Winfarm : 2022 full-year results and Outlook for 2023.

PRESS RELEASE Loudéac, 30 March

2023

2022 full-year resultsExcellent

business activitySolid gross margin maintained and good EBITDA

resilience in an inflationary environmentIllustration of the

strength and resilience of WINFARM’s business model

Outlook for 2023Continued growth

and improvement in operating profitability

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the number one French distance seller for the farming

industry, published its consolidated 2022 full-year

results today.

At its meeting on 30 March 2023, the Board of

Directors approved the consolidated financial statements for the

financial year ended 31 December 2022. These financial statements

have been reviewed by the statutory auditors and the certification

reports are currently being prepared. The consolidated financial

statements for the 2022 financial year are available on the

company's website in the investor space.

|

Consolidated data, French accounting standards, Audited financial

statements in €m |

2022 |

2021 |

|

Revenue |

130.9 |

108.1 |

|

Gross margin |

41.7 |

36.1 |

|

As a % of revenue |

31.9% |

33.5% |

|

EBITDA |

4.5 |

4.9 |

|

As a % of revenue |

3.5% |

4.5% |

|

Depreciation, amortisation and provisions |

(3.6) |

(3.1) |

|

Operating income/loss |

1.1 |

2.2 |

|

Financial income |

(0.2) |

(0.1) |

|

Non-recurring profit/loss |

(0.2) |

(0.0) |

|

Corporate tax |

(0.2) |

(0.6) |

|

Share of net income of companies accounted for by the equity

method |

- |

0.1 |

|

Net income (Group share) |

0.6 |

1.4 |

STRONG BUSINESS GROWTH: +21% TO

€130.9M

WINFARM recorded a sharp increase in business in

2022. Consolidated revenue came to €130.9m in 2022 versus €108.1m

at 31 December 2021, reflecting strong growth of +21%, of which

+10% organic growth. This performance includes the full-year

contribution from BTN de Haas, which was acquired in July 2021, and

five months of activity of the Kabelis Group companies acquired in

August 2022.

The Farming Supplies business

(89% of annual revenue), the products of which are marketed under

the Vital Concept brand, generated revenue of €116.8m, up 21%

compared with 2021 (+10% organic). During the year, WINFARM

succeeded in passing on the substantial price increases in its

products while meeting customer demand against a backdrop of

shortages. This effective forward-looking and agile management

approach enabled it to continue winning new business throughout

2022.

The Farming Production business

(formerly Farming Nutrition) (10% of annual revenue),

marketed under the Alphatech brand, made revenue of €12.2m, a sharp

increase of +25% entirely through organic growth, having benefited

from the Group's aggressive sales policy, particularly in exports,

to gain new market share.

The arrival of a new operational manager at

Alphatech during the first half of 2021 helped to boost momentum

and ramp up activity throughout the year, which is reflected in the

Group's overall performance.

SOLID GROSS MARGIN MAINTAINED

FARMING SUPPLIES: GROWTH IN

EBITDA

FARMING NUTRITION: EBITDA INTEGRATING A

PROACTIVE SALES POLICY

Despite the inflationary environment, WINFARM

succeeded in maintaining a solid gross margin. Overall, gross

margin rose by 16% to €41.7m versus €36.1m in 2021, representing

31.9% of revenue compared with 33.5% in 2021. Amid a widespread

increase in raw material prices, this performance demonstrates the

Group's ability to effectively pass on the purchase price increases

recorded over the period while retaining its appeal for its

customer base.

In the Farming Supplies business, which accounts

for 80% of the Group's sales, WINFARM showed excellent financial

discipline, enabling it to generate strong activity and operating

profitability. This financial discipline also allowed it to

effectively pass on the increase in its purchase prices and in

certain external expenses, such as fuel (+€700k) and wage

(structural increase in the basis point due to inflation) costs. As

a result, EBITDA from operating activities increased by 6% to €7.2m

compared with €6.8m at end-2021, giving a consistently high EBITDA

margin of 6.2%. This includes the contribution to activity from

Kabelis Matériaux and Kabelis Espaces Verts (consolidated from

August 2022), whose activity levels are traditionally lower during

the last few months of the year.

In the Farming Production (formerly Farming

Nutrition) business, the aggressive customer acquisition strategy

that gave rise to growth of +25% over the year also weighed

temporarily on the profitability of the business, with EBITDA

coming out at €0.5m versus €0.7m. In this context of new gains in

market share, WINFARM succeeded in keeping the division's gross

margin stable in value terms (+2% to €5.2m at end-2022 versus €5.1m

at end-2021).

Overall, the Group saw a limited fall in

consolidated EBITDA to €4.5m versus €4.9m in 2021.

After accounting for €3.6m in depreciation and

amortisation, compared with €3.1m in 2021, related to the Group's

infrastructure reinforcement work (extension of the plant,

extension of administrative buildings and construction of the

transformation plant), operating income came to €1.1m versus €2.2m

in 2021. Net income (Group share) came to €0.6m versus €1.4m in

2021.

A SOLID FINANCIAL STRUCTURE

As at 31 December 2022, the Company had

shareholders’ equity of €23.9m and financial debt of €32.2m

(including amounts due to credit institutions, financial

liabilities on financial leases, current bank loans and shareholder

current account contributions). The cash position was €9.2m

compared with €12.2m at 31 December 2021.

2023: CONFIDENT ABOUT CONTINUED GROWTH AND

AN IMPROVEMENT IN OPERATING

PROFITABILITY

One of the Group's priorities for the year is to

achieve a further improvement in profitability while maintaining

continued strong growth. The Group will benefit in this regard from

the combined effect of several growth drivers:

- The gradual easing

of agricultural raw material prices since the beginning of the

year;

- Greater care in

optimising the cost structure;

- Synergies from the

successful consolidation of BTN of Haas;

- The full-year

contribution of the Kabelis business;

- The significant

improvement in farming production margins (Alphatech brand)

following the sales efforts undertaken in 2021 to resume

sustainable growth momentum, enabling it to be reference listed

with the biggest clients in Europe. In the longer term, the Group

believes it can achieve a double-digit operating margin for this

division.

After the successful acquisition of BTN of Haas

in 2021 and Kabelis in 2022, WINFARM continues to explore external

growth opportunities, and is looking outside France in particular

due to strong potential for further expansion, in order to

strengthen its positions and establish a stronger foothold at the

European level.

In the longer term, the Group reasserted its

goals of achieving revenue of around €200m and an EBITDA margin of

around 6.5% by 2025.

To this end, WINFARM will draw on the strength

of its model which is underpinned by key fundamentals that create

results:

- A solid business

model combining an established historical activity and growth

drivers that offer strong growth potential;

- A vast catalogue

that is constantly being renewed through constant innovation;

- Prices that are

competitive and transparent to customers and optimised costs;

- Proven acquisition

and integration capacity;

- A unique

positioning at the centre of the agricultural market, creating

competitive offers for its farmer customers.

About WINFARM

Founded in Loudéac, in the heart of Brittany, at

the beginning of the 1990s, the Winfarm group is today the leading

French player offering the agricultural, livestock, horse-breeding

and landscape markets a range of consultancy, service and distance

selling products and global, unique and integrated solutions to

help them meet the new technological, economic, environmental and

social challenges of the new generation of agriculture.

With a vast catalogue of more than 35,000

product references (seeds, phytosanitary, harvesting products,

etc.), two-thirds of which are marketed under own brands, WINFARM

has more than 45,000 customers in France, Belgium and the

Netherlands.

By 2025, WINFARM aims to achieve revenue of

around €200m and an EBITDA margin of about 6.5%.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, Financial CommunicationsBenjamin

Lehari+33 (0) 1 56 88 11 11winfarm@actifin.fr |

ACTIFIN, Financial Press RelationsJennifer

Jullia+33 (0)1 56 88 11 19jjullia@actifin.fr |

- WINFARM_CP_RA_2022_VDef_EN

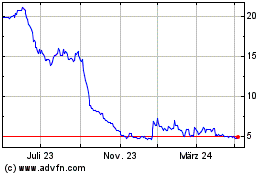

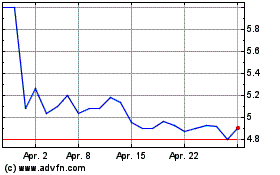

Winfarm (EU:ALWF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024