0001606698FALSE00016066982024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) July 25, 2024

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYER IDENTIFICATION NO.) |

2375 E. Camelback Rd, Suite 600

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

2525 E. Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard, Transfer of Listing.

Item 8.01 Other Events

On July 25, 2024, Alpine 4 Holdings, Inc., a Delaware corporation (the “Company”) received written notification (the “Letter”) from the Nasdaq Hearings Panel (the “Panel”) notifying the Company of its decision to grant the Company's request to continue its listing on The Nasdaq Stock Market (“Nasdaq”) subject to the Company’s meeting certain conditions outlined in the letter.

As the Company has previously reported, the Company had participated in its Hearing with the Nasdaq Panel on July 2, 2024, in relation to its delinquent public reports, namely the Annual Report on Form 10-K for the year ended December 31, 2023, and the Quarterly Report on Form 10-Q for the period ended March 31, 2024.

In the letter, the Hearings Advisor noted that in making its decision, the Panel considered the entire record, which was incorporated by reference into the Panel’s decision. Background information about the Company, including its business description, financial information, market data and compliance history, had been presented by the Listing Qualifications’ Staff to the Panel.

As noted in the Letter, the Company is in violation of the obligation to file periodic financial reports with the U.S. Securities and Exchange Commission (“SEC”) as required under Nasdaq Listing Rule 5250(c)(1) (the “Periodic Filing Rule”). As previously reported by the Company, the Nasdaq Listing Qualifications Department Staff had previously granted an additional 180-day extension, until December 23, 2024, for the Company to regain compliance with the minimum bid price requirement as set forth in Nasdaq Listing Rule 5550(a)(2).

In the Letter, the Hearings Advisor reviewed the information presented to the Panel by the Company, detailing the reasons for the delays in filing the Company’s Quarterly Report for the quarter ended September 30, 2023 (which subsequently has been filed by the Company), as well as the Annual Report for the year ended December 31, 2023, and the Quarterly Report for the Quarter ended March 31, 2024. The Letter discussed the Company’s change in certified public accounting firm/auditors, as well as the reasons for the change in auditors. The Letter notes that there had been no disagreements regarding accounting treatment or principles between the Company and its prior auditors, but that the Company had felt it was not receiving adequate customer service. The Letter noted that the Company was working with its new auditor to complete the audit for 2023, and to complete and file the Annual Report for the year ended December 31, 2023, and the Quarterly Reports for the quarters ended March 31 and June 30, 2024.

The Letter also noted that the Company has implemented certain enhancements to internal controls in order to prevent a similar delay occurring in the future and hired a new staff with the stated goal of centralizing accounting throughout the Company. The Company’s new audit firm, Marcum LLP and its other advisors have provided recommendations on how to address internal controls and the quality of financial reporting.

Panel Conclusions

The Letter stated that based on the information presented, the Panel had decided to grant the Company’s request for an exception until October 31, 2024, to regain compliance with the periodic filing delinquency. The Letter noted that the Company was unexpectedly required to conduct additional accounting analysis immediately prior to the filing of a Form 10-Q. Upon learning of this requirement, the Company set out to retain a new accounting firm and complete the analysis as instructed. Since that time, it has completed the analysis, filed the initial delinquent report and is now working to file all remaining reports. The Panel believes an exception is appropriate in light of the work the Company has conducted thus far to cure the deficiency and the short time period requested for the exception.

The Letter noted that the Nasdaq Listing and Hearing Review Council may, on its own motion, determine to review any Panel decision within 45 calendar days after issuance of the written decision. The Letter continued that if the Listing Council determines to review the decision set forth in the Letter, the Listing Council may affirm, modify,

reverse, dismiss or remand the decision to the Panel, and that the Company would be notified immediately in the event the Listing Council determines that this matter will be called for review.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On July 26, 2024, Christopher Meinerz, the Company’s Chief Financial Officer, notified Kent Wilson, the Company’s Chief Executive Officer, and the Board of Directors (the “Board”) that Mr. Meinerz intends to resign as the Company’s Chief Financial Officer effective on or by August 30, 2024. Mr. Meinerz will continue to assist the Company with the preparation of the financial statements and the filing of the Company’s Annual Report on Form 10-K, serving as a consultant to the Company. The Company has begun a search for a new full-time Chief Financial Officer.

Mr. Meinerz informed Mr. Wilson and the Board that his decision to resign was not based on any disagreements with the Company, its officers or directors, or anything related to the business of the Company. Rather, Mr. Meinerz and his family have been subjected to threats and online harassment related to his service with the Company. Specifically, the threats from one individual against his underage children that included postings of pictures of his wife and children with guns to their heads on platforms such as X and StockTwits. This individual also contacted Mr. Meinerz’s spouse and children directly. The FBI has opened a case and is working with Interpol to find this individual. The Company’s management shares Mr. Meinerz’s concern and frustration with such unwarranted criminal conduct. Mr. Meinerz believes that for the safety of his family and himself, it is in his and their best interest that he resigns his position. The Board accepted Mr. Meinerz’s decision and thanked him for his valuable service to the Company. The Company intends to pursue all legal remedies against this individual to the highest extent possible.

Appointment of Interim Chief Financial Officer

Following Mr. Meinerz’s resignation, on July 26th, 2024, the Board, acting on the recommendation of the Audit Committee of the Board, appointed Ginger Smith, currently serving as the Company’s Corporate Controller, to serve as interim Chief Financial Officer until the company hires a permanent replacement.

Ms. Smith, age 64, has over 35 years of accounting and management experience and has been with the Company since December 2023. She started her career at PriceWaterhouseCoopers in Los Angeles and holds a CPA, currently inactive, from the State of California. From October 2021 to November 2023, Ms. Smith was the Director of Accounting at YourWay Cannabis Brands Inc., a publicly held company on the Canadian Stock Exchange. From February 2020 to June 2021, she was a Director of Accounting at Lumen Technologies, NYSE: LUMN. From November 2018 to November 2019, she worked as a senior consultant with Robert Half Management Resources. Ms. Smith has broad experience in operational accounting, financial reporting, internal audit, accounting systems, and internal controls. She has been the Chief Accounting Officer and the CFO at two publicly held companies and the Vice President of Finance at a company that successfully completed an IPO. She has been the Director of Accounting or Controller at several companies. Ms. Smith holds bachelor’s degrees in accounting (1985) and finance (1982) from George Mason University and has an MBA (1996) from California State University.

Appointment of Restructuring Consultant

On July 14th, 2024, Mr. Wilson, CEO, sought board approval to hire Mr. Charles A. Josenhans as the Company’s Restructuring Consultant to bring a fresh set of eyes to the challenges the company faces. The Board agreed to this proposal and the Company hired Mr. Josenhans on July 20th, 2024. Mr. Josenhans has been tasked with helping the Company to restructure its subsidiary and operational structure and will play a critical role in stabilizing the business.

Mr. Josenhans responsibilities will include working closely with the Board and management to revise the Company’s business plan, identifying restructuring options including debt and equity solutions, and developing proposals. Additionally, Mr. Josenhans will negotiate with current Company stakeholders to execute the Company’s

plan for near-term and long-term success. Furthermore, Mr. Josenhans will oversee budgeting and financial planning processes to ensure that the Company’s next CFO has the tools necessary to monitor the financial health of the Company. He will develop and implement financial strategies to optimize resource allocation, manage costs effectively, and enhance profitability. His expertise will be instrumental in aligning the Company's financial goals with its strategic objectives, thereby contributing to the overall stability and growth of the business.

Mr. Josenhans is a seasoned financial executive with over 35 years of experience in senior financial roles. He has a distinguished track record in leading M&A transactions, enhancing business performance, and spearheading business transition initiatives. Mr. Josenhans began his career with Ernst & Young in Seattle, Washington, after earning a BA in Accounting from Western Washington University. He is a Certified Public Accountant (CPA) in Washington State, currently inactive. His expertise spans early-stage ventures, public growth companies, and mature organizations, including a Fortune 100 telecom company. He has a comprehensive understanding of financial management and operations and has founded or co-founded several businesses in diverse industries. Throughout his career, Mr. Josenhans has demonstrated a commitment to driving business success and fostering organizational growth. His strategic vision and leadership have consistently delivered outstanding results, making him a highly respected figure in the financial sector.

Other Company Updates

Annual Shareholder Meeting: As previously reported by the Company in the CEO Company Update letter dated May 7, 2024, the Company’s Annual Meeting of the Shareholders for the 2023/2024 year previously had been tentatively scheduled for Friday, August 2, 2024, at 5 pm EST. Based on the Nasdaq Appeal Approval and Company’s plan for the timing of the SEC filings to satisfy the Periodic Filing Rule, Management anticipates that the Shareholder Meeting for the 2023/2024 year will now be held on Friday, November 1, 2024, at 5PM EST.

Corporate Office Move: Due to recent cost-cutting measures, including a lower employee headcount, the Company’s Corporate Office is in the process of being relocated. The new office location will include additional security measures and will be announced soon. In the interim, the Company has a temporary location at 2375 E Camelback Rd, Suite 600, Phoenix, AZ 85016.

Forward-looking Statements

This Report contains forward-looking statements that involve risks and uncertainties. For example, forward-looking statements include statements regarding the timing of the filing of the Company’s filings, the date of the Annual Meeting, and the Company’s plans to regain compliance with Nasdaq listing requirements. Actual results could differ materially from the results projected in or implied by the forward-looking statements made in this report. Factors that might cause these differences include, but are not limited to: the possibility of unanticipated delays that will prevent the filing of the Company’s filings, and the risk that the work necessary to complete the filings is greater than anticipated or may involve the resolution of additional issues identified during the review process. Other risk factors that may impact these forward-looking statements are discussed in more detail in the Company’s 2022 Annual Report on Form 10-K filed with the SEC on May 5, 2023. Copies of the Company’s 2022 Annual Report and other periodic reports are available through the Company's Investor Relations department and website, alpine4.com. The Company expressly disclaims any obligation or intention to update these forward-looking statements to reflect new information and developments.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: July 30, 2024

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

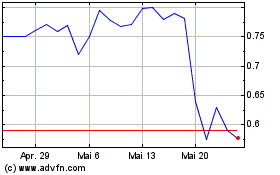

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024