UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ |

Definitive

Information Statement |

TRxADE

HEALTH, INC.

(Exact

name of Registrant as specified in its charter)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11 |

TRxADE

HEALTH, INC.

6308

Benjamin Rd, Suite 708

Tampa,

Florida 33634

NOTICE

OF STOCKHOLDER ACTION BY WRITTEN CONSENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

Dear

Stockholders:

This

information statement (the “Information Statement”) has been filed with the Securities and Exchange Commission (the “SEC”)

and is being mailed or otherwise furnished to the holders of record of the common stock, par value $0.00001 per share, of TRxADE HEALTH,

INC., a Delaware corporation (the “Company,” “us” or “we”), on or about August [●], 2024. Only

stockholders of record as of the close of business on July 25, 2024 (the “Record Date”) are entitled to receive this Information

Statement.

The

purpose of this notice and the accompanying Information Statement is to notify you that on July 25, 2024, in connection with the Company’s

previously announced transaction with Scienture, Inc., a Delaware corporation (“Scienture”), a majority of the holders of

the Company’s common stock executed a written consent in lieu of a meeting of stockholders (the “Stockholder Consent”),

which (i) approved the conversion of the Company’s Series X Non-Voting Convertible Preferred Stock, par value $0.00001 per share

(the “Series X Preferred Stock”) into shares of the Company’s common stock (the “Preferred Stock Conversion”),

(ii) authorized the Company’s board of directors (the “Board”) to change the Company’s name to “Scienture

Holdings, Inc.” (the “Name Change”), and (iii) approved an increase in the number of shares available to be awarded

under the Company’s Second Amended and Restated 2019 Equity Incentive Plan, as amended, to five million shares of the Company’s

common stock (the “Incentive Plan Share Increase” and, together with the Preferred Stock Conversion and the Name Change,

the “Stockholder Approval Matters”).

The

Stockholder Consent was entered into in connection with the Agreement and Plan of Merger (the “Merger Agreement”), which

was entered into and closed on July 25, 2024, by and among the Company, MEDS Merger Sub I, Inc., a Delaware corporation and wholly

owned subsidiary of the Company (“Merger Sub I”), MEDS Merger Sub II, LLC, a Delaware limited liability company and wholly

owned subsidiary of the Company (“Merger Sub II”), and Scienture, Inc., a Delaware corporation (“Scienture”).

Pursuant to the Merger Agreement, on July 25, 2024, (i) Merger Sub I merged with and into Scienture (the “First Merger”),

with Scienture continuing as the surviving entity and a wholly owned subsidiary of the Company, and (ii) Scienture merged with and into

Merger Sub II (the “Second Merger” and, together with the First Merger, the “Mergers”), with Merger Sub II continuing

as the surviving entity and Merger Sub II changed its name to “Scienture, LLC”. The Board approved the Merger

Agreement and the related transactions, and the consummation of the Mergers was not subject to approval of the Company’s stockholders.

As

consideration for the Mergers, at the effective time of the First Merger (the “First Effective Time”), the shares of Scienture’s

common stock issued and outstanding immediately prior to the First Effective Time were converted into the right to receive, in the aggregate,

(i) 291,555 shares of the Company’s common stock, which represents 19.99% of the number of shares of the Company’s common

stock issued and outstanding immediately prior to the First Effective Time, and (ii) 6,826,713 shares of Series X Preferred Stock, each

share of which is convertible into one share of the Company’s common stock, subject to certain conditions.

In

accordance with Rule 14c-2 of the Securities Exchange Act of 1934, as amended, and the rules promulgated

by the SEC thereunder, the Information Statement is being furnished to our stockholders solely for the purpose of informing our stockholders

of the corporate actions taken in the Stockholder Consent, which will be effective on September [●], 2024, twenty (20) days

after we mail the Information Statement to stockholders of record.

August

[●], 2024

| |

By

order of the Board, |

| |

|

| |

/s/

Suren Ajjarapu |

| |

Suren

Ajjarapu |

| |

Chairman

of the Board |

TRxADE

HEALTH, INC.

6308

Benjamin Rd, Suite 708

Tampa,

Florida 33634

INFORMATION

STATEMENT

PURSUANT

TO SECTION 14(C) OF THE

SECURITIES

EXCHANGE ACT OF 1934

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

TABLE

OF CONTENTS

ABOUT

THIS INFORMATION STATEMENT

TRxADE

HEALTH, INC. and its consolidated subsidiaries are referred to herein as “the Company,” “we,” “us”

and “our,” unless the context indicates otherwise.

This

Information Statement (the “Information Statement”) is being furnished to the Company’s stockholders of record

as of July 25, 2024 (the “Record Date”) in the manner required by Section 14(c) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and is being furnished to notify stockholders of the action taken by written consent of

a majority of the Company’s stockholders (the “Majority Stockholders”).

On

July 25, 2024, in connection with the Company’s previously announced transaction with Scienture, Inc., a Delaware corporation (“Scienture”),

the Majority Stockholders executed a written consent in lieu of a meeting of stockholders (the “Stockholder Consent”), which

(i) approved the conversion of the Company’s Series X Non-Voting Convertible Preferred Stock, par value $0.00001 per share (the

“Series X Preferred Stock”) into shares of the Company’s common stock (the “Preferred Stock Conversion”),

(ii) authorized the Company’s board of directors (the “Board”) to change the Company’s name to “Scienture

Holdings, Inc.” (the “Name Change”), and (iii) approved an increase in the number of shares available to be awarded

under the Company’s Second Amended and Restated 2019 Equity Incentive Plan, as amended (the “Incentive Plan”), to five

million shares of the Company’s common stock (the “Incentive Plan Share Increase” and, together with the Preferred

Stock Conversion and the Name Change, the “Stockholder Approval Matters”).

The

Stockholder Consent was entered into in connection with the Agreement and Plan of Merger (the “Merger Agreement”), attached

hereto as Annex A, which was entered into and closed on July 25, 2024, by and among the Company, MEDS Merger Sub I, Inc.,

a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub I”), MEDS Merger Sub II, LLC, a Delaware limited

liability company and wholly owned subsidiary of the Company (“Merger Sub II”), and Scienture. Pursuant to the Merger Agreement,

on July 25, 2024, (i) Merger Sub I merged with and into Scienture (the “First Merger”), with Scienture continuing as the

surviving entity and a wholly owned subsidiary of the Company, and (ii) Scienture merged with and into Merger Sub II (the “Second

Merger” and, together with the First Merger, the “Mergers”), with Merger Sub II continuing as the surviving entity

and Merger Sub II changed its name to “Scienture, LLC”. The Board approved the Merger Agreement and the related

transactions, and the consummation of the Mergers was not subject to approval of the Company’s stockholders.

As

consideration for the Mergers, at the effective time of the First Merger (the “First Effective Time”), the shares of Scienture’s

common stock issued and outstanding immediately prior to the First Effective Time were converted into the right to receive, in the aggregate,

(i) 291,555 shares of the Company’s common stock, which represents 19.99% of the number of shares of the Company’s common

stock issued and outstanding immediately prior to the First Effective Time, and (ii) 6,826,713 shares of Series X Preferred Stock, each

share of which is convertible into one share of the Company’s common stock, subject to certain conditions.

The

Company’s common stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) and the Company is subject to Nasdaq’s

rules and regulations, including (i) Nasdaq Rule 5635(a), which requires stockholder approval prior to the issuance of securities in

connection with the acquisition of the stock or assets of another company if such securities represent, or will represent upon issuance,

twenty percent (20%) or more of the outstanding common stock or voting power of a company prior to the issuance of the securities

in connection with the acquisition, (ii) Nasdaq Rule 5635(c), which requires stockholder approval prior to issuing securities when a

stock option or purchase plan, or other equity compensation arrangement, pursuant to which stock may be acquired by officers, directors,

employees, or consultants (subject to certain exceptions) is materially amended, and (iii) Nasdaq Rule 5635(d), which requires stockholder

approval prior to the issuance of securities in a transaction (other than a public offering) of common stock (or securities convertible

into or exercisable for common stock) equal to 20% or more of the outstanding common stock or 20% or more of the voting power of a company

for a purchase price that is lower than (a) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the

signing of a binding agreement, or (b) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for

the five trading days immediately preceding the signing of the binding agreement (such lower amount, the “Minimum Price”).

The

approval of (i) the Preferred Stock Conversion, for purposes of Nasdaq Rule 5635(a) and Nasdaq Rule 5635(d), and

(ii) the Incentive Plan Share Increase, for purposes of Nasdaq Rule 5635(c), was taken by written consent pursuant to Section 228

of the General Corporation Law of the State of Delaware, which provides that any action that may be taken at any annual or special meeting

of stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting

forth the action so taken, shall be signed by the holders of outstanding common stock having not less than the minimum number of votes

that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

On

July 25, 2024, the Board adopted resolutions approving the Merger Agreement and the transactions contemplated thereby, including the

Stockholder Approval Matters. In connection with the adoption of these resolutions, the Board had been informed that the Majority Stockholders

were in favor of the proposals and would enter into a written consent approving each of the Stockholder Approval Matters. Thereafter,

on July 25, 2024, the Majority Stockholders executed the Stockholder Consent to consent in writing to each of the Stockholder Approval

Matters.

Accordingly,

all necessary corporate approvals in connection with the transactions have been obtained and this Information Statement is being furnished

to stockholders solely for purposes of informing the stockholders of the actions in the manner required under the Exchange Act.

The

Company knows of no other matters other than those described in this Information Statement which have been recently approved or considered

by the holders of the Company’s issued and outstanding voting securities.

Available

Information

We

file annual, quarterly, and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s website at http://www.sec.gov. Copies of documents filed by us with the SEC are also

available from us without charge, upon oral or written request to our Secretary, who can be contacted at the corporate address and telephone

number set forth in this Information Statement. Our website address is https://trxadehealth.com/. The information on, or

that may be accessed through, our websites not incorporated by reference into this Information Statement and should not be considered

a part of this Information Statement.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Information Statement contains statements that constitute forward-looking statements which are subject to the safe-harbor provisions

of the Private Securities Litigation Reform Act of 1995. Statements that are not historical are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act. Some of the statements in this Information Statement constitute forward-looking statements because they relate

to future events or our future performance or future financial condition. These forward-looking statements are not historical facts,

but rather are based on current expectations, estimates and projections about our company, our industry, our beliefs and our assumptions.

Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases,

you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” or the negative of these terms or other

similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this Information Statement are based on our current expectations and beliefs concerning future

developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we

have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or

other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual

results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required

under applicable securities laws.

Although

we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove

to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these

and other uncertainties, the inclusion of a projection or forward-looking statements in this Information Statement should not be regarded

as a representation by us that our plans and objectives will be achieved.

We

have based the forward-looking statements included in this Information Statement on information available to us on the date of this Information

Statement, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise

or update any forward-looking statements in this Information Statement, whether as a result of new information, future events or otherwise,

you are advised to consult any additional disclosures that we may make directly to you or through reports that we may file in the future

with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

SUMMARY

TERM SHEET

This

summary highlights selected information from this Information Statement and may not contain all of the information that is important

to you to understand the Mergers and related transactions. For a more complete description of the legal terms of the Mergers,

you should carefully read this entire Information Statement, the annexes attached to this Information Statement and the documents referred

to or incorporated by reference in this Information Statement. Any document or agreement referred to in this Information Statement is

qualified in its entirety by reference to the full text of such document or agreement. All references in this Information Statement to

terms defined in the notice to which this information statement is attached have the meanings provided in that notice. All references

to capitalized terms not defined herein or in the notice to which this Information Statement is attached have the meanings ascribed to

them in the Merger Agreement.

| |

● |

On

July 25, 2024, the Company entered into the Merger Agreement with Merger Sub I, Merger Sub II, and Scienture. |

| |

|

|

| |

● |

The

Board approved the Merger Agreement and the related transactions on July 25, 2024, and the consummation of the Mergers was not subject

to approval of the Company’s stockholders. |

| |

|

|

| |

● |

The

Majority Stockholders executed the Stockholder Consent on July 25, 2024, following the execution of the Merger Agreement. |

| |

|

|

| |

● |

Also

on July 25, 2024, the parties completed the Mergers, pursuant to which (i) Merger Sub I merged with and into Scienture, with Scienture

continuing as the surviving entity and a wholly owned subsidiary of the Company, and (ii) Scienture merged with and into Merger Sub

II, with Merger Sub II continuing as the surviving entity and Merger Sub II changed its name to “Scienture, LLC”.

|

| |

|

|

| |

● |

The

aggregate merger consideration paid in connection with the Mergers consisted of: (i) 291,555 shares of the Company’s common

stock, which represents 19.99% of the number of shares of the Company’s common stock issued and outstanding immediately prior

to the First Effective Time, and (ii) 6,826,713 shares of Series X Preferred Stock, each share of which is convertible into one share

of the Company’s common stock, subject to certain conditions. |

| |

|

|

| |

● |

The

Board considered various factors in determining whether to approve the Merger Agreement and the transactions contemplated

thereby, including the Mergers. For more information about the reasons for approving the Merger Agreement and the transactions, see

“The Transactions – Reasons for Entering into the Merger Agreement.” |

| |

|

|

| |

● |

Each

party’s obligation to complete the Mergers was subject to the satisfaction or waiver by each of the parties of various conditions,

which include, but were not limited to, the following: |

| |

● |

Scienture

having obtained its required stockholder vote; |

| |

|

|

| |

● |

the

Company having received approval for the listing of additional shares of the Company’s common stock on Nasdaq; and |

| |

|

|

| |

● |

the

Company having filed the Certificate of Designation of Preferences, Rights and Limitations of Series X Preferred Stock dated July

25, 2024 (the “Series X Certificate of Designation”) with the Secretary of State of the State of Delaware. |

| |

● |

Pursuant

to the Merger Agreement, on July 25, 2024, the Company entered into lock-up agreements with each of the directors and officers of

the Company and Scienture as well as certain of the stockholders of each of the Company and Scienture. For more information

see “The Transactions – Related Agreements – Lock-Up Agreements.” |

| |

|

|

| |

● |

Pursuant

to the Merger Agreement, on July 25, 2024, the Company entered into consulting agreements with each of Suren Ajjarapu and Prashant

Patel, the material terms of which will become effective when Mr. Ajjarapu or Mr. Patel, as applicable, are no longer employed by

the Company for any reason. For more information see “The Transactions – Related Agreements – Consulting Agreements.” |

| |

|

|

| |

● |

Separately,

in connection with the transactions, the Company intends to enter into a registration rights agreement. For more information see

“The Transactions – Registration Rights Agreement.” |

THE

PARTIES

TRxADE

Health, Inc.

We

historically focused on health services IT assets and operations aimed at digitalizing the retail pharmacy experience via an online pharmaceutical

marketplace. Our current primary operations are conducted through our wholly-owned subsidiary, Integra Pharma Solutions, LLC (“IPS”),

which is a licensed pharmaceutical wholesaler and sells brand, generic and non-drug products to customers. IPS customers include all

healthcare markets including government organizations, hospitals, clinics and independent pharmacies nationwide.

We

began operations as Trxade Group, Inc., a Nevada corporation (“Trxade Nevada”) in August of 2010 and spent over two years

creating and enhancing our web-based services. The Company changed its name on June 1, 2021, from “Trxade Group, Inc” to

“TRxADE HEALTH, INC.” Our services provided pricing transparency, purchasing capabilities and other value-added services

on a single platform focused on serving the nation’s approximately 19,397 independent pharmacies with annual purchasing power of

$67.1 billion (according to the National Community of Pharmacists Association’s 2021 Digest). Our national wholesale supply partners

and manufacturers were able to fulfill orders on our platform in real-time and provide pharmacies and wholesale suppliers with cost-saving

payment terms and next-day delivery capabilities in unrestrictive states. We expanded significantly since 2015 and served approximately

14,400+ registered members on our sales platform.

Trxade.com

previously operated the Company’s web-based pharmaceutical marketplace engaged in promoting and enabling commerce among independent

pharmacies, small chains, hospitals, clinics, and alternate dispensing sites with large pharmaceutical suppliers nationally. That marketplace

had over 60 national and regional pharmaceutical suppliers providing over 120,000 branded and generic drugs, including over-the-counter

drugs (OTCs), and drugs available for purchase by pharmacists. We served approximately 14,400+ registered members, providing access to

Trxade’s proprietary pharmaceutical database and data analytics regarding medication pricing. We generated revenue from these services

by charging a transaction fee to the seller of the products for sales conducted via the Trxade platform. The buyers did not bear the

cost of transaction fees for the purchases that they made, nor did they pay a fee to join or register with our platform. In February

2024 we divested substantially all of our assets related to our web-based pharmaceutical marketplace previously operated through TRxADE,

Inc. Substantially all of our revenues during Fiscal 2023, Fiscal 2022, and Fiscal 2021 were from platform revenue generated on www.rx.trxade.com,

product sales through Integra Pharma Solutions, LLC, and prescription sales through Community Specialty Pharmacy, LLC.

We

previously had a number of products and services focused on the US market in operation and business assets, which are described below.

Integra

Pharma Solutions, LLC. IPS is intended to serve as our logistics company for pharmaceutical distribution. We currently distribute

through our manufacturer and strategic distribution partners prescription medication, medical devices and over the counter medication

to over 1,600 pharmacies and medical clinics across 38 states.

Trxade

Prime. Trxade Prime previously allowed pharmacy members on the Trxade platform to process, consolidate and ship purchase orders that

were placed directly with Trxade suppliers via Trxade Prime. This service was provided at no cost, with the goal of offering a single

tool with one low order minimum, one invoice, one package and one delivery from multiple quality wholesalers and distributors. Revenue

had been generated from this service through our IPS subsidiary, which provided the consolidation of the orders.

Bonum

Health Application. The “Bonum Health app,” previously provided an overall healthcare experience comparable to a primary

care practitioner, and an online portal as a personal electronic medical record and scheduling system was available on a subscription

basis, primarily as a stand-alone telehealth software application that could be licensed on a business-to-business (B2B) model to clients

as an employment health benefit for the clients’ employees. Revenue was generated from this service through our Bonum subsidiary.

Bonum+

Business to Business (B2B). Bonum+ previously bundled telehealth, a COVID-19 risk assessment tool and a Personal Protective Equipment

(PPE) purchasing tool, through a secure mobile dashboard for corporate clients. The B2B platform eased pressure on employees who were

required to report any relevant health issues daily, centralizing communication and contact tracing to deliver risk scores. This allowed

employers to monitor employee COVID-19 risk profiles and streamlined the ordering of new PPE as needed. An integrated artificial intelligence

(AI) tool offered health recommendations and connects employees with board certified physicians, as needed. No revenue was generated

from this product.

SOSRx,

LLC. On February 15, 2022, the Company entered into a relationship with Exchange Health, LLC (“Exchange Health”), a technology

company providing an online platform for manufacturers and suppliers to sell and purchase pharmaceuticals. SOSRx, LLC (“SOSRx”)

was formed, which was owned 51% by the Company and 49% by Exchange Health. SOSRx did not generate material revenue and in February of

2023, the Company voluntarily withdrew from the joint venture agreement.

Superlatus.

As of December 31, 2023, Superlatus, Inc. (“Superlatus”) was a wholly owned subsidiary of the Company as a result of

a merger transaction that closed in July 2023. Superlatus is a diversified food technology company with distribution capabilities and

systems to optimize food security and population health via innovative Consumer Packaged Goods products, agritech, foodtech, plant-based

proteins and alt-protein and includes wholly-owned subsidiary, Sapientia, Inc., a food tech business. Subsequent to December 31, 2023,

the Company divested its entire interest in Superlatus.

Scienture,

Inc. (n/k/a Scienture, LLC)

Overview

Scienture

is a specialty pharmaceutical company focused on developing and commercializing products for the treatment of central nervous system

(“CNS”) and cardiovascular (“CVS”) diseases. Scienture is developing a broad range of novel product candidates

including new potential treatments for hypertension, migraine, pain and thrombosis and other related disorders

Scienture

was originally incorporated in Delaware and commenced operations in 2019.In connection with its acquisition by the Company in July 2024,

Scienture became a wholly owned subsidiary of the Company and merged with and into Merger Sub II, continuing as a limited liability company.

As described in this Information Statement, the Company will change its name to “Scienture Holdings, Inc.” immediately following

the effectiveness of the Stockholder Consent. Scienture’s principal executive offices are located in Commack, New York.

Scienture’s

Strategy

Scienture’s

mission is to improve the lives of patients suffering from CNS and CVS diseases. Scienture’s vision is to be a leader in the industry

by developing and commercializing new medicines for the treatment of CNS and CVS diseases. Key elements of Scienture’s strategy

to achieve this vision include:

| | ● | Advance product

candidates through clinical studies and toward commercialization. Scienture is in various stages of clinical development for the

product candidates in its pipeline, and it intends to move these programs efficiently toward being commercially available to patients,

subject to approval by the U. S. Food and Drug Administration (the “FDA”). Scienture is working to obtain regulatory approval

of its first product candidate, SCN-102. |

| | | |

| | ● | Drive

growth and profitability. Using dedicated sales and marketing resources in the U.S., which Scienture is in the process of building,

Scienture will seek to drive the revenue growth of its product candidates approved for marketing by the FDA. |

| | | |

| | ● | Continue

to grow pipeline. Scienture will continue to evaluate and seek to develop additional product candidates that Scienture believes have

significant commercial potential through Scienture’s internal research and development efforts. |

| | | |

| | ● | Target

strategic business development opportunities. Scienture is exploring a broad range of strategic opportunities. This may include in-licensing

products and entering into co-promotion and co-development partnerships for Scienture’s product candidates, although no agreements

have been reached. |

Research

and Development and Product Portfolio

Scienture

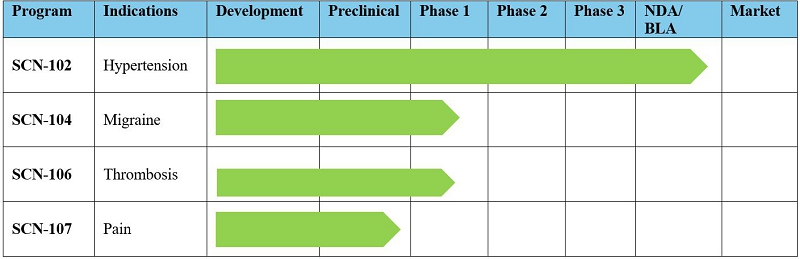

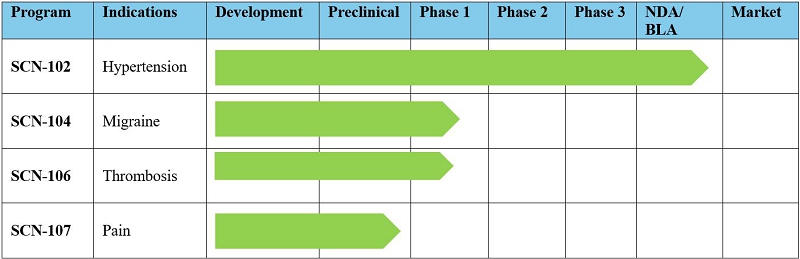

is committed to the development of innovative product candidates in the CNS and CVS therapeutic areas, including the following:

Scienture

does not have any product candidates approved for sale and has not generated any revenue from product sales. Scienture will not generate

revenue from product sales unless and until it successfully obtains regulatory approval for its product candidates. Scienture

is engaged in a variety of research and development efforts including development of a pipeline of novel product candidates for the treatment

of various disease conditions. Scienture has devoted and will continue to devote significant resources to research and development activities.

Scienture expects to incur significant expenses as Scienture continues advancing its product candidates towards FDA approval and expanding

product indications for approved products and its intellectual property portfolio. Scienture’s expectations regarding its research

and development programs are subject to risks, including the risk that Scienture’s financial condition and results of operations

for fiscal year 2024 and beyond may be materially and adversely affected by delays and failures in the completion of clinical development

of its product candidates, which could increase its costs or delay or limit our ability to generate revenues.

SCN-102

(ARBLITM - Losartan Oral Suspension)

SCN-102

is an oral liquid formulation of losartan potassium in development under the 505(b)(2) pathway, for (i) treatment of hypertension, to

lower blood pressure in adults and children greater than 6 years old, (ii) reduction of the risk of stroke in patients with hypertension

and left ventricular hypertrophy, and (iii) treatment of diabetic nephropathy with an elevated serum creatinine and proteinuria in patients

with type 2 diabetes and a history of hypertension. Currently, there are no FDA-approved liquid formulations of losartan potassium. SCN-102

has shown close comparability to the immediate-release tablet and, if approved, would be the first FDA approved oral liquid formulation

of losartan on the market.

Scienture

submitted an Investigational New Drug (“IND”) application to the FDA in September 2022. Multiple human pharmacokinetics

studies were performed, showing close comparability with the oral solid dosage form. In October 2023, Scienture submitted a New Drug

Application (“NDA”) to the FDA. In December 2023, the FDA accepted the NDA for review and assigned a Prescription Drug

User Fee Act (“PDUFA”) target action date of August 19, 2024. During the FDA’s review, Scienture has responded to information requests related to chemistry and manufacturing controls (“CMC”), pharmacovigilance, clinical, microbiology and labeling. If Scienture receives

approval on the PDUFA target action date, Scienture anticipates commercially launching this product in the first quarter of

2025.

SCN-104

(Multi-dose Dihydroergotamine (DHE) Mesylate injection pen)

The

SCN-104 injection pen is a disposable, multiple fixed dose, single entity combination product comprised of a small molecule drug, SCN-104,

which is administered using a customized injection pen. The SCN-104 injection pen is being developed via the 505(b)(2) regulatory pathway.

The SCN-104 injection pen is in development for the acute treatment of migraine headaches with or without aura and the acute treatment

of cluster headache episodes.

As

shown in third party studies of DHE, SCN-104’s mechanism of action for its antimigraine effect is due to its potential action as

an agonist at the serotonin 5-HT1D receptors. SCN-104 is intended for subcutaneous administration. SCN-104 is also

intended for acute use and is not intended for chronic administration.

Scienture

believes the SCN-104 injection pen may offer a significant improvement, in terms of usability and patient acceptability, on the current

standard of care in the market (ampoules for injection). The intended pen delivery system was designed with patients in mind to carry

multiple doses, have a lower volume of injection, and utilize shielded needles to avoid unnecessary exposure.

Scienture

has had initial discussions with the FDA to align on a path forward for this development program. The formulation has been scaled up

to enable future commercial scale production and the pen has been optimized for commercial use. Several pharmacokinetics studies

have shown comparability between SCN-104 and the currently available marketed injection product. Scienture is initiating

manufacturing activities and planning to conduct bioequivalence studies. Scienture plans to initiate a Phase 1 single dose study in

healthy adults in 2025, following submission of an IND, if the IND is cleared by the FDA.

SCN-106

(Potential Biosimilar)

Scienture

is developing a potential biosimilar, SCN-106, based on a reference product that is a thrombolytic agent that binds to fibrin in clots

and converts entrapped plasminogen to plasmin. SCN-106 is a sterile, purified glycoprotein that is synthesized using the complementary

DNA for natural human tPA obtained from a Chinese hamster ovary cell-line.

Scienture

is working with an external partner to develop a biosimilar product that utilizes the same mechanism(s) of action for the proposed condition

of use, and has the same route of administration, dosage form, and strength as the reference product.

The

CMC development program is focused on establishing the analytical similarity of SCN-106 to the reference product. Multiple clones of

CHO cells have been produced to synthesize lots of SCN-106 which were screened for similarity to the reference product for several key

biochemical quality attributes as well as overall protein yield and finalization of a lead clone.

Scienture

completed a Biosimilar Initial Advisory meeting with the FDA in June 2023 to discuss the CMC, non-clinical, and clinical studies required

for regulatory approval.

SCN-107

(Bupivacaine Long-Acting Injection)

SCN-107

is a long acting injection suspension formulation of a non-opioid analgesic that is indicated for postsurgical local and regional analgesia.

Scienture’s long-acting

formulation, SCN-107, is a novel microsphere-based formulation of bupivacaine that comprises the drug in polymer-based microspheres and

is intended to provide pain management over a period of 5-7 days. The product candidate is designed to potentially provide longer term

post-surgical pain relief compared to the currently available products in the market.

Based

on initial discussions with FDA regarding this program, Scienture believes this product candidate would require at least one Phase 3

clinical trial to support submission of a marketing application.

Scienture

anticipates submitting an IND and, if cleared by the FDA, initiating a Phase 1 single dose study in healthy adults in 2025 to conduct

an initial assessment of safety and tolerability of SCN-107.

Sales

and Marketing

Scienture

intends to market its products through its own sales forces in the U.S. and seek strategic collaborations with other pharmaceutical

companies to commercialize its products outside of the U.S. Scienture is in the process of building a commercial sales and marketing

operation in the U.S., through a

partnership with a Contract Sales Organization, to support sales of Scienture’s products. Once

approved, this sales and marketing organization will include a combination of field teams, virtual sales representatives and

omnichannel marketing to effectively reach Health Care Providers (“HCPs”) and offer patient education. Scienture’s promotional

efforts are expected to further include developing a market access strategy to obtain commercial and government payor coverage for

its products. In addition, Scienture intends to partner with a third party logistics

provider (“3PL”) and have internal sales operations and analytics teams to provide state-of-the-art distribution capabilities to

wholesalers, pharmacies, institutional buying groups and hospitals. Scienture believes

its commercial operations infrastructure, once established, will enable it to effectively target healthcare providers to support and

grow its products subsequent to market entry.

Customers

The

majority of Scienture’s product sales, if its products are approved by the FDA, are expected to be to pharmaceutical

wholesalers, specialty pharmacies, and distributors who, in turn, would sell such products to pharmacies, hospitals, long term care

institutions and other customers, potentially including federal and state

entities.

Market

and Competition

Scienture

is engaged in segments of the pharmaceutical

industry that are highly competitive and rapidly changing. Many large pharmaceutical and biotechnology companies, academic institutions,

governmental agencies, and other public and private research organizations are commercializing or pursuing the development of products

utilizing the same molecules or compounds or for the same indications that Scienture is currently pursuing or may target in the future.

Hypertension

Hypertension

(high blood pressure) is a CVS condition, when the pressure in the blood vessels is too high (140/90 mmHg or higher). According to the

CDC, hypertension, or high blood pressure, affects nearly half of adults in the United States, or 119.9 million people. Hypertension

is defined as a systolic blood pressure of 140 mmHg or higher, and diastolic blood pressure of 90 mmHg or higher. Hypertension is a risk

factor for stroke and heart disease, which are leading causes of death in the U.S. Factors that increase the risk of having high blood

pressure include: older age, genetics, being overweight or obese, not being physically active, high-salt diet and drinking too much alcohol.

Hypertension is clinically diagnosed if, when blood pressure is measured on two different days, the systolic blood pressure readings

on both days is ≥140 mmHg and/or the diastolic blood pressure readings on both days is ≥ 90 mmHg.

The

hypertension market has increased with the commercial launch of several branded products in recent years, as well as the launch of generic

versions of branded drugs, such as Prinvil, Lotensin, Cozaar, Cardizem, Apresoline, Nitrostat and Toprol-XL. Treatment options for hypertension

in the U.S. market can be broadly classified across the following product classes, Angiotensin-converting enzyme (ACE) inhibitors, Angiotensin

II receptor blockers (ARBs), Beta-Blockers, Diuretics and Calcium Channel Blockers.

Scienture’s

product candidate SCN-102, ARBLITM (Losartan Oral Suspension 10mg/mL), is a ready to use oral suspension of losartan for increased

patient convenience and ease of dosing. Losartan is classified as an ARB for treating hypertension and is one of the highest prescribed

molecules for this indication. Current products in the market containing losartan are available only as oral solids, which can be further

compounded to a liquid formulation. Scienture believes that ARBLITM, if approved by the FDA, would be the first liquid formulation

of losartan on the market that does not require compounding and has reduced dosing volume and long term shelf life at room temperature

storage.

Migraine

Migraine

is a painful, complex neurological disorder consisting of recurring painful attacks that can significantly impact quality of life. Migraine

headaches are often characterized by throbbing pain, extreme sensitivity to light or sound, and potentially nausea and vomiting. The

World Health Organization categorizes migraine as one of the most disabling medical illnesses worldwide. The American Research Foundation

categorizes migraine as the third most prevalent illness in the world, and nearly 1 in 4 U.S. households includes someone with migraines.

Migraine is estimated to affect over 39 million individuals in the U.S.

Current

products in the market that are available to treat migraine headaches, include CGRP antagonists (calcitonin gene related peptide), which

is a class of products first introduced in 2018 (Nurtec, Ubrelvy), Botox, branded and generic versions of triptans (Imitrex, Maxalt,

Relpax), and ergot alkaloids (Ergotamine and Dihydroergotamine (DHE)).

Scienture’s

product candidate, SCN-104, is supplied in a multi-dose pen-based delivery system for self-injection and increased patient convenience.

The product candidate is in development for the acute treatment of migraine headaches with or without aura and the acute treatment of

cluster headache episodes.

Thrombotically

Occluded Catheter (CVAD) Management

Catheters,

which are a type of a Central Venous Access Device (“CVAD”), are employed to deliver life-sustaining therapies. They can be used for short-term

or long-term infusion of antibiotics, parenteral nutrition, chemotherapy, blood and blood products in patients with limited peripheral

access. More than 7 million CVADs are inserted each year in patients in the United States. Occlusion of catheters while in use can complicate

patient care by interrupting the administration of medications and solutions, delaying or disrupting therapies and leading to additional

procedures such as catheter replacement. Occlusion is the most common noninfectious complication in the long-term use of CVADs and may

occur soon after insertion of a device or develop at any time. About 58% of catheter occlusions are thrombotic, resulting from the formation

of a thrombus within, surrounding, or at the tip of the catheter.

Scienture’s

product candidate, SCN-106, is a thrombolytic agent currently in development. Scienture plans to develop SCN-106 through the

FDA’s 351(k) pathway for biosimilars.

Postoperative

Pain

Post-surgery

pain, also known as postoperative pain, is pain that a patient experiences after a surgical procedure. Pain can be caused by a number

of factors, including: the type of procedure, the size of the operation, and medications used during surgery. Chronic pain can negatively

impact a patient’s rehabilitation, quality of life, and the results of the procedure.

Current

drug product treatments available in the market for treating postoperative pain include IV and oral opioids, injectable local

anesthetics, and steroidal and non-steroidal analgesics. Marketed products include branded and generic versions of Celebrex,

Ketalar, Exparel, Lyrica, Neurontin and Astromorph.

Scienture’s

product candidate, SCN-107, is a microsphere based long-acting injection of Bupivacaine, a local anesthetic, in development for postsurgical

analgesia. SCN-107 is designed to be a non-opioid treatment regimen with rapid onset of action and analgesia that is intended to provide

coverage over a period of 5-7 days.

Manufacturing

Scienture

currently depends on third-party commercial manufacturing organizations (“CMOs”) for all manufacturing

operations, including the production of raw materials, finished dosage form product, and product packaging for both its planned commercial

scale manufacturer and the products used in its preclinical and clinical research. Scienture does not own or operate manufacturing facilities

for the production of any of its product candidates nor does Scienture have plans to develop its own manufacturing operations in the

foreseeable future to support clinical trials or commercial production. Scienture currently employs internal resources to manage its manufacturing

contractors.

Scienture

is in discussion with CMOs headquartered in North America, Europe and Asia for its pipeline product candidates. These CMOs offer a comprehensive

range of commercial contract manufacturing and packaging services.

If

Scienture fails to produce its products and product candidates in the volumes that Scienture requires on a timely basis, or fails to comply

with stringent regulations applicable to pharmaceutical drug manufacturers, Scienture may face delays in the development and commercialization

of its products and product candidates or be required to withdraw its products from the market for

risks associated with manufacturing and supply of its products and product candidates.

License Agreements

On May 26, 2020, Scienture

entered into Feasibility Study and Animal Trial Material Manufacturing Agreement with Innocore Technologies, B.V. (“Innocore”),

as amended on December 2, 2022 (the “Innocore License”), for certain intellectual property rights. Under the Innocore License,

Innocore granted Scienture a worldwide exclusive, milestone, royalty-bearing and sublicensable license to certain patent rights for the

research and development of SCN-107 in postsurgical local and regional analgesia. Pursuant to the Innocore License, Scienture is required

to make low single-digit percentage royalty payments based on annual net sales of licensed products for the first three years of sales

on a country-by-country basis, subject to a low single digit increase as of the fourth year of sales on a country-by-country basis. Scienture

is required to remunerate Innocore for the development of the licensed product, subject to a limit of $0.4 million for certain safety

and toxicity studies which will be deducted from certain development and regulatory milestones as described below. Scienture is required

to make development and regulatory milestone payments up to €2.7 million in the aggregate, commercial sale milestone payments

of up to €18.875 million in the aggregate, and maintenance fees of €0.25 million annually, subsequent to the first regulatory

filing, until the date that Scienture begins making royalty payments based on annual net sales, up to €0.5 million of which may

be credited toward the regulatory milestone payments.

Intellectual

Property

Overview

Scienture continues to build its intellectual

property portfolio to provide protection for its technologies, products, and product candidates. Scienture seeks patent protection,

where appropriate, both in the U.S. and internationally for products and product candidates.

Scienture’s intended objective is to protect its innovations and proprietary

products by, among other things, filing patent applications in the U.S. and abroad, including Europe, Canada, and other countries when

appropriate. Scienture also relies on trade secrets, know-how, proprietary knowledge, continuing technological innovation, and in-licensing

opportunities to develop and maintain its proprietary position. Scienture cannot be sure that patents will be granted with respect to

its pending patent applications or with respect to any patent applications filed by it in the future, nor can Scienture be sure that any

of its existing patents or any patents that may be granted to it in the future will be commercially useful in protecting its technology

or its products. Scienture cannot be sure that any patents, if granted, will sustain a legal challenge.

Patent

Portfolio

SCN-102

SCN-102 will soon have two orange book listable formulation composition

and method of use patents in the U.S. One of them is already issued (Patent #: 11,890,273, Issue Date: February 6, 2024, titled “Losartan

Liquid Formulations and Methods of Use”) and the other patent application is allowed, with the issue fee paid on July 24,

2024 (Appl. No. 18/421,405; Filing Date: January 24, 2024, titled “LOSARTAN LIQUID FORMULATIONS AND METHODS OF USE”). A third

application is pending (Appl. No. 18/061,819, Filing Date: December 5, 2022).

SCN-104

SCN-104 has a formulation composition and method of use application pending

in the U.S. (Appl. No. 17/757,924; Filing Date: June 23, 2022).

SCN-107

SCN-107 has a formulation composition and method of use application pending

in the U.S. (Appl. No. 17/996,995; Filing Date: October 24, 2022). Applications in Canada and Europe are currently pending.

Collaborations

and Licensing Arrangements

Scienture entered into exclusive license and commercial agreements on August

28, 2022 and April 24, 2023, with Kesin Pharma Corporation (“Kesin”), a related party, pursuant to which Scienture granted

the exclusive license rights to commercialize SCN-102 and SCN-104, respectively to Kesin for use in the United States of America (together,

the “Kesin Agreement”). In consideration of the rights granted, Scienture received milestone payments and reimbursement of

costs actually incurred related to SCN-102 and SCN-104.

On March 13, 2024, the parties terminated the Kesin Agreement by entering

a Confidential Termination Agreement (the “Kesin Termination Agreement”), and the parties agreed that Scienture would pay

Kesin a total gross amount of $1.285 million upon commercialization of either SCN-102 or SCN-104 via a royalty arrangement. The Kesin

Termination Agreement also requires that if the full $1.285 million has not been repaid within two years of the earlier of (i) commercial

launch of a product or (ii) 120 days after FDA approval of a product, then interest will accrue prospectively at a rate of 8% annually

on the unpaid balance.

In

August 2024, Kesin demanded immediate payment of the full amount under the Kesin Termination Agreement, alleging the full amount is payable

in connection with the consummation Scienture’s business combination with the Company. Scienture has disputed that the amount is

now payable, and the parties are in discussions to resolve the issue. There can be no assurance that an amicable resolution will be obtained.

If Kesin brings a legal action, Scienture will vigorously defend it.

Government

Regulation

U.S.

Drug Development Process

In

the United States, pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act (the

“FDCA”) and other federal and state statutes and regulations, govern, among other things, the research, development, testing,

manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting,

sampling, and import and export of pharmaceutical products. Scienture, along with third-party contractors, will be required to navigate

the various preclinical, clinical and commercial approval requirements of the governing regulatory authorities of the countries in which

Scienture wishes to conduct studies or seek approval of its product candidates. Failure to comply with applicable United States requirements

may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending applications, withdrawal

of an approval, warning or untitled letters, clinical holds, product recalls or withdrawals from the market, product seizures, total

or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement

of profits, civil penalties, and criminal prosecution.

FDA

approval is required before any new unapproved product or a product with certain changes to a previously approved product, including

a new use of a previously approved drug, can be marketed in the United States. The steps required to be completed by the FDA before a

drug may be marketed in the United States generally include the following:

| ● | completion

of preclinical laboratory tests, animal studies, and formulation studies performed in accordance

with the FDA’s Good Laboratory Practice (“GLP”) regulations; |

| | | |

| ● | submission

to the FDA of an IND application for human clinical testing, which

must become effective before human clinical trials may begin and must be updated annually

or when significant changes are made; |

| | | |

| ● | approval

by an independent institutional review board (“IRB”) or ethics committee at each

clinical site before the clinical trial is commenced; |

| | | |

| ● | performance

of adequate and well-controlled human clinical trials in accordance with applicable IND regulations,

good clinical practices (“GCPs”) requirements and other clinical-trial related regulations to establish the safety and

efficacy of the proposed drug for each indication; |

| | | |

| ● | preparation

and submission to the FDA of a NDA or biologics license application (“BLA”),

after completion of all pivotal clinical trials, which includes not only the results of the

clinical trials, but also, detailed information on the chemistry, manufacture and quality

controls for the product candidate and proposed labeling; |

| | | |

| ● | satisfactory

completion of an FDA Advisory Committee review, if applicable; |

| | | |

| ● | a

determination by the FDA within 60 days of its receipt of an NDA or BLA to file the application

for review; |

| | | |

| ● | satisfactory

completion of an FDA pre-approval inspection of the manufacturing facility or facilities

at which the proposed drug is produced to assess compliance with current good manufacturing practices (“GMPs”) regulations

and of selected clinical trial sites to assess compliance with GCPs; and |

| | | |

| ● | FDA

review and approval of the NDA or BLA to permit commercial marketing of the product for particular

indications for use in the United States. |

Satisfaction

of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the

type, complexity, and novelty of the product or disease.

Preclinical

and Clinical Development

Preclinical

tests include laboratory evaluation of product chemistry, formulation, and toxicity, as well as animal trials to assess the characteristics

and potential safety and efficacy of the product candidate. The conduct of the preclinical tests must comply with federal regulations

and requirements, including GLP. The results of preclinical testing are submitted to the FDA as part of an IND application along with

other information, including information about the product candidate, chemistry, manufacturing and controls, any available human data

or literature to support the use of the product candidate and a proposed clinical trial protocol. Long term preclinical tests, such as

animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

An

IND application must become effective before human clinical trials may begin. The IND application automatically becomes effective 30

days after receipt by the FDA, unless the FDA, within the 30-day period, raises safety concerns or questions relating to one or more

proposed clinical trials and places the clinical trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any

outstanding concerns or questions before the clinical trial can begin. The FDA may also impose clinical holds on a product candidate

at any time before or during clinical trials due to safety concerns, non-compliance or other issues affecting the integrity of the trial.

Accordingly, submission of an IND application may or may not result in the FDA allowing clinical trials to commence and, once begun,

issues may arise that could cause the trial to be suspended or terminated.

Clinical

trials involve the administration of the investigational drug product to human subjects under the supervision of a qualified investigator.

Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with GCP, an international standard

meant to protect the rights and health of clinical research participants and to define the roles of clinical trial sponsors, administrators,

and monitors; as well as (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety,

and the effectiveness criteria to be evaluated. Each protocol involving testing on United States patients and subsequent protocol amendments

must be submitted to the FDA as part of the IND. Furthermore, an independent IRB or ethics committee for each site proposing to conduct

the clinical trial must review and approve the plan for any clinical trial and its informed consent form before the clinical trial begins

at that site, and must monitor the study until completed. An IRB is charged with protecting the welfare and rights of trial participants

and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in

relation to anticipated benefits.

Regulatory

authorities, the IRB or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects

are being exposed to an unacceptable health risk or that the trial is unlikely to meet its stated objects. The FDA may order the temporary,

or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial is not being conducted in accordance with FDA requirements. Further, an IRB may also require the clinical trial at the site to be halted,

either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions. Some trials

also include oversight by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring

board, which provides authorization for whether or not a study may move forward at designated check points based on access to certain

data from the study and may recommend a clinical trial to be halted if it determines that there is an unacceptable safety risk for subjects

or other grounds, such as futility.

Clinical

trials to support an NDA or BLA for marketing approval are typically conducted in three sequential phases, but the phases may overlap

or be combined. In Phase 1 clinical trials, the investigational product is typically introduced into a limited population of healthy

human subjects or patients with the target disease or condition. These trials are designed to test the safety, dosage tolerance, pharmacokinetics

and pharmacological actions of the investigational product, to identify side effects associated with increasing doses, and, if possible,

to gain early evidence on effectiveness. Phase 2 clinical trials usually involve administering the investigational product to a limited

patient population with the specified disease or condition to evaluate the preliminarily efficacy, dosage tolerance, and optimum dosage,

and to identify possible adverse effects and safety risks. Phase 3 clinical trials are typically undertaken in a larger number of patients,

typically at geographically dispersed clinical trial sites, to provide substantial evidence of clinical efficacy and to further test

for safety in an expanded and diverse patient population. These clinical trials are intended to permit the FDA to evaluate the overall

benefit-risk relationship of the investigational product and to provide adequate information for the labeling of the product candidate.

In

reviewing an NDA or BLA, the FDA will consider all information submitted in the application, including the results of all clinical trials

conducted. In some cases, the FDA may require, or companies may voluntarily pursue, additional clinical trials after a product is approved

to gain more information about the product. These so-called Phase 4 studies may be made a condition to approval of the NDA or BLA. These

trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication and further document

clinical benefit in the case of drugs approved under accelerated approval regulations. Failure to exhibit due diligence with regard to

conducting Phase 4 clinical trials could result in the withdrawal of approval for products.

Concurrent

with clinical trials, companies may complete additional animal studies and develop additional information about the biological characteristics

of the product candidate, and must finalize a process for manufacturing the product in commercial quantities in accordance with current

GMP requirements. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among

other things, must develop methods for testing the identity, strength, quality and purity of the final product. Additionally, appropriate

packaging must be selected and tested and stability studies must be conducted to demonstrate that the product candidate does not undergo

unacceptable deterioration over its shelf life.

During

all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical

data, and clinical study investigators. Progress reports detailing the results of the clinical trials, among other information, must

be submitted at least annually to the FDA, and written IND safety reports must be submitted to the FDA and the investigators for serious

and unexpected suspected adverse events, findings from other studies suggesting a significant risk to humans exposed to the product candidate,

findings from animal or in vitro testing that suggest a significant risk for human subjects, and any clinically important increase in

the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure.

NDA

and BLA Submission and Review

Assuming

successful completion of the required clinical testing in accordance with all applicable regulatory requirements, an NDA or BLA application

which includes, among other information, the results of product development, preclinical studies and clinical trials is submitted to

the FDA. FDA approval of the application is required before marketing of the product may begin in the United States. The application

must include, among other things, the results of all trials and preclinical testing, and other testing and a compilation of data relating

to the product’s pharmacology, chemistry, manufacture, controls and proposed labeling. The cost of preparing and submitting an

NDA or BLA is substantial.

The

FDA has 60 days from its receipt of an NDA or BLA to either issue a Refuse to File Letter or accept the NDA or BLA for filing, indicating

that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth

review. The FDA has agreed to certain performance goals in the review of NDAs and BLAs. Under applications subject to the performance

goals of the PDUFA, the FDA has a goal of responding to standard review NDAs and BLAs within ten months after

it accepts the application for filing, or, if the application qualifies for priority review, six months after the FDA accepts the application

for filing, but this timeframe can be extended, such as by the submission of major amendments by applicants during the review period.

The FDA reviews an application to determine, among other things, whether the product is safe and effective and the facility in which

it is manufactured, processed, packed or held meets standards designed to assure the product’s continued safety, purity and potency.

The

FDA may refer applications for novel drug products, or drug products that present difficult questions of safety or efficacy, to an advisory

committee—typically a panel that includes clinicians and other experts—for review, evaluation, and a recommendation as to

whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows

such recommendations. Before approving an application, the FDA will typically inspect one or more clinical sites to assure compliance

with GCPs. Additionally, the FDA will inspect the facility or the facilities at which the proposed product is manufactured. If the FDA

determines that the application, manufacturing process or manufacturing facilities are not acceptable, it will outline the deficiencies

in the submission and often will request additional testing or information. Notwithstanding the submission of any requested additional

information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

After

the FDA evaluates the application and conducts inspections of the manufacturing facilities where the investigational product and/or its

drug substance will be produced, it issues either an approval letter or a Complete Response Letter. An approval letter authorizes commercial

marketing of the drug with approved prescribing information for specific indications. A Complete Response Letter indicates that the review

cycle of the application is complete and the application is not ready for approval. A Complete Response Letter generally outlines the

deficiencies in the submission, except that where the FDA determines that the data supporting the application are inadequate to support

approval, the FDA may issue the Complete Response Letter without first conducting required inspections or reviewing proposed labeling.

In issuing the Complete Response Letter, the FDA may require substantial additional clinical data and/or other significant, expensive,

and time-consuming requirements related to clinical trials, preclinical studies and/or manufacturing. If a Complete Response Letter is

issued, the applicant may either resubmit the NDA or BLA, addressing all of the deficiencies identified in the letter, withdraw the application

or request a hearing. The FDA has committed to reviewing resubmissions of the NDA or BLA addressing such deficiencies in two or six months

depending on the type of information included. Even if such data are submitted, however, the FDA may ultimately decide that the NDA or

BLA does not satisfy the criteria for approval.

If

regulatory approval of a product is granted, such approval will be granted for a particular indication(s) and may include

limitations on the indicated use(s) for which such product may be marketed. Further, the FDA may require that certain

contraindications, warnings or precautions be included in the product labeling or may condition the approval of the application on

other changes to the proposed labeling, development of adequate controls and specifications, or a commitment to conduct post-market

testing or clinical trials and surveillance to monitor the effects of approved products. As a condition of NDA or BLA approval, the

FDA may require a risk evaluation and mitigation strategy (“REMS”) to help ensure that the benefits of the drug outweigh

the potential risks. REMS can include medication guides, communication plans for healthcare professionals, and elements to assure

safe use (“ETASU”). ETASU can include, but are not limited to, special training or certification for prescribing or

dispensing, dispensing only under certain circumstances, special monitoring, and the use of patient registries. The requirement for

REMS can materially affect the potential market and profitability of the product. Moreover, product approval may also be conditioned

on substantial post-approval testing, such as Phase 4 post-market studies, and surveillance to monitor the product’s safety or

efficacy, and the FDA may limit further marketing of the product based on the results of these post-approval studies. Once granted,

product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following

initial marketing.

Changes

to some of the conditions established in an approved application, including changes in indications, labeling, or manufacturing processes

or facilities, require submission and FDA approval of a new NDA or BLA, or NDA or BLA supplement before the change can be implemented.

An NDA or BLA supplement for a new indication typically requires clinical data similar to that in the original application, and the FDA

uses the same procedures and actions in reviewing NDA and BLA supplements as it does in reviewing NDAs and BLAs. As with new NDAs and

BLAs, the review process is often significantly extended by requests for additional information or clarification.

505(b)(2)

NDA Approval Process

Section

505(b)(2) of the FDCA provides an alternate regulatory pathway for the FDA to approve a new product and permits reliance for such approval

on published literature or an FDA finding of safety and effectiveness for a previously approved drug product. Specifically, section 505(b)(2)

permits the filing of an NDA where one or more of the investigations relied upon by the applicant for approval were not conducted by

or for the applicant and for which the applicant has not obtained a right of reference. Typically, 505(b)(2) applicants must perform

additional trials to support the change from the previously approved drug and to further demonstrate the new product’s safety and

effectiveness. The FDA may then approve the new product candidate for all or some of the labeled indications for which the referenced

product has been approved, as well as for any new indication sought by the section 505(b)(2) applicant.

Regulation

of Combination Products in the United States

Certain

products may be comprised of components, such as drug components and device components, that would normally be regulated under different

types of regulatory authorities, and frequently by different centers at the FDA. These products are known as combination products. Specifically,

under regulations issued by the FDA, a combination product may be:

| ● | a

product comprised of two or more regulated components that are physically, chemically, or

otherwise combined or mixed and produced as a single entity; |

| | | |

| ● | two

or more separate products packaged together in a single package or as a unit and comprised

of drug and device products, device and biological products, or biological and drug products; |

| | | |

| ● | a

drug, or device, or biological product packaged separately that according to its investigational

plan or proposed labeling is intended for use only with an approved individually specified

drug, or device, or biological product where both are required to achieve the intended use,

indication, or effect and where upon approval of the proposed product the labeling of the

approved product would need to be changed, e.g., to reflect a change in intended use, dosage

form, strength, route of administration, or significant change in dose; or |

| | | |

| ● | any

investigational drug, or device, or biological product packaged separately that according

to its proposed labeling is for use only with another individually specified investigational

drug, device, or biological product where both are required to achieve the intended use,

indication, or effect. |

Under

the FDCA and its implementing regulations, the FDA is charged with assigning a center with primary jurisdiction, or a lead center, for

review of a combination product. The designation of a lead center generally eliminates the need to receive approvals from more than one

FDA component for combination products, although it does not preclude consultations by the lead center with other components of FDA.

The determination of which center will be the lead center is based on the “primary mode of action” of the combination product.

Thus, if the primary mode of action of a drug-device combination product is attributable to the drug product, the FDA center responsible

for premarket review of the drug product would have primary jurisdiction for the combination product. The FDA has also established an

Office of Combination Products to address issues surrounding combination products and provide more certainty to the regulatory review

process. That office serves as a focal point for combination product issues for agency reviewers and industry. It is also responsible

for developing guidance and regulations to clarify the regulation of combination products, and for assignment of the FDA center that

has primary jurisdiction for review of combination products where the jurisdiction is unclear or in dispute.

A

combination product with a drug primary mode of action generally would be reviewed and approved pursuant to the drug approval processes

under the FDCA. In reviewing the NDA application for such a product, however, FDA reviewers in the drug center could consult with their

counterparts in the device center to ensure that the device component of the combination product met applicable requirements regarding

safety, effectiveness, durability and performance. In addition, under FDA regulations, combination products are subject to current GMP

requirements applicable to both drugs and devices, including the Quality System regulations applicable to medical devices.

Post-Approval

Requirements

Once

an NDA or BLA is approved, a product will be subject to pervasive and continuing regulation by the FDA including, among other things,

requirements relating to current GMPs, quality controls, record-keeping, reporting of adverse experiences, periodic reporting, product