Crown Place VCT PLC Crown Place Vct Plc : Annual -5-

02 Oktober 2014 - 6:08PM

UK Regulatory

being passed to the Board or to shareholders. performed on the Manager, and providing the opportunity

for the Audit Committee to ask specific and detailed

questions. The Chairman of the Audit Committee met

with the internal audit partner of PKF Littlejohn

LLP in January 2014 to discuss the most recent Internal

Audit Report on the Manager. The Manager has a comprehensive

business continuity plan in place in the event that

operational continuity is threatened. Further details

regarding the Board's management and review of the

Company's internal controls through the implementation

of the Turnbull guidance are detailed on page 29 of

the full Annual Report and Financial Statements.

Measures are in place to mitigate information security

risk in order to ensure the integrity, availability

and confidentiality of information used within the

business.

Reliance The Group and the Company are reliant upon the services There are provisions within the management agreement

upon third of Albion Ventures LLP and other third party service for the change of Manager under certain circumstances

parties providers for the provision of investment management (for further detail, see the management agreement

risk and administrative functions. paragraph above). In addition, the Manager has demonstrated

to the Board that there is no undue reliance placed

upon any one individual within Albion Ventures LLP.

The Board monitors the performance of other third

party service providers annually.

Financial By its nature, as a venture capital trust, the Company The Company's policies for managing these risks and

risk is exposed to investment risk (which comprises investment its financial instruments are outlined in full in

price risk and cash flow interest rate risk), credit note 18 to the Financial Statements.

risk and liquidity risk. All of the Group's income and expenditure is denominated

in sterling and hence the Company has no foreign currency

risk. The Group is financed through equity and does

not have any borrowings. The Group does not use derivative

financial instruments for speculative purposes.

This Strategic report of the Company for the year ended 30 June 2014 has

been prepared in accordance with the requirements of section 414A of the

Act. The purpose of this report is to provide Shareholders with

sufficient information to enable them to assess the extent to which the

Directors have performed their duty to promote the success of the

Company in accordance with section 172 of the Act.

On behalf of the Board,

Patrick Crosthwaite

Chairman

2 October 2014

Responsibility Statement

In preparing these financial statements for the year to 30 June 2014,

the Directors of the Company, being Patrick Crosthwaite, Rachel Beagles,

Karen Brade and Richard Huntingford, confirm that to the best of their

knowledge:

-- summary financial information contained in this announcement and the full

Annual Report and Financial Statements for the year ended 30 June 2014

for the Group has been prepared in accordance with International

Financial Reporting Standards, and for the Company has been prepared in

accordance with United Kingdom Generally Accepted Accounting Practice (UK

Accounting Standards and applicable law) and give a true and fair view of

the assets, liabilities, financial position and profit and loss of the

Group and the Company for the year ended 30 June 2014 as required by DTR

4.1.12.R;

-- the Chairman's statement and Strategic report include a fair review of

the information required by DTR 4.2.7R (indication of important events

during the year ended 30 June 2014 and description of principal risks and

uncertainties that the Group and the Company faces); and

-- the Chairman's statement and Strategic report include a fair review of

the information required by DTR 4.2.8R (disclosure of related parties

transactions and changes therein).

A detailed "Statement of Directors' responsibilities for the preparation

of the Group and the Company's financial statements" is contained within

the full audited Annual Report and Financial Statements.

By order of the Board

Patrick Crosthwaite

Chairman

2 October 2014

Consolidated statement of comprehensive income

Year ended Year ended

30 June 2014 30 June 2013

Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains on

investments 2 - 1,812 1,812 - 1,479 1,479

Investment income

and deposit

interest 3 925 - 925 967 - 967

Investment

management fees 4 (120) (361) (481) (114) (343) (457)

Other expenses 5 (280) - (280) (263) - (263)

Profit before

taxation 525 1,451 1,976 590 1,136 1,726

Taxation 6 - - - - - -

Profit and total

comprehensive

income for the

year 525 1,451 1,976 590 1,136 1,726

Basic and diluted

return per

Ordinary share

(pence)* 8 0.61 1.67 2.28 0.73 1.41 2.14

* excluding treasury shares

The accompanying notes form an integral part of these Financial

Statements.

The total column of this statement represents the Group's statement of

comprehensive income, prepared in accordance with International

Financial Reporting Standards ('IFRS'). The supplementary revenue and

capital columns are prepared under guidance published by the Association

of Investment Companies.

All revenue and capital items in the above statement derive from

continuing operations and are wholly attributable to the owners of the

parent Company.

Consolidated balance sheet

30 June 2014 30 June 2013

Note GBP'000 GBP'000

Non-current assets

Investments 9 27,689 24,567

Current assets

Trade and other receivables less than one

year 12 74 17

Current asset investments 12 42 21

Cash and cash equivalents 16 1,466 2,780

1,582 2,818

Total assets 29,271 27,385

Current liabilities

Trade and other payables less than one year 13 (221) (219)

Net assets 29,050 27,166

Equity attributable to equityholders

Ordinary share capital 14 10,006 9,300

Share premium 5,527 3,756

Capital redemption reserve 1,415 1,283

Unrealised capital reserve 657 (1,690)

Realised capital reserve 145 1,041

Other distributable reserve 11,300 13,476

Total equity shareholders' funds 29,050 27,166

Basic and diluted net asset value per share

(pence)* 15 32.04 32.26

* excluding treasury shares

The accompanying notes form an integral part of these Financial

Statements.

These Financial Statements were approved by the Board of Directors, and

authorised for issue on 2 October 2014 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Company number: 03495287

Company balance sheet

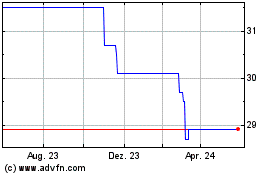

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024