false

0001065088

0001065088

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report

(Date of earliest event reported): May 10, 2024

eBay Inc.

(Exact name

of registrant as specified in its charter)

| |

|

|

| Delaware |

001-37713 |

77-0430924 |

| (State

or other jurisdiction |

(Commission

File Number) |

(I.R.S.

Employer |

| of

incorporation) |

|

Identification

No.) |

2025 Hamilton

Avenue

San Jose,

California 95125

(Address of

principal executive offices)

(408) 376-7108

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name

or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ☐ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of exchange on which registered |

| Common stock |

EBAY |

The Nasdaq Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

May 10, 2024, eBay Inc., a Delaware corporation (“eBay”), eBay International Holding GmbH, a wholly owned

subsidiary of eBay incorporated under the laws of Switzerland (“eBay GmbH”), and eBay International Management

B.V., a wholly owned subsidiary of eBay incorporated under the laws of the Netherlands (“eBay B.V.” and together

with eBay and eBay GmbH, the “eBay Parties”), BCP Aurelia Luxco S.à r.l. incorporated under the laws of

the Grand Duchy of Luxembourg (“HoldCo”), Aurelia UK Feederco Limited, a wholly owned subsidiary of HoldCo

incorporated under the laws of England and Wales (the “Equity Investor”), Aurelia Netherlands TopCo B.V., a wholly owned subsidiary of the Equity Investor

incorporated under the laws of the Netherlands (“TopCo”), Aurelia BidCo Norway AS, a wholly owned subsidiary of

TopCo incorporated under the laws of Norway (“BidCo”) and Aurelia BidCo 1 Norway AS, a wholly owned subsidiary of

BidCo incorporated under the laws of Norway (“BidCo 1”) entered into amendments (the

“Amendments”) to the Bid Conduct Agreement dated as of November 21, 2023 and the Transaction Completion Agreement

dated as of November 21, 2023.

Pursuant

to the Amendments the eBay Parties have agreed, subject to certain terms and conditions, to (a) increase the number of shares of Adevinta

ASA (“Adevinta”) sold to BidCo 1 to 227,115,592 shares in exchange for approximately $2.4 billion of cash (the “Sale”)

and (b) to reduce the number of Adevinta shares transferred to TopCo to 177,115,591 shares in exchange for the issuance of new shares

in TopCo (together with the Sale, the “Transactions”). When combined, the impact of the Amendments increases the cash expected to be received by eBay at the closing of the Transactions by approximately

$270 million and reduces eBay's expected ownership in Adevinta from approximately 20% to approximately 18%.

The

foregoing description of the Amendments does not purport to be complete and is qualified in its entirety by reference to the full

text of the Amendments, respectively, which are attached hereto as Exhibit 2.1 and Exhibit 2.2 to this Current Report on Form

8-K and incorporated herein by reference in their entirety.

Cautions Regarding Forward-Looking Statements

Certain

statements herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Such forward-looking statements are often identified by words such as “anticipate,”

“approximate,” “believe,” “commit,” “continue,” “could,” “estimate,”

“expect,” “hope,” “intend,” “may,” “outlook,” “plan,”

“project,” “potential,” “should,” “would,” “will” and other similar

words or expressions. Such forward-looking statements reflect eBay’s current expectations or beliefs concerning future events

and actual events may differ materially from historical results or current expectations. The reader is cautioned not to place

undue reliance on these forward-looking statements, which are not a guarantee of future performance and are subject to a number

of uncertainties, risks, assumptions and other factors, many of which are outside the control of eBay. The forward-looking statements

in this document address a variety of subjects including, for example, the closing of the Transactions and the potential benefits

of the Transactions. The following factors, among others, could cause actual results to differ materially from those described

in these forward-looking statements: the possibility that the conditions to the Transactions are not satisfied on a timely basis

or at all; the possibility that eBay may not fully realize the projected benefits of the Transactions; the possibility that the

closing of the Transactions may not occur on the anticipated timeline or at all; business disruption during the pendency of or

following the Transactions; diversion of management’s time on Transactions-related issues; the reaction of customers and

other persons to the Transactions; and other events that could adversely impact the completion of the Transactions, including

industry or economic conditions outside of eBay’s control. In addition, actual results are subject to other risks and uncertainties

that relate more broadly to eBay’s overall business, including those more fully described in eBay’s filings with the

U.S. Securities and Exchange Commission, including its annual report on Form 10-K for the fiscal year ended December 31, 2023

and subsequent quarterly reports on Form 10-Q. The forward-looking statements in this document speak only as of this date. We

undertake no obligation to revise or update publicly any forward-looking statement, except as required by law.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits.

The following materials are attached

as exhibits to this Current Report on Form 8-K:

| Exhibit |

|

|

| Number |

|

Description |

| 2.1 |

|

Amendment Agreement to Bid Conduct Agreement, dated as of May 10, 2024, by and among eBay Inc., eBay International Holding GmbH, eBay International Management B.V., BCP Aurelia Luxco S.à r.l., Aurelia UK Feederco Limited, Aurelia Netherlands TopCo B.V., Aurelia BidCo Norway AS and Aurelia BidCo 1 Norway AS† |

| |

|

|

| 2.2 |

|

Amendment Agreement to Transaction Completion Agreement, dated as of May 10, 2024, by and among eBay Inc., eBay International Holding GmbH, eBay International Management B.V., BCP Aurelia Luxco S.à r.l., Aurelia UK Feederco Limited, Aurelia Netherlands TopCo B.V., Aurelia BidCo Norway AS and Aurelia BidCo 1 Norway AS† |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

| † | Schedules have been omitted

pursuant to Item 601(b)(2) of Regulation S-K. The registrant hereby undertakes to furnish supplementally copies of any of the

omitted schedules upon request by the SEC; provided, however, that the parties may request confidential treatment pursuant to

Rule 24b-2 of the Exchange Act for any document so furnished. |

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

eBay Inc. |

| |

(Registrant) |

| |

|

| Date: May 10, 2024 |

/s/ Molly Finn |

| |

Name: Molly Finn |

| |

Title: Vice President & Deputy General

Counsel, Corporate & Assistant Secretary |

Exhibit 2.1

10 May 2024

AURELIA

UK FEEDERCO LIMITED

EBAY

INC.

EBAY

INTERNATIONAL HOLDING GMBH

EBAY

INTERNATIONAL MANAGEMENT B.V.

BCP

AURELIA LUXCO S.À R.L.

AURELIA

NETHERLANDS TOPCO B.V.

Aurelia

Bidco Norway AS

Aurelia

Bidco 1 Norway AS

FIRST

AMENDMENT AGREEMENT

regarding

the

BID

CONDUCT AGREEMENT

relating

to Project Aurelia

Contents

THIS AGREEMENT

(the Amendment Agreement) is dated 10 May 2024

PARTIES:

| (1) | AURELIA

UK FEEDERCO LIMITED incorporated under the laws of England and Wales (registered

number 15245581), whose registered office is at 10th floor, 30 St Mary Axe,

London, EC3A 8BF, United Kingdom (Equity Investor); |

| (2) | EBAY

INC. incorporated under the laws of Delaware (I.R.S. Employer Identification No.

77-0430924), whose principal executive office is at 2025 Hamilton Avenue, San Jose, California

95215, United States (Erik); |

| (3) | EBAY

INTERNATIONAL HOLDING GMBH, an indirect wholly-owned subsidiary of Erik, incorporated

under the laws of Switzerland (registered number CHE-262.723.657), whose registered office

is at Helvetiastrasse 15-17, 3005 Bern, Switzerland (Erik GmbH); |

| (4) | EBAY

INTERNATIONAL MANAGEMENT B.V., an indirect wholly-owned subsidiary of Erik,

incorporated under the laws of the Netherlands (registered number 71993312), whose registered

office is at Stadhouderskade 85, 1054 ES Amsterdam, the Netherlands (Erik

BV); |

| (5) | BCP

AURELIA LUXCO S.À R.L. incorporated under the laws of the Grand Duchy of Luxembourg

(registered number B281366), whose registered office is at 2-4, rue Eugene Ruppert, L-2453

Luxembourg, Grand Duchy of Luxembourg (Bjoern); |

| (6) | AURELIA

NETHERLANDS TOPCO B.V. incorporated under the laws of the Netherlands (registered

number 91818427), whose registered office is at Amstelveenseweg 760, 1081 JK Amsterdam,

the Netherlands (the Company); |

| (7) | Aurelia

Bidco Norway AS incorporated under the laws

of Norway (registered number 932 213 346), whose office is at c/o Wikborg Rein Advokatfirma

AS, Dronning Mauds gate 11, 0250 Oslo, Norway (pending registration in the Norwegian

Registry of Business Enterprises) (BidCo); and |

| (8) | Aurelia

Bidco 1 Norway AS incorporated under the laws

of Norway (registered number 932 213 311), whose office is at c/o Wikborg Rein Advokatfirma

AS, Dronning Mauds gate 11, 0250 Oslo, Norway (pending registration in the Norwegian

Registry of Business Enterprises) (BidCo 1) |

(the

Equity Investor, Erik, Erik GmbH, Erik BV, Bjoern, the Company, BidCo as well as BidCo 1 each also, a Party and

collectively, the Parties).

WHEREAS:

| (A) | On

21 November 2023, the Parties, among other agreements, entered into a certain

Bid Conduct Agreement, among other things, setting out their respective rights and obligations

in relation to the voluntary public takeover offer for all issued and outstanding class

A shares (voting shares) in Adevinta ASA and the Offer Process (as amended from time

to time, the Erik BCA and where reference is made in this Amendment Agreement

to the term “original” Erik BCA, such reference shall designate the original

version of the Erik BCA as executed on 21 November 2023). |

| (B) | The

Parties wish to amend the original Erik BCA by this Amendment Agreement and agree as

set out in the following. |

IT

IS AGREED:

Capitalised

terms used or referenced in this Amendment Agreement shall have the meaning ascribed to them in this Amendment Agreement or, in

the absence of a separate definition as contained herein, shall have the meaning as ascribed to them in the original Erik BCA.

The

Parties agree that the original Erik BCA shall be changed and amended as follows, subject to further changes from time to time

to the extent agreed in writing between the Parties:

Schedule 6

(Sample cap table calculation) of the Erik BCA shall be replaced by Schedule 6 (Sample cap table calculation)

as attached to this Amendment Agreement.

The

Parties hereby agree that any reference made to any of the Transaction Documents in the original Erik BCA shall refer to such

Transaction Document as amended from time to time.

| 4.1 | Except

as expressly set forth in this Amendment Agreement, all other provisions of the Erik

BCA, as contained in the original Erik BCA, shall remain unaffected. |

| 4.2 | Clauses 15

through 30 of the original Erik BCA shall apply mutatis mutandis to this Amendment

Agreement. |

[Schedules

and signature pages follow]

Schedule 6

Sample cap table calculation

Equity

Investor

| Shareholder | |

Percentage | |

| Peter I | |

| 20.9 | % |

| Peter II | |

| 28.4 | % |

| Bjoern | |

| 36.2 | % |

| Gunnar | |

| 9.4 | % |

| Torben | |

| 5.1 | % |

| Total | |

| 100 | % |

Company

(illustrative and subject to equity funding amount)

| Shareholder | |

Percentage | |

| Equity Investor | |

| 68 | % |

| Erik | |

| 18 | % |

| Sven | |

| 14 | % |

| Total | |

| 100 | % |

[Signature

pages to be added]

[Signature

pages to the First Amendment Agreement regarding the Erik Bid Conduct

Agreement relating to Project Aurelia]

| Aurelia UK Feederco Limited |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel Assant |

|

/s/ Alexander Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Director |

|

Title: Director |

[Signature

pages to the First Amendment Agreement regarding the Erik Bid Conduct

Agreement relating to Project Aurelia]

| eBay Inc. |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Steve Priest |

|

|

| Name: Steve Priest |

|

|

| Title: SVP, Chief Financial Officer |

|

|

| |

|

|

| eBay International Holding GmbH |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Kenneth Ebanks |

|

|

| Name: Kenneth Ebanks |

|

|

| Title: President and Managing Officer |

|

|

| |

|

|

| eBay International Management B.V. |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Kenneth Ebanks |

|

/s/ Mark Solomons |

| Name: Kenneth Ebanks |

|

Name: Mark Solomons |

| Title: Director A |

|

Title: Director B |

[Signature

pages to the First Amendment Agreement regarding the Erik Bid Conduct

Agreement relating to Project Aurelia]

| BCP Aurelia Luxco S.à

r.l. |

|

| |

|

| Date: 10 May 2024 |

|

| |

|

| by: |

|

| |

|

| /s/ John Sutherland |

|

| Name: John Sutherland |

|

| Title: Manager |

|

| Aurelia Netherlands Topco

B.V. |

|

| |

|

| Date: 10 May 2024 |

|

| |

|

| by: |

|

| |

|

| /s/ Lionel Assant |

|

| Name: Lionel Assant |

|

| Title: Authorized representative |

|

[Signature

pages to the First Amendment Agreement regarding the Erik Bid Conduct

Agreement relating to Project Aurelia]

| Aurelia Bidco Norway AS |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel

Assant |

|

/s/ Alexander

Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Chairman of the Board |

|

Title: Board member |

[Signature

pages to the First Amendment Agreement regarding the Erik Bid Conduct

Agreement relating to Project Aurelia]

| Aurelia Bidco 1 Norway

AS |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel

Assant |

|

/s/ Alexander

Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Chairman of the Board |

|

Title: Board member |

Exhibit 2.2

10

May 2024

Aurelia

UK Feederco Limited

EBAY

INC.

eBay

International Holding GmbH

eBay

International Management B.V.

BCP

Aurelia Luxco S.à r.l.

Aurelia

Netherlands Topco B.V.

AURELIA

BIDCO NORWAY AS

AURELIA

BIDCO 1 NORWAY AS

FIRST

AMENDMENT AGREEMENT

regarding

the

TRANSACTION

COMPLETION AGREEMENT

relating

to Project Aurelia

Contents

THIS AGREEMENT

(the Amendment Agreement) is dated 10 May 2024

PARTIES:

| (1) | AURELIA

UK FEEDERCO LIMITED incorporated under the laws of England and Wales (registered

number 15245581), whose registered office is at 10th floor, 30 St Mary Axe, London, EC3A

8BF, United Kingdom (Equity Investor); |

| (2) | eBay

Inc. incorporated under the laws of Delaware

(I.R.S. Employer Identification No. 77-0430924), whose principal executive office is

at 2025 Hamilton Avenue, San Jose, California 95215, United States (Erik); |

| (3) | EBAY

INTERNATIONAL HOLDING GMBH, an indirectly wholly-owned subsidiary of Erik, incorporated

under the laws of Switzerland (registered number CHE-262.723.657), whose registered office

is at Helvetiastrasse 15-17, 3005 Bern, Switzerland (Erik GmbH); |

| (4) | eBay

International Management B.V., an indirectly

wholly-owned subsidiary of Erik, incorporated under the laws of the Netherlands (registered

number 71993312), whose registered office is at Stadhouderskade 85, 1054 ES Amsterdam,

the Netherlands (Erik BV); |

| (5) | BCP

AURELIA LUXCO S.À R.L. incorporated under the laws of the Grand Duchy of Luxembourg

(registered number B281366), whose registered office is at 2-4, rue Eugene Ruppert, L-2453

Luxembourg, Grand Duchy of Luxembourg (Bjoern); |

| (6) | AURELIA

NETHERLANDS TOPCO B.V. incorporated under the laws of the Netherlands (registered

number 91818427), whose registered office is at Amstelveenseweg 760, 1081JK Amsterdam,

the Netherlands (the Company); |

| (7) | AURELIA

BIDCO NORWAY AS incorporated under the laws of Norway (registered number 932 213

346), office is at c/o Wikborg Rein Advokatfirma AS, Dronning Mauds gate 11, 0250 Oslo,

Norway (pending registration in the Norwegian Registry of Business Enterprises) (BidCo);

and |

| (8) | AURELIA

BIDCO 1 NORWAY AS incorporated under the laws of Norway (registered number 932 213

311), registered office is at c/o Wikborg Rein Advokatfirma AS, Dronning Mauds gate 11,

0250 Oslo, Norway (pending registration in the Norwegian Registry of Business Enterprises)

(BidCo 1) |

(the Equity

Investor, Erik, Erik GmbH, Erik BV, Bjoern, the Company, BidCo as well as BidCo 1 each also, a Party and collectively,

the Parties).

WHEREAS:

| (A) | On

21 November 2023, the Parties, among other agreements, entered into a certain Transaction

Completion Agreement in order to, among other things, set out the terms governing the

transfers of the Erik Target Shares to the BidCo Group as well as certain other actions

connected to the voluntary public takeover offer for all issued and outstanding class

A shares (voting shares) in Adevinta ASA by BidCo (as amended from time to time,

the Erik TCA and where reference is made in this Amendment Agreement to

the term “original” Erik TCA, such reference shall designate the original

version of the Erik TCA as executed on 21 November 2023). |

| (B) | The

Parties wish to amend the original Erik TCA by this Amendment Agreement and agree as

set out in the following. |

IT

IS AGREED:

Capitalised

terms used or referenced in this Amendment Agreement shall have the meaning ascribed to them in this Amendment Agreement or, in

the absence of a separate definition as contained herein, shall have the meaning as ascribed to them in the original Erik TCA.

The

Parties agree that the original Erik TCA shall be changed and amended as follows, subject to further changes from time to time

to the extent agreed in writing between the Parties:

| 2.1 | Clause 4.1

of the original Erik TCA shall be replaced in its entirety by the following new Clause

4.1: |

Erik

hereby commits to the Company, and only to the Company, to cause Erik GmbH to transfer, and Erik GmbH commits to transfer, at

Completion 177,115,591 of the Erik Class A Target Shares (the Erik Rollover Target Shares) to the Company against issuance

of new shares in the Company. As consideration for the transfer of the Erik Rollover Target Shares, the Company shall issue to

Erik GmbH such number of Ordinary Shares that is equal in value to the Erik Rollover Target Shares valued at NOK 115 per Erik

Rollover Target Share at the Signing Exchange Rate (such newly issued shares, the Erik Rollover Shares).

| 2.2 | Clause 5.1

of the original Erik TCA shall be replaced in its entirety by the following new Clause

5.1: |

Erik

hereby commits to BidCo 1, and only to BidCo 1, to cause Erik BV, Erik GmbH and/or their respective applicable subsidiaries to

sell and transfer, and each of Erik BV and Erik GmbH commits to sell and transfer (and/or cause its respective applicable subsidiaries

to sell and transfer), at Completion 167,859,524 of the Erik Class A Target Shares and all of the Erik Class B Target Shares (jointly,

the Erik Sale Target Shares) to BidCo 1 against a consideration in the amount of USD 2,431,150,493.58 (in words: two

billion four hundred thirty-one million one hundred fifty thousand four hundred ninety-three dollars US Dollars and fifty-eight

cents) (the Erik Cash Purchase Price). The Erik Cash Purchase Price shall be payable by BidCo 1 to Erik in cash at Completion

in accordance with Clause 10.

| 2.3 | Schedule 4

(Sample cap table calculation) of the Erik TCA shall be replaced by Schedule

4 (Sample cap table calculation) as attached to this Amendment Agreement. |

The

Parties hereby agree that any reference made to any of the Transaction Documents in the original Erik TCA shall refer to such

Transaction Document as amended from time to time.

| 4.1 | Except

as expressly set forth in this Amendment Agreement, all other provisions of the Erik

TCA, as contained in the original Erik TCA, shall remain unaffected. |

| 4.2 | Clauses

13 through 27 of the original Erik TCA shall apply mutatis mutandis to this Amendment

Agreement. |

[schedules

and signature pages follow]

Schedule 4

Sample cap table calculation

Equity

Investor

| Shareholder | |

Percentage | |

| Peter I | |

| 20.9 | % |

| Peter II | |

| 28.4 | % |

| Bjoern | |

| 36.2 | % |

| Gunnar | |

| 9.4 | % |

| Torben | |

| 5.1 | % |

| Total | |

| 100 | % |

Company

(illustrative and subject to equity funding amount)

| Shareholder | |

Percentage | |

| Equity Investor | |

| 68 | % |

| Erik | |

| 18 | % |

| Sven | |

| 14 | % |

| Total | |

| 100 | % |

Signature

[Signature

pages to be added]

[Signature pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| Aurelia UK Feederco Limited |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel Assant |

|

/s/ Alexander Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Director |

|

Title: Director |

[Signature pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| eBay Inc. |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Steve Priest |

|

|

| Name: Steve Priest |

|

|

| Title: SVP, Chief Financial Officer |

|

|

| |

|

|

| eBay International Holding GmbH |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Kenneth Ebanks |

|

|

| Name: Kenneth Ebanks |

|

|

| Title: President and Managing Officer |

|

|

| |

|

|

| eBay International Management B.V. |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Kenneth Ebanks |

|

/s/ Mark Solomons |

| Name: Kenneth Ebanks |

|

Name: Mark Solomons |

| Title: Director A |

|

Title: Director B |

[Signature pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| BCP Aurelia Luxco S.à

r.l. |

|

| |

|

| Date: 10 May 2024 |

|

| |

|

| by: |

|

| |

|

| /s/ John Sutherland |

|

| Name: John Sutherland |

|

| Title: Manager |

|

[Signature

pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| Aurelia Netherlands Topco

B.V. |

|

| |

|

| Date: 10 May 2024 |

|

| |

|

| by: |

|

| |

|

| /s/ Lionel Assant |

|

| Name: Lionel Assant |

|

| Title: Authorized representative |

|

[Signature pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| Aurelia Bidco Norway AS |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel

Assant |

|

/s/ Alexander

Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Chairman of the Board |

|

Title: Board member |

[Signature pages to the First Amendment Agreement regarding the Erik Transaction

Completion Agreement relating to Project Aurelia]

| Aurelia Bidco 1 Norway

AS |

|

|

| |

|

|

| Date: 10 May 2024 |

|

|

| |

|

|

| by: |

|

|

| |

|

|

| /s/ Lionel

Assant |

|

/s/ Alexander

Walsh |

| Name: Lionel Assant |

|

Name: Alexander Walsh |

| Title: Chairman of the Board |

|

Title: Board member |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

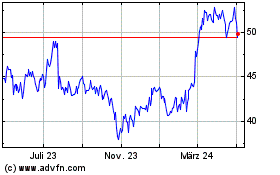

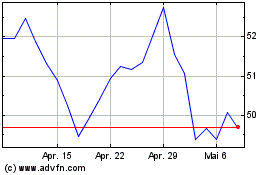

eBay (NASDAQ:EBAY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024