Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical

company, today announced financial results for the third quarter

ended September 30, 2024, and provided a business update.

“In the third quarter, we reached several

important milestones, most notably the completion of enrollment in

the Phase 2b IMPACT trial of pemvidutide in MASH, positioning us to

report top-line efficacy data in the second quarter of 2025,” said

Vipin K. Garg, Ph.D., President and Chief Executive Officer of

Altimmune. “Further, we successfully completed our End-of-Phase 2

meeting with the FDA for the pemvidutide Phase 3 obesity program,

gaining agreement on the design of the pivotal studies as well as

the measures of efficacy and safety.”

Dr. Garg continued, “The Phase 3 program is

designed to leverage the key attributes of pemvidutide, including

the effects of balanced GLP-1/glucagon dual agonism in subjects

with overweight and obesity. The program will include four pivotal

trials with a primary efficacy endpoint of weight loss and will

evaluate the effects of pemvidutide on principal co-morbidities of

obesity, including elevated serum lipids and excess liver fat. The

program will also assess the preservation of lean mass and its

impact on subjects at risk for loss of physical function and other

complications of sarcopenia.”

“At the 60th Annual Meeting of the European

Association for the Study of Diabetes, we presented compelling data

from our Phase 2 MOMENTUM trial of pemvidutide in obesity, which

highlighted its class-leading preservation of lean mass and

preferential reduction in visceral adipose tissue, both of which

are important differentiators for pemvidutide,” said Scott Harris,

M.D., Chief Medical Officer of Altimmune. “We also remain on-track

to submit an IND application this quarter for the first of up to

three additional indications for pemvidutide, with the trial

expected to initiate in the first half of 2025.”

Dr. Garg concluded, “The data we have generated

to date, coupled with the multiple key inflection points on the

horizon, give us confidence that 2025 will be a transformational

year for pemvidutide, and for Altimmune.”

Recent Highlights and Anticipated

Milestones:

Metabolic Dysfunction-Associated

Steatohepatitis (MASH):

- The Company completed patient

enrollment in IMPACT, a biopsy-driven Phase 2b trial of pemvidutide

in MASH

- The IMPACT trial is evaluating the

efficacy and safety of pemvidutide in approximately 190 subjects

with biopsy-confirmed MASH.

- With a successful readout from

IMPACT, pemvidutide would be the first MASH therapy to achieve both

fibrosis improvement and significant weight loss at 24 weeks of

treatment.

- Top-line efficacy data is expected

in Q2 2025.

Obesity:

- Completed End-of-Phase 2 Meeting

for the obesity program with the FDA

- Agreement was reached on the plan

for four Phase 3 clinical trials that leverage the key attributes

of pemvidutide including balanced GLP-1/glucagon dual agonism.

- Each of the four studies is

designed to assess the ability of pemvidutide treatment to drive

meaningful weight loss and address co-morbidities in specific

subpopulations of patients with overweight or obesity.

- Data from these studies are

expected to form the basis for a registrational package to support

FDA approval of pemvidutide in obesity.

- The Company presented data from a

body composition sub-study from the Phase 2 MOMENTUM trial at the

60th Annual Meeting of the European Association for the Study of

Diabetes (EASD)

- In an MRI evaluation of subjects

with overweight and obesity treated with pemvidutide for 48 weeks,

the lean loss ratio was 21.9%.

- Lean mass preservation was greater

in subjects aged 60 years and older, in whom the lean loss ratio

was further reduced to 19.9%.

- In addition to the preservation of

lean mass, visceral adipose tissue (VAT) was reduced by 28.3% in

the 2.4mg cohort at Week 48. Reduction of VAT is important as VAT

is closely associated with cardiovascular risk.

Additional Indications for

Pemvidutide:

- The Company plans to submit IND

applications for pemvidutide in up to three additional indications

- The first of these IND applications

will be submitted in Q4 2024, with remaining IND applications

expected to be submitted in the first half of 2025.

- Preparations for the first trial

are underway, with initiation planned for H1 2025.

Corporate Update:

- On November 11, 2024, the Company

announced the appointment of life sciences industry veteran Greg

Weaver as Chief Financial Officer

Financial Results for the Three Months

Ended September 30, 2024:

- Altimmune had cash, cash

equivalents and short-term investments totaling $139.4 million on

September 30, 2024.

- Research and development expenses

were $19.8 million for the three months ended September 30, 2024,

compared to $18.4 million in the same period in 2023. The expenses

for the quarter ended September 30, 2024, included $12.4 million in

direct costs related to development activities for pemvidutide and

$0.8 million in direct costs related to additional research and

discovery projects.

- General and administrative expenses

were $5.0 million for the three months ended September 30, 2024,

compared to $4.5 million in the same period in 2023. The increase

was primarily due to a $0.4 million increase in professional

fees.

- Interest income was consistent

period-over-period at $1.9 million for each of the three months

ended September 30, 2024 and 2023.

- Net loss for the three months ended

September 30, 2024, was $22.8 million, or $0.32 net loss per share,

compared to a net loss of $20.7 million, or $0.39 net loss per

share, in the same period in 2023.

Conference Call Information:

| |

|

| Date: |

November 12, 2024 |

| Time: |

8:30 a.m. Eastern Time |

| Webcast: |

To listen, the conference call will be webcast live on

Altimmune’s Investor Relations website at

https://ir.altimmune.com/investors. |

| Dial-in: |

To participate or dial-in, register here to receive the dial-in

numbers and unique PIN to access the call. |

| |

|

Following the conclusion of the call, the

webcast will be available for replay on the Investor Relations (IR)

page of the Company’s website at www.altimmune.com. The Company has

used, and intends to continue to use, the IR portion of its website

as a means of disclosing material non-public information and for

complying with disclosure obligations under Regulation FD.

About Pemvidutide

Pemvidutide is a novel, investigational,

peptide-based GLP-1/glucagon dual receptor agonist in development

for the treatment of obesity and MASH. Activation of the GLP-1 and

glucagon receptors is believed to mimic the complementary effects

of diet and exercise on weight loss, with GLP-1 suppressing

appetite and glucagon increasing energy expenditure. Glucagon is

also recognized as having direct effects on hepatic fat metabolism,

which is believed to lead to rapid reductions in levels of liver

fat and serum lipids. In clinical trials to date, once-weekly

pemvidutide has demonstrated compelling weight loss with

class-leading lean mass preservation, and robust reductions in

triglycerides, LDL cholesterol, liver fat content and blood

pressure. The U.S. FDA has granted Fast Track designation

to pemvidutide for the treatment of MASH. Pemvidutide recently

completed the MOMENTUM Phase 2 obesity trial and is being studied

in the ongoing IMPACT Phase 2b MASH trial.

About Altimmune

Altimmune is a clinical-stage biopharmaceutical

company focused on developing innovative next-generation

peptide-based therapeutics. The Company is developing pemvidutide,

a GLP-1/glucagon dual receptor agonist for the treatment of obesity

and MASH. For more information, please visit www.altimmune.com.

Follow @Altimmune, Inc. on

LinkedInFollow @AltimmuneInc on

Twitter

Forward-Looking Statement

Any statements made in this press release

relating to future financial or business performance, conditions,

plans, prospects, trends, or strategies and other financial and

business matters, including without limitation, the timing of the

IMPACT trial data readout, the timing of the planned End-of-Phase 2

FDA meeting, the timing of the planned IND submissions for

pemvidutide, the timing of key milestones for any of our clinical

assets, and the prospects for the utility of, regulatory approval,

commercializing or selling any product or drug candidates, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. In addition, when or if

used in this press release, the words “may,” “could,” “should,”

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

“predict” and similar expressions and their variants, as they

relate to Altimmune, Inc. may identify forward-looking statements.

The Company cautions that these forward-looking statements are

subject to numerous assumptions, risks, and uncertainties, which

change over time. Important factors that may cause actual results

to differ materially from the results discussed in the

forward-looking statements or historical experience include risks

and uncertainties, including risks relating to: delays in

regulatory review, manufacturing and supply chain interruptions,

access to clinical sites, enrollment, adverse effects on healthcare

systems and disruption of the global economy; the reliability of

the results of studies relating to human safety and possible

adverse effects resulting from the administration of the Company’s

product candidates; the Company’s ability to manufacture clinical

trial materials on the timelines anticipated; and the success of

future product advancements, including the success of future

clinical trials. Further information on the factors and risks that

could affect the Company's business, financial conditions and

results of operations are contained in the Company’s filings with

the U.S. Securities and Exchange Commission, including under the

heading “Risk Factors” in the Company’s most recent annual report

on Form 10-K and our other filings with the SEC, which are

available at www.sec.gov.

Company Contact:Vipin GargPresident and Chief

Executive OfficerPhone: 240-654-1450ir@altimmune.com

Investor Contact:Lee RothBurns McClellanPhone:

646-382-3403lroth@burnsmc.com

Media Contact:Danielle CanteyInizio Evoke,

BiotechPhone: 619-826-4657Danielle.cantey@inizioevoke.com

| |

|

ALTIMMUNE, INC.CONSOLIDATED BALANCE

SHEETS(In thousands, except share and per-share

amounts) |

| |

|

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

| |

|

2024 |

|

|

2023 |

|

| |

|

(Unaudited) |

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

31,474 |

|

|

$ |

135,117 |

|

|

Restricted cash |

|

|

42 |

|

|

|

41 |

|

|

Total cash, cash equivalents and restricted cash |

|

|

31,516 |

|

|

|

135,158 |

|

|

Short-term investments |

|

|

107,906 |

|

|

|

62,698 |

|

|

Accounts and other receivables |

|

|

428 |

|

|

|

1,111 |

|

|

Income tax and R&D incentive receivables |

|

|

2,912 |

|

|

|

3,742 |

|

|

Prepaid expenses and other current assets |

|

|

2,997 |

|

|

|

6,917 |

|

|

Total current assets |

|

|

145,759 |

|

|

|

209,626 |

|

| Property and equipment,

net |

|

|

446 |

|

|

|

651 |

|

| Other assets |

|

|

1,659 |

|

|

|

363 |

|

|

Total assets |

|

$ |

147,864 |

|

|

$ |

210,640 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,133 |

|

|

$ |

2,070 |

|

|

Accrued expenses and other current liabilities |

|

|

7,505 |

|

|

|

10,073 |

|

|

Total current liabilities |

|

|

8,638 |

|

|

|

12,143 |

|

| Other noncurrent

liabilities |

|

|

5,849 |

|

|

|

4,398 |

|

|

Total liabilities |

|

|

14,487 |

|

|

|

16,541 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Common stock, $0.0001 par value; 200,000,000 shares authorized;

71,124,407 and 70,677,400 shares issued and outstanding as of

September 30, 2024 and December 31, 2023,

respectively |

|

|

7 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

|

676,425 |

|

|

|

665,427 |

|

|

Accumulated deficit |

|

|

(538,210 |

) |

|

|

(466,331 |

) |

|

Accumulated other comprehensive loss, net |

|

|

(4,845 |

) |

|

|

(5,004 |

) |

|

Total stockholders’ equity |

|

|

133,377 |

|

|

|

194,099 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

147,864 |

|

|

$ |

210,640 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

ALTIMMUNE, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(In

thousands, except share and per-share amounts) |

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

$ |

5 |

|

|

$ |

362 |

|

|

$ |

15 |

|

|

$ |

389 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

19,803 |

|

|

|

18,388 |

|

|

|

62,445 |

|

|

|

48,890 |

|

|

General and administrative |

|

|

4,969 |

|

|

|

4,514 |

|

|

|

15,876 |

|

|

|

13,805 |

|

|

Total operating expenses |

|

|

24,772 |

|

|

|

22,902 |

|

|

|

78,321 |

|

|

|

62,695 |

|

| Loss from operations |

|

|

(24,767 |

) |

|

|

(22,540 |

) |

|

|

(78,306 |

) |

|

|

(62,306 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(6 |

) |

|

|

(29 |

) |

|

|

(8 |

) |

|

|

(33 |

) |

|

Interest income |

|

|

1,910 |

|

|

|

1,884 |

|

|

|

6,505 |

|

|

|

5,387 |

|

|

Other income (expense), net |

|

|

18 |

|

|

|

14 |

|

|

|

(70 |

) |

|

|

146 |

|

|

Total other income (expense), net |

|

|

1,922 |

|

|

|

1,869 |

|

|

|

6,427 |

|

|

|

5,500 |

|

| Net loss |

|

|

(22,845 |

) |

|

|

(20,671 |

) |

|

|

(71,879 |

) |

|

|

(56,806 |

) |

| Other comprehensive income —

unrealized gain on short-term investments |

|

|

347 |

|

|

|

56 |

|

|

|

159 |

|

|

|

103 |

|

| Comprehensive loss |

|

$ |

(22,498 |

) |

|

$ |

(20,615 |

) |

|

$ |

(71,720 |

) |

|

$ |

(56,703 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.32 |

) |

|

$ |

(0.39 |

) |

|

$ |

(1.01 |

) |

|

$ |

(1.10 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

|

71,084,787 |

|

|

|

53,633,354 |

|

|

|

70,927,222 |

|

|

|

51,495,957 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This press release was published by a CLEAR® Verified

individual.

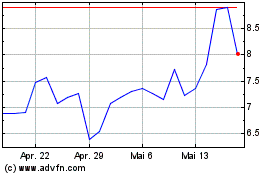

Altimmune (NASDAQ:ALT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Altimmune (NASDAQ:ALT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024