ArcelorMittal Announces Pricing of Bond Issue

10 Dezember 2024 - 7:00PM

ArcelorMittal priced yesterday an offering of €500,000,000 3.125

per cent notes due 13 December 2028 (the “2028 Notes”) and

€500,000,000 3.500 per cent notes due 13 December 2031 (the “2031

Notes” and together with the 2028 Notes, the "Notes").

The Notes will be issued under ArcelorMittal’s €10,000,000,000

wholesale Euro Medium Term Notes Programme.

The proceeds of the issuance will be used for general corporate

purposes and refinancing of existing indebtedness.

The offering is scheduled to close on 13 December 2024, subject

to satisfaction of customary conditions.

Important note: This press release does not, and

shall not, in any circumstances constitute a public offering by

ArcelorMittal of the Notes nor an invitation to the public in

connection with any offer. No communication and no information in

respect of the issuance of the Notes may be distributed to the

public in any jurisdiction where a registration or approval is

required. No steps have been or will be taken in any jurisdiction

where such steps would be required. The offering or purchase of the

Notes may be subject to specific legal or regulatory restrictions

in certain jurisdictions. ArcelorMittal takes no responsibility for

any violation of any such restrictions by any person.

This press release is an advertisement for the

purposes of the Prospectus Regulation (EU) 2017/1129 (the

“Prospectus Regulation”). A prospectus prepared pursuant to the

Prospectus Regulation has been published, which can be obtained

from the website of the Luxembourg Stock Exchange at

www.luxse.com.

The base prospectus of the €10 billion wholesale

Euro Medium Term Note Programme of ArcelorMittal dated as of 15

December 2023 and the supplement to the base prospectus dated 22

November 2024 which together constitute a base prospectus (the

“Base Prospectus”), and the final terms prepared by the Issuer in

connection with the issuance of the Notes have been prepared on the

basis that any offer of Notes in any Relevant State of the European

Economic Area (each, a "Relevant State") will be made pursuant to

an exemption under the Prospectus Regulation, as implemented in

that Relevant State, from the requirement to publish a prospectus

for offers of the Notes.

In any Relevant State of the European Economic

Area, this communication is only addressed to and directed at

qualified investors in that Relevant State within the meaning of

the Prospectus Regulation.

This press release is only being distributed to

and is only directed at (i) persons who are outside the United

Kingdom, (ii) investment professionals falling within Article 19(5)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the “Order”) or (iii) high net worth

entities, and other persons to whom it may lawfully be

communicated, falling within Article 49(2)(a) to (d) of the Order

(all such persons together being referred to as “relevant

persons”). Any Notes will only be available to, and any invitation,

offer or agreement to subscribe, purchase or otherwise acquire such

Notes will be engaged in only with, relevant persons. Any person

who is not a relevant person should not act or rely on this

document or any of its contents.

Notwithstanding any target market assessment,

distributors should note that: the price of the Notes may decline

and investors could lose all or part of their investment; the Notes

offer no guaranteed income and no capital protection; and an

investment in the Notes is compatible only with investors who do

not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The target market assessment is

without prejudice to any contractual, legal or regulatory selling

restrictions in relation to the offering.

This press release does not constitute an offer

to sell or a solicitation of an offer to purchase any securities in

the United States. The Notes have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

"Securities Act") or the laws of any state within the U.S., and may

not be offered or sold in the United States or to or for the

account or benefit of U.S. Persons, except in a transaction not

subject to, or pursuant to an applicable exemption from, the

registration requirements of the Securities Act or any state

securities laws. This press release and the information contained

herein may not be distributed or sent into the United States, or in

any other jurisdiction in which offers or sales of the Notes would

be prohibited by applicable laws and should not be distributed to

United States persons or publications with a general circulation in

the United States. No offering of the Notes has been made or will

be made in the United States.

ENDS

About ArcelorMittal

ArcelorMittal is one of the world’s leading integrated steel and

mining companies with a presence in 60 countries and primary

steelmaking operations in 15 countries. It is the largest steel

producer in Europe, among the largest in the Americas, and has a

growing presence in Asia through its joint venture AM/NS India.

ArcelorMittal sells its products to a diverse range of customers

including the automotive, engineering, construction and machinery

industries, and in 2023 generated revenues of $68.3 billion,

produced 58.1 million metric tonnes of crude steel and 42.0 million

tonnes of iron ore.

Our purpose is to produce smarter steels for people and planet.

Steels made using innovative processes which use less energy, emit

significantly less carbon and reduce costs. Steels that are

cleaner, stronger and reusable. Steels for the renewable energy

infrastructure that will support societies as they transform

through this century. With steel at our core, our inventive people

and an entrepreneurial culture at heart, we will support the world

in making that change.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia

(MTS).

http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20 3214

2419press@arcelormittal.com |

|

|

|

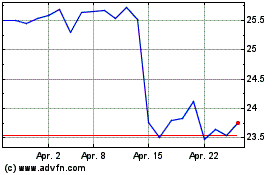

ArcelorMittal (EU:MT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

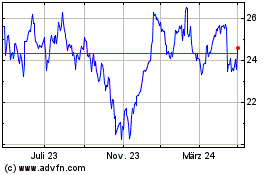

ArcelorMittal (EU:MT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024