Is MATIC Poised For Takeoff? Key Area Breaks Records, Fueling Bullish Outlook

03 Mai 2024 - 10:30AM

NEWSBTC

Polygon (MATIC), the Ethereum scaling solution, has been a hot

topic for weeks. Its daily active addresses recently hit an

all-time high, exceeding 1.4 million, a testament to the network’s

growing user base. This surge in activity, however, presents a tale

of two sides for MATIC. Related Reading: Is Ethereum Back? Record

267,000 New Users Spark Speculation Polygon’s Busy Streets: A Sign

Of Growth Or Gridlock? The high traffic on Polygon’s virtual

streets is undeniable. The consistent daily active addresses above

1 million suggest a thriving ecosystem. However, a closer look

reveals a potential bottleneck. While the number of users has

skyrocketed, transaction fees have taken a nosedive. This decline

in fees translates to a drop in revenue for the network, raising

concerns about Polygon’s long-term sustainability. JUST IN: Polygon

PoS has recorded a new all time high in daily active addresses with

1.4M pic.twitter.com/YnOdDYbyJD — Today In Polygon

(@TodayInPolygon) May 1, 2024 The story doesn’t end there. Despite

the network’s bustling activity, the Total Value Locked (TVL) in

Polygon’s Decentralized Finance (DeFi) protocols has dipped. This

could indicate a cautious approach from DeFi whales, hesitant to

fully commit their assets in the current market climate. MATIC

Bulls Charge In, Waving Green Flags Despite the underlying

concerns, MATIC bulls are charging forward. The token’s price

experienced a surge exceeding 8% in the past 24 hours, currently

hovering around $0.71. This bullish momentum could be attributed to

a rise in buying pressure. Data suggests a decrease in MATIC supply

on exchanges, coupled with an increase in holdings by large

investors (whales). This shift indicates investor confidence in

Polygon’s future potential. MATIC market cap currently at $7

billion. Chart: TradingView.com Technical Indicators Flash Bullish,

But Caution Remains Technical indicators also paint a bullish

picture for MATIC. The Chaikin Money Flow (CMF), Money Flow Index

(MFI), and the Moving Average Convergence Divergence (MACD) all

point towards a potential upward trend. These indicators suggest

strong buying pressure and a bullish upper hand in the market.

However, the Bollinger Bands, which measure price volatility,

indicate that MATIC might be entering a period of lower price

swings. Related Reading: Whales Dive In, But Dogecoin Price Sinks

20%: What’s Going On? While this could be a sign of consolidation

after the recent surge, it also introduces an element of

uncertainty. The cryptocurrency market is notoriously

unpredictable, and technical indicators can be misleading. The Road

Ahead: Can Polygon Navigate The Challenges? Polygon finds itself at

a crossroads. The network’s high activity is a positive sign, but

the decline in fees and DeFi TVL raises concerns. The recent price

surge and bullish technical indicators offer a glimmer of hope for

MATIC investors. However, navigating the volatile cryptocurrency

market requires a cautious approach. For Polygon to maintain its

current momentum, it needs to address the issue of declining fees.

Exploring alternative revenue models or implementing fee structures

that incentivize network usage are crucial

steps. Additionally, fostering a robust DeFi ecosystem by

attracting innovative protocols and users could reignite investor

confidence and drive TVL growth. Featured image from Pixabay, chart

from TradingView

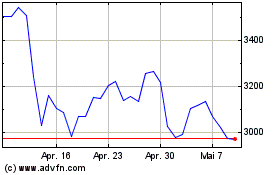

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024