Chainlink Presents Potential Buy Opportunities Despite Moving Sideways

06 April 2023 - 9:00PM

NEWSBTC

Over the past few days, the Chainlink price gained momentum. At the

time of writing, however, it encountered selling pressure. The coin

lost 0.7% of its value in the last 24 hours, indicating

consolidation on the chart and erasing most of its gains from the

past week. The technical outlook showed that the bullish strength

of the coin was weakening due to a decline in the number of buyers

due to a decrease in demand and accumulation. Unless the demand

remains positive, the coin may fall below its immediate support

level, bringing in the bears. Related Reading: Dogecoin Dominates

Top 10 Crypto Roster With 20% Rally In Last 7 Days However, if the

demand remains positive, the bulls may attempt to increase the

price. LINK has two crucial support levels. Its performance depends

on the broader market strength, which has been uncertain as Bitcoin

fluctuates above and below the $28,500 price mark, leading to

confusion on most altcoin charts. Chainlink Price Analysis: One-Day

Chart At the time of writing, LINK was trading at $7.20. Having

recently appreciated above the $7 mark, the initial bullish trend

was short-lived. The $7.20 level had acted as a strong resistance

zone for the altcoin, thwarting every attempt by the bulls to push

the price up. The coin’s overhead resistance was $7.60, and

breaking through it could take LINK to $8. However, the altcoin’s

performance highly depends on its support levels, with the first

being at $7. Falling below this level would lead to further drops

to $6.80 and then $6.40, both of which present buying opportunities

for traders. In the last session, the amount of LINK traded was

negative, indicating a rise in selling pressure. Technical Analysis

Sellers are attempting to take over the price of LINK, leading to a

dip in demand on the coin’s one-day chart. The Relative Strength

Index has also fallen close to the half-line, indicating buyers are

starting to exit the market. Further drops in demand may attract

more sellers to the chart. Additionally, the altcoin price has

recently fallen below the 20-Simple Moving Average line, suggesting

a depreciation in demand and indicating that sellers are driving

the market momentum. However, a slight push above the $7.20 mark

could help LINK regain momentum and lift its price back above the

20-SMA line. LINK is showing a decline in buy signals due to

falling demand. The Moving Average Convergence Divergence (MACD)

indicates price momentum and reversals. It has formed shorter green

signal bars that correspond to the decrease in buy signals for

LINK. Related Reading: Ethereum Price Corrects Gains But This

Support Could Spark Fresh Increase Additionally, the Bollinger

Bands, which measure price volatility, have narrowed, suggesting

that the coin may experience range-bound movement in the immediate

trading sessions. Featured Image From UnSplash, Charts From

TradingView.com

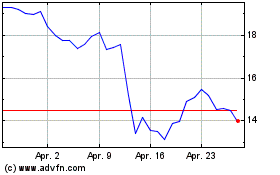

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024