Alphatec Holdings, Inc. (Nasdaq:ATEC), the parent company of

Alphatec Spine, Inc., a medical device company that designs,

develops, manufactures and markets products for the surgical

treatment of spine disorders, with a focus on treating conditions

related to the aging spine, announced today financial results for

the fourth quarter and fiscal year ended December 31, 2011.

Under a separate release today, Alphatec Spine announced that it

has realigned the leadership roles of Dirk Kuyper and Les Cross.

Mr. Kuyper, formerly President and CEO, will assume the role of

President, Global Commercial Operations and will remain a member of

the Board of Directors. Les Cross, formerly Non-Executive Chairman

of the Board, will assume the role of Chairman and Chief Executive

Officer. The realignment is designed to enhance Alphatec Spine's

future revenue growth and operating excellence.

Fourth Quarter and Full Year 2011

Highlights

- Fourth quarter revenue grew 7.6% to $49.5 million, compared to

the fourth quarter of 2010, or 7.0% on a constant currency

basis.

- U.S. revenue grew 2.0% to $32.8 million in the fourth quarter

2011, compared to the fourth quarter 2010.

- International revenue grew 20.6% to $16.8 million in the fourth

quarter 2011, compared to the fourth quarter 2010, and 18.8% on a

constant currency basis.

- Full year 2011 revenue of $197.7 million grew 8.1% on a pro

forma basis, or 5.8% on a constant currency basis, compared to the

full year 2010. Full year 2011 revenue on a GAAP basis grew 15.2%,

or 12.5% on a constant currency basis.

- Generated non-GAAP cash from business operations of $2.0

million in the fourth quarter 2011 and was cash flow positive for

the full year 2011, before the effects of certain one-time charges

noted below.

- Introduced three new products in the fourth quarter 2011 at the

North American Spine Society (NASS) meeting in Chicago, IL.

- Trestle LuxeTM Anterior Cervical Plate System,

AvalonTM Occipito-Cervico Plating System, and the

Epicage® MIS Lumbar Interbody Spacer.

- Reached a global settlement agreement with Cross Medical

Products in connection with two pending legal matters.

"We are pleased with our revenue growth in the fourth quarter

and full year," said Dirk Kuyper, president, global commercial

operations at Alphatec Spine. "In the fourth quarter, constant

currency revenue growth of 7.0% was near the high end of our

performance in 2011, and we believe that we outpaced the global

spine market's rate of growth. This is a solid result given the

ongoing headwinds in the market and reflects the strength of our

broad product portfolio and global infrastructure.

"For 2012, we expect the global spine market to remain

challenging, but longer-term, we continue to believe the spine

market fundamentals remain strong as our global population ages and

the prevalence of disease states such as obesity, diabetes and

osteoporosis increases. We will continue to address the current

environment by controlling what we can; focusing on innovation to

maintain a continuous flow of new products; expanding our global

footprint; and, reducing our manufacturing costs and operating

expense structure to drive improving profitability and cash

flow.

"We are also focused on streamlining and strengthening Alphatec

Spine's operating fundamentals in 2012. We are not at all satisfied

with our performance in this area in 2011 and we have identified

three key initiatives in 2012 to address this; reduce our cost of

goods sold and increase efficiencies in our U.S. operations; reduce

our cost of goods sold in international operations; and, reduce

SG&A expenses internationally, all of which should help us

achieve our long-term goal of 20% non-GAAP adjusted EBITDA

margins.

"In order to expedite our success in this area we have enlisted

the support of a corporate performance improvement consulting firm

specializing in operational efficiency. The consulting firm will

help us quickly define and strengthen our essential business

processes such as raw material acquisition, manufacturing

processing, and field inventory management. Over time, we expect

our cost reduction programs to achieve annualized cost savings of

approximately $2 million.

"In the U.S., we are presently validating machinery to begin

manufacturing certain implants that we currently outsource,

beginning with our next generation anterior cervical plate, Trestle

Luxe. We have also begun to in-source certain finishing steps in

the manufacturing process such as anodizing. We have many other

initiatives underway in the U.S. and Europe as well.

"We remain focused on full market releases for certain new

products including Alphatec Solus and Epicage to complement Avalon

and Trestle Luxe. We will also continue to develop the next

generation of new products to keep the pipeline flowing in 2013 and

beyond with differentiated technologies to gain market share

globally.

"For 2012, our global focus on new markets, especially emerging

markets in Asia Pacific, Latin America, Brazil, China and India

strengthens our global diversification. We continue to be pleased

with our performance in Japan, which consistently produced solid

double digit growth in 2011."

Mr. Kuyper finished by saying, "We look forward to 2012 being

Alphatec Spine's best year ever. Today, our business has never been

stronger and our ability to succeed never greater. I am confident

we have the right products, strategies and global team in place to

be successful in 2012 and help us achieve our long-term goal of

being a top-five market leader. You have our commitment that

Alphatec Spine will remain dedicated to conducting its business

with a sense of urgency, accountability and excellence."

Fourth Quarter 2011 Financial Results

Consolidated revenues for the fourth quarter 2011 were $49.5

million, an increase of 7.6 percent, compared to $46.0 million

reported for the fourth quarter 2010. U.S. revenues for the fourth

quarter 2011 were $32.8 million, an increase of 2.0 percent,

compared to $32.1 million reported for the fourth quarter 2010.

International revenues totaled $16.8 million, reflecting growth of

20.6 percent, compared to the fourth quarter of 2010. On a constant

currency basis, revenues in the fourth quarter of 2011 grew 7.0

percent, compared to the fourth quarter of 2010.

Gross profit for the fourth quarter of 2011 was $24.9 million,

or 50.3 percent of revenues, reflecting a decrease of $6.6 million,

compared to the fourth quarter 2010.

Gross profit and gross margin in the fourth quarter of 2011 were

impacted by approximately $5.5 million in one-time charges,

primarily related to inventory write-offs and other inventory

adjustments in the Company's U.S. and international businesses.

Excluding the $5.5 million in adjustments, gross profit margin

would have been approximately 61.4 percent. Slightly negative

pricing and mix contributed to the sequential decline in gross

margin from the third quarter of 2011.

Total operating expenses for the fourth quarter of 2011 were

$41.4 million, or 83.6 percent of revenues, reflecting an increase

of $8.2 million, compared to the fourth quarter of 2010. Operating

expenses in the fourth quarter of 2011 include the $9.8 million

litigation settlement discussed below as well as provisions to

cover fixed asset write-offs and certain non income tax accruals

totaling $1.1 million.

Excluding the litigation settlement charge, total operating

expenses for the fourth quarter of 2011 would have been $31.6

million, or 63.8 percent of revenues, reflecting a $1.6 million

decrease from total operating expenses in the fourth quarter of

2010.

On January 5, 2012, the Company announced that it had reached a

global settlement agreement with Cross Medical Products, Inc. (a

subsidiary of Biomet, Inc.) regarding a license agreement dispute.

As part of the settlement, Alphatec Spine agreed to pay Cross

Medical $18 million. An initial payment of $5 million dollars was

made in January 2012. In addition to the initial payment, Alphatec

Spine will make thirteen payments of $1 million, with the payments

made quarterly, and the first payment being due in August 2012, and

each subsequent payment due three months thereafter until the final

payment, which is due in August 2015, is made. The Company has

expensed $9.8 million in the fourth quarter of 2011, which was

charged to operating expenses as a legal settlement adjustment.

With respect to the remaining $8.2 million, $8.0 million will be

recorded as a licensed intangible asset to be amortized over the

next seven quarters in 2012 and 2013, plus imputed interest of $0.2

million.

Net loss for the fourth quarter 2011, including the legal

settlement, was $16.0 million, or ($0.18) per share (basic and

diluted), compared with a net loss of $2.9 million, or ($0.03) per

share (basic and diluted) for the fourth quarter 2010.

Non-GAAP net loss for the fourth quarter of 2011 was $5.2

million or ($0.06) per share (basic and diluted), compared to

non-GAAP net loss of $1.5 million, or ($0.02) per share (basic and

diluted) reported for the fourth quarter 2010. Non-GAAP net loss

for the fourth quarter of 2011 includes adjustments for $9.8

million related to the legal settlement, amortization of intangible

assets and restructuring expenses.

Adjusted EBITDA in the fourth quarter of 2011 was ($1.2)

million, compared to the $4.4 million reported for the fourth

quarter of 2010. The decline in Adjusted EBITDA is primarily

attributable to adjustments noted above, which were $5.5 million in

gross profit and $1.1 million in operating expenses.

Cash and cash equivalents were $20.7 million at December 31,

2011, reflecting a decrease of $1.5 million, compared to the cash

position as of September 30, 2011 and $2.5 million, compared to the

cash position as of December 31, 2010. The Company's cash position

at December 31, 2011 reflects the repayment of an additional $3.5

million of the Company's working capital line of credit in the

fourth quarter for a total repayment of $5.0 million for the year.

For the full year 2011, the operations of the business, excluding

debt repayments, generated $2.5 million in positive cash flow of

which, $2.0 million occurred in the fourth quarter.

2012 Financial Guidance

The Company is providing its full year 2012 revenue guidance to

a range of $204 million to $209 million, a three to six percent

increase over 2011. The Company expects annual adjusted EBITDA to

be in the range of $23 million to $27 million, or 11 to 13 percent

of revenues. The Company expects to generate positive cash flow for

the full year 2012 after fulfilling its banking and legal

settlement obligations.

Conference Call Information

Alphatec Spine has scheduled a conference call to discuss its

financial results beginning today, February 28, 2012, at 2:00 p.m.

Pacific Time / 5:00 p.m. Eastern Time. Individuals interested in

listening to the conference call may do so by dialing (877)

556-5251 for domestic callers and (720) 545-0036 for international

callers. A live webcast of the conference call will be available

online from the investor relations section of the Alphatec Spine

website at www.alphatecspine.com. The webcast will be recorded and

will remain available on the investor relations section of Alphatec

Spine's website for at least 30 days.

About Alphatec Spine

Alphatec Spine, Inc. is a wholly owned subsidiary of Alphatec

Holdings, Inc. (Nasdaq:ATEC). Alphatec Spine is a medical device

company that designs, develops, manufactures and markets products

for the surgical treatment of spine disorders, primarily focused on

the aging spine. The Company's mission is to combine world-class

customer service with innovative, surgeon-driven products that will

help improve the aging patient's quality of life. The Company

is poised to achieve its goal through new solutions for patients

with osteoporosis, stenosis and other aging spine deformities,

improved minimally invasive products and techniques and integrated

biologics solutions. In addition to its U.S. operations, the

Company also markets its products in over 50 international markets

through its affiliate, Scient'x S.A.S., via a direct sales force in

France, Italy and the United Kingdom and via independent

distributors in the rest of Europe, the Middle East and Africa,

South America and Latin America. In Japan, the Company markets

its products through its subsidiary, Alphatec Pacific, Inc. In

the rest of Asia and Australia, the Company sells its and

Scient'x's products through it's and Scient'x's

distributors.

The Alphatec Holdings, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=3520

Non-GAAP Information

Non-GAAP earnings included in this press release is a non-GAAP

(generally accepted accounting principles) financial measure that

represents net income (loss) excluding the effects of in-process

research and development expenses and transaction-related expenses.

Management does not consider these expenses when it makes certain

evaluations of the operations of the Company. Non-GAAP earnings, as

defined above, may not be similar to non-GAAP earnings measures

used by other companies and is not a measurement under

GAAP. Adjusted EBITDA included in this press release is a

non-GAAP financial measure that represents net income (loss)

excluding the effects of interest, taxes, depreciation,

amortization, stock-based compensation expenses, and other

non-recurring income or expense items, such as in-process research

and development expense and transaction-related expenses. Adjusted

EBITDA, as defined above, may not be similar to adjusted EBITDA

measures used by other companies and is not a measurement under

GAAP. Though management finds non-GAAP-based earnings or loss and

EBITDA useful for evaluating aspects of the Company's business, its

reliance on these measures is limited because excluded items often

have a material effect on the Company's earnings and earnings per

common share calculated in accordance with GAAP. Therefore,

management uses non-GAAP adjusted EBITDA in conjunction with GAAP

earnings and earnings per common share measures. The Company

believes that non-GAAP adjusted EBITDA provides investors with an

additional tool for evaluating the Company's core performance,

which management uses in its own evaluation of continuing operating

performance, and a base-line for assessing the future earnings

potential of the Company. While the GAAP results are more complete,

the Company prefers to allow investors to have supplemental metrics

since, with reconciliation to GAAP, they may provide greater

insight into the Company's financial results.

Forward Looking Statements

This press release may contain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve risks and uncertainty. Such statements are

based on management's current expectations and are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Alphatec Spine cautions investors that there can be no

assurance that actual results or business conditions will not

differ materially from those projected or suggested in such

forward-looking statements as a result of various factors. Forward

looking statements include references to Alphatec Spine's 2012

revenue, adjusted EBITDA, free cash flow and earnings projections;

the growth rate of the spine market related to aging and elderly

patients; new product development and market success of those

products; reductions in the Company's manufacturing costs and

operating expenses; and geographic expansion. The words "believe,"

"will," "should," "expect," "intend," "estimate" and "anticipate,"

variations of such words and similar expressions identify

forward-looking statements, but their absence does not mean that a

statement is not a forward-looking statement. The important

factors that could cause actual operating results to differ

significantly from those expressed or implied by such

forward-looking statements include, but are not limited to; the

uncertainty of success in developing new products or products

currently in Alphatec Spine's pipeline; the successful global

launch of the Company's new products and the products in its

development pipeline including Alphatec Solus, Trestle Luxe, Avalon

and Epicage; failure to achieve acceptance of Alphatec Spine's

products by the surgeon community; failure to obtain FDA clearance

or approval for new products, or unexpected or prolonged delays in

the process; Alphatec Spine's ability to develop and expand its

U.S. and/or global revenues; continuation of favorable third party

payor reimbursement for procedures performed using Alphatec Spine's

products; unanticipated expenses or liabilities or other adverse

events affecting cash flow or Alphatec Spine's ability to

successfully control its costs or achieve profitability;

uncertainty of additional funding; Alphatec Spine's ability to

compete with other competing products and with emerging new

technologies; product liability exposure; patent infringement

claims and claims related to Alphatec Spine's intellectual

property. Please refer to the risks detailed from time to time in

Alphatec Spine's SEC reports, including quarterly reports on Form

10-Q, reports on Form 8-K and annual reports on Form 10-K. Alphatec

Spine disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless required by law.

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (in thousands -

unaudited) |

| |

|

|

| |

December 31, 2011 |

December 31, 2010 |

|

ASSETS |

|

|

| Current assets: |

|

|

| Cash and cash

equivalents |

$ 20,666 |

$ 23,168 |

| Accounts receivable,

net |

41,711 |

39,777 |

| Inventories, net |

45,916 |

51,635 |

| Prepaid expenses and other

current assets |

6,888 |

6,652 |

| Deferred income tax

assets |

1,248 |

1,592 |

| Total current assets |

116,429 |

122,824 |

| |

|

|

| Property and equipment, net |

31,476 |

38,440 |

| Goodwill |

168,609 |

170,194 |

| Intangibles, net |

47,144 |

43,148 |

| Other assets |

3,034 |

2,410 |

| Total assets |

$ 366,692 |

$ 377,016 |

| |

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 17,390 |

$ 15,957 |

| Accrued expenses |

32,583 |

22,530 |

| Deferred revenue |

2,768 |

3,396 |

| Current portion of long-term

debt |

4,396 |

1,708 |

| Total current liabilities |

57,137 |

43,591 |

| |

|

|

| Total long term

liabilities |

40,624 |

43,388 |

| Redeemable preferred

stock |

23,603 |

23,603 |

| Stockholders' equity |

245,328 |

266,434 |

| Total liabilities and stockholders'

equity |

$ 366,692 |

$ 377,016 |

| |

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands,

except per share amounts - unaudited) |

| |

|

|

|

|

| |

Three Months Ended

December 31, |

Year Ended December

31, |

| |

2011 |

2010 |

2011 |

2010 |

| |

|

|

|

|

| Revenues |

$ 49,510 |

$ 46,018 |

$ 197,711 |

$ 171,610 |

| Cost of revenues |

24,209 |

14,141 |

79,168 |

57,657 |

| Amortization of acquired intangible

assets |

390 |

394 |

1,613 |

1,136 |

| Total cost of revenues |

24,599 |

14,535 |

80,781 |

58,793 |

| Gross profit |

24,911 |

31,483 |

116,930 |

112,817 |

| |

|

|

|

|

| Operating expenses: |

|

|

|

|

| Research and development |

3,235 |

4,084 |

16,888 |

16,431 |

| In-process research and

development |

-- |

-- |

-- |

2,967 |

| Sales and marketing |

18,124 |

18,971 |

75,189 |

66,542 |

| General and administrative |

9,660 |

9,578 |

36,367 |

31,078 |

| Amortization of acquired

intangible assets |

523 |

533 |

2,152 |

1,535 |

| Transaction related

expenses |

-- |

20 |

-- |

3,671 |

| Restructuring expenses |

57 |

(7) |

1,050 |

2,382 |

| Litigation settlement |

9,800 |

-- |

9,800 |

-- |

| Total operating expenses |

41,399 |

33,179 |

141,446 |

124,606 |

| Operating loss |

(16,488) |

(1,696) |

(24,516) |

(11,789) |

| Interest and other income

(expense), net |

(941) |

(2,335) |

(2,172) |

(4,698) |

| Loss from continuing operations before

taxes |

(17,429) |

(4,031) |

(26,688) |

(16,487) |

| Income tax benefit |

(1,463) |

(1,155) |

(4,507) |

(2,054) |

| Loss from continuing operations |

(15,966) |

(2,876) |

(22,181) |

(14,433) |

| Income from discontinued

operations, net of tax |

-- |

-- |

-- |

78 |

| |

|

|

|

|

| Net loss |

$ (15,966) |

$ (2,876) |

$ (22,181) |

$ (14,355) |

| |

|

|

|

|

| Net loss per common share: |

|

|

|

|

| Basic and diluted net loss from

continuing operations |

$ (0.18) |

$ (0.03) |

$ (0.25) |

$ (0.18) |

| Basic and diluted net income

from discontinued operations |

-- |

-- |

-- |

-- |

| Basic and diluted net loss per

share |

$ (0.18) |

$ (0.03) |

$ (0.25) |

$ (0.18) |

| |

|

|

|

|

| Weighted-average shares - basic and

diluted |

88,918 |

88,078 |

88,798 |

78,590 |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES |

| (in thousands, except

per share amounts - unaudited) |

| |

|

|

|

|

| |

Three Months Ended

December 31, |

Year Ended December

31, |

| |

2011 |

2010 |

2011 |

2010 |

| |

|

|

|

|

| Operating loss, as reported |

$ (16,488) |

$ (1,696) |

$ (24,516) |

$ (11,789) |

| Add back: |

|

|

|

|

| Depreciation |

3,684 |

3,664 |

14,789 |

13,126 |

| Amortization of intangible

assets |

340 |

204 |

1,322 |

1,449 |

| Amortization of acquired

intangible assets |

913 |

927 |

3,765 |

2,671 |

| Total EBITDA |

(11,551) |

3,099 |

(4,640) |

5,457 |

| |

|

|

|

|

| Add back significant items: |

|

|

|

|

| Stock-based compensation |

497 |

851 |

2,425 |

3,177 |

| In-process research and

development |

-- |

-- |

-- |

2,967 |

| Acquisition-related inventory

step-up |

-- |

449 |

751 |

1,281 |

| Transaction related

expenses |

-- |

20 |

-- |

3,671 |

| Restructuring expenses |

57 |

(7) |

1,050 |

2,382 |

| Litigation settlement |

9,800 |

-- |

9,800 |

-- |

| |

|

|

|

|

| EBITDA, as adjusted for significant

items |

$ (1,197) |

$ 4,412 |

$ 9,386 |

$ 18,935 |

| |

|

|

|

|

| Net loss, as reported |

$ (15,966) |

$ (2,876) |

$ (22,181) |

$ (14,355) |

| Add back: |

|

|

|

|

| In-process research and

development |

-- |

-- |

-- |

2,967 |

| Acquisition-related inventory

step-up |

-- |

449 |

751 |

1,281 |

| Amortization of acquired

intangible assets |

913 |

927 |

3,765 |

2,671 |

| Transaction related

expenses |

-- |

20 |

-- |

3,671 |

| Restructuring expenses |

57 |

(7) |

1,050 |

2,382 |

| Litigation settlement |

9,800 |

-- |

9,800 |

-- |

| |

|

|

|

|

| Net loss, as adjusted for significant

items |

$ (5,196) |

$ (1,487) |

$ (6,815) |

$ (1,383) |

| |

|

|

|

|

| Net loss per common share - basic and

diluted |

$ (0.18) |

$ (0.03) |

$ (0.25) |

$ (0.18) |

| Add back: |

|

|

|

|

| In-process research and

development |

-- |

0.00 |

-- |

0.04 |

| Acquisition-related inventory

step-up |

-- |

0.01 |

0.01 |

0.01 |

| Amortization of acquired

intangible assets |

0.01 |

0.01 |

0.04 |

0.03 |

| Transaction related

expenses |

-- |

0.00 |

-- |

0.05 |

| Restructuring expenses |

-- |

(0.00) |

0.01 |

0.03 |

| Litigation settlement |

0.11 |

-- |

0.11 |

-- |

| |

|

|

|

|

| Net loss per common share - basic and

diluted, as adjusted for significant items |

$ (0.06) |

$ (0.02) |

$ (0.08) |

$ (0.02) |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

GEOGRAPHIC SEGMENT REVENUES AND GROSS PROFIT |

| (in thousands, except

percentages - unaudited) |

| |

|

|

|

| |

Three Months Ended

December 31, |

|

Impact from Foreign |

| |

2011 |

2010 |

% Change |

Currency |

| |

|

|

|

|

| Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 32,752 |

$ 32,117 |

2.0% |

0.0% |

| International |

16,758 |

13,901 |

20.6% |

1.5% |

| Total revenues |

$ 49,510 |

$ 46,018 |

7.6% |

0.5% |

| |

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

| U.S. |

$ 18,728 |

$ 25,082 |

|

|

| International |

6,183 |

6,401 |

|

|

| Total gross profit |

$ 24,911 |

$ 31,483 |

|

|

| |

|

|

|

|

| Gross profit margin by geographic

segment |

|

|

|

|

| U.S. |

57.2% |

78.1% |

|

|

| International |

36.9% |

46.0% |

|

|

| Total gross profit margin |

50.3% |

68.4% |

|

|

| |

|

|

|

|

| |

Year Ended December

31, |

|

Impact from Foreign |

| |

2011 |

2010 |

% Change |

Currency |

| |

|

|

|

|

| Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 133,824 |

$ 119,880 |

11.6% |

0.0% |

| International |

63,887 |

51,730 |

23.5% |

7.2% |

| Total revenues |

$ 197,711 |

$ 171,610 |

15.2% |

2.3% |

| |

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

| U.S. |

$ 87,085 |

$ 89,226 |

|

|

| International |

29,845 |

23,591 |

|

|

| Total gross profit |

$ 116,930 |

$ 112,817 |

|

|

| |

|

|

|

|

| Gross profit margin by geographic

segment |

|

|

|

|

| U.S. |

65.1% |

74.4% |

|

|

| International |

46.7% |

45.6% |

|

|

| Total gross profit margin |

59.1% |

65.7% |

|

|

| |

|

|

|

|

| Footnotes: |

|

|

|

|

| 1) The impact from foreign

currency represents the percentage change in 2011 revenues due to

the change in foreign exchange rates for the periods

presented. |

| |

| ALPHATEC HOLDINGS,

INC. |

| PRO FORMA REVENUES BY

GEOGRAPHIC SEGMENT |

| (in thousands, except

percentages - unaudited) |

| |

|

|

|

|

| |

Three Months Ended

December 31, |

|

Impact from Foreign |

| |

2011 |

2010 |

% Change |

Currency |

| |

|

|

|

|

| Pro Forma Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 32,752 |

$ 32,117 |

2.0% |

0.0% |

| International |

16,758 |

13,901 |

20.6% |

1.5% |

| Total revenues |

$ 49,510 |

$ 46,018 |

7.6% |

0.5% |

| |

|

|

|

|

| |

Year Ended December

31, |

|

Impact from Foreign |

| |

2011 |

2010 |

% Change |

Currency |

| |

|

|

|

|

| Pro Forma Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 133,824 |

$ 122,855 |

8.9% |

0.0% |

| International |

63,887 |

60,090 |

6.3% |

6.5% |

| Total revenues |

$ 197,711 |

$ 182,945 |

8.1% |

2.1% |

| |

|

|

|

|

| Footnotes: |

|

|

|

|

| 1) Pro Forma revenues for

the periods presented include the results of Scient'x as if the

Scient'x acquisition had occurred on January 1, 2010. |

| |

|

|

|

|

| 2) The impact from foreign

currency represents the percentage change in 2011 revenues due to

the change in foreign exchange rates for the periods

presented. |

CONTACT: Investor/Media Contact:

Mark Francois

Senior Director, Investor Relations

Alphatec Spine, Inc.

(760) 494-6610

mfrancois@alphatecspine.com

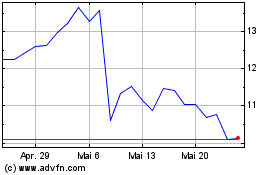

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

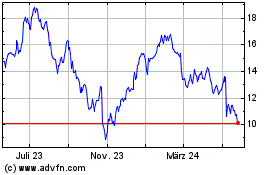

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024