XRP Holds Key Demand Level – Whale Activity Suggests Strength

22 Dezember 2024 - 4:00AM

NEWSBTC

XRP has faced a steep correction over the past few days, plunging

more than 23% since Tuesday amid heightened market volatility.

Despite this sharp downturn, XRP has shown resilience, bouncing

back with a notable 20% recovery since yesterday. This quick

rebound has reignited discussions about XRP’s long-term prospects,

even as short-term sentiment remains shaky. Related Reading:

Bitcoin Realized Losses Spike 3 Times The Weekly Average – Healthy

Correction Or Downturn? According to data shared by prominent

crypto analyst Ali Martinez, whales have accumulated 80 million XRP

since the correction began on December 17. This surge in whale

activity suggests a growing confidence among large investors, who

appear to be seizing the opportunity to buy XRP at lower prices.

Such accumulation often signals a long-term bullish outlook, even

as the broader market navigates periods of uncertainty. While XRP’s

recovery is encouraging, it comes amid a backdrop of negative

sentiment and price instability. The coming days will likely prove

crucial in determining whether XRP can maintain its upward momentum

or if further consolidation is on the horizon. For now, whale

activity offers a glimmer of optimism, hinting at sustained

interest in the asset despite recent setbacks. XRP Whales Loading

Up XRP is currently trading 22% below its multi-year high of $2.90,

following a period of heightened market volatility. Despite the

recent turbulence, XRP has maintained its footing above the $1.90

low—a critical support level that serves as the bulls’ last line of

defense. Holding this level is essential for preserving the broader

bullish structure and preventing a deeper correction. Recent data

from Santiment, shared by crypto analyst Ali Martinez, highlights a

significant development: whales have purchased 80 million XRP since

the correction began on December 17. This accumulation by

large investors suggests growing confidence in XRP’s long-term

potential despite the short-term price decline. Historically, whale

activity has often preceded significant price movements, as these

investors typically have access to better market insights. If XRP

can sustain its position above $2 and begin to push through crucial

supply zones, a rapid recovery could follow. Overcoming these

resistance levels would likely pave the way for renewed bullish

momentum, with the potential to retest multi-year highs. Related

Reading: Solana Holds Monthly Support As Network Activity Grows –

Time For A Breakout? While challenges remain, such as prevailing

market uncertainty and cautious sentiment, the combination of

strong support and significant whale accumulation offers an

optimistic outlook for XRP in the weeks ahead. Holding current

levels could signal the start of a new upward trajectory. Testing

Liquidity Above $2 XRP is trading at $2.35, marking a strong

recovery from its recent dip to $1.95. This rebound underscores the

resilience of XRP’s price action, as it continues to hold above key

support levels. The $1.95 low has proven to be a pivotal point for

bulls, and maintaining this momentum could signal further gains in

the coming days. However, for the rally to gain credibility, XRP

must reclaim the $2.60 mark. This level serves as a critical

resistance point and a confirmation zone for bullish sentiment.

Breaking above $2.60 would likely attract more buying interest,

propelling XRP toward retesting multi-year highs. On the flip side,

a loss of the $2 support level would shift the narrative. Such a

move would expose XRP to further downside risks, potentially

leading to a deeper correction. Market sentiment remains cautious,

and a break below $2 could result in accelerated selling pressure.

Related Reading: Bitcoin Data Reveals No Significant Panic Selling

In The Market – Shakeout Or Trend Shift? For now, XRP’s outlook

hinges on its ability to navigate between these crucial levels.

Bulls will need to push the price above $2.60 to validate the

rally, while bears will aim to drag it below $2 to seize control.

The next few sessions will be critical in defining XRP’s short-term

trend. Featured image from Dall-E, chart from TradingView

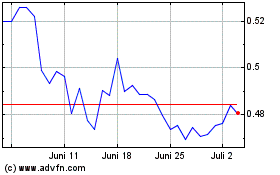

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

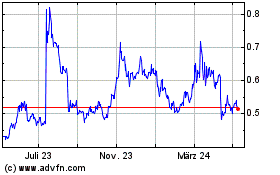

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024