Is A $72K Bitcoin Surge On The Horizon? Glassnode’s Latest Analysis Points To An Answer

24 April 2024 - 4:00AM

NEWSBTC

Recent insights from Glassnode’s cofounders, shared under their X

(formerly Twitter) account ‘Negentrophic’ have sparked interest in

Bitcoin market dynamics, leading to a promising stabilization and

possible price surge. Related Reading: ‘More Upside Is Coming’:

Crypto Market Set For 350% Growth, Predicts Glassnode Cofounders

Market Sentiments And EMA Trends With Bitcoin’s value recently

wavering below the $70,000 mark, a detailed analysis from the

cofounders suggests that a strong support level around the $62,000

50-day Exponential Moving Average (EMA) could set the stage for a

significant rebound. This crucial support level indicates a strong

buying sentiment, indicating the market’s confidence in the

cryptocurrency’s value and a potential resistance against further

declines. Using the strategic placement of the 50-day EMA as a

support point, the analysis suggests that investors might see the

current price levels as a solid base, preventing significant

downward movements. #BTC potential trajectory may offer

Buy-the-dips Opportunities BTC’s 50-day EMA near $62k provides

potential support, targeting $72k for a rebound. Shorter EMAs

signal a tendency to buy, while longer EMAs suggest a preference

for selling. Given BTC’s recent significant gains…

pic.twitter.com/3NjUUqa001 — 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 23,

2024 This perspective is reinforced by recent price movements,

where despite a pre-halving general dip, Bitcoin has experienced a

7.1% increase in value over the past week, and the same uptick

continued in the last 24 hours. Further analysis by the Glassnode

cofounders delves into the behavior of EMAs over different

durations. Short-term EMAs indicate a growing inclination among

investors to buy, while longer-term EMAs lean towards selling. This

contrasting behavior between short and long-term EMAs sheds light

on the current phase of the market, which seems to be in a period

of consolidation after the notable 92% increase in Bitcoin’s price

over six weeks earlier in the year. Such insights are vital as they

offer a deeper understanding of the underlying market forces and

investor behavior during volatile periods. Meanwhile, Glassnode’s

team’s analytical approach extends beyond simple price movements.

Yesterday, they compared the current market conditions to the early

2021 “strong correction,” which they term “wave 4” of the ongoing

market cycle. This historical perspective provides a lens through

which current trends can be evaluated, suggesting a cyclic return

to bullish conditions reminiscent of past market behaviors. Bitcoin

Bullish Projections And Market Dynamics Bitfinex analysts have

highlighted significant activities around Bitcoin withdrawals,

supporting the optimistic outlook on Bitcoin. The current levels,

echo those of January 2023, suggest that investors are increasingly

moving their Bitcoin to cold storage—a sign that many anticipate

further price increases. Related Reading: Analyst Reveals Bitcoin’s

Bull Market Breakthrough: Here’s What You Need To Know Veering back

to Glassnode’s projections yesterday based on their indexes and

Fibonacci levels, the cofounders were boldly optimistic,

anticipating a potential 350% increase from current market levels.

The #Crypto Bull Market Continues. “OTHERS” follows Crypto excl.

the largest 10 Cryptos. Observe that we in early 2021 had a strong

correction. We believe that was a wave 4. We now have a similar

strong decline. More upside is coming. This index and our Fibonacci

levels… pic.twitter.com/qKtIOSXneP — 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_)

April 22, 2024 Notably, this forecast highlights the expected

financial trajectory and underscores a growing confidence

among experts and market analysts in Bitcoin’s market performance

and its foundational economic principles. Featured image from

Unsplash, Chart from TradingView

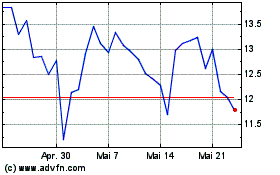

Dexe (COIN:DEXEUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Dexe (COIN:DEXEUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024