Bitcoin Investors Remain Unmoved Despite BTC Drop Below $60,000, The Worst Is Almost Over

01 Mai 2024 - 10:00PM

NEWSBTC

On Wednesday, Bitcoin sharply declined, dropping below the crucial

$60,000 support level. Despite this recent market downtrend,

Bitcoin investors remain confident as they believe the flagship

crypto can still reach new heights in this market cycle. Some say

this might be what Bitcoin needs before making another parabolic

run to the upside. Bitcoin’s Decline Is Nothing To Be Scared

Of Raoul Pal, the CEO of Real Vision, reassured in an X (formerly

Twitter) post that Bitcoin’s recent price decline was not unusual,

stating it was “pretty ordinary stuff.” He also pointed out that

this was Bitcoin’s fourth 20% correction in the past 12 months,

underscoring how normal these price movements are.

Related Reading: Crypto Funds Mark 3rd Consecutive Weeks Of

Outflows With $435 Million In Withdrawals Source: X Alex Thorn,

Head of Research at Galaxy Digital, had previously warned that

price declines of such magnitude were to be expected, stating that

“bull markets are not straight lines up.” He noted that the same

thing happened in the 2021 and 2017 bull runs when Bitcoin

experienced about 13 price drawdowns of over 10% or more.

Meanwhile, crypto analyst Rekt Capital claimed in an X post that

“this is exactly what the cycle needs to resynchronize with

historical price norms and the traditional Halving Cycle.” He

added, “The longer this goes on, the better.” In another X post, he

reassured his followers that Bitcoin is getting closer to its final

bottom with each passing day. Like Rekt Capital, crypto

analyst Mikybull Crypto also sounded confident that Bitcoin’s

recent decline was just a part of the bigger picture for its move

to the upside. They claimed this would be the “final shakeout

before up, only rally to a cycle top.” Thomas Fahrer, the CEO of

Apollo, also shared his bullish sentiment towards Bitcoin, as he

suggested that the crypto token’s volatility is what makes it a

great investment. “Price might fall to $40K, but it might rise to

$400K. That’s just how it is, and it’s a great bet. Bitcoin is

still the best asymmetric opportunity in the market,” he wrote on

X. Bitcoin Bull Run Is Far From Over Crypto analyst Ali

Martinez suggested that Bitcoin’s bull run was far from over while

comparing Bitcoin’s current price action to the last two halving

events. According to him, Bitcoin consolidated for 189 and 87 days

around the halving in 2016 and 2020, respectively, before the bull

run resumed. Source: X He further noted that Bitcoin has only

consolidated for 60 days this time around, meaning that the

flagship crypto will continue its run eventually. In a subsequent X

post, the analyst stated that Bitcoin might be 538 days away from

hitting its next market top if it follows its trend from the

previous two bull runs. Related Reading: Ethereum Flashes Bullish

Signals, Can It Rally 50% From Here? Before now, Martinez mentioned

that Bitcoin could rise to a new all-time high (ATH) of $92,190 if

it breaches the resistance level of $69,150. At the time of

writing, Bitcoin is trading at around $59,600, down over 5% in the

last 24 hours, according to data from CoinMarketCap. BTC price

succumbs to bears | Source: BTCUSD on Tradingview.com Featured

image from CriptoFacil, chart from Tradingview.com

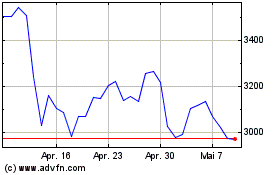

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024