UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 6-K

____________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

Commission File Number: 001-39327

____________________________

SEADRILL LIMITED

(Exact name of Registrant as specified in its Charter)

____________________________

Park Place

55 Par-la-Ville Road

Hamilton HM 11 Bermuda

(Address of principal executive office)

____________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form 40-F ☐

Seadrill Limited

Report on Form 6-K for the three months ended March 31, 2024

EXPLANATORY NOTE

This Form 6-K contains the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the unaudited interim condensed Consolidated Financial Statements and related information and data of the Company as of and for the three month period ended March 31, 2024.

INDEX

| | | | | |

| |

| |

| Interim Financial Statements (unaudited) | |

| Unaudited Consolidated Statements of Operations for the three months ended March 31, 2024 and 2023 | |

| |

| Unaudited Consolidated Balance Sheets as of March 31, 2024 and December 31, 2023 | |

| Unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2024 and 2023 | |

| Unaudited Consolidated Statements of Changes in Shareholders’ Equity for the three months ended March 31, 2024 and 2023 | |

| Notes to the Unaudited Consolidated Financial Statements | |

| |

| |

THIS REPORT ON FORM 6-K IS HEREBY INCORPORATED BY REFERENCE INTO (I) THE REGISTRATION STATEMENT ON FORM F-3 (NO. 333-271916) ORIGINALLY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 15, 2023 AND (II) THE REGISTRATION STATEMENT ON FORM S-8 (NO. 333-276710) ORIGINALLY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JANUARY 26, 2024.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements included in this report on Form 6-K regarding future financial performance and results of operations and other statements that are not historical facts, are forward-looking statements within the meaning of Section 27A of the United States ("U.S.") Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements in this report on Form 6-K include, but are not limited to, statements about the following subjects:

•the effect of any disputes and actions with respect to production levels by, among or between major oil and gas producing countries and any expectations we may have with respect thereto;

•our results of operations, our cash flow from operations, our revenue efficiency and other performance indicators and optimization of rig-based spending;

•the offshore drilling market, including the effects of variations in commodity prices, supply and demand, utilization rates, dayrates, customer drilling programs, stacking and reactivation of rigs, effects of new rigs on the market, the impact of the changes to regulations in jurisdictions in which we operate and changes in the global economy or market outlook for our industry, our rig classes or various geographies in which we operate;

•customer drilling contracts, including contract backlog, force majeure provisions, contract awards, commencements, extensions, cancellations, terminations, renegotiation, contract option exercises, contract revenues, early termination fees, indemnity provisions and rig mobilizations;

•the addition of renewable or other energy alternatives to meet local, regional or global demand for energy, the commitment, by us or our customers, to reduce greenhouse gas emissions or operating intensity thereof;

•liquidity, including availability under our credit facilities, and adequacy of cash flows for our debt obligations;

•debt levels, including interest rates, credit ratings and our evaluation or decisions with respect to any potential liability management transactions or strategic alternatives intended to prudently manage our liquidity, debt maturities and other aspects of our capital structure and any litigation, alleged defaults and discussions with creditors related thereto;

•upgrade, shipyard, reactivations, newbuild and other capital projects, including the level of expected capital expenditures and the timing and cost of completing capital projects delivery and operating commencement dates, relinquishment or abandonment, expected downtime and lost revenues;

•the cost, timing and benefits, including synergies, of acquisitions, including the acquisition of Aquadrill LLC (“Aquadrill”), reactivations and the proceeds and timing of dispositions;

•tax matters, including our effective tax rate, uncertain tax positions, changes in tax laws, treaties and regulations, tax assessments, tax incentive programs and liabilities for tax issues in the tax jurisdictions in which we operate or have a taxable presence;

•legal and regulatory matters, including results and effects of current or potential legal proceedings, and governmental audits and assessments, outcomes and effects of internal and governmental investigations, customs and environmental matters;

•insurance matters, risk tolerance and risk response, including adequacy of insurance, renewal of insurance and insurance proceeds;

•effects of accounting changes and adoption of accounting policies;

•investment in recruitment, retention and personnel development initiatives, the timing of, and other matters concerning, severance payments and benefit payments and maintaining agreements with labor unions;

•the impact of the closing of our London, England office and consolidation of our corporate offices in Houston, Texas;

•our capital allocation framework goal of returning at least 50% of the Free Cash Flow to shareholders through dividends and share repurchases, including our ability to meet such goal and the timing of such dividends and share repurchases, if any; and

•the Company’s outlook and guidance, plans, strategies and business prospects.

These statements may include words such as "assumes", "projects", "forecasts", "estimates", "expects", "anticipates", "believes", "plans", "intends", "may", "might", "will", "would", "can", "could", "should" or, in each case, their negative, or other variations or comparable terminology in connection with any discussion of the timing or nature of future operating or financial performance or other events. These statements are based on management’s current plans, expectations, assumptions and beliefs concerning future events impacting the Company and therefore involve a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied in the forward-looking statements.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: those described under Item 3D, "Risk Factors" in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 27, 2024 (the “2023 20-F”), offshore drilling market conditions including supply and demand, dayrates, customer drilling programs and effects of new or reactivated rigs on the market, contract awards and rig mobilizations, contract backlog, dry-docking and other costs of maintenance, special periodic surveys, upgrades and regulatory work for the drilling rigs in the Company’s fleet, the cost and timing of shipyard and other capital projects, the performance of the drilling rigs in the Company’s fleet, delay in payment or disputes with customers, Seadrill’s ability to successfully employ its drilling units, procure or have access to financing, ability to comply with loan covenants, fluctuations in the international price of oil, international financial market conditions, inflation, changes in governmental regulations that affect the Company or the operations of the Company’s fleet, increased competition in the offshore drilling industry, the review of competition authorities, the impact of global economic conditions and global health threats, pandemics and epidemics, our ability to maintain relationships with suppliers, customers, employees and other third parties, our ability to maintain adequate financing to support our business plans, our ability to successfully complete and realize the intended benefits of any mergers, acquisitions and divestitures, and the impact of other strategic transactions, our liquidity and the adequacy of cash flows to satisfy our obligations, future activity under and in respect of the Company’s share repurchase program, our ability to satisfy (or timely cure any noncompliance with) the continued listing requirements of the NYSE and the Oslo Stock Exchange (“OSE”), or other exchanges where our shares may be listed, the cancellation of drilling contracts currently included in reported contract backlog, losses on impairment of long-lived fixed assets, shipyard, construction and other delays, the results of meetings of our shareholders, political and other uncertainties, including those related to the conflicts in Ukraine and the Middle East, and any related sanctions, the effect and results of litigation, regulatory matters, settlements, audits, assessments and contingencies, including any litigation related to acquisitions or dispositions, our ability to successfully integrate with Aquadrill following the Merger (as defined herein), the concentration of our revenues in certain geographical jurisdictions, limitations on insurance coverage, our ability to attract and retain skilled personnel on commercially reasonable terms, the level of expected capital expenditures, our expected financing of such capital expenditures and the timing and cost of completion of capital projects, fluctuations in interest rates or exchange rates and currency

devaluations relating to foreign or U.S. monetary policy, tax matters, changes in tax laws, treaties and regulations, tax assessments and liabilities for tax issues, legal and regulatory matters in the jurisdictions in which we operate, customs and environmental matters, the potential impacts on our business resulting from decarbonization and emissions legislation and regulations, the impact on our business from climate-change generally, the occurrence of cybersecurity incidents, attacks or other breaches to our information technology systems, including our rig operating systems, and other important factors described from time to time in the reports filed or furnished by us with the SEC, which are available free of charge on the SEC website at www.sec.gov.

The foregoing risks and uncertainties are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond our control. In many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward looking statement speaks only as of the date of the particular statement. We expressly disclaim any obligations or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in our expectations or beliefs with regard to the statement or any change in events, conditions or circumstances on which any forward-looking statement is based, except as required by law.

Investors should note that we announce material financial information in SEC filings, press releases and public conference calls. Based on guidance from the SEC, we may use the Investors section of our website (www.seadrill.com) to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. The information on our website is not part of, and is not incorporated into, this report on Form 6-K.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our financial condition and results of operations in conjunction with the interim Financial Statements as of and for the three months ended March 31, 2024 presented in this report, as well as the historical Consolidated Financial Statements and related notes of Seadrill Limited included in the 2023 20-F. Among other things, those financial statements include more detailed information regarding the basis of presentation for the following information. The unaudited Consolidated Financial Statements of Seadrill Limited included in this report have been prepared in accordance with United States Generally Accepted Accounting Principles and are presented in US Dollars.

Management’s Discussion and Analysis of Financial Condition and Results of Operations is designed to provide a reader of our financial statements with a narrative from the perspective of management.

Overview

Seadrill Limited (along with any one or more of its consolidated subsidiaries, or to all such entities, referred to as "Seadrill", "we", "us", "our", and "the Company") is an offshore drilling contractor providing worldwide offshore drilling services to the oil and gas industry. Our primary business is the ownership and operation of drillships, semi-submersible rigs and jackup rigs for operations in shallow to ultra-deepwater in both benign and harsh environments. We contract our drilling units to drill wells for our customers on a dayrate basis. Our customers include oil super-majors, state-owned national oil companies and independent oil and gas companies. In addition, we provide management services to certain affiliated entities.

As of March 31, 2024, we owned a total of 19 drilling rigs, of which 13 were operating (inclusive of three leased to the Gulfdrill LLC ("Gulfdrill") joint venture and one leased to the Sonadrill joint venture), two were undergoing contract preparations for upcoming contracts expected to commence at the end of 2024, one was undergoing its special periodic survey and three were cold stacked. The operating units include eight floaters (comprising six 7th generation drillships and two 6th generation drillships), two harsh environment units (comprising one semi-submersible unit and one jackup) and three jackups. In addition to our owned assets, as of March 31, 2024, we managed two rigs owned by Sonangol.

Significant Developments since January 1, 2024

In this section, we have set out important recent developments to our business, which covers the period from the beginning of the financial year.

Share repurchase program

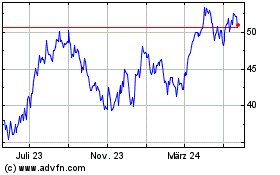

For the period from January 1, 2024 through May 10, 2024, 2024, pursuant to its share repurchase program, Seadrill repurchased approximately 3.8 million Shares on the NYSE and the OSE, with a weighted average share price of $46.95. Refer to “Liquidity and Capital Resources—Capital allocation framework and share repurchase program” and Note 19 – "Subsequent events" for additional information about the share repurchase program.

OSE Delisting Application

As contemplated by our proxy statement, dated March 21, 2024, we submitted an application to delist our common shares on the OSE, on April 30, 2024. Subject to the OSE’s procedures, our common shares may cease trading on the OSE in the second half of 2024.

Contract Backlog

Contract backlog includes all firm contracts at the contractual operating dayrate multiplied by the number of days remaining in the firm contract period. For contracts which include a market indexed rate mechanism, we utilize the current applicable dayrate multiplied by the number of days remaining in the firm contract period. Contract backlog includes management contract revenues and lease revenues from

bareboat charter arrangements, denoted as "other" in the tables below. Contract backlog excludes revenues for mobilization, demobilization and contract preparation or other incentive provisions and excludes backlog relating to non-consolidated entities.

The contract backlog for our fleet was as follows as of the dates specified:

| | | | | | | | | | | | | | | | | |

| | | | | |

| (In $ millions) | | March 31, 2024 | | | December 31, 2023 |

| Drilling contracts | | 2,481 | | | | 2,612 | |

| Other | | 341 | | | | 408 | |

| Total contract backlog | | 2,822 | | | | 3,020 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Our contract backlog includes only firm commitments represented by signed drilling contracts. The full contractual operating dayrate may differ from the actual dayrate we ultimately receive. For example, an alternative contractual dayrate, such as a waiting‑on‑weather rate, repair rate, standby rate or force majeure rate, may apply under certain circumstances. The contractual operating dayrate may also differ from the actual dayrate we ultimately receive because of several other factors, including rig downtime or suspension of operations. In certain contracts, the dayrate may be reduced to zero if, for example, repairs extend beyond a stated period.

We project the March 31, 2024 contract backlog to be realized over the following periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In $ millions) | | | | Year ending December 31 | | |

| Contract backlog | | Total | | 2024(1) | | 2025 | | 2026 | | | | Thereafter |

| Drilling contracts | | 2,481 | | | 741 | | | 895 | | | 494 | | | | | 351 | |

| Other | | 341 | | | 213 | | | 121 | | | 7 | | | | | — | |

| Total | | 2,822 | | | 954 | | | 1,016 | | | 501 | | | | | 351 | |

(1) Remainder of 2024The actual amounts of revenues earned and the actual periods during which revenues are earned may differ from the amounts and periods shown in the tables above due to various factors, including shipyard and maintenance projects, unplanned downtime and other factors that result in lower applicable dayrate than the full contractual operating dayrate. Additional factors that could affect the amount and timing of actual revenue to be recognized include customer liquidity issues and contract terminations, which are available to our customers under certain circumstances.

Market Overview and Trends

The below table shows the average oil price for the three months ended March 31, 2024 and for each year ended December 31 over the three preceding years. The Brent oil price at May 13, 2024 was $83.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Dec-2021 | | Dec-2022 | | Dec-2023 | | Mar-2024 |

| Average Brent oil price ($/bbl) | | 71 | | | 101 | | | 82 | | | 82 | |

Source: BloombergThe industry has continued to recover and stabilize after the pandemic-related downturn as underscored by improvements in several factors, including oil demand and offshore capital expenditures. Nevertheless, uncertainty still persists in the market, which is primarily driven by concerns over energy security as well as uncertain global economic conditions. Such concerns could have a negative impact on future demand for offshore drilling services, as the industry faces volatility in oil prices and growth trajectory for oil demand, among others. In addition, inflationary pressures may impact the cost base in our industry, including personnel costs, and the prices of goods and services required to reactivate or operate rigs.

The below table shows the global number of rigs on contract and marketed utilization for the three months ended March 31, 2024, and for each of the three preceding years:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Dec-2021 | | Dec-2022 | | Dec-2023 | | Mar-2024 |

| Contracted rigs | | | | | | | | |

| | | | | | | | |

| Harsh environment floater | | 25 | | | 26 | | | 26 | | | 23 | |

| Benign environment floater | | 106 | | | 111 | | | 119 | | | 124 | |

| | | | | | | | |

| Marketed utilization | | | | | | | | |

| | | | | | | | |

| Harsh environment floater | | 77 | % | | 82 | % | | 93 | % | | 91 | % |

| Benign environment floater | | 80 | % | | 81 | % | | 85 | % | | 85 | % |

| | | | | | | | |

Source: IHS Rigpoint Petrodata

Global harsh environment units

The marketed utilization for harsh environment floaters has decreased slightly during the first quarter of 2024 compared to 2023. Though there was a slight decrease in the total supply, the number of contracted units also went down, which impacted the marketed utilization. The utilization levels are expected to remain consistent or drop further through the remainder of 2024 due to limited incremental demand and available supply.

Global benign-environment floaters

Marketed utilization remained consistent for the first quarter of 2024 compared to 2023, even when there was considerable improvement in the number of contracted rigs. This was mainly attributable to the increase in supply. The marketed utilization level in drillships is trending above 90% with the traditional golden triangle regions driving the utilization.

Results of Operations

The tables included below set out financial information for the three months ended March 31, 2024 and the three months ended March 31, 2023:

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| (In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| Operating revenues | 367 | | | 266 | | | | | | | | |

| Operating expenses | (303) | | | (219) | | | | | | | | |

| Other operating items | 16 | | | 4 | | | | | | | | |

| Operating profit | 80 | | | 51 | | | | | | | | |

| Interest expense | (15) | | | (16) | | | | | | | | |

| Other income and expense, net | 5 | | | 9 | | | | | | | | |

| Profit before income taxes | 70 | | | 44 | | | | | | | | |

| Income tax expense | (10) | | | (1) | | | | | | | | |

| | | | | | | | | | |

| Net income | 60 | | | 43 | | | | | | | | |

1) Operating revenues

Operating revenues consist of contract revenues, reimbursable revenues, management contract revenues and other revenues. We have analyzed operating revenues between these categories in the table below:

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| (In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

Contract revenues (a) | 275 | | | 186 | | | | | | | | |

Reimbursable revenues (b) | 20 | | | 9 | | | | | | | | |

Management contract revenues (c) | 58 | | | 61 | | | | | | | | |

Other revenues (d) | 14 | | | 10 | | | | | | | | |

| Total operating revenues | 367 | | | 266 | | | | | | | | |

a) Contract revenues

Contract revenues represent the revenues that we earn from contracting our drilling units to customers, primarily on a dayrate basis, and are primarily driven by the average number of rigs under contract during a period, the average dayrates earned and economic utilization achieved by those rigs under contract. We have set out movements in these key indicators of performance in the sections below.

i.Average number of rigs on contract

We calculate the average number of rigs on contract by dividing the aggregate days our rigs were on contract during the reporting period by the number of days in that reporting period.

The average number of rigs on contract increased to 10 in the three months ended March 31, 2024 from nine in the three months ended March 31, 2023. The increase is due to fleet additions through the Aquadrill acquisition, which brought in the West Capella, West Vela, West Auriga and West Polaris on contract. This was offset by the Sevan Louisiana not operating during the three months ended March 31, 2024 due to undergoing its special periodic survey, compared to being on contract for three months ended March 31, 2023. The West Auriga and West Polaris were also not on contract throughout the entire three months ended March 31, 2024, as they started preparation for the contracts with Petrobras in Brazil, which are expected to commence at the end of 2024.

ii.Average contractual dayrates

We calculate the average contractual dayrate by dividing the aggregate contractual dayrates during a reporting period by the aggregate number of days for the reporting period.

The average contractual dayrate earned for the three months ended March 31, 2024 was $300 thousand compared to $262 thousand for the three months ended March 31, 2023. The increase is primarily driven by higher contract rates on the rigs acquired from Aquadrill, the West Auriga and West Vela, operating in the US GoM, and West Capella operating in Indonesia. Higher dayrates were also observed for the West Neptune with LLOG Exploration Offshore L.L.C. ("LLOG"). These improvements were partially offset by the Sevan Louisiana not operating for the three months ended March 31, 2024.

iii.Economic utilization for rigs on contract

We define economic utilization as dayrate revenue earned during the period, excluding bonuses, divided by the contractual operating dayrate multiplied by the number of days on contract in the period. If a drilling unit earns its full operating dayrate throughout a reporting period, its economic utilization would be 100%. However, there are many situations that give rise to a dayrate being earned that is less than contractual operating rate, such as planned downtime for maintenance. In such situations, economic utilization is below 100%.

The economic utilization for the three months ended March 31, 2024 of 97% was higher compared to the three months ended March 31, 2023 of 95%. There were no major downtime events during the first quarter of 2024.

b) Reimbursable revenues

We generally receive reimbursements from our customers and joint ventures for the purchase of supplies, equipment, personnel and other services provided at their request in accordance with a drilling contract or agreement. We classify such revenues as reimbursable revenues. The increase in the three months ended March 31, 2024 was due to additional reimbursable services provided relating to the Libongos and Quenguela for long-term maintenance.

Refer to Note 1 – "General information" for reclassifications of reimbursable revenues and reimbursable expenses related to our joint ventures, including $3 million of management contract revenues and $3 million of management contract expenses for the three months ended March 31, 2023 reclassified to reimbursable revenues and reimbursable expenses, respectively.

c) Management contract revenues

Management contract revenues include revenues related to contracts where we are providing management, operational and technical support services, and additional integrated services, and are comprised of revenue from our joint venture, Sonadrill, relating to the Libongos, Quenguela and the West Gemini. During the three months ended March 31, 2023, we also earned fees from managing SeaMex's five jackup units that were under contract with Pemex in the Gulf of Mexico. The decrease in the three months ended March 31, 2024 is due to the three months ended March 31, 2023 including management services provided to SeaMex, offset by an increase in management fees on three Sonadrill rigs from January 1, 2024. Refer to Note 15 - "Related party transactions" for further details on these related parties.

d) Other revenues

Other revenues include the following:

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| (In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| Leasing revenues | 11 | | | 7 | | | | | | | | |

| Other | 3 | | | 3 | | | | | | | | |

| | | | | | | | | | |

| Total other revenues | 14 | | | 10 | | | | | | | | |

Leasing revenues represent revenue earned on the charter of the West Castor, West Telesto and West Tucana to Gulfdrill, one of our related parties. Refer to Note 15 - "Related party transactions" for further details. The increase in leasing revenue is due to a higher bareboat charter rate for West Castor, which came into effect in September 2023.

Revenues labeled as "other" in the above table relate to the amortization of a fair value liability related to the lease of the West Gemini to the Sonadrill joint venture. On July 1, 2022, Seadrill novated its drilling contract for the West Gemini in Angola to the Sonadrill joint venture and leased the West Gemini to Sonadrill for the duration of that contract and the follow-on contract, entered into directly by Sonadrill, at a nominal charter rate, based on a commitment made under the terms of the joint venture agreement. At the commencement of the lease, we recorded a liability representing the fair value of the lease commitment which we amortize as lease revenue, on a straight-line basis, over the lease term. This lease is considered to form part of Seadrill’s investment in the joint venture, Sonadrill.

2) Operating expenses

Total operating expenses include vessel and rig operating expenses, amortization of intangibles, reimbursable expenses, management contract expenses, depreciation of drilling units and equipment, and selling, general and administrative expenses.

We have analyzed operating expenses between these categories in the table below:

| | | | | | | | | | | | | | | | | | |

| | | | | | |

(In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| Vessel and rig operating expenses (a) | (180) | | | (115) | | | | | | | | |

| Reimbursable expenses | (20) | | | (9) | | | | | | | | |

| Depreciation and amortization (b) | (38) | | | (36) | | | | | | | | |

| Management contract expenses (c) | (38) | | | (42) | | | | | | | | |

| Selling, general and administrative expenses (d) | (25) | | | (14) | | | | | | | | |

| Merger and integration related expenses (e) | (2) | | | (3) | | | | | | | | |

| Total operating expenses | (303) | | | (219) | | | | | | | | |

a) Vessel and rig operating expenses

Vessel and rig operating expenses represent the costs we incur to operate a drilling unit that is either in operation or stacked. This includes the remuneration of offshore crews, rig supplies, expenses for repair and maintenance and onshore support costs. Vessel and rig operating expenses are mainly driven by rig activity. On average, we incur higher vessel and rig operating expenses when a rig is operating compared to when it is stacked. For stacked rigs, we incur higher vessel and rig expenses for warm stacked rigs compared to cold stacked rigs. We incur one-time costs for activities such as preservation and severance when we cold stack a rig. We also incur significant costs when re-activating a rig from cold stack, a proportion of which is expensed as incurred. Where a rig is leased to another operator, the majority of vessel and rig expenses are incurred by the operator.

The average number of rigs on contract increased for the three months ended March 31, 2024 compared to the three months ended March 31, 2023, primarily due to additions from the Aquadrill acquisition. As a result, our vessel and rig operating expenses were comparatively higher for the first quarter of 2024 compared to the first quarter of 2023.

b) Depreciation and amortization

The $2 million increase in depreciation and amortization consists of a $16 million increase in depreciation of drilling units and equipment offset by a $14 million decrease in amortization of intangibles, as described below.

Depreciation of drilling units and equipment

We record depreciation expense to reduce the carrying value of drilling unit and equipment balances to their residual value over their expected remaining useful economic lives.

Depreciation increased by $16 million in the three months ended March 31, 2024, compared to the three months ended March 31, 2023, primarily due to the additional rigs from the Aquadrill acquisition.

Amortization of intangibles

As a result of the Aquadrill acquisition, there was an additional $5 million of amortization recognized related to unfavorable contracts for the three months ended March 31, 2024, compared to the three months ended March 31, 2023. The three months ended March 31, 2023 also included a $9 million decrease in amortization related to favorable contracts for the West Phoenix, Quenguela, and the managed contract for the five SeaMex jackups, which were fully amortized during 2023.

c) Management contract expenses

Management contract expenses include costs related to Sonadrill's rigs, Quenguela and Libongos, and, the Seadrill rig novated to Sonadrill, West Gemini. For the three months ended March 31, 2023, management contract expenses also included SeaMex's five jackup units. Management contract expenses decreased during the three months ended March 31, 2024, compared to three months ended March 31, 2023 primarily due to costs incurred managing the SeaMex jackup units in the three months ended March 31, 2023, which were no longer managed by Seadrill during the three months ended March 31, 2024.

d) Selling, general and administrative expenses

Selling, general and administrative expenses include the cost of our corporate and regional offices, certain legal and professional fees as well as the remuneration and other compensation of our officers, directors and employees engaged in central management and administration activities. Selling, general and administrative expense increased during the three months ended March 31, 2024 compared to the three months ended March 31, 2023, due to increased onshore employee costs, additional costs attributable to the closure of our London office and increased professional service fees.

e) Merger and integration related expenses

Merger and integration related expenses primarily consist of legal and advisory costs incurred to facilitate the Aquadrill acquisition, as well as expenses associated with integrating Aquadrill into Seadrill's existing operating structure.

3) Other operating items

Other operating items for the three months ended March 31, 2024 represent the recovery of historical import duties in the form of tax credits following the approval by the applicable tax authorities. Other operating items for the three months ended March 31, 2023 are comprised of gains on disposals related to the sale of various capital spares.

4) Interest expense

Interest expense is comprised of the following:

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | |

(In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

Interest on debt facilities (a) | (14) | | | (15) | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other | (1) | | | (1) | | | | | | | | |

| Total interest expense | (15) | | | (16) | | | | | | | | |

a) Interest on debt facilities

The table below summarizes our interest expense on debt facilities.

| | | | | | | | | | | | | | | | | | |

| | | | | | |

(In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| $575 million secured bond in issue | (12) | | | — | | | | | | | | |

| First-lien senior secured | — | | | (5) | | | | | | | | |

| Second lien senior secured | — | | | (9) | | | | | | | | |

| Unsecured convertible bond | (2) | | | (1) | | | | | | | | |

| Total interest on debt facilities | (14) | | | (15) | | | | | | | | |

5) Other income and expense

We have analyzed other income and expense into the following components:

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| (In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

Interest income (a) | 7 | | | 7 | | | | | | | | |

Share in results from associated companies (net of tax) (b) | 4 | | | 3 | | | | | | | | |

| | | | | | | | | | |

Other financial items (c) | (6) | | | (1) | | | | | | | | |

| Total other income and expense | 5 | | | 9 | | | | | | | | |

a) Interest income

Interest income relates to interest earned on bank deposits.

b) Share in results from associated companies (net of tax)

The income during the three months ended March 31, 2024 and the three months ended March 31, 2023 relates to Seadrill's proportion of profits from Sonadrill and Gulfdrill.

c) Other financial items

The "Other Financial Items" line item encompasses several categories of expense, including gains and losses on derivative instruments, foreign exchange gains and losses, and other miscellaneous expenses. The increased expense in the three months ended March 31, 2024 compared to the three months ended March 31, 2023, is mainly attributable to foreign currency losses following the appreciation of the US Dollar against the Brazilian Real, Norwegian Krone and Indonesian Rupiah in 2024.

6) Income tax expense

Income tax expense consists of taxes currently payable and changes in deferred tax assets and liabilities related to our ownership and operation of drilling units and may vary significantly depending on jurisdictions and contractual arrangements. In most cases, the calculation of taxes is based on net income or deemed income, the latter generally being a function of gross revenue.

The increase in the three months ended March 31, 2024 compared to the three months ended March 31, 2023 is primarily due to increased operational activities following the Aquadrill acquisition completed in the second quarter of 2023, a shift in the Company's mix of income among tax jurisdictions, and the tax effect of import duty tax credits recognized in the three months ended March 31, 2024. This was partially offset by the recognition of a discrete deferred tax benefit during the first quarter of 2024 related to the partial release of the valuation allowance in Switzerland.

Liquidity and Capital Resources

1) Capital allocation framework and share repurchase program

In July 2023, in connection with the issuance of the Notes (as defined herein), Seadrill announced capital allocation principles designed to prioritize a conservative capital structure and liquidity position, focused capital investment in its fleet, and returns to shareholders. Within this framework, Seadrill intends to maintain a net leverage target of less than 1.0x under current market conditions, with a maximum through-cycle net leverage target of less than 2.0x. Seadrill also intends to maintain a strong liquidity position to provide resilience even in a downturn scenario by establishing a target minimum cash-on-hand of $250 million. Further, Seadrill intends to evaluate the potential for accretive additions in core asset categories.

So long as Seadrill is able to meet its net leverage and liquidity targets on a forward-looking basis, as well as comply with its credit facility covenant requirements, Seadrill would seek to provide a return to our shareholders of at least 50% of Free Cash Flow (defined as cash flows from operating activities minus capital expenditures) in the form of share repurchases or dividends. Seadrill will consider additional returns to shareholders from the proceeds of any asset sales in the absence of identified, accretive opportunities. Dividends and share repurchases will be authorized and determined by the Board of Directors in its sole discretion and depend upon a number of factors, including those described above, its future prospects, market trend evaluation and such other factors as the Board of Directors may deem relevant. Please see “Risk Factors— Financial and Tax Risks— We may be unable to meet our capital return framework goal of returning at least 50% of Free Cash Flow to shareholders through dividends and share repurchases, which could decrease expected returns on an investment in our shares” in our 2023 20-F.

On August 14, 2023, the Board of Directors authorized a share repurchase program, which was announced on August 15, 2023 and completed in December 2023, under which the Company could purchase up to $250 million of its outstanding common shares. On November 27, 2023, the Board of Directors authorized, and the Company announced, an increase in the Company’s aggregate share repurchase authorization, allowing the Company to repurchase up to an additional $250 million of its outstanding common shares, taking the aggregate authorization to $500 million. The repurchase program does not have a fixed expiration, and may be modified, suspended or discontinued at any time. Shares may be repurchased at any time and from time to time under the program in open market purchases, privately negotiated purchases, block trades, tender offers, accelerated share repurchase transactions or other derivative transactions, through the purchase of call options or the sale of put options, or otherwise, or by any combination of the foregoing. The Company is under no obligation to purchase any common shares in respect of the repurchase program. The manner, timing, pricing and amount of any repurchases may be based upon a number of factors, including market conditions, the Company’s financial position and capital requirements, financial conditions, competing uses for cash, statutory solvency requirements, the restrictions in the Company’s debt agreements and other factors.

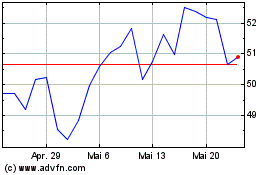

As of May 10, 2024 4.1 million of common shares on the NYSE and the OSE amounting to $192 million have been repurchased, with a weighted average share price of $46.84, pursuant to the additional $250 million of share repurchases authorized on November 27, 2023.

2) Liquidity

Our level of liquidity fluctuates depending on a number of factors. These include, among others, our contract backlog, economic utilization achieved, average contract dayrates, timing of accounts receivable collection, capital expenditures for rig upgrades and reactivation projects, and timing of payments for operating costs and other obligations.

As of March 31, 2024, Seadrill had available liquidity of $809 million, which consisted of cash and cash equivalents, including restricted cash, of $612 million and available borrowings under our Revolving Credit Facility (as defined herein) of $225 million. The below table shows cash and restricted cash balances, and total available liquidity, as of each date presented.

| | | | | | | | | | | | | | | |

| | | | | |

| (In $ millions) | | March 31,

2024 | | | December 31,

2023 |

| Unrestricted cash | | 584 | | | | 697 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Undrawn revolving credit facility | | 225 | | | | 225 | |

| Total available liquidity | | 809 | | | | 922 | |

We have shown our sources and uses of cash by category of cash flow in the below table:

| | | | | | | | | | | | | | |

| | | | |

| (In $ millions) | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | |

Cash flows provided by operating activities (a) | 29 | | | 15 | | | | |

Cash flows (used in)/provided by investing activities (b) | (23) | | | 36 | | | | |

Cash flows used in financing activities (c) | (119) | | | (160) | | | | |

| Effect of exchange rate changes in cash | (3) | | | 2 | | | | |

| Change in period | (116) | | | (107) | | | | |

a) Cash flows provided by operating activities

Cash flows provided by operating activities includes cash receipts from customers, cash paid to employees and suppliers (except for capital expenditure), payments for major rig maintenance projects, interest and dividends received (except for returns of capital), interest paid, income taxes paid and other operating cash payments and receipts.

The $29 million cash inflow from operating activities during the three months ended March 31, 2024, was primarily driven by cash inflows from customer revenues and receipts from our related parties, Sonadrill and Gulfdrill. This was partially offset by cash outflows related to long-term maintenance across the fleet, payments made to third-party managers (the “MSA managers”) for the Aquadrill rigs, settlement of liabilities for previously accrued expenditures, and our first interest payment under the $575 million secured bond in issue.

The $15 million cash inflow from operating activities during the three months ended March 31, 2023 was primarily driven by cash flows from operations and the timing of receipts from customers. This was partially offset by cash outflows related to the settlement of liabilities for previously accrued expenditures, primarily associated with the mobilization of the West Jupiter and West Carina to new contracts in Brazil following the reactivation of those rigs in 2022.

b) Cash flows (used in)/provided by investing activities

The $23 million cash used in investing activities during the three months ended March 31, 2024 was mainly due to capital expenditures across the fleet, primarily on West Auriga and West Polaris, preparing for their new contracts in Brazil with Pertobras.

The $36 million cash provided by investing activities during the three months ended March 31, 2023 was due to net proceeds of $43 million received on disposal of Paratus Energy Services Ltd (“PES”) in February 2023 and $4 million from the disposal of equipment, offset by $11 million of capital expenditures across the fleet.

c) Cash flows used in financing activities

The $119 million cash used in financing activities during the three months ended March 31, 2024 was related to share repurchases.

The $160 million cash used in financing activities during the three months ended March 31, 2023 was due to payments of debt principal of $153 million and exit fees of $8 million made in February 2023 and March 2023.

Borrowing Activities

An overview of our debt as of March 31, 2024, divided into (i) bonds in issue and (ii) unsecured senior convertible notes, is presented in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | |

| (In $ millions) | Principal value as of March 31, 2024 | Debt Premium | | Debt Issuance Costs | | Carrying value as of March 31, 2024 | | Maturity date |

| Bonds in issue | | | | | | | | |

| $575 million secured bond in issue | 575 | 1 | | (17) | | | 559 | | August 2030 |

| | | | | | | | |

| | | | | | | | |

| Unsecured | | | | | | | | |

| $50 million senior convertible bond | 50 | — | | | — | | | 50 | | August 2028 |

| Total debt | 625 | 1 | | (17) | | | 609 | | |

Corporate credit rating

In July 2023, in connection with the Notes offering, Seadrill Limited received corporate family credit ratings from Moody’s (B1), S&P (B+), and Fitch (B+), with each agency assigning a stable outlook to the Company. There have been no changes to these ratings at the time of this report. A decline in corporate family credit ratings could increase borrowing costs under our Revolving Credit Facility.

We cannot assure that the ratings set forth above will remain in effect for any given period of time or that one or more of these ratings will not be lowered or withdrawn entirely by a rating agency. We note that these credit ratings are included for informational purposes and are not recommendations to buy, sell or hold our securities and may be revised or withdrawn at any time by the rating agency. Each rating should be evaluated independently of any other rating. Any future reduction or withdrawal of one or more of our credit ratings could have a material adverse impact on our ability to obtain short- and long-term financing, the cost of such financings and the execution of our commercial strategies.

Collateral package

New Revolving Credit Facility

In July 2023, the Company entered into a new $225 million, 5-year Senior Secured Revolving Credit Agreement in respect of the Revolving Credit Facility (the “New Credit Agreement”). Seadrill Finance (as defined herein) is the borrower under the New Credit Agreement, and the facility is secured by first priority liens on substantially all of the Company’s rigs and related assets, other than non-core assets. The Company, and certain of its subsidiaries that own collateral or are otherwise material, guarantee the obligations under the New Credit Agreement. The loans outstanding under the New Credit Agreement bear interest at a rate per annum equal to the applicable margin plus, at Seadrill Finance’s option, either: (i) the Term SOFR (as defined in the New Credit Agreement) plus 0.10%; or (ii) the Daily Simple SOFR (as defined in the New Credit Agreement) plus 0.10%. For both the Term SOFR loans and Daily Simple SOFR loans, the applicable margin is initially 2.75% per annum and may vary based on Seadrill’s Credit Ratings (as defined in the New Credit Agreement), from 2.50% to 3.50% per annum.

$575 million Notes Offerings

Also in July 2023, Seadrill Finance issued the Notes in a private offering. The Notes mature on August 1, 2030. The Notes are guaranteed by the Company and the same subsidiaries of the Company that guarantee the New Credit Agreement. The Notes are secured by a second priority lien on the same assets that secure the New Credit Agreement.

Please refer to Note 11 - "Debt" for further details on these facilities.

Financial covenants

The New Credit Agreement obligates Seadrill and its restricted subsidiaries to comply with the following financial covenants:

•as of the last day of each fiscal quarter, the Interest Coverage Ratio (as defined in the New Credit Agreement) is not permitted to be less than 2.50 to 1.00; and

•as of the last day of each fiscal quarter, the Consolidated Total Net Leverage Ratio (as defined in the New Credit Agreement) is not permitted to be greater than 3.00 to 1.00.

For the three month period ended March 31, 2024, Seadrill was in compliance with these financial covenants.

Quantitative and Qualitative Disclosures About Market Risk

We are exposed to several market risks, including credit risk, foreign currency risk and interest rate risk. Our policy is to reduce our exposure to these risks, where possible, within boundaries deemed appropriate by our management team. Please refer to Note 14 - "Risk management and financial instruments" for further details.

Critical Accounting Estimates

The preparation of the Consolidated Financial Statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures about contingent assets and liabilities. We base these estimates and assumptions on historical experience and on various other information and assumptions that we believe to be reasonable. Critical accounting estimates are important to the portrayal of both our financial position and results of operations and require us to make subjective or complex assumptions or estimates about matters that are uncertain. The basis of preparation, significant accounting policies, and critical accounting estimates are disclosed in our 2023 20-F.

Risk Factors

Please see “Item 3D - Risk Factors” in our 2023 20-F for a discussion of the risks that are material to our business.

Seadrill Limited

INDEX TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

| | | | | | | | |

Unaudited Consolidated Statements of Operations for the three months ended March 31, 2024 and 2023 | | |

| | |

Unaudited Consolidated Balance Sheets as of March 31, 2024 and December 31, 2023 | | |

Unaudited Consolidated Statements of Cash Flows for the three months ended March 31, 2024 and 2023 | | |

Unaudited Consolidated Statements of Changes in Shareholders’ Equity for the three months ended March 31, 2024 and 2023 | | |

| Notes to the Unaudited Consolidated Financial Statements | | |

Seadrill Limited

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (In $ millions, except per share data) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | | | |

| Operating revenues | | | | | | | | | | | | | |

| Contract revenues | | 275 | | | 186 | | | | | | | | | | |

Reimbursable revenues (1) | | 20 | | | 9 | | | | | | | | | | |

Management contract revenues (1) | | 58 | | | 61 | | | | | | | | | | |

Other revenues (1) | | 14 | | | 10 | | | | | | | | | | |

| Total operating revenues | | 367 | | | 266 | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | |

| Vessel and rig operating expenses | | (180) | | | (115) | | | | | | | | | | |

| Reimbursable expenses | | (20) | | | (9) | | | | | | | | | | |

| Depreciation and amortization | | (38) | | | (36) | | | | | | | | | | |

| | | | | | | | | | | | | |

| Management contract expense | | (38) | | | (42) | | | | | | | | | | |

| Merger and integration related expenses | | (2) | | | (3) | | | | | | | | | | |

| Selling, general and administrative expenses | | (25) | | | (14) | | | | | | | | | | |

| Total operating expenses | | (303) | | | (219) | | | | | | | | | | |

| Other operating items | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Gain on disposals | | — | | | 4 | | | | | | | | | | |

| Other operating income | | 16 | | | — | | | | | | | | | | |

| Total other operating items | | 16 | | | 4 | | | | | | | | | | |

| Operating profit | | 80 | | | 51 | | | | | | | | | | |

| Financial and other non-operating items | | | | | | | | | | | | | |

| Interest income | | 7 | | | 7 | | | | | | | | | | |

| Interest expense | | (15) | | | (16) | | | | | | | | | | |

| Share in results from associated companies (net of tax) | | 4 | | | 3 | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other financial items and non-operating items | | (6) | | | (1) | | | | | | | | | | |

| Total financial and other non-operating items, net | | (10) | | | (7) | | | | | | | | | | |

| Profit before income taxes | | 70 | | | 44 | | | | | | | | | | |

| Income tax expense | | (10) | | | (1) | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | 60 | | | 43 | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Basic EPS ($) | | 0.83 | | 0.86 | | | | | | | | | |

| | | | | | | | | | | | | |

| Diluted EPS ($) | | 0.81 | | 0.83 | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) Includes revenue from related parties of $76 million and $74 million for the three months ended March 31, 2024 and the three months ended March 31, 2023, respectively. Please refer to Note 15 – "Related party transactions" for further details on these transactions.

The accompanying notes form an integral part of these Unaudited Consolidated Financial Statements.

Seadrill Limited

UNAUDITED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| | |

| (In $ millions, except per share data) | | March 31,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | 584 | | | 697 | |

| Restricted cash | | 28 | | | 31 | |

| Accounts receivable, net | | 197 | | | 222 | |

| Amounts due from related parties, net | | 14 | | | 9 | |

| | | | |

| Other current assets | | 213 | | | 199 | |

| Total current assets | | 1,036 | | | 1,158 | |

| Non-current assets | | | | |

| Investments in associated companies | | 94 | | | 90 | |

| Drilling units | | 2,862 | | | 2,858 | |

| | | | |

| Deferred tax assets | | 53 | | | 46 | |

| Equipment | | 10 | | | 10 | |

| | | | |

| Other non-current assets | | 67 | | | 56 | |

| Total non-current assets | | 3,086 | | | 3,060 | |

| Total assets | | 4,122 | | | 4,218 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | |

| Current liabilities | | | | |

| | | | |

| Trade accounts payable | | 64 | | | 53 | |

| | | | |

| Other current liabilities | | 291 | | | 336 | |

| Total current liabilities | | 355 | | | 389 | |

| | | | |

| | | | |

| Non-current liabilities | | | | |

| Long-term debt | | 609 | | | 608 | |

| | | | |

| Deferred tax liabilities | | 9 | | | 9 | |

| Other non-current liabilities | | 222 | | | 229 | |

| Total non-current liabilities | | 840 | | | 846 | |

| Commitments and contingencies (see Note 16) | | | | |

| SHAREHOLDERS' EQUITY | | | | |

Common shares of par value $0.01 per share: 375,000,000 shares authorized and 74,060,628 issued at March 31, 2024 (December 31, 2023: 74,048,962) | | 1 | | | 1 | |

| Additional paid-in capital | | 2,364 | | | 2,480 | |

| | | | |

| Accumulated other comprehensive income | | 1 | | | 1 | |

| Retained earnings | | 561 | | | 501 | |

| Total shareholders' equity | | 2,927 | | | 2,983 | |

| Total liabilities and shareholders' equity | | 4,122 | | | 4,218 | |

The accompanying notes form an integral part of these Unaudited Consolidated Financial Statements

Seadrill Limited

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| (In $ millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | |

| Cash Flows from Operating Activities | | | | | | | | | |

| Net income | | 60 | | | 43 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization | | 38 | | | 36 | | | | | |

| | | | | | | | | |

| Gain on disposal of assets | | — | | | (4) | | | | | | |

| | | | | | | | | |

| Share in results from associated companies (net of tax) | | (4) | | | (3) | | | | | | |

| Deferred tax benefit | | (5) | | | (2) | | | | | | |

| Unrealized loss on foreign exchange | | 3 | | | — | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of discount on debt | | 1 | | | — | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Share based incentive compensation | | 3 | | | — | | | | | | |

| | | | | | | | | |

| Other cash movements in operating activities | | | | | | | | | |

| Payments for long-term maintenance | | (29) | | (10) | | | | | |

| | | | | | | | | |

| Changes in operating assets and liabilities, net of effect of acquisitions and disposals | | | | | | | | | |

| Trade accounts receivable | | 25 | | | 18 | | | | | |

| Trade accounts payable | | 11 | | | (10) | | | | | | |

| Prepaid expenses/accrued revenue | | (7) | | | (5) | | | | | | |

| Deferred revenue | | 5 | | | 12 | | | | | | |

| Deferred mobilization costs | | 4 | | | — | | | | | | |

| Related party receivables | | (5) | | | 8 | | | | | | |

| | | | | | | | | |

| Other assets | | (21) | | | (3) | | | | | | |

| Other liabilities | | (50) | | | (65) | | | | | | |

| Net cash flows provided by operating activities | | 29 | | | 15 | | | | | | |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | | |

| Additions to drilling units and equipment | | (23) | | | (11) | | | | | | |

| Proceeds from disposal of assets | | — | | | 4 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Proceeds from disposal of investment in associates | | — | | | 43 | | | | | | |

| Net cash flows (used in)/provided by investing activities | | (23) | | | 36 | | | | | | |

| | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | | |

| Repayments of secured credit facilities | | — | | | (160) | | | | | | |

| Shares repurchased | | (119) | | | — | | | | | | |

| Net cash used in financing activities | | (119) | | | (160) | | | | | | |

| Effect of exchange rate changes on cash | | (3) | | | 2 | | | | | | |

| Net decrease in cash and cash equivalents, including restricted cash | | (116) | | | (107) | | | | | | |

| Cash and cash equivalents, including restricted cash, at beginning of the period | | 728 | | | 598 | | | | | | |

| Cash and cash equivalents, including restricted cash, at the end of period | | 612 | | | 491 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The accompanying notes form an integral part of these Unaudited Consolidated Financial Statements

Seadrill Limited

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In $ millions) | | Common shares | | Additional paid-in capital | | | | Accumulated

other comprehensive income | | Retained earnings | | Total shareholders' equity |

| Balance as of January 1, 2024 | | 1 | | | 2,480 | | | | | 1 | | | 501 | | | 2,983 | |

| Share-based compensation plans | | — | | | 3 | | | | | — | | | — | | | 3 | |

| Share repurchased | | — | | | (119) | | | | | — | | | — | | | (119) | |

| Net income | | — | | | — | | | | | — | | | 60 | | | 60 | |

| | | | | | | | | | | | |

| Balance as of March 31, 2024 | | 1 | | | 2,364 | | | | | 1 | | | 561 | | | 2,927 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In $ millions) | | Common shares | | Additional paid-in capital | | | | | | Accumulated other comprehensive income | | Retained earnings | | Total shareholders' equity |

| Balance as of January 1, 2023 | | — | | | 1,499 | | | | | | | 2 | | | 201 | | | 1,702 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income | | — | | | — | | | | | | | — | | | 43 | | | 43 | |

| Balance as of March 31, 2023 | | — | | | 1,499 | | | | | | | 2 | | | 244 | | | 1,745 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

The accompanying notes form an integral part of these Unaudited Consolidated Financial Statements

Seadrill Limited

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – General information

We are an offshore drilling contractor providing worldwide offshore drilling services to the oil and gas industry. Our primary business is the ownership and operation of drillships, semi-submersible rigs and jackup rigs for operations in shallow to ultra-deepwater in both benign and harsh environments. We contract our drilling units to drill wells for our customers on a dayrate basis. Our customers include oil super-majors, state-owned national oil companies and independent oil and gas companies. In addition, we provide management services to certain affiliated entities.

Basis of presentation

The Consolidated Financial Statements comply with generally accepted accounting principles in the United States of America. The amounts are presented in U.S. dollar (“US dollar”, “$” or “US$”) rounded to the nearest million, unless otherwise stated. They include the financial statements of Seadrill Limited and its consolidated subsidiaries.

The accompanying unaudited interim financial statements, in the opinion of management, include all material adjustments that are considered necessary for a fair statement of the Company’s financial statements in accordance with generally accepted accounting principles in the United States of America. The accompanying unaudited interim condensed Consolidated Financial Statements do not include all of the disclosures required in complete annual financial statements. These financial statements should be read in conjunction with our 2023 20-F.

The financial information presented assumes that we will continue as a going concern, able to realize our assets and discharge liabilities in the normal course of business as they come due.

Reclassifications

Effective in the first quarter of 2024, we have classified reimbursable revenues and expenses associated with our joint ventures as "Reimbursable revenues" and "Reimbursable expenses", respectively, in order to enhance the presentation of the arrangements and to reflect the underlying nature of these transactions. To conform to current period presentation, $3 million of "Management contract revenues" and $3 million of "Management contract expenses" for the three months ended March 31, 2023 have been reclassified to "Reimbursable revenues" and "Reimbursable expenses", respectively.

Acquisition of Aquadrill LLC

On April 3, 2023 (the "Closing Date"), Seadrill completed the acquisition of Aquadrill LLC ("Aquadrill"), an offshore drilling rig owner. Pursuant to the Agreement and Plan of Merger (the "Merger Agreement") dated December 22, 2022, by and among Seadrill, Aquadrill (formerly Seadrill Partners LLC) and Seadrill Merger Sub, LLC, a Marshall Islands limited liability company (“Merger Sub”), Merger Sub merged with and into Aquadrill, with Aquadrill surviving the merger as a wholly owned subsidiary of Seadrill (the “Merger”). In connection with the Merger, and pursuant to the Merger Agreement, Seadrill exchanged consideration consisting of (i) 29.9 million Seadrill common shares, (ii) $30 million settled by tax withholding in lieu of common shares, and (iii) cash consideration of $1 million.

Through the acquisition of Aquadrill in April 2023, we added four drillships, one semi-submersible, and three tender-assist units to our fleet. The three tender-assist units were subsequently sold in July 2023.

Significant accounting policies

The accounting policies adopted in the preparation of the unaudited interim financial statements as of and for the three months ended March 31, 2024 are consistent with those followed in the preparation of our annual audited Consolidated Financial Statements for the year ended December 31, 2023.

Note 2 – Recent accounting pronouncements

There are currently no accounting standard updates issued since the reporting date of our 2023 20-F that are expected to materially affect our Consolidated Financial Statements and related disclosures in future periods.

Note 3 – Revenue from contracts with customers

The following table provides information about receivables and contract liabilities from our contracts with customers:

| | | | | | | | | | | | | | |

| | |

| (In $ millions) | | As of March 31, 2024 | | As of December 31,

2023 |

| Accounts receivable, net | | 197 | | | 222 | |

| Current contract liabilities (classified within other current liabilities) | | (33) | | | (31) | |

| Non-current contract liabilities (classified within other non-current liabilities) | | (29) | | | (33) | |

Seadrill Limited

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Significant changes in the contract liabilities balances for the three months ended March 31, 2024 are as follows:

| | | | | | | | |

| (In $ millions) | | Contract Liabilities |

| Net contract liability as of January 1, 2024 | | (64) | |

| Amortization of revenue that was included in the beginning contract liability balance | | 11 | |

| Cash received, excluding amounts recognized as revenue | | (9) | |

| Net contract liability as of March 31, 2024 | | (62) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Revenues are attributed to geographical locations based on the country of operations for drilling activities, i.e. the country where the revenues are generated. The following table presents our revenues by geographic area:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (In $ millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| United States | 95 | | | 57 | | | | | | | | |

| Brazil | | 89 | | | 82 | | | | | | | | |

| Angola | 77 | | | 63 | | | | | | | | |

| Norway | | 54 | | | 52 | | | | | | | | |

| Indonesia | | 36 | | | — | | | | | | | | |

| | | | | | | | | | | |

Other (1) | | 16 | | | 12 | | | | | | | | |

| Total operating revenues | | 367 | | | 266 | | | | | | | | |

(1) Other represents countries in which we operate that individually had revenues representing less than 10% of total revenues earned for any of the periods presented.

We had the following customers with total revenues greater than 10% in any of the periods presented:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| | | | | | | | | | | |

| Sonadrill | | 18 | % | | 24 | % | | | | | | | |

| Petrobras | | 18 | % | | 22 | % | | | | | | | |

| | | | | | | | | | | |

| LLOG | | 10 | % | | 12 | % | | | | | | | |

| Premiere | | 10 | % | | — | % | | | | | | | |

| Vår Energi | | 9 | % | | 12 | % | | | | | | | |

| Talos | | — | % | | 10 | % | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other | | 35 | % | | 20 | % | | | | | | | |

Note 4 – Interest expense

Interest expense consists of the following:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

(In $ millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| Interest on debt facilities | | (14) | | | (15) | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other | | (1) | | | (1) | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Interest expense | | (15) | | | (16) | | | | | | | | |

Interest on debt facilities

We incur cash interest on our debt facilities. This is summarized in the table below.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

(In $ millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| $575 million secured bond in issue | | (12) | | | — | | | | | | | | |

| First-lien senior secured | | — | | | (5) | | | | | | | | |

| Second lien senior secured | | — | | | (9) | | | | | | | | |

| Unsecured convertible bond | | (2) | | | (1) | | | | | | | | |

| Interest on debt facilities | | (14) | | | (15) | | | | | | | | |

Seadrill Limited

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Note 5 – Taxation

For the three months ended March 31, 2024, Seadrill reported income tax expense of $10 million, compared to income tax expense of $1 million for the same period in 2023.

The effective tax rate for the three months ended March 31, 2024 increased to 14.3% from 2.3%, in the same period of 2023. The change in the effective tax rate is primarily due to increased operational activities following the Aquadrill acquisition completed in the second quarter of 2023, a shift in the Company's mix of income among tax jurisdictions, and the tax effect of import duty tax credits recognized in the first quarter of 2024. This was partially offset by the recognition of a discrete deferred tax benefit during the first quarter of 2024 related to the partial release of the valuation allowance in Switzerland.

Note 6 – Earnings per share

The computation of basic earnings per share (“EPS”) is based on the weighted average number of shares outstanding during the period. Diluted EPS includes the effect of the assumed conversion of potentially dilutive instruments, related to the effect of the convertible note and share based compensation. Refer to Note 11 – "Debt" for further details on the convertible note.

The components of the numerator for the calculation of basic and diluted EPS were as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (In $ millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income available to stockholders | | 60 | | | 43 | | | | | | | | |

| Effect of dilution | | 1 | | | 1 | | | | | | | | |

| Diluted net income available to stockholders | | 61 | | | 44 | | | | | | | | |

The components of the denominator for the calculation of basic and diluted EPS were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (In millions) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | | | |

| Basic earnings per share: | | | | | | | | | | | | | |

Weighted average number of common shares outstanding (1) | | 72 | | | 50 | | | | | | | | | | |

| Diluted earnings per share: | | | | | | | | | | | | | |

| Effect of dilution | | 3 | | | 3 | | | | | | | | | | |

| Weighted average number of common shares outstanding adjusted for the effects of dilution | | 75 | | | 53 | | | | | | | | | | |

(1) Weighted average number of common shares outstanding in the three months ended March 31, 2024 excludes shares repurchased during the period. Please refer to Note 19 – "Subsequent events" for details on additional shares repurchased after March 31, 2024. The basic and diluted earnings per share were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (In $) | | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | | | | | | | | | |

| Basic earnings per share | | 0.83 | | 0.86 | | | | | | | | | |

| Diluted earnings per share | | 0.81 | | 0.83 | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Note 7 – Restricted cash

Restricted cash as of March 31, 2024 and December 31, 2023 was as follows:

| | | | | | | | | | | | | | | |

| | | |

| (In $ millions) | | As of March 31, 2024 | | As of December 31, 2023 | |

| Cash held in escrow | | 23 | | | 23 | | |

| | | | | |

| | | | | |

| Other | | 5 | | | 8 | | |

| Total restricted cash | | 28 | | | 31 | | |

| | | | | |

| | | | | |

Seadrill Limited

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Note 8 - Other current and non-current assets

As of March 31, 2024 and December 31, 2023, other assets included the following:

| | | | | | | | | | | | | | |

| (In $ millions) | | As of March 31, 2024 | | As of December 31, 2023 |

| Taxes receivable | | 58 | | | 67 |

| Prepaid expenses | | 53 | | | 54 |

| Deferred contract costs | | 81 | | | 85 | |

| Pre-funding of MSA manager arrangements | | 38 | | | 23 | |

| | | | |

| | | | |

| | | | |

| Other | | 50 | | | 26 | |

| Other assets | | 280 | | | 255 | |

Other assets were presented in our Consolidated Balance Sheet as follows:

| | | | | | | | | | | | | | |

| | |

| (In $ millions) | | As of March 31, 2024 | | As of December 31, 2023 |

| Other current assets | | 213 | | | 199 | |

| Other non-current assets | | 67 | | | 56 | |

| Total other assets | | 280 | | | 255 | |

Note 9 – Investment in associated companies

As of March 31, 2024 and December 31, 2023, the carrying values of our investments in associated companies were as follows:

| | | | | | | | | | | | | | |

| | |

| (In $ millions) | | As of March 31, 2024 | | As of December 31, 2023 |

| | | | |

| | | | |

| | | | |

| | | | |

| Sonadrill | | 84 | | | 80 | |

| Gulfdrill | | 10 | | | 10 | |

| | | | |

| | | | |

| Total investment in associated companies | | 94 | | | 90 | |

Note 10 – Drilling units

The following table summarizes the movement for the three months ended March 31, 2024: