Genesis Energy, L.P. Announces Public Offering of Senior Notes

07 August 2017 - 1:40PM

Business Wire

Genesis Energy, L.P. (NYSE: GEL) today announced the

commencement of a registered underwritten public offering of

$550,000,000 in aggregate principal amount of senior unsecured

notes due 2025. The notes will be co-issued with our subsidiary,

Genesis Energy Finance Corporation, and will be guaranteed, with

certain exceptions, by substantially all of our existing and future

subsidiaries. We intend to use net proceeds from the offering to

fund a portion of the purchase price for our recently announced

pending acquisition of the trona and trona-based exploring, mining,

processing, producing, marketing and selling business of Tronox

Limited and its affiliates.

Wells Fargo Securities, LLC, Deutsche Bank Securities Inc. and

BMO Capital Markets Corp. are acting as joint book-running managers

for the offering. A copy of the preliminary prospectus supplement

and accompanying base prospectus relating to this offering, when

available, may be obtained from the underwriters as follows:

Wells Fargo Securities, LLCAttn: WFS Customer Service608 2nd Ave

S, Suite 1000Minneapolis, MN 55402Telephone: (800) 645-3751 Opt

5Email: wfscustomerservice@wellsfargo.com

Deutsche Bank Securities Inc.Attn: Prospectus Group60 Wall

StreetNew York, NY 10005Telephone: (800) 503-4611Email:

prospectus.cpdg@db.com

BMO Capital Markets Corp.3 Times SquareNew York, NY

10036Attention: Syndicate DepartmentTelephone: (212) 702-1882

You may also obtain these documents for free, when they are

available, by visiting the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy any securities nor shall there be

any sale of these securities in any state or jurisdiction in which

such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. The offer is being made only through the prospectus

supplement and accompanying base prospectus, each of which is part

of our effective shelf registration statement on Form S-3

previously filed with the Securities and Exchange Commission.

Genesis Energy, L.P. is a diversified midstream energy master

limited partnership headquartered in Houston, Texas. Genesis’

operations include offshore pipeline transportation, refinery

services, marine transportation and onshore facilities and

transportation. Genesis’ operations are primarily located in Texas,

Louisiana, Arkansas, Mississippi, Alabama, Florida, Wyoming and the

Gulf of Mexico.

This press release includes forward-looking statements as

defined under federal law. Although we believe that our

expectations are based upon reasonable assumptions, no assurance

can be given that our goals will be achieved, including statements

regarding our ability to successfully close the offering and to use

the net proceeds as indicated above. Actual results may vary

materially. We undertake no obligation to publicly update or revise

any forward-looking statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170807005451/en/

Genesis Energy, L.P.Bob Deere, 713-860-2516Chief Financial

Officer

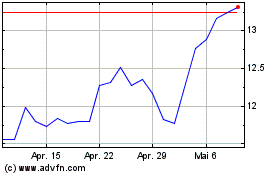

Genesis Energy (NYSE:GEL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Genesis Energy (NYSE:GEL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024