Bitcoin In Flux: Bearish Trends Can’t Deter $100,000 Price Predictions, CNBC

04 Oktober 2024 - 9:43PM

NEWSBTC

Following a volatile week, Bitcoin (BTC) has once again captured

the attention of investors as it fluctuates between bearish and

bullish sentiments. Earlier this week, the leading cryptocurrency

retracted to the $59,800 mark after reaching a two-month high of

$66,500 at the end of the previous week. Despite these

fluctuations, analysts express confidence that Bitcoin could reach

new records by year’s end. Could Bitcoin Prices Rise As Year-End

Approaches? As noted in a recent CNBC report, a recent resurgence

in demand for Bitcoin exchange-traded funds (ETFs) offers a glimmer

of hope for the cryptocurrency’s price in the medium term.

Related Reading: XRP Macro Charts Signal Explosive Bullish Move

Despite SEC Appeal: Analyst However, demand for BTC remains

stagnant and needs a significant boost to facilitate any upward

movement in its price. John Todaro, a crypto analyst at Needham,

emphasized that a significant weekly buying demand is essential

for a significant price increase. He told CNBC:

Bitcoin’s overall market cap is very large now, at $1.2 trillion,

and there is considerable liquidity. While there is a lot of buying

volume, there are also a lot of sellers. Recent data from

CryptoQuant also reveals a shift in Bitcoin ETF activity. After net

selling 5,000 BTC on September 2, Bitcoin ETFs net purchased 7,000

BTC by the end of September, marking the highest daily purchase

since July 21. Analysts believe that if this upward trend

continues, it could help drive Bitcoin prices higher as the year

progresses. Moreover, the fourth quarters of previous Halving

cycles have historically been promising for BTC, with surges of 9%,

59% and 171% in 2012, 2016 and 2020 respectively. Interest Rate

Cuts And Global Tensions Several factors have contributed to the

current volatile price action, and there is hope for a further

recovery for the leading digital asset. As highlighted by CNBC, the

stock market has hit new highs, and both US presidential candidates

have commented positively about cryptocurrencies.

Furthermore, the Federal Reserve’s (Fed) decision to cut interest

rates on September 18 and a series of rate cuts announced by

China’s central bank have created an environment that could be

favorable for Bitcoin. Related Reading: Analyst Says PEPE Bearish

Continuation Is Possible For A 50% Price Crash While Bitcoin

appears poised for a bullish fourth quarter, it still faces

challenges, including a supply overhang stemming from US and German

government actions and impending repayments to creditors from the

Mt. Gox exchange. In addition, CNBC claims that many traders

are taking a wait-and-see approach to the outcome of the upcoming

US presidential election, which will take place in less than two

months, and there are rising tensions in the Middle East between

Israel and Iran. At the time of writing, BTC has climbed above the

$62,380 mark, gaining 2.6% in the last 24 hours. Featured image

from DALL-E, chart from TradingView.com

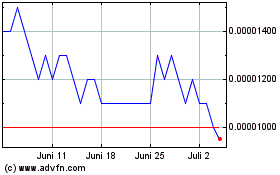

Pepe (COIN:PEPEUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Pepe (COIN:PEPEUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024