Salesforce.com Earnings: What to Watch

28 Februar 2017 - 3:22PM

Dow Jones News

By Jay Greene

Salesforce.com Inc. is scheduled to report fiscal fourth-quarter

earnings after the market closes Tuesday. Here is what to

expect:

EARNINGS FORECAST: Analysts surveyed by Thomson Reuters expect

Salesforce to report adjusted earnings of 25 cents a share for the

quarter ended Jan. 31, up from 19 cents a year earlier. Adjusted

results exclude items such as amortization and stock-based

compensation.

REVENUE FORECAST: Analysts expect Salesforce to post revenue of

$2.28 billion, up from $1.81 billion a year ago.

WHAT TO WATCH:

SCATTERED CLOUDS: While still posting double-digit revenue

growth in its sales-force automation business in the fiscal third

quarter, the Sales Cloud category has become "more mature," Nomura

Securities Co. analyst Frederick Grieb wrote in a recent research

note. But Salesforce has used that business to cross-sell its other

web-based, on-demand computing services, such as its Service Cloud,

which helps companies run customer-service operations and Marketing

Cloud, used for email and advertising campaigns, Mr. Grieb noted.

In the fiscal third quarter, Service Cloud revenue grew 26% and

Marketing Cloud revenue gained 46%.

CURRENCY HEADWINDS: Like many tech companies with significant

international operations, Salesforce's results are hampered by the

strong U.S. dollar. Revenue in Europe, which accounted for 16% of

the company's sales in the third quarter, grew 11% in the period.

But in constant currency, a measurement used to eliminate the

effects of exchange-rate fluctuations, the growth was 27%. In a

conference call with analysts after last quarter, Salesforce

finance chief Mark Hawkins said he expected $100 million to $150

million of foreign- exchange headwind this fiscal year.

ACTIVIST INVESTORS: Recent securities filings showed that three

hedge funds, known for sometimes taking on activist roles,

accumulated Salesforce shares. The funds -- Corvex Management, Jana

Partners and Sachem Head -- have amassed 8.75 million shares among

them, but they haven't disclosed their intent. But Salesforce faced

some investor concern when it considered acquiring Twitter Inc.

last year, a bid it ultimately decided not to pursue. UBS Group AG

analyst John Byun wrote in a recent research note that the activist

stakes "could lead to a greater focus on improving relatively low

operating margins -- a frequent bear argument."

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

February 28, 2017 09:07 ET (14:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

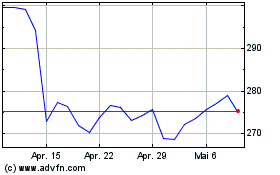

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024