Eurozone Sentix Investor Confidence Rises To -13.8

07 Oktober 2024 - 8:36AM

RTTF2

Euro area investor sentiment rose for the first time in four

months in October, indicating a further attempt to emerge from

recession amid rising expectations on the back of the of the ECB's

rate cuts and China stimulus.

The investor confidence index improved to -13.8 in October from

-15.4 in September, survey results from the behavioral research

institute Sentix showed Monday. The expected score was -14.6.

While the current assessment values once again plumb a new low

for the year, the expectations values rise, Sentix said.

The current situation index declined for the fourth straight

month to -23.3 in October, the lowest since December 2023, versus

-22.5 in September. By contrast, the expectations index rose to

-3.8 from -8.0 in the prior month.

"Investors are not only encouraged by the ECB's interest rate

cuts but also by the stimulus recently provided in China," the

Sentix revealed.

The German economy remains in recession mode for the time being.

However, the expectation values show an improvement with a plus of

6.8 points, as the latest growth momentum in China in particular is

having an impact on expectations in the German economy. The

investor sentiment index hit -31.5 in October, up from -34.7 in the

previous month.

Nonetheless, the positive impact from China is still modest,

while EU policy is creating the next obstacle to growth with new

car tariffs for e-cars from China.

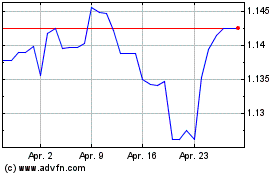

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Nov 2024 bis Dez 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

Von Dez 2023 bis Dez 2024