Ethereum Sees Massive Outflows from Derivatives: What Does This Mean For ETH?

10 September 2024 - 1:00PM

NEWSBTC

Ethereum, the second-largest cryptocurrency by market

capitalization, has been experiencing noteworthy movements in its

derivatives markets. Particularly, according to a recent analysis

by a CryptoQuant analyst known as ‘Heisenberg,’ the netflow of

Ethereum on derivative exchanges has seen a significant negative

shift, exceeding 40,000 ETH. Related Reading: Ethereum’s Plunge

Could Be Over: This Key Pattern Signals A Rally Back To $4,000

Ethereum Derivative Market Outflow: What It Means For ETH

Heisenberg explained that netflow refers to the difference between

the amount of Ethereum entering exchanges (inflows) and the amount

being withdrawn (outflows). A negative netflow indicates that more

ETH is withdrawn from derivative exchanges than deposited. This is

particularly relevant because derivative exchanges, such as

leveraged positions or short selling, are often used for trading. A

negative netflow of 40,000 ETH, as reported by Heisenberg, could be

a signal suggesting that the selling pressure on Ethereum may be

reduced, which could lead to a less volatile market in the coming

days. Negative netflow exceeding 40,000 $ETH on derivative

exchanges “Indicates that more ETH is being withdrawn from

Derivative Exchanges, which might suggest reduced selling

pressure.” – By @3AMRTAHA_ Full post 👇https://t.co/5v0PWwq9Mw

pic.twitter.com/MrE4zRNQro — CryptoQuant.com (@cryptoquant_com)

September 9, 2024 Elaborating on this phenomenon, when more

Ethereum is withdrawn from exchanges than deposited, it generally

indicates that investors and traders are holding onto their assets

rather than selling them. This reduction in selling pressure is a

major metric for assessing the potential stability of Ethereum’s

price in the near term. In addition, the reduced borrowing on

derivative exchanges might indicate a decreased interest in opening

new short positions, further reducing the downward pressure on

Ethereum’s price. ETH Market Performance And Outlook Notably, the

implication of this increased outflow of ETH on derivative

exchanges is not reflected in the asset’s market price. As

mentioned earlier, the current trend in this metric signals reduced

downward pressure for ETH. However, the asset remains drowning in

red according to ETH’s latest price performance. Particularly, over

the past week alone, ETH has still been down by 9.2%. Although the

asset has seen a slight 0.5% increase in price over the past day,

this was not enough to make ETH’s price see a major recovery. At

the time of writing, the asset currently trades for $2,282, with a

24-hour high of $2,334 and a 24-hour low of $2,246. As for its

daily trading volume, this metric has also refused to see a

significant increase. Related Reading: Is Ethereum Headed For

Trouble? Analyst Warns Of Surging Exchange Reserves Instead, over

the past week, ETH’s daily trading volume has continued to range

between $13 billion and $11 billion. According to renowned crypto

analyst Ezekiel, “It’s not crypto bottom until ETH drops below

2,000.” #eth #ethereum It’s not crypto bottom until eth drops below

2k pic.twitter.com/uSn9uEekcQ — Ezekiel🐼 (@duje_matic) September 9,

2024 Featured image created with DALL-E, Chart from TradingView

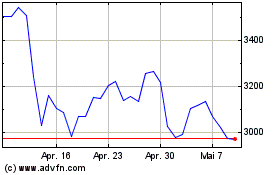

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024