and

the CITROËN C4 Picasso (1,450 units sold).

Commenting on these results, the Chief Executive Officers of

the three brands made the following remarks:

Maxime Picat, Chief Executive Officer, PEUGEOT Brand: “In

terms of sales, 2014 was a year of success for PEUGEOT, with a 5.4%

increase in worldwide unit sales and remarkable growth of more than

43% in China. It was also a success for our drive to globalise

models that end in 8, as seen in strong demand for the 308 and the

2008 and 3008 crossovers. This situation allows us to look towards

2015 with confidence.”

Linda Jackson, Chief Executive Officer, CITROËN Brand:

“2014 was a very vibrant year for CITROËN, with a double title in

the FIA World Touring Car Championship (WTCC), sales growth of 4%

and four launches that embody the brand’s renewal. More than ever,

CITROËN represents creativity and technology, combined to promote

well-being.”

Yves Bonnefont, Chief Executive Officer, DS Brand: “In

June 2014, we affirmed our ambition to make DS a global premium

brand through a long-term strategy based on enriching our line-up

and deploying internationally. In 2014, DS took off in China, with

the successful launch of our two new models.”

Appendices

Worldwide Automobile Sales (in thousands of units)

REGION Brand 2013Unit sales

2014Unit sales % % change

AV China & Southeast Asia Peugeot 277,918

393,508 13.39% 41.59% Citroën 281,110 321,602 10.94%

14.40% DS 4,818 26,978 0.92% ++

PSA

563,846 742,088 25.25%

31.61% Eurasia Peugeot 40,700 23,765 0.81% -41.61% Citroën

31,931 19,198 0.65% -39.88% DS 1,767 867 0.03% -50.93%

PSA 74,398 43,830 1.49%

-41.09% Europe Peugeot 878,950 965,090 32.84% 9.80%

Citroën 643,023 709,710 24.15% 10.37% DS 106,691 86,044 2.93%

-19.35%

PSA 1,628,664 1,760,844

59.92% 8.12% India-Pacific Peugeot

15,049 16,933 0.58% 12.52% Citroën 3,208 3,961 0.13% 23.47% DS

2,705 1,456 0.05% -46.17%

PSA 20,962

22,350 0.76% 6.62% Latin America

Peugeot 182,943 120,857 4.11% -33.94% Citroën 115,670 77,827 2.65%

-32.72% DS 4,058 1,185 0.04% -70.80%

PSA

302,671 199,869 6.80%

-33.96% Africa & Middle-East Peugeot 155,996 114,513

3.90% -26.59% Citroën 68,384 52,936 1.80% -22.59% DS 2,655 1,942

0.07% -26.86%

PSA 227,035

169,391 5.76% -25.39% Total

Peugeot 1,551,556 1,634,666 55.62% 5.36% Citroën 1,143,326

1,185,234 40.33% 3.67% DS 122,694 118,472 4.03% -3.44%

PSA 2,817,576 2,938,372

99.98% 4.29%

CKD China

& Southeast Asia Peugeot 1,119 527 0.02% -52.90%

PSA 1,119 527 0.02%

-52.90% Africa & Middle-East Peugeot 0 0.00% 0.00%

PSA 0 0.00%

0.00% Total Peugeot 1,119 527 0.02% -52.90%

PSA 1,119 527

0.02% -52.90% AV + CKD Peugeot 1,552,675

1,635,193 55.64% 5.31% Citroën 1,143,326 1,185,234 40.33% 3.67% DS

122,694 118,472 4.03% -3.44%

PSA

2,818,695 2,938,899 100.00%

4.26%

Top 10 markets – Group (in thousands of units)

China 734,119 France 637,682 United Kingdom

255,036 Spain 158,642 Italy 144,355 Germany

124,653 Belgium and Luxembourg 95,289 Brazil 86,959

Argentina 84,371 Netherlands 64,922

Top 10 markets – Peugeot Brand (in thousands of

units)

China 386,568 France 347,091 United Kingdom

139,810 Italy 82,579 Spain 82,294 Germany

61,857 Argentina 61,740 Belgium and Luxembourg 50,335

Algeria 41,802 Netherlands 41,729

Top 10 markets – Citroën Brand (in thousands of

units)

China 320,813 France 259,220 United Kingdom

90,943 Spain 71,425 Italy 57,309 Germany

55,476 Brazil 49,249 Belgium and Luxembourg 40,976

Argentina 22,366 Netherlands 21,290

Top 10 markets – DS Brand (in thousands of units)

France 31,371 China 26,738 United Kingdom

24,283 Germany 7,320 Spain 4,923 Italy 4,467

Belgium and Luxembourg 3,978 Switzerland 2,013

Netherlands 1,903 Japan 970

Communications Division - 75 avenue de la

Grande-Armée - 75116 Paris, France+33 1 40 66 42 00 –

psa-peugeot-citroen.com – @PSA_news

PSA Peugeot CitroënMedia

ContactsMedia RelationsJean-Baptiste Thomas, +33

1 40 66 47 59jean-baptiste.thomas@mpsa.comorAntonia Krpina, +33 1

40 66 48 02antonia.krpina@mpsa.comorPierre-Olivier Salmon, +33 1 40

66 49 94pierreolivier.salmon@mpsa.comorLaure de Servigny, +33 1 40

66 35 42Laure.deservigny@mpsa.comorInvestor

RelationsFrédéric Brunet, +33 1 40 66 42

59frederic.brunet@mpsa.comorAnne-Laure Descleves, +33 1 40 66 43

65annelaure.descleves@mpsa.comorKarine Douet, +33 1 40 66 57

45karine.douet@mpsa.com

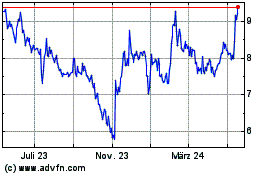

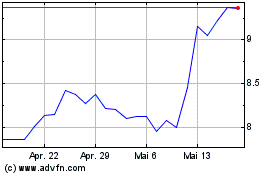

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024