SPY: The S&P 500 Index Likely to Remain Volatile in Q4 of 2023

02 Oktober 2023 - 11:23AM

Finscreener.org

The rally surrounding tech stocks

has driven the

S&P 500 index higher by 12.6% in the first nine months of

2023. Comparatively, the tech-heavy NASDAQ Composite index is up over 27% year-to-date.

However, in recent trading

sessions, Wall Street analysts and stock market investors remain

wary of a sluggish macro economy, lower consumer spending, higher

interest rates, and elevated inflation, dragging share prices of

companies across sectors significantly lower.

Let’s see why the S&P 500

and other equity indices might remain volatile in Q4 of

2023.

Consumer savings are on the decline

Citigroup (NYSE: C) CEO

Jane Fraser has noted a change in spending habits among

lower-income consumers as they attempt to stretch their diminishing

savings, revealing this insight during an interview with CNBC’s

Sara Eisen. Citigroup, America’s third-largest bank, has been

closely observing the financial behaviors of its credit cardholders

for early signs of financial strain.

Fraser highlighted emerging

issues among consumers with lower FICO scores, indicating that the

surplus savings accumulated during the pandemic are nearing

exhaustion. The shift in financial stability can be attributed to

the substantial financial assistance provided by the U.S.

government to households and businesses during the COVID-19 crisis.

This influx of funds contributed to the economy’s resilience,

defying many initial projections.

However, the ongoing series of

interest rate hikes by the Federal Reserve, the most vigorous in 40

years, has increased the cost of credit card debts, mortgages, and

auto loans. Consequently, incidents of late payments and defaults

are on the rise.

In discussing the broader

economic landscape with Fraser, other corporate executives have

echoed concerns beyond artificial intelligence and labor shortages.

They’ve shared observations of a softening demand, signaling

potential economic headwinds ahead.

Student loan to resume for 40 million

Americans

The moratorium on federal student

loan repayments, a relief that has been in place since the onset of

the pandemic, is set to conclude this Sunday. This change is set to

affect approximately 40 million Americans, who will now be obliged

to resume payments that have been on hold for over three

years.

The reintegration of this

financial obligation carries an air of unpredictability for

individual households and the broader economy. There is no

historical reference to gauge the potential impacts of such an

extensive pause in loan repayments. As the Biden administration

initiates the process of collecting over $1.7 trillion in federal

student loans, both retail sectors and financial institutions are

preparing for potential economic turbulence.

Jefferies, a prominent financial

services company, has expressed concerns regarding the impending

risk to consumer spending due to the resumption of student loan

repayments. A recent survey conducted by the firm involving

approximately 600 student loan recipients showed that half of the

respondents harbored significant concerns about their ability to

cover all their expenses once loan payments recommence.

The survey also indicated

behavioral shifts in spending, with about 70% of borrowers

intending to delay significant purchases beginning in October.

Additionally, many individuals with student debt are expected to

reduce their clothing, travel, and dining expenditures.

The lift of the repayment freeze

introduces an element of financial strain and adaptation, the

effects of which on the broader economic landscape remain to be

fully realized.

Jobs market update

This week, investors will receive

new insights into the state of the labor market, beginning with the

August Job Openings and Labor Turnover Survey (JOLTS) release on

Tuesday.

Following that, on

Wednesday, ADP (NASDAQ:

ADP), a prominent payroll provider, will publish

its National Employment Report for September, offering a detailed

account of private sector payroll expansions.

These preliminary reports will

lead to the unveiling of the nonfarm payroll data for September on

Friday, providing a comprehensive overview of the employment

landscape.

Though still robust and nearing

historic peaks, the job market has started to feel the impacts of

the Federal Reserve’s rate hikes. While still strong, hiring is

showing signs of slowing, marking a testament to the enduring

strength and adaptability of the job market in the face of economic

adjustments.

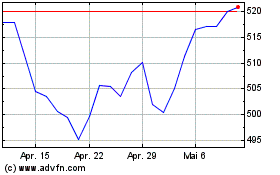

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

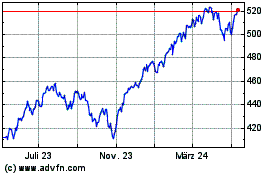

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024