Vivendi Shares Rise on Breakup Plan

14 Dezember 2023 - 10:13AM

Dow Jones News

By Adria Calatayud

Vivendi shares jumped after the French media group said it will

explore a possible split into three businesses around Canal+, Havas

and an investment company housing a majority stake in

Lagardere.

At 0838 GMT, shares in Vivendi were up 8% at EUR9.68, having

been nearly unchanged since the beginning of the year through

Wednesday's close.

Vivendi said its split proposal seeks to address what it

described as the significantly high conglomerate discount it has

experienced since it spun out Universal Music Group in September

2021. This has reduced the company's valuation and limited its

ability to carry out growth transactions for its subsidiaries, it

said.

As of Wednesday's close, Vivendi's stock was down about 15%

since UMG began trading on Euronext Amsterdam.

The company said entities resulting from its breakup plan would

be listed on the stock market. The businesses would pivot around

television and film-production group Canal+ TV, advertising firm

Havas and an investment company that would include the recently

acquired majority stake in publishing and travel-retail business

Lagardere, Vivendi said.

"This project will have to prove its added value for all

stakeholders and include an analysis of the tax consequences of the

various contemplated operations," it said.

Vivendi had a market capitalization of 9.23 billion euros

($10.03 billion) as at Wednesday's close, according to FactSet.

Last year, it generated revenue of EUR9.595 billion.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 14, 2023 03:58 ET (08:58 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

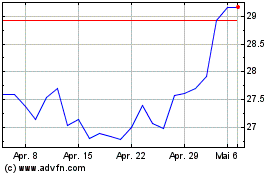

Universal Music Group NV (EU:UMG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Universal Music Group NV (EU:UMG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024