What Next for S&P 500 After 13.8% Gain In First Half of 2023?

27 Juni 2023 - 1:07PM

Finscreener.org

WeU+02019re approaching a

significant milestone next week - the concluding trading week of

not just the month and quarter, but also the first half of 2023.

The

S&P 500 has shown

a stellar performance, boasting an increase of 13.8% so far this

year.

Delving into history, when the

S&P 500 has ascended by at least 10% by the end of June, it

has climbed higher 82% of the time by year-end, averaging an

additional gain of 7.7%. These statistics come courtesy of research

conducted by the Carson Group.

Interest rate hikes might lead to corporate

defaults

The Federal ReserveU+02019s

commitment to raising interest rates to curb inflation could

trigger a surge in corporate default rates in the upcoming months.

In May, the corporate default rate climbed, highlighting the

challenges that U.S. companies face in dealing with rising interest

rates, which complicate debt refinancing and pose an uncertain

economic future.

A striking 41 defaults have

occurred in the U.S., along with one in Canada this year, marking

the highest in any global region and over double compared to the

same timeframe in 2022, as per Moody’s Investors

Service.

Federal Reserve Chairman Jerome

Powell recently suggested more interest rate hikes are on the

horizon this year, although at a subdued pace until significant

strides are made to curb inflation.

Financial experts point to high

interest rates as the primary stress inducers. Companies requiring

liquidity or those burdened with significant debt and in need of

refinancing face an escalated cost of new debt.

Distressed exchanges often emerge

as a go-to solution. This involves companies exchanging their debt

for a different form of debt or repurchasing the debt. In extreme

cases, restructuring in or outside court becomes

necessary.

In an interview with CNBC, Mohsin

Meghji, founding partner of M3 Partners, illustrates the point of

higher debt costs by citing how average financing rates of 4% to 6%

over the past 15 years have now soared to 9% to 13%.

Despite recently affected

companies

being the most troubled, Meghji predicts that even financially

stable firms will face refinancing issues due to high interest

rates.

As of June 22, 324 bankruptcy

filings were reported, nearing the 374 total in 2022, according to

S&P Global Market Intelligence. Over 230 bankruptcy filings

occurred by April this year, marking the highest rate since

2010.

The most substantial default in

May was Envision Healthcare, an emergency medical services provider

with over $7 billion in debt at the time of filing for bankruptcy,

according to Moody’s (NYSE:

MCO). Other notable

bankruptcy filings this year include Monitronics International,

Silicon Valley Bank, Bed Bath & Beyond, and Diamond

Sports.

Moody’s projects the global

default rate to escalate to 4.6% by yearU+02019s end, surpassing

the long-term average of 4.1%, and to peak at 5% by April 2024

before beginning to decrease.

U.S. Home Price Overview

On Tuesday, we expect fresh

updates on U.S. home prices via the Case-Shiller Home Price Index

and the Federal Housing Finance Agency’s (FHFA) House Price Index

for April. The Case-Shiller Index likely shows a 0.8% rise in home

prices in April, recovering from a 1.5% increase in March. However,

these values probably represent a 1.5% decrease on a year-over-year

basis.

March witnessed the first annual

fall in prices since the early days of 2012, a stark contrast to

the record-high growth rates observed a year earlier before the

Federal ReserveU+02019s interest rate hikes began influencing

housing demand.

FedU+02019s Favored Inflation Indicator

On Friday, the Bureau of Economic

Analysis (BEA) will release the Personal Consumption Expenditures

(PCE) Price Index, the FedU+02019s favored inflation measure, for

May. The prediction is that prices rose by 0.2% last month,

following a 0.4% increase in April. The annual rise is likely to be

4.1%, a deceleration from AprilU+02019s 4.4%.

Core PCE prices, which omit the

unstable food and energy costs, likely increased 4.5% year-on-year,

slowing from the 4.7% pace observed in April. ItU+02019s worth

noting that the Federal Reserve aims for a 2% annual PCE inflation

rate as a part of its dual mandate to achieve price stability and

full employment.

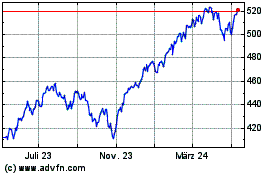

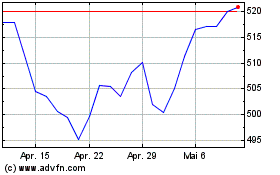

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024