Ethereum Battles Bearish Retail Sentiment Amid Surging ETF Demand

11 Dezember 2024 - 1:30AM

NEWSBTC

Ethereum (ETH) continues to experience pullback in its price as it

recently tested the $4,000 resistance level, a key psychological

price mark for the cryptocurrency. Amid this correction, bearish

tendencies among investors on Binance have surfaced. A recent

analysis by CryptoQuant analyst Darkfost highlights a significant

trend where Binance’s taker buy-sell ratio for Ethereum turned

“sharply negative” at the $4,000 mark. This suggests that traders

on the exchange have predominantly adopted a selling stance.

Related Reading: Sell Pressure Rises As Ethereum Tests $4,000

Resistance—What’s Next For ETH? Ethereum Tug of War According to

Darkfost, the bearish sentiment on Binance has persisted since the

start of November, coinciding with Ethereum’s approach to this

critical resistance level. The analyst pointed out that while this

bearish sentiment could typically signal a potential reversal,

Ethereum’s price movement has defied seeing high bearish

inclination, driven by other influential factors. Notably, demand

for Ethereum Exchange-Traded Funds (ETFs) has surged, showcasing a

growing institutional interest that continues to support Ethereum’s

price action. The surge in demand for Ethereum ETFs signals a shift

in market stance where institutional players increasingly influence

price movements. Institutional interest, evidenced by consistent

inflows into Ethereum-focused investment products seems to have

been pivotal in offsetting the selling pressure observed among

retail traders on Binance. ETH Market Performance And Outlook So

far, Ethereum has seen a significant correction in its price

decreasing to as low as $3,616 as of today. At the time of writing,

the asset currently trades at a price of $3,621 down by nearly 6%

in the past day. Notably, this price performance has unsurprisingly

dropped the asset’s market cap by over $40 billion, falling from

over $490 billion seen last week Friday to $434 billion today.

Interestingly, despite this price decrease, Ethereum’s daily

trading volume has seen an opposite trend rising from below $60

billion on December 6 to now at $72 billion. Given the current

market condition, it is likely that the increase in ETH’s volume is

coming from sell-offs. Related Reading: Ethereum Funding Rates Hit

Multi-Month Highs, But Is A Correction On The Horizon? According to

data from Coinglass, in the past 24 hours , 526,828 traders were

liquidated with the total liquidations coming in at $1.58 billion.

Out of this total liquidations, ETH accounts for roughly $234.72

million. Long liquidations dominates reaching $208.83 million.

Short traders also had their share losses registering $25.89

million worth of ETH liquidations. Regardless of this, analysts are

still optimistic about Ethereum, suggesting that the current price

dip is quite “healthy” for ETH’s market. $ETH remains strong in

HTF!#Ethereum weekly healthy correction will be left behind as a

RETEST and pumped hard! https://t.co/o78x8eBucf

pic.twitter.com/YSixFqjuLQ — EᴛʜᴇʀNᴀꜱʏᴏɴᴀL 💹🧲📈 (@EtherNasyonaL)

December 10, 2024 Featured image created with DALL-E, Chart from

TradingView

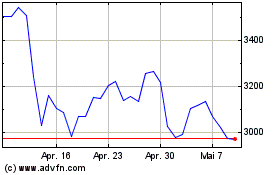

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024