AppTech Payments Corp. Announces Pricing of $2.0 Million Underwritten Public Offering of Common Stock

26 März 2024 - 1:00PM

AppTech Payments Corp. (Nasdaq: APCX) (“AppTech” or the

“Company”), a pioneering fintech company powering

frictionless commerce, today announced the pricing of its

previously announced underwritten public offering of 2,000,000

shares of its common stock at a public offering price of $1.00 per

share for aggregate gross proceeds of approximately $2.0 million,

prior to deducting underwriting discounts and other offering

expenses. In addition, the Company has granted the underwriters a

45-day option to purchase up to an additional 300,000 shares of

common stock at the public offering price per share, less the

underwriting discounts to cover over-allotments, if any. The

offering is expected to close on March 27, 2024, subject to

satisfaction of customary closing conditions.

EF Hutton LLC is acting as the sole book-runner

for the offering.

AppTech intends to use the net proceeds from the

offering for integration of existing business, working capital and

general corporate purposes.

The securities are being offered by the Company

pursuant to a "shelf" registration statement on Form S-3 (File No.

333-265526), including a preliminary prospectus supplement filed

with U.S. Securities and Exchange Commission (the "SEC") on March

26, 2024 and the and accompanying base prospectus, filed with the

SEC on June 10, 2022, as amended on July 8, 2022, and declared

effective on July 15, 2022 and a final prospectus supplement that

will be filed on or before March 27, 2024.

Copies of the prospectus supplement and the

accompanying prospectus relating to this offering may be obtained,

when available, on the SEC’s website at http://www.sec.gov or by

contacting EF Hutton LLC Attention: Syndicate Department, 590

Madison Avenue, 39th Floor, New York, NY 10022, by email at

syndicate@efhuttongroup.com, or by telephone at (212) 404-7002.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. Any offer, if at all, will be made only by means of

the prospectus supplement and accompanying prospectus forming a

part of the effective registration statement.

About AppTech Payments

Corp.

AppTech Payments Corp. (NASDAQ: APCX) provides

digital financial services for financial institutions,

corporations, small and midsized enterprises (“SMEs”), and

consumers through the Company’s scalable cloud-based platform

architecture and infrastructure, coupled with our Specialty

Payments development and delivery model. AppTech maintains

exclusive licensing and partnership agreements in addition to a

full suite of patented technology capabilities. For more

information, please visit apptechcorp.com.

Notice Regarding Forward-Looking

Statements

The information contained herein includes

forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended, and Section 27A of the

Securities Act of 1933, as amended. These statements include, among

others, statements regarding the proposed public offering, and the

timing of the offering. Forward-looking statements generally

include statements that are predictive in nature and depend upon or

refer to future events or conditions, and include words such as

"may," "will," "should," "would," "expect," "plan," "believe,"

"intend," "look forward," and other similar expressions among

others. These statements relate to future events or to the

Company’s future financial performance, and involve known and

unknown risks, uncertainties and other factors that may cause the

Company’s actual results to be materially different from any future

results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements. You should not

place undue reliance on forward-looking statements since they

involve known and unknown risks, uncertainties and other factors

which are, in some cases, beyond the Company’s control and which

could, and likely will, materially affect actual results, levels of

activity, performance or achievements. Any forward-looking

statement reflects the Company’s current views with respect to

future events and is subject to these and other risks,

uncertainties and assumptions relating to the Company’s operations,

results of operations, growth strategy and liquidity. More detailed

information about the Company and the risk factors that may affect

the realization of forward-looking statements is set forth in the

Company’s most recent Annual Report on Form 10-K and other filings

with the SEC. Investors and security holders are urged to read

these documents free of charge on the SEC’s website at

http://www.sec.gov. Except as may be required by applicable law,

the Company assumes no obligation to publicly update or revise

these forward-looking statements for any reason, or to update the

reasons actual results could differ materially from those

anticipated in these forward-looking statements, whether as a

result of new information, future events or otherwise.

Investor Relations ContactCORE IRScott

Arnoldscotta@coreir.com

AppTech Payments

Corp.760-707-5959info@apptechcorp.com

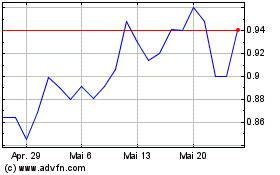

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024