Will the S&P 500 Index Move Higher This Week?

13 November 2023 - 10:54AM

Finscreener.org

The

S&P 500 index fell

close to 10% between August and October 2023 due to geopolitical

tensions, elevated inflation, and rising interest rates, resulting

in a sluggish macro economy.

However, as economic activity

remains tepid globally, experts believe it will allow countries to

rein in inflation in the next 12 months. This, combined with the

possibility of normalizing interest rates, has driven the

S&P 500 index higher by 8% this month.

Let’s see what should drive the

equity markets in the next week.

Moody’s cuts U.S. outlook to negative

MoodyU+02019s Investors Service

downgraded its outlook on the U.S. governmentU+02019s credit rating

to negative from stable on Friday, signaling escalating concerns

over the nationU+02019s fiscal strength. While maintaining the

U.S.U+02019s Aaa long-term issuer and senior unsecured ratings,

MoodyU+02019s warned that the U.S. is expected to sustain

substantial fiscal deficits without effective fiscal measures to

curb spending or enhance revenue. According to MoodyU+02019s, this

is set to markedly diminish debt affordability, especially in the

current climate of rising interest rates.

The rating agency also cited the

political leadership in Washington as a detrimental influence,

suggesting that ongoing division within Congress heightens the risk

of an inability to agree on fiscal strategies to mitigate the

downward trajectory of debt affordability.

Despite these concerns,

MoodyU+02019s affirmed the top-tier Aaa rating, anticipating the

U.S. will maintain its exceptional economic vigor and suggesting

that any further positive economic developments could decelerate

the worsening of debt affordability.

Is another government shutdown on the

cards?

Responding to MoodyU+02019s

outlook shift, Deputy Secretary of the Treasury Wally Adeyemo

expressed disagreement, emphasizing the strength of the U.S. economy and

the global trust in Treasury securities.

The downgrade in outlook

coincides with Congress facing another potential government

shutdown. Currently funded until November 17, disagreements persist

in Congress regarding a long-term funding solution.

House Speaker Mike Johnson has

announced intentions to reveal a Republican funding strategy on

Saturday, setting up a potential vote for Tuesday. However, through

December 7 for some government areas and through January 19 for

others, his approach of staggered funding has been deemed nonviable

by the White House and the Democrat-majority Senate.

The White House has attributed

MoodyU+02019s decision to alter the U.S. outlook to the extreme and

dysfunctional behaviors of Congressional Republicans.

This change by MoodyU+02019s

follows a similar move by Fitch in August, which lowered the

U.S.U+02019s long-term foreign currency issuer default rating,

citing projected fiscal decline over the next few years, weakening

governance, and an increasing debt burden. Fitch also noted that

the recurrent confrontations and last-minute resolutions regarding

the debt ceiling have undermined confidence in the U.S.U+02019s

fiscal stewardship.

Analysts expect the S&P 500 earnings to surge 11%

in 2024

According to Nicholas Colas from

DataTrek Research, while there is a chance for the U.S. economy to

enter a recession in 2024, these concerns are not reflected in

consensus estimates. According to average analyst estimates, the

S&P 500 is forecast to increase adjusted earnings by 11%

year over year to $246 per share in 2024, up from $221 per share in

2023.

Colas explains, “The S&P

trades for 18x analysts’ 2024 estimates, but 28x a 30 percent

decline from this year’s earnings. The latter number seems

unrealistically high if the US really is heading into a recession

next year.”

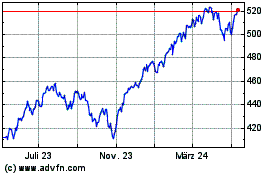

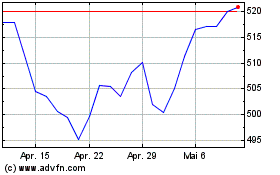

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024