0001445283falseKINETA, INC./DENASDAQ00014452832024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

KINETA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-37695 |

20-8436652 |

(State or other jurisdiction |

(Commission |

(IRS Employer |

of incorporation) |

File Number) |

Identification No.) |

7683 SE 27th Street, Suite 481 |

|

|

Mercer Island, WA |

|

98040 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (206) 378-0400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

Trading |

Name of each exchange |

|

|

Symbol(s) |

on which registered |

|

Common Stock, par value $0.001 per share |

|

KA |

|

The Nasdaq Capital Market |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 15, 2024, Kineta, Inc. (the “Company”) issued a press release containing information about the Company’s results of operations for the three months ended March 31, 2024. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. Document

99.1 Press release issued by Kineta, Inc., dated May 15, 2024

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 15, 2024

Kineta, Inc.

|

|

By: |

/s/ Craig Philips |

Name: |

Craig Philips |

Title: |

President |

Exhibit 99.1

Kineta Reports First Quarter 2024 Financial Results and Provides Update on its Ongoing Phase 1/2 VISTA-101 Clinical Trial and Corporate Activities

Partial response and stable disease reported in combination cohort, and durable stable disease observed in monotherapy cohorts

Favorable clinical safety and tolerability profile observed with no dose limiting toxicities and no evidence of CRS-associated cytokines observed at any dose level

Cleared fifth of six monotherapy cohorts and second of four combination cohorts

Kineta is actively exploring strategic alternatives to maximize value for all stakeholders

Received $500,000 investment from an existing investor

SEATTLE — (May 15, 2024) Kineta, Inc. (Nasdaq: KA), a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies in oncology that address cancer immune resistance, announced today financial results for the three months ended March 31, 2024 and provided a corporate update.

In February 2024, the Company announced a significant corporate restructuring to substantially reduce expenses and preserve cash. The restructuring included a significant workforce reduction and the suspension of enrollment of new patients in its ongoing VISTA-101 Phase 1/2 clinical trial evaluating KVA12123 in patients with advanced solid tumors. Patients currently enrolled in the trial will be permitted to continue to participate. The Company announced the restructuring as a result of certain investors indicating that they would not fulfill their April 2024 funding obligation in the previously disclosed private placement financing. In connection with the restructuring, the Company announced that it is exploring strategic alternatives to maximize stockholder value.

“The Company announced additional clinical updates on the progress of the KVA12123 monotherapy and combination therapy results during the first quarter of 2024. We continue to be pleased with these early clinical results as well as the accompanying biomarkers and immune cell data sets. We look forward to sharing additional clinical updates in the second quarter and we will continue to explore strategic alternatives,” said Craig Philips, President of Kineta.

RECENT CORPORATE HIGHLIGHTS

Phase 1/2 VISTA-101 Trial of KVA12123 in Patients with Solid Cancer Tumors (clinical data was announced in March 2024)

Efficacy

•Announced positive KVA12123 monotherapy safety data from its ongoing Phase 1/2 VISTA-101 clinical trial in patients with advanced solid tumors.

•Monotherapy Dose Escalation (3 – 300 mg KVA12123 Q2W)

· Of 21 patients enrolled, 12 received at least one baseline and one follow up scan.

· Best overall response (BOR) in nine of 12 patients is currently stable disease among patients with at least one follow-up scan with a mean duration of 15 weeks.

· One patient with non-small cell lung cancer that failed six prior lines of therapy, including checkpoint inhibitor (CPI) therapy, has experienced a stable disease lasting 28 weeks.

· Nine participants remain on-treatment.

•Combination Therapy Dose Escalation (30-100 mg KVA12123 Q2W, 400 mg pembrolizumab Q6W).

· Of nine patients enrolled, three received at least one baseline and one follow-up scan.

· BOR in 2 of 3 patients with at least one follow up scan is:

o Stable disease in one CPI-failure renal cell carcinoma patient with a 24% reduction in target lesions.

o Partial response in one patient with a PD-L1 negative mucoepidermoid carcinoma and a 54% reduction in target lesions and a complete response in non-target lesions.

o Eight patients remain on treatment.

Biomarkers

· Dose-dependent induction of on-target pro-inflammatory cytokines and chemokines.

· Dose-dependent increases in non-classical monocytes, CD4+ and CD8+ T cells, and NK cells.

Safety

· No dose limiting toxicities (DLTs) observed in any patient at any dose level.

· No evidence of cytokine release syndrome in any patient at any dose level.

Conference Presentations

•Co-organized the 3rd Annual VISTA Symposium, with Hummingbird Bioscience and Dartmouth Giesel School of Medicine.

•Presented clinical and preclinical data on VISTA blocking KVA12123 at the Keystone Symposia of Cancer Immunotherapy: Beyond Immune Checkpoint Blockade and Overcoming Resistance.

•Presented new preclinical data on KVA12123 in acute myeloid leukemia (AML) at the American Association for Cancer Research (AACR) Blood Cancer Discovery Symposium.

ANTICIPATED FUTURE MILESTONES

•Additional KVA12123 monotherapy safety and efficacy data in Q2 2024.

•Additional KVA12123 and pembrolizumab combination therapy data in Q2 2024.

FIRST QUARTER 2024 FINANCIAL HIGHLIGHTS

•Cash position: As of March 31, 2024, cash was $1.8 million, compared to $5.8 million as of December 31, 2023. The decrease was primarily due to cash used for clinical trial development of KVA12123 as well as general corporate purposes. As of March 31, 2024, we had $1.8 million in cash. In April 2024, we received a cash investment of $500,000 from an existing investor in connection with settlement of claims relating to the prior failure to fund by certain investors in the private placement. We are pursuing litigation against the other two larger investors who did not fund. Based on our current operating plans, we do not have sufficient cash and cash equivalents to fund our operating expenses and capital expenditures for at least the next 12 months from the filing date of our Quarterly Report on Form 10-Q for the three months ended March 31, 2024, which we expect to file on May 15, 2024, and there is substantial doubt about our ability to continue as a going concern.

•Revenues: Total revenues were zero for the three months ended March 31, 2024 and $281,000 for the three months ended March 31, 2023. Revenues in 2023 were primarily due to providing research services provided under the Merck Neuromuscular License Agreement, which we completed in June 2023.

•Research and development (R&D) expense: R&D expenses were $2.7 million for the three months ended March 31, 2024 and $2.8 million for the three months ended March 31, 2023. The decrease in R&D expenses was primarily due to lower facilities allocations expense as we transitioned to clinical trials in 2023 and ceased using our laboratory space, partially offset by higher activities for KVA12123, our lead product candidate, and CD27 licensing expense.

•General and administrative expense: General and administrative expenses were $3.7 million for the three months ended March 31, 2024 and $3.9 million for the three months ended March 31, 2023. The decrease was primarily due to a decrease in personnel costs of $538,000 and other administrative expenses of $328,000, partially offset by an increase in professional services of $441,000 and higher facilities allocation of $181,000.

•Net loss: Net loss was $10.2 million, or $0.89 per basic and diluted share, for the three months ended March 31, 2024 compared to a net loss of $6.5 million, or $0.77 per basic and diluted share, for the three months ended March 31, 2023.

About Kineta

Kineta (Nasdaq: KA) is a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies that transform patients’ lives. Kineta has leveraged its expertise in innate immunity and is focused on discovering and developing potentially differentiated immunotherapies that address the mechanisms of cancer immune resistance. For more information on Kineta, please visit www.kinetabio.com, and follow Kineta on X (Twitter), LinkedIn and Facebook.

Cautionary Statements Regarding Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as, but not limited to, “believe,” “expect,” “estimate,” “project,” “intend,” “future,” “potential,” “continue,” “may,” “might,” “plan,” “will,” “should,” “seek,” “anticipate,” or “could” and other similar words or expressions are intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements relating to exploring strategic alternatives that may include sale of assets of the Company, a sale of the Company, a merger or other strategic action. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on Kineta’s current beliefs, expectations and assumptions regarding the future of Kineta’s business, future plans and strategies, clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

Such forward-looking statements are subject to a number of material risks and uncertainties including, but not limited to: Kineta’s ability to successfully initiate and complete clinical trials; the difficulty in predicting the time and cost of development of Kineta’s product candidates; Kineta’s plans to research, develop and commercialize its current and future product candidates, including, but not limited to, KVA12123; the timing and anticipated results of Kineta’s planned pre-clinical studies and clinical trials and the risk that the results of Kineta’s pre-clinical studies and clinical trials may not be predictive of future results in connection with future studies or clinical trials; the timing of the availability of data from Kineta’s clinical trials; the timing of any planned investigational new drug application or new drug application; the risk of cessation or delay of any ongoing or planned clinical trials of Kineta or its collaborators; the clinical utility, potential benefits and market acceptance of Kineta’s product candidates; Kineta’s commercialization, marketing and manufacturing capabilities and strategy; developments and projections relating to Kineta’s competitors and its industry; the impact of government laws and regulations; the timing and outcome of Kineta’s planned interactions with regulatory authorities; Kineta’s ability to protect its intellectual property position; risks relating to volatility and uncertainty in the capital markets for biotechnology companies; availability of suitable third parties with which to conduct contemplated strategic transactions; whether Kineta will be able to pursue a strategic transaction, or whether any transaction, if pursued, will be completed on attractive terms or at all; whether Kineta’s cash resources will be sufficient to fund its foreseeable and unforeseeable operating expenses and capital requirements; and those risks set forth under the caption “Risk Factors” in the Company’s most recent Annual Report on Form 10-K filed with the SEC on March 21, 2024, as well as discussions of potential risks, uncertainties and other important factors in Kineta’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Except as required by law, Kineta undertakes no obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise.

KINETA, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

Collaboration revenues |

|

|

$ |

— |

|

|

$ |

281 |

|

Total revenues |

|

|

|

— |

|

|

|

281 |

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

|

2,726 |

|

|

|

2,843 |

|

General and administrative |

|

|

|

3,680 |

|

|

|

3,924 |

|

Total operating expenses |

|

|

|

6,406 |

|

|

|

6,767 |

|

Loss from operations |

|

|

|

(6,406 |

) |

|

|

(6,486 |

) |

Other (expense) income: |

|

|

|

|

|

|

|

Interest income |

|

|

|

48 |

|

|

|

54 |

|

Interest expense |

|

|

|

(42 |

) |

|

|

(23 |

) |

Change in fair value of rights from Private Placement |

|

|

|

(3,832 |

) |

|

|

— |

|

Change in fair value measurement of notes payable |

|

|

|

(9 |

) |

|

|

(6 |

) |

Other income (expense), net |

|

|

|

(8 |

) |

|

|

(19 |

) |

Total other (expense) income, net |

|

|

|

(3,843 |

) |

|

|

6 |

|

Net loss |

|

|

$ |

(10,249 |

) |

|

$ |

(6,480 |

) |

Net loss attributable to noncontrolling interest |

|

|

|

(11 |

) |

|

|

(29 |

) |

Net loss attributable to Kineta, Inc. |

|

|

$ |

(10,238 |

) |

|

$ |

(6,451 |

) |

Net loss per share, basic and diluted |

|

|

$ |

(0.89 |

) |

|

$ |

(0.77 |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

|

11,443 |

|

|

|

8,361 |

|

SELECTED CONSOLIDATED BALANCE SHEET DATA

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

(in thousands) |

|

Cash |

|

$ |

1,773 |

|

|

$ |

5,783 |

|

Total current assets |

|

|

2,160 |

|

|

|

5,977 |

|

Working capital (deficit) |

|

|

(6,366 |

) |

|

|

(1,095 |

) |

Total assets |

|

|

2,433 |

|

|

|

10,281 |

|

Total debt |

|

|

779 |

|

|

|

770 |

|

Total stockholders' equity (deficit) |

|

|

(6,243 |

) |

|

|

3,059 |

|

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations:

info@kineta.us

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

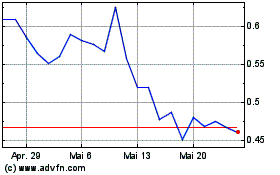

Kineta (NASDAQ:KA)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

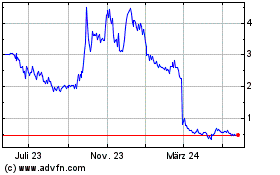

Kineta (NASDAQ:KA)

Historical Stock Chart

Von Jun 2023 bis Jun 2024