B U I L D I N G B R I G H T E R F U T U R E S February 26-28, 2024 BMO Global Metals, Mining & Critical Minerals Conference

2 Disclosure Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the securities laws. Forward- looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects,” "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's or the Board’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events, or developments that may occur in the future are forward-looking statements, including statements regarding the shareholder return framework, execution of Peabody's operating plans, market conditions, reclamation obligations, financial outlook, potential acquisitions and strategic investments, and liquidity requirements. They may include estimates of sales and other operating performance targets, cost savings, capital expenditures, other expense items, actions relating to strategic initiatives, demand for the company’s products, liquidity, capital structure, market share, industry volume, other financial items, descriptions of management’s plans or objectives for future operations and descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect Peabody’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, Peabody disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond Peabody's control, that are described in Peabody's periodic reports filed with the SEC including its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 and other factors that Peabody may describe from time to time in other filings with the SEC. You may get such filings for free at Peabody's website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

3 Peabody Quick Facts1 Confidential 1 All statistics are for the year ended December 31, 2023. 2 Total Recordable Incident Frequency Rate (‘TRIFR’) equals recordable incidents per 200,000 hours worked; MSHA reported total U.S. TRIFR for 2023 of 2.72. 3 Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix.

4 Note: The company attributes revenue to individual regions based on the location of the physical delivery of the coal. Revenue breakdown for FY 2023. Peabody Serves Broad Global Customer Base 0% 20% 40% India France Indonesia Vietnam Brazil Other Taiwan Australia China Japan U.S. Revenue from Customer Regions

5 Portfolio Diversity and Financial Strength Note: Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measure in the appendix. (1) Includes $10 million related to dividend declared on February 8, 2024 and $80 million available for additional share repurchases in accordance with the previously announced program. FY 2023 Adjusted EBITDA ($ in millions) Seaborne Thermal $577 Seaborne Metallurgical $438 PRB $154 Other US Thermal $207 Other ($12) Total $1.4 Billion • Global scale and diversification in most attractive regions • Proven consistent operating results in the United States and Australia • Adjusted EBITDA of $1.4 billion in 2023 • 2023 total shareholder returns of $471 million(1) - Increasing earnings per share exposure by 15% • $1.0+ billion of available liquidity • Continue to reweight assets to seaborne markets

6 Peabody Undervalued Relative to Peers Source: Latest public company filings, IBES consensus estimates and FactSet market data as of 31-Jan-2024 | Note: Debt calculations for Enterprise Value include unaffected asset retirement obligations and accrued pensions and other post-retirement benefit costs. Levered Free Cash Flow (FCF) is defined as the residual cash belonging to equity holders after deducting operating costs, reinvestments, and debt obligations. EBITDA adjusted for asset retirement obligations and pension / OPEB periodic costs / benefits. Market cap calculated on fully dilutive shares outstanding. (1) Available Free Cash Flow is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix. • Broad product and market diversification - Seaborne met (U.S. and Australia) - Seaborne thermal (Australia) - U.S. thermal • Sustainable shareholder return program of $471 million from 2023 Available Free Cash Flow(1) • Progressing premier coking coal development project in Australia to further weight production and cash flows to seaborne metallurgical coal 2.6x 3.8x3.6x 3.7x 4.9x 5.9x 2024E 2025E EV / EBITDA Peabody Thermal Peers Metallurgical Peers 6.1x 6.0x7.0x 8.4x 12.8x 9.3x 2024E 2025E Price / Levered FCF Peabody Thermal Peers Metallurgical Peers

7 Financial Strength

8 Financial Strategy • Generate cash in excess of liquidity and capital requirements • Repaid all senior secured debt • Pre-funded global reclamation in excess of full estimated cost to complete • $1.0+ billion of available liquidity • Shareholder returns of $471 million based on 2023 Available Free Cash Flow • Centurion premium hard coking coal project on track for 2026 longwall production at ~4.0 million tons per year No Secured Debt Reclamation Fully Funded Balance Sheet Resiliency Free Cash Flow Generation Shareholder Returns & Strategic Investments Reinvest in the Portfolio Shareholder Returns

9 Shareholder Return Program Announced 2023 Total Shareholder Returns of $471 million Year Ended Dec. 2023 (Dollars in millions) Cash Flow from Operations: $1,035.5 - Cash Flows Used in Investing Activities (342.6) - Distributions to Noncontrolling Interest (59.0) +/- Changes to Restricted Cash and Collateral(1) 90.2 - Anticipated Expenditures or Other Requirements — Available Free Cash Flow (AFCF) $724.1 Minimum Allocated for Shareholder Returns (65%) $470.7 - Shares Repurchased (16.1 million shares) (350.0) - Dividends Paid(2) (30.6) - Dividends Declared(3) (9.7) Remaining Amount Available for Additional Share Repurchases $80.4 (1) This amount is equal to the total change in Restricted Cash and Collateral on the balance sheet, excluding the $660 million one-time surety funding related to the surety program in the first quarter and partially offsetting amounts of $200 million already included in cash flow from operations. (2) Does not include $0.2 million of non-cash dividend equivalent units issued. (3) Represents dividend declared on February 8, 2024.

10 Centurion Mine Complex: Unique Growth Project

11 Centurion Mine Complex: Organic Growth Tier one premium hard coking coal mine complex utilizing $1.0 billion of existing infrastructure and equipment Mine life potential of 25+ years through 130Mt integrated mine plan with the anticipated acquisition of a large portion of the Wards Well coal deposit Premium grade hard coking coal, mined from the Goonyella Middle Seam, an established cornerstone of coking coal blends Further weights Peabody’s long-term cash flows toward premium hard coking coal when longwall production begins in 2026

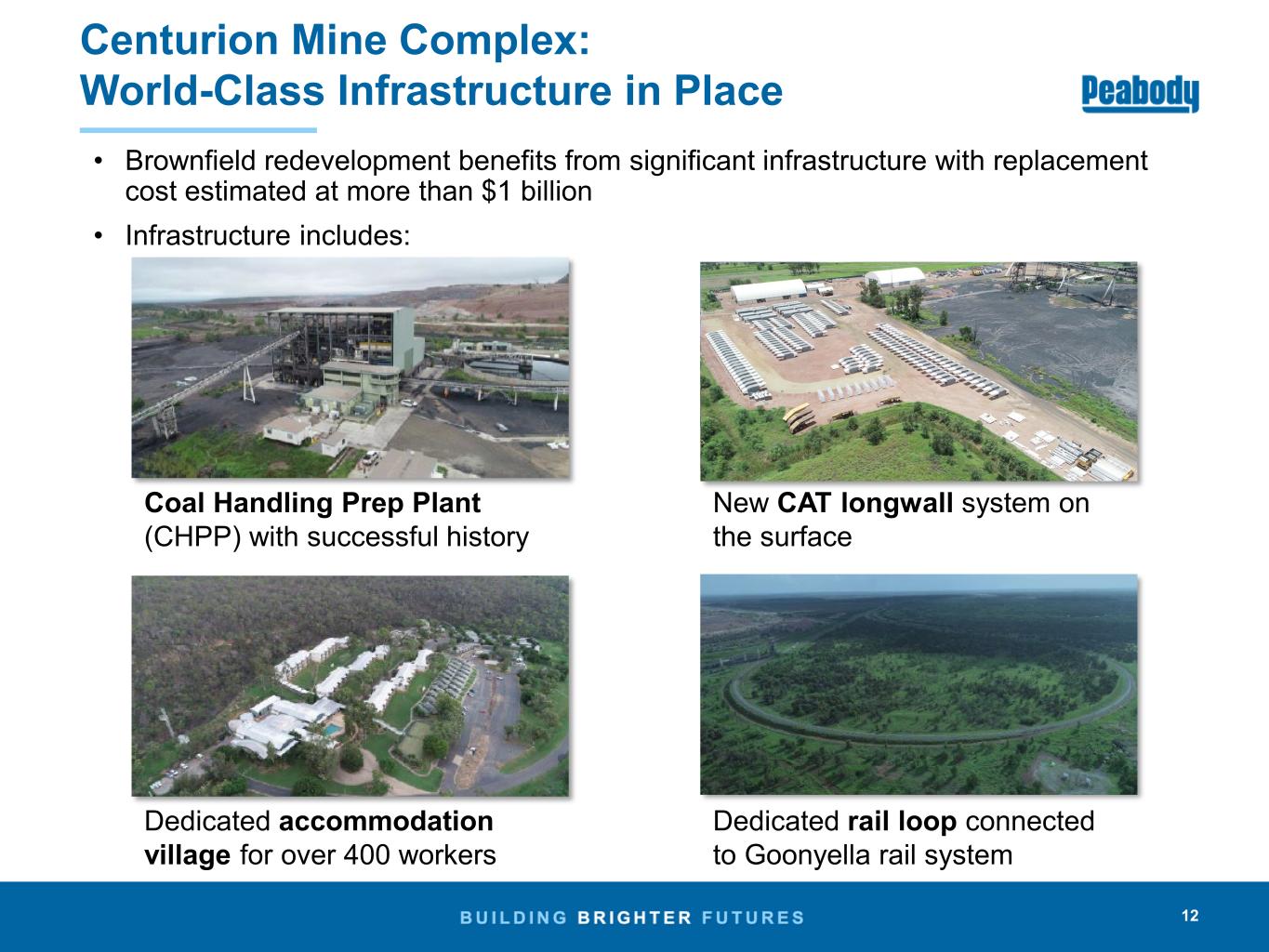

12 Centurion Mine Complex: World-Class Infrastructure in Place • Brownfield redevelopment benefits from significant infrastructure with replacement cost estimated at more than $1 billion • Infrastructure includes: Coal Handling Prep Plant (CHPP) with successful history Dedicated accommodation village for over 400 workers New CAT longwall system on the surface Dedicated rail loop connected to Goonyella rail system

13 Centurion Mine Complex: A Premier, Tier One Premium Hard Coking Coal Mine Current Development Area • Targeting first development coal in April 2024 and longwall production in 2026 • Goonyella Middle Seam expected to support five years of longwall production from 20 million tons of reserves • Projected to generate returns of 21 percent at long term premium hard coking coal prices (~$180/tonne - real) Wards Well Deposit (Pending Acquisition) • Life extension with potential to add over 110 million Goonyella Middle Seam tons to the integrated mine plan (25+years) • Anticipated close date Q2 2024; cash consideration of $136 million • 2024 capital of $45 million related to development (equipment, infrastructure, gas drainage, etc.) • Integrated mine plan under development • Wards Well lease joins Peabody leases to South and East increasing coal resource potential Wards Well Current Development Area Mined Area Current Centurion Mine Mine Entry Peabody Lease

14 Centurion: Project Summary – Current Development Area Projections Description Mine Goonyella Middle (“GM”) Seam Through Existing Mine Workings (excludes Wards Well) Reserves GM Seam: 20 million tons Product Low Vol Premium Hard Coking Coal Production ~3.9 million saleable tons per year First Coal • April 2024 – Development • 2026 – Longwall Capital Expenditures Full Project: $489 million • To Date: ~$125 million • 2024: ~$150 million • 2025: ~$155 million • 2026+: ~$55 million Costs ~$95/ton avg. (real) 2026+ Project Returns1 ~21 percent at long-term PHCC prices (~$180/tonne - real) from initial 20 million tons of longwall production Saleable Production (Million Tons) Project Map Note: All values in real $ and short tons. (1) Assumes LV PHCC (US$/Metric Tonne) of $205/tonne in 2024, $172/tonne in 2025, $186/tonne in 2026 and $180/tonne 2027+. 0.2 0.4 3.7 3.5 4.5 4.4 3.4 2024 2025 2026 2027 2028 2029 2030 Mined Area Current Development Area Mine Entry

15 Centurion Mine Complex: 2024 Goals Current Development Area • Commission development equipment to commence construction of underground roadways • Continue to onboard operators and maintenance personnel to support underground development and preparation for longwall mining • Complete refurbishment of the CHPP to facilitate the processing of first coal • Establish gas drainage and related infrastructure • Development coal in April 2024 and sale of product coal targeted for H2 2024 (~100kt) Integrated Mine Plan with Wards Well • Close acquisition of the Wards Well coal deposit - anticipated close Q2 2024 • Complete integrated mine plan incorporating Wards Well • Complete consolidated geological model and technical report • Commence development infrastructure work for Centurion’s expansion to the north

16 Centurion: “The World’s Best Coking Coal” Centurion Quality is Perfect Balance of High Coal Reactivity and Coke Strength Very high coke strength - +68 CSR means highly productive coke Very low ash for premium coking coal - Less than 10% ash, increasingly rare Low sulphur - Supports steel mills to meet strict environmental standards Low phosphorus - Improves steel quality, lowers steel cost Very high fluidity for premium coking coal - Enabler for blending and lowering coke cost

17 Market Overview

18 Supply Side Response Limited Due to High Barriers to Entry Coal Supply Development Constraints Reduced Capital Investment NGO Activity Political Environment Increased Permit Scrutiny Labor Shortage Increased Regulation

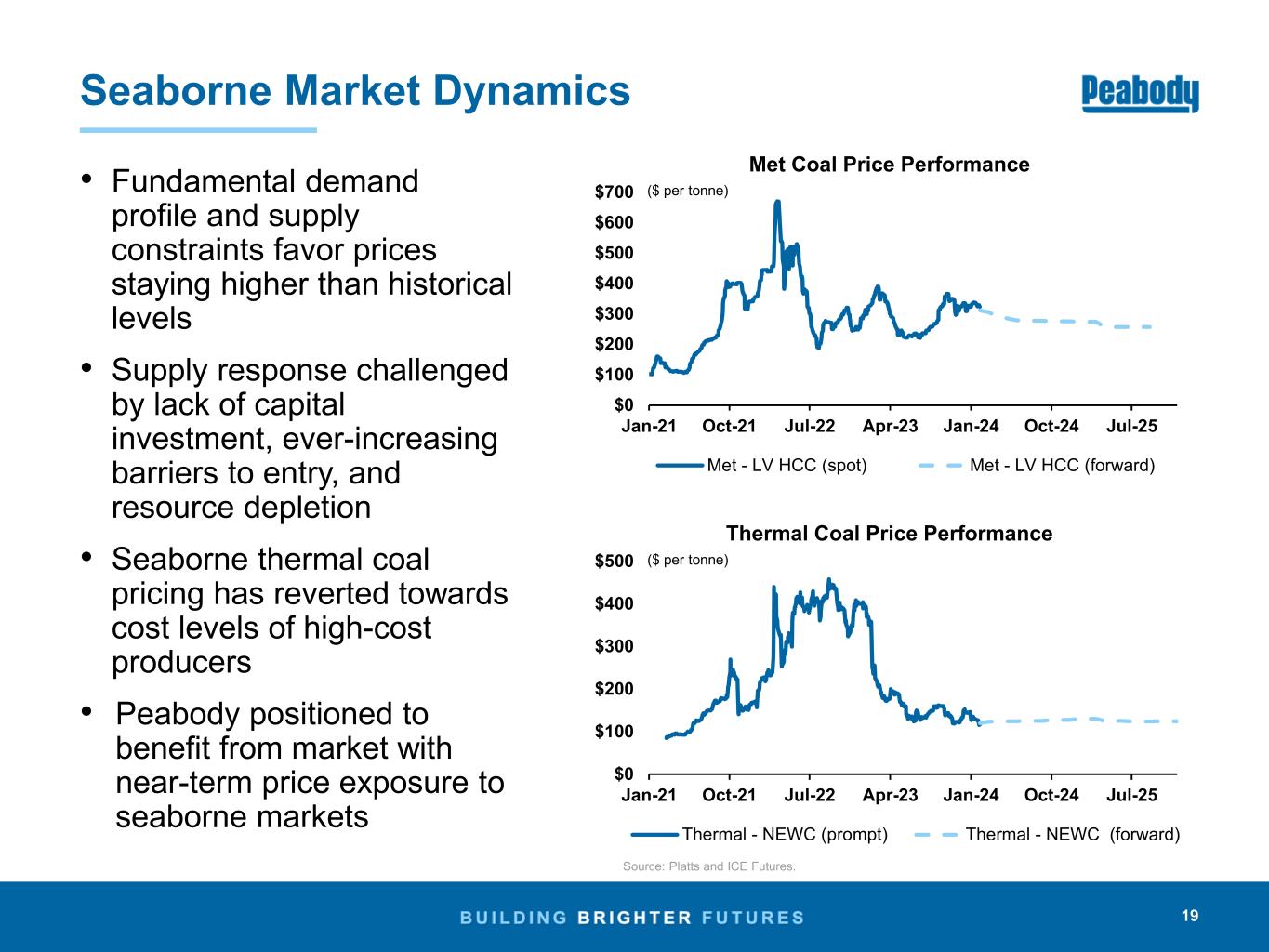

19 Seaborne Market Dynamics • Fundamental demand profile and supply constraints favor prices staying higher than historical levels • Supply response challenged by lack of capital investment, ever-increasing barriers to entry, and resource depletion • Seaborne thermal coal pricing has reverted towards cost levels of high-cost producers • Peabody positioned to benefit from market with near-term price exposure to seaborne markets $0 $100 $200 $300 $400 $500 $600 $700 Jan-21 Oct-21 Jul-22 Apr-23 Jan-24 Oct-24 Jul-25 Met Coal Price Performance Met - LV HCC (spot) Met - LV HCC (forward) Source: Platts and ICE Futures. $0 $100 $200 $300 $400 $500 Jan-21 Oct-21 Jul-22 Apr-23 Jan-24 Oct-24 Jul-25 Thermal Coal Price Performance Thermal - NEWC (prompt) Thermal - NEWC (forward) ($ per tonne) ($ per tonne)

20 Seaborne Met Coal Demand Growing – Supply Response Constrained – Organic Centurion Development • China’s rapid urbanization drove met coal consumption growth the last 15 years; India is projected to drive the next ~25 years and was the growth story of 2023 • Australia projected to continue to dominate seaborne met coal supply, advantaged by high- quality products, low-cost operations and proximity to demand centers • Most new met coal supply projections are from restarts and expansions; greenfield projects face ongoing challenges • Restart of Centurion significantly increases Peabody’s premium HCC production profile Seaborne Metallurgical Coal Demand Source: The graph was obtained from Wood Mackenzie Long Term Outlook (November 2023). 73 90 171 99 93 6860 42 29 14 14 14 17 3063 75 61317 331 373 2023 2030 2050 India Japan/Korea/Taiwan China Brazil Vietnam Others (Million Tonnes) +135%

21 Seaborne Thermal Coal Demand – New Supply Required • Demand is projected to exceed installed and probable supply through the 2030s • Operating resources are in decline and could fall well short of forecast demand • China’s growth in ’23 suggests potential for China’s seaborne demand to exceed forecasts • Peabody’s seaborne thermal coal portfolio well positioned to serve Asia centric demand Source: Supply data from Wood Mackenzie Long Term Outlook (November 2023) and demand data from EIA International Energy Outlook 2023. (Million Tonnes) Seaborne Thermal Supply and Demand - 200 400 600 800 1,000 1,200 2023 2030 2035

22 MISO SPP ERCOT PJM U.S. Electricity Generation Mix Remains Very Reliant on Coal Generation Source: Graph based on EIA, S&P Capital IQ, ISOs and Peabody analysis (1/01/2023 – 2/12/2024). Each dataset is represented by a boxed area where the central line signifies the median (P50) value, the bottom edge represents the 25th percentile, and the top edge represents the 75th percentile. Between the two extreme "whiskers" of each dataset, more than 90% of the data is encompassed. • Difficult to match reliability characteristics of coal generation • High coal share when renewables are not dispatching • MISO and SPP continue to rely heavily on coal to meet power demand • ~60% of Peabody’s U.S. thermal coal shipped to utilities goes to MISO and SPP plants • Hourly data for the past 12 months shows significant regional differences in coal’s contribution to the generation mix Hourly Coal Generation Share

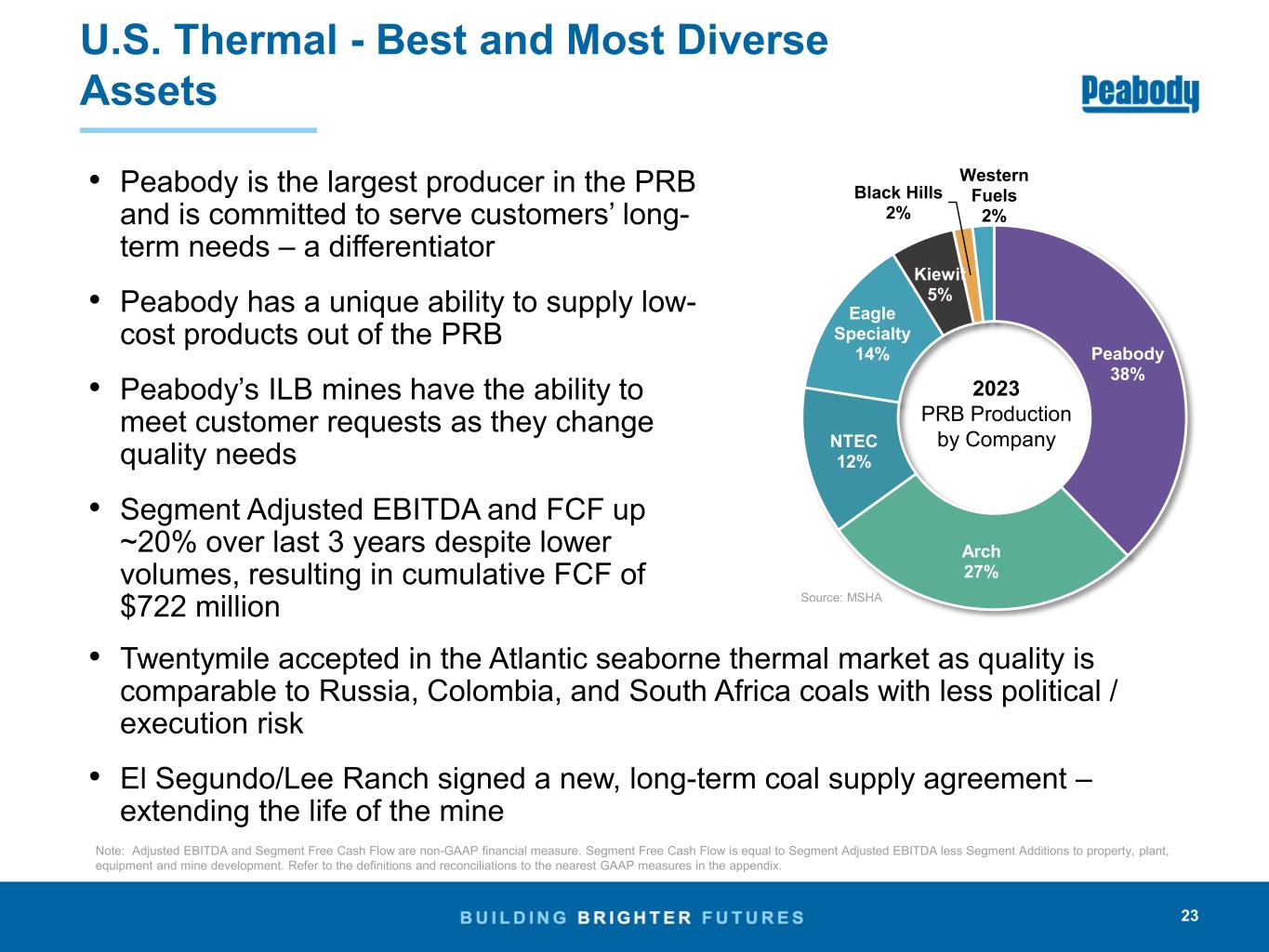

23 U.S. Thermal - Best and Most Diverse Assets • Peabody is the largest producer in the PRB and is committed to serve customers’ long- term needs – a differentiator • Peabody has a unique ability to supply low- cost products out of the PRB • Peabody’s ILB mines have the ability to meet customer requests as they change quality needs • Segment Adjusted EBITDA and FCF up ~20% over last 3 years despite lower volumes, resulting in cumulative FCF of $722 million • Twentymile accepted in the Atlantic seaborne thermal market as quality is comparable to Russia, Colombia, and South Africa coals with less political / execution risk • El Segundo/Lee Ranch signed a new, long-term coal supply agreement – extending the life of the mine Peabody 38% Arch 27% NTEC 12% Eagle Specialty 14% Kiewit 5% Black Hills 2% Western Fuels 2% 2023 PRB Production by Company Source: MSHA Note: Adjusted EBITDA and Segment Free Cash Flow are non-GAAP financial measure. Segment Free Cash Flow is equal to Segment Adjusted EBITDA less Segment Additions to property, plant, equipment and mine development. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix.

24 Operations Overview

25 Seaborne Met Segment Operations Overview Strategic Advantage: Multiple locations and products, positioned to serve Asia Pacific and Atlantic market Metropolitan Mine Production: 2.2 million tons Reserves: 10 million tons Type: Underground - Longwall Product: Semi-hard (65%), PCI (25%), Thermal (10%) Port: Port Kembla Coal Terminal (PKCT) Location: New South Wales, Australia Shoal Creek Mine Production: 0.6 million tons Reserves: 17 million tons Type: Underground - Longwall Product: Coking – High Vol A Port: Barge coal to McDuffie Terminal (Mobile, AL) Location: Alabama CMJV (Coppabella Mine and Moorvale Mine) Production: 4.4 million tons Reserves: 26 million tons Type: Surface - Dragline, Dozer/Cast, Truck/Shovel Product: Premium Low Volatile PCI Port: Dalrymple Bay Coal Terminal (DBCT) Location: Queensland, Australia Note: Production is for full year 2023. Reserves reflect estimated proven and probable reserves as of December 31, 2023.

26 Seaborne Thermal Segment Operations Overview Strategic Advantage: High margin operations positioned to serve Asia Pacific market Wilpinjong Mine Production: 12.0 million tons (export and domestic) Reserves: 57 million tons Type: Surface - Dozer/Cast, Truck/Shovel Product: Export (5,000-6,000 kcal/kg NAR) Port: Newcastle Coal Infrastructure Group (NCIG) and Port Waratah Coal Services (PWCS) Location: New South Wales, Australia Wambo Open-Cut Production : 2.6 million tons Reserves: 25 million tons Type: Surface - Truck/Shovel Product: Premium Export (~6000 kcal/kg NAR) Port: NCIG and PWCS Location: New South Wales, Australia Wambo Underground Production: 1.2 million tons Reserves: 4 million tons Type: Underground - Longwall Product: Premium Export (~6000 kcal/kg NAR) Port: NCIG and PWCS Location: New South Wales, Australia Note: Production is for full year 2023. Reserves reflect estimated proven and probable reserves as of December 31, 2023.

27 North Antelope Rochelle Mine (NARM) Production: 62.0 million tons Reserves: 1,364 million tons Type: Surface - Dragline, Dozer/Cast, Truck/Shovel Product: Sub-Bit Thermal (~8,800 BTU/lb, <0.50 lbs SO2) Rail: BNSF and UP Location: Wyoming PRB Segment Operations Overview Strategic Advantage: Low-cost operations, largest producer, significant reserves, shared resources, technologies Rawhide Mine Production: 9.8 million tons Reserves: 90 million tons Type: Surface - Dozer/Cast, Truck/Shovel Product: Sub-Bit Thermal (~8,200-8,300 BTU/lb, 0.85 lbs. SO2) Rail: BNSF Location: Wyoming Caballo Mine Production: 15.3 million tons Reserves: 180 million tons Type: Surface - Dozer/Cast, Truck/Shovel Product: Sub-Bit Thermal (~8,500 BTU/lb, 0.80 lbs. SO2) Rail: BNSF and UP Location: Wyoming Note: Production is for full year 2023. Reserves reflect estimated proven and probable reserves as of December 31, 2023.

28 Other U.S. Thermal Segment Operations Overview Strategic Advantage: Located to serve regional customers in high coal utilization regions Bear Run Mine Production: 5.5 million tons Reserves: 72 million tons Type: Surface - Dragline, Dozer/Cast, Truck/Shovel Product: Thermal ~11,000 Btu/lb, 4.5 lbs. SO2 Rail: Indiana Railroad to Indiana Southern / NS and CSX Location: Indiana Wild Boar Mine Production: 1.9 million tons Reserves: 13 million tons Type: Surface - Dragline, Dozer/Cast, Truck/Shovel Product: Thermal ~11,000 Btu/lb, 5.0 lbs. SO2 Rail: NS or Indiana Southern Location: Indiana Francisco Underground Production: 2.0 million tons Reserves: 5 million tons Type: Underground - Continuous Miner Product: Thermal ~11,500 Btu/lb, 6.0 lbs. SO2 Rail: NS Location: Indiana Note: Production is for full year 2023. Reserves reflect estimated proven and probable reserves as of December 31, 2023.

29 Other U.S. Thermal Segment Operations Overview (continued) with competitive cost operations and ample reserves / resources Gateway North Mine Production: 2.5 million tons Reserves: 26 million tons Type: Underground – Continuous Miner Product: Thermal ~11,000 Btu/lb, 5.4 lbs. SO2 Rail: UP Location: Illinois El Segundo / Lee Ranch Mine Production: 3.4 million tons Reserves: 11 million tons Type: Surface - Dragline, Dozer/Cast, Truck/Shovel Product: Thermal ~9,250 Btu/lb, 2.0 lbs SO2 Rail: BNSF Location: New Mexico Twentymile Mine Production: 1.3 million tons Reserves: 9 million tons Type: Underground – Longwall Product: Thermal ~11,200 Btu/lb, 0.80 lbs SO2 Rail: UP Location: Colorado Note: Production is for full year 2023. Reserves reflect estimated proven and probable reserves as of December 31, 2023.

2 30 Sustainability

31 Sustainability Objectives • Responsible coal mining, reducing impact from operations and making best use of natural resources while creating economic value • Targets for greenhouse gas reduction and land reclamation • Collaborating with stakeholders on a pipeline of projects aimed at reducing emissions and creating future carbon offsets • Supporting research and innovation to position our industry for the future Environmental Social • Safety is our first value and leading measure of excellence • Strive for diversity of backgrounds, thoughts and experiences by emphasizing inclusive hiring practices and workplaces • Active engagement with communities and indigenous stakeholders • Significant contributions to regions through taxes, fees and royalties • Member of U.N. Global Compact and signatory to CEO Action for Diversity & Inclusion pledge Governance • Focus on good governance, strategy and management, with integrity a driving value • Independent Board Chair and committees • Executive compensation designed to align management with stockholders, and incorporates measurable ESG metrics

32 Opportunity to Create Additional Value with Our Existing Assets Peabody Development • Land: 175,000+ surface acres owned in U.S. - Opportunity: develop solar energy and storage projects such as R3 Renewables - Potential for carbon capture and underground storage • Water: 38 million gallons managed per day - Opportunity: develop pumped hydro generation - Potential sale of water • Methane Gas: 60,000+ tons per year - Opportunity: capture methane from underground facilities - Potential sale for energy generation Joint venture in collaboration with Riverstone Holdings and Summit Partners Pursue development of over ~4.8 GW of utility-scale solar PV and ~1.8 GW of battery storage Eight potential sites on large tracts of land on or near previous coal mining operations in Indiana and Illinois

33 Technology and Collaboration • We support research and key initiatives in low emissions projects and partnerships such as: - Low Emission Technology Australia (LETA) - Carbon Utilization Research Council (CURC) • University of Wyoming School of Energy Resources - Peabody Advanced Coal Technology - Carbon engineering - Carbon Capture, Use and Storage - Coal-derived products • Washington University in St. Louis - Supports the Consortium for Clean Coal Utilization research on carbon capture and storage

34 Committed to Safety and Health as a Way of Life • Twentymile Mine won the Sentinels of Safety Award for the second year in a row, recognizing the mine as the safest underground mine in the U.S. • Annual Global Injury Rate - 2022 Lowest Rate in Company History - 2023 Second Lowest Rate in Company History

35 Commitment to Sustainability Shapes Our Strategy for the Future 2,400 2,300 3,230 2021 2022 2023 Acres Reclaimed Gained final bond release approval on over 2,600 acres in 2023

2 36 Appendix Materials

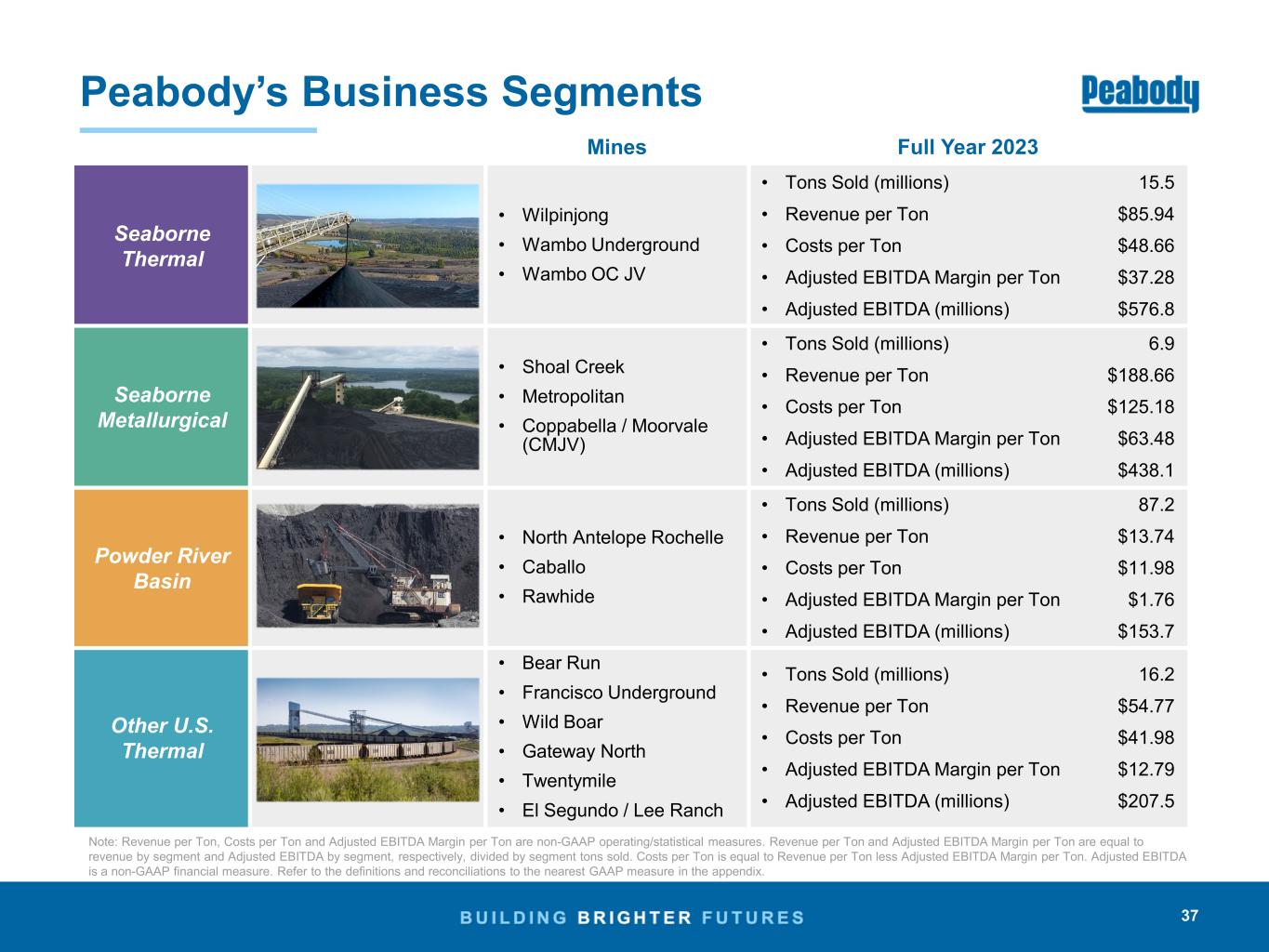

37 Peabody’s Business Segments Mines Full Year 2023 Seaborne Thermal • Wilpinjong • Wambo Underground • Wambo OC JV • Tons Sold (millions) • Revenue per Ton • Costs per Ton • Adjusted EBITDA Margin per Ton • Adjusted EBITDA (millions) 15.5 $85.94 $48.66 $37.28 $576.8 Seaborne Metallurgical • Shoal Creek • Metropolitan • Coppabella / Moorvale (CMJV) • Tons Sold (millions) • Revenue per Ton • Costs per Ton • Adjusted EBITDA Margin per Ton • Adjusted EBITDA (millions) 6.9 $188.66 $125.18 $63.48 $438.1 Powder River Basin • North Antelope Rochelle • Caballo • Rawhide • Tons Sold (millions) • Revenue per Ton • Costs per Ton • Adjusted EBITDA Margin per Ton • Adjusted EBITDA (millions) 87.2 $13.74 $11.98 $1.76 $153.7 Other U.S. Thermal • Bear Run • Francisco Underground • Wild Boar • Gateway North • Twentymile • El Segundo / Lee Ranch • Tons Sold (millions) • Revenue per Ton • Costs per Ton • Adjusted EBITDA Margin per Ton • Adjusted EBITDA (millions) 16.2 $54.77 $41.98 $12.79 $207.5 Note: Revenue per Ton, Costs per Ton and Adjusted EBITDA Margin per Ton are non-GAAP operating/statistical measures. Revenue per Ton and Adjusted EBITDA Margin per Ton are equal to revenue by segment and Adjusted EBITDA by segment, respectively, divided by segment tons sold. Costs per Ton is equal to Revenue per Ton less Adjusted EBITDA Margin per Ton. Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measure in the appendix.

38 Seaborne Thermal Life-Extension Opportunities • Exploring 4,125 acres immediately adjacent to Wilpinjong • Drilling program on track for completion in Q1 2024 • Two phase extension and approval process • Environmental assessments underway Wilpinjong • Revised mine plan extends current UG mine life through 2026 • South Wambo UG project assessment continues • Project holds over 70Mt+ of premium thermal & metallurgical coal reserves within existing approved mining lease Wambo Underground Wilpinjong Wambo

39 Seaborne Metallurgical Life-Extension Opportunities • Moorvale South extension • Targeting to develop 15Mt+ of metallurgical resource • Drilling program completed • Preparing project and environmental assessments CMJV • Commenced drilling program on metallurgical coal exploration lease • Peabody exploration lease to the West of existing operations • Initiated environmental and project assessments to facilitate the approval of the mining lease • Targeting first development coal production in 2029 Metropolitan CMJV Metropolitan

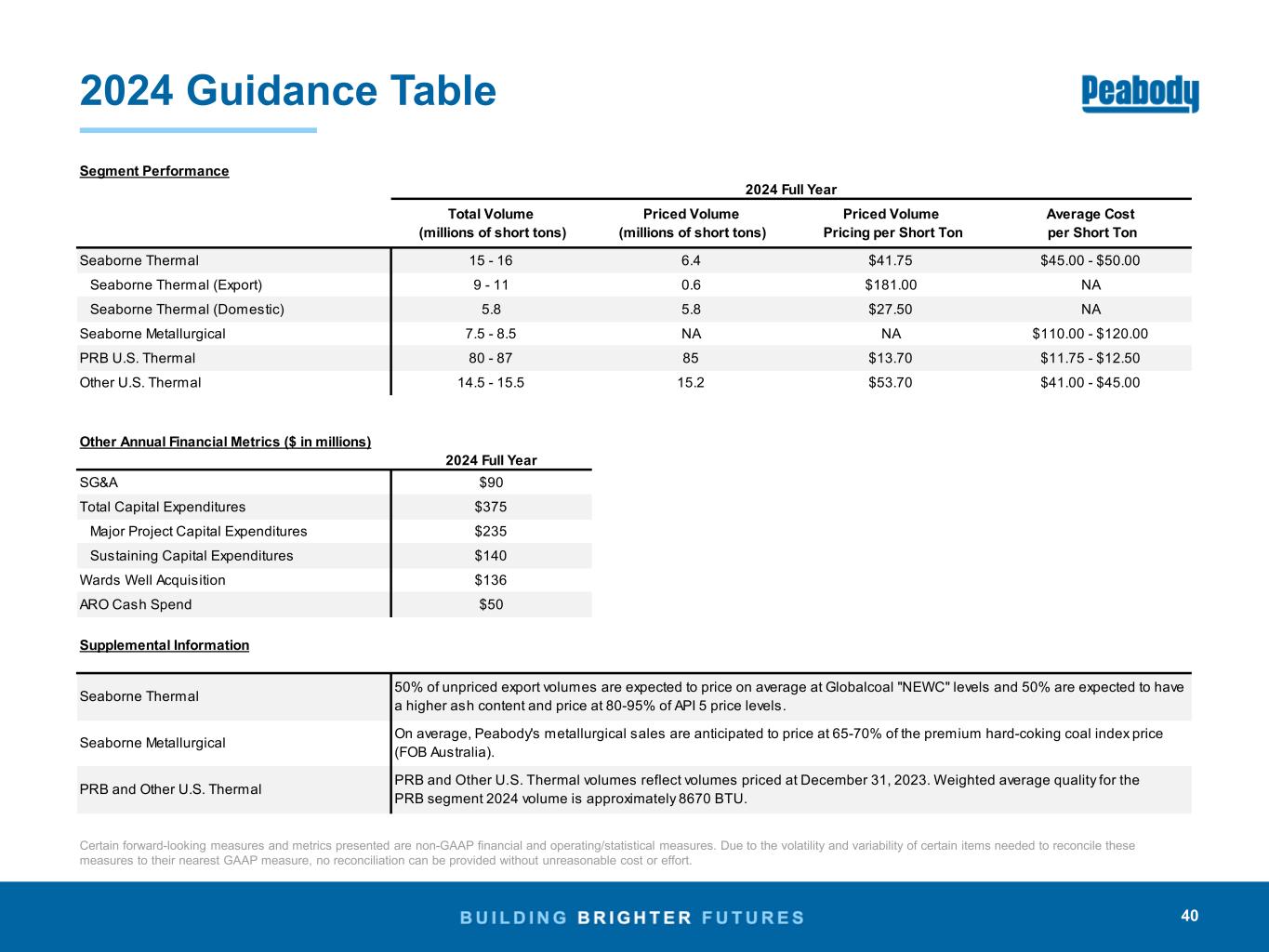

40 2024 Guidance Table Certain forward-looking measures and metrics presented are non-GAAP financial and operating/statistical measures. Due to the volatility and variability of certain items needed to reconcile these measures to their nearest GAAP measure, no reconciliation can be provided without unreasonable cost or effort. Segment Performance Seaborne Thermal 15 - 16 6.4 $41.75 $45.00 - $50.00 9 - 11 0.6 $181.00 NA 5.8 5.8 $27.50 NA 7.5 - 8.5 NA NA $110.00 - $120.00 80 - 87 85 $13.70 $11.75 - $12.50 14.5 - 15.5 15.2 $53.70 $41.00 - $45.00 2024 Full Year $90 $375 $235 $140 $136 $50 Seaborne Metallurgical PRB and Other U.S. Thermal Other U.S. Thermal Total Capital Expenditures Wards Well Acquisition ARO Cash Spend Supplemental Information Seaborne Thermal Other Annual Financial Metrics ($ in millions) SG&A 50% of unpriced export volumes are expected to price on average at Globalcoal "NEWC" levels and 50% are expected to have a higher ash content and price at 80-95% of API 5 price levels. On average, Peabody's metallurgical sales are anticipated to price at 65-70% of the premium hard-coking coal index price (FOB Australia). PRB and Other U.S. Thermal volumes reflect volumes priced at December 31, 2023. Weighted average quality for the PRB segment 2024 volume is approximately 8670 BTU. Major Project Capital Expenditures Sustaining Capital Expenditures Seaborne Thermal (Export) Seaborne Thermal (Domestic) Seaborne Metallurgical PRB U.S. Thermal 2024 Full Year Total Volume (millions of short tons) Priced Volume (millions of short tons) Priced Volume Pricing per Short Ton Average Cost per Short Ton

41 Reconciliation of Non-GAAP Measures Note: Refer to definitions and footnotes on slide 44. Year Ended Year Ended Year Ended Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Tons Sold (In Mill ions) Seaborne Thermal 15.5 Seaborne Metallurgical 6.9 Powder River Basin 87.2 Other U.S. Thermal 16.2 Total U.S. Thermal 103.4 Corporate and Other 0.4 Total 126.2 Revenue Summary (In Mill ions) Seaborne Thermal 1,329.7$ Seaborne Metallurgical 1,301.9 Powder River Basin 1,198.1 Other U.S. Thermal 888.2 Total U.S. Thermal 2,086.3 Corporate and Other 228.8 Total 4,946.7$ Total Reporting Segment Costs Summary (In Mill ions) (1) Seaborne Thermal 752.9$ Seaborne Metallurgical 863.8 Powder River Basin 1,044.4 Other U.S. Thermal 680.7 Total U.S. Thermal 1,725.1 Corporate and Other 11.6 Total 3,353.4$ Adjusted EBITDA (In Mill ions) (2) Seaborne Thermal 353.1$ 647.6$ 576.8$ Seaborne Metallurgical 178.2 781.7 438.1 Powder River Basin 134.9 68.2 153.7 Other U.S. Thermal 164.2 242.4 207.5 Total U.S. Thermal 299.1 310.6 361.2 Middlemount 48.2 132.8 13.2 Resource Management Results (3) 6.9 29.3 21.0 Sell ing and Administrative Expenses (84.9) (88.8) (90.7) Other Operating Costs, Net (4) 116.1 31.5 44.3 Adjusted EBITDA (2) 916.7$ 1,844.7$ 1,363.9$

42 Reconciliation of Non-GAAP Measures Note: Refer to definitions and footnotes on slide 44. Year Ended Year Ended Year Ended Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Reconcil iation of Non-GAAP Financial Measures (In Mill ions) Income from Continuing Operations, Net of Income Taxes 347.4$ 1,317.4$ 816.0$ Depreciation, Depletion and Amortization 308.7 317.6 321.4 Asset Retirement Obligation Expenses 44.7 49.4 50.5 Restructuring Charges 8.3 2.9 3.3 Asset Impairment - 11.2 2.0 Provision for NARM and Shoal Creek Losses - - 40.9 (33.8) (2.3) (1.6) Interest Expense 183.4 140.3 59.8 Net (Gain) Loss on Early Debt Extinguishment (33.2) 57.9 8.8 Interest Income (6.5) (18.4) (76.8) Net Mark-to-Market Adjustment on Actuarially Determined Liabil ities (43.4) (27.8) (0.3) Unrealized Losses (Gains) on Derivative Contracts Related to Forecasted Sales 115.1 35.8 (159.0) Unrealized Losses (Gains) on Foreign Currency Option Contracts 7.5 2.3 (7.4) Take-or-Pay Contract-Based Intangible Recognition (4.3) (2.8) (2.5) Income Tax Provision (Benefit) 22.8 (38.8) 308.8 Adjusted EBITDA (2) 916.7$ 1,844.7$ 1,363.9$ Operating Costs and Expenses 3,385.1$ Unrealized Gains on Foreign Currency Option Contracts 7.4 Take-or-Pay Contract-Based Intangible Recognition 2.5 Net Periodic Benefit Credit, Excluding Service Cost (41.6) Total Reporting Segment Costs (1) 3,353.4$ Net Cash Provided By Operating Activities 1,035.5$ - Net Cash Used In Investing Activities (342.6) - Distributions to Noncontroll ing Interests (59.0) +/- Changes to Restricted Cash and Collateral 90.2 - Anticipated Expenditures or Other Requirements - Available Free Cash Flow (5) 724.1$ Changes in Deferred Tax Asset Valuation Allowance and Reserves and Amortization of Basis Difference Related to Equity Affi l iates

43 Reconciliation of Non-GAAP Measures Note: Refer to definitions and footnotes on slide 44. Year Ended Year Ended Year Ended Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Segment Free Cash Flow (In Mill ions) Seaborne Thermal Adjusted EBITDA 353.1$ 647.6$ 576.8$ Less: Segment additions to property, plant, equipment and mine development (88.6) (38.8) (62.0) Total 264.5 608.8 514.8 Seaborne Metallurgical Adjusted EBITDA 178.2 781.7 438.1 Less: Segment additions to property, plant, equipment and mine development (25.1) (84.8) (186.4) Total 153.1 696.9 251.7 Powder River Basin Adjusted EBITDA 134.9 68.2 153.7 Less: Segment additions to property, plant, equipment and mine development (41.4) (59.1) (40.9) Total 93.5 9.1 112.8 Other U.S. Thermal Adjusted EBITDA 164.2 242.4 207.5 Less: Segment additions to property, plant, equipment and mine development (24.2) (35.3) (47.6) Total 140.0 207.1 159.9 Total U.S. Thermal Adjusted EBITDA 299.1 310.6 361.2 Less: Segment additions to property, plant, equipment and mine development (65.6) (94.4) (88.5) Total 233.5 216.2 272.7 Corporate and Other Adjusted EBITDA 86.3 104.8 (12.2) Less: Segment additions to property, plant, equipment and mine development (3.8) (3.5) (11.4) Total 82.5 101.3 (23.6) Consolidated Adjusted EBITDA 916.7 1,844.7 1,363.9 Less: Additions to property, plant, equipment and mine development (183.1) (221.5) (348.3) Total 733.6$ 1,623.2$ 1,015.6$

44 Reconciliation of Non-GAAP Measures: Definitions (1) (2) (3) (4) (5) Note: Management believes that non-GAAP performance measures are used by investors to measure our operating performance. These measures are not intended to serve as alternatives to U.S. GAAP measures of performance and may not be comparable to similarly-titled measures presented by other companies. Total Reporting Segment Costs is defined as operating costs and expenses adjusted for the discrete items that management excluded in analyzing each of our segment's operating performance as displayed in the reconcil iation above. Total Reporting Segment Costs is used by management as a component of a metric to measure each of our segment's operating performance. Adjusted EBITDA is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses and depreciation, depletion and amortization. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing each of our segment's operating performance as displayed in the reconcil iation above. Adjusted EBITDA is used by management as the primary metric to measure each of our segment's operating performance and allocate resources. Includes gains (losses) on certain surplus coal reserve and surface land sales and property management costs and revenue. Includes trading and brokerage activities; costs associated with post-mining activities; minimum charges on certain transportation-related contracts; costs associated with suspended operations including the Centurion Mine; a gain of $26.1 mill ion recognized on the sale of the Millennium Mine during 2021; and revenue of $25.9 mill ion related to the assignment of port and rail capacity during 2023. Available Free Cash Flow is defined as operating cash flow minus investing cash flow and distributions to noncontroll ing interests; plus/minus changes to restricted cash and collateral (excluding one-time effects of the recent surety agreement amendment) and other anticipated expenditures. Available Free Cash Flow is used by management as a measure of our abil ity to generate excess cash flow from our business operations.