Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

09 November 2023 - 1:12PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

BRASKEM S.A.

Corporate Taxpayer ID (CNPJ):

42.150.391/0001-70

Company Registry: 29.300.006.939

Publicly Held Company

MATERIAL FACT

Braskem S.A. (“Braskem”

or “Company”), in compliance with CVM Resolution 44/21, informs its shareholders and the market in general that it received

on November 8, 2023, correspondence sent by Adnoc International Limited - Sole Partnership L.L.C. (“ADNOC”) to Novonor S.A.

– Under Judicial Reorganization (“Novonor”) and to certain creditors holding the fiduciary lien of Braskem S.A. shares

owned by Novonor (“Financial Institutions”), containing a non-binding offer for the acquisition of the interest held by Novonor

in the Company (“Proposal”), as detailed below:

| (1) | In consideration of Novonor’s

38.3% equity interest in the Company, the payment of an Equity Value of R$10.5 billion and Novonor shall retain an economic equity interest

in the Company post-Closing up to 3% of the total shares currently issued by Braskem, which implies a value of R$37.29 per share. |

| (2) | The amount of R$10.5 billion

will be delivered by ADNOC directly to the Financial Institutions as follows: (i) 50% cash to be paid by ADNOC on Closing; and (ii) the

remaining 50% converted into US dollars, on the closing date of the transaction, and paid as a cash equivalent deferred payment senior

to ADNOC’s equity, with a maturity of 7 years, with annual coupons of 7.25% that are paid-in-kind until the end of the 3rd year

and paid in cash from the 4th year onwards. |

The Proposal is also conditioned,

among other usual conditions in transactions of this nature, to (i) satisfactory conclusion by ADNOC of Due Diligence; (ii) investigation

of possible additional liabilities arising from the event in Alagoas; (iii) no existence of unaccounted for or unreported material contingent

liabilities; (iv) alignment and conclusion of a new shareholders' agreement with Petróleo Brasileiro S.A. - Petrobras.

Braskem informs that it

will continue to support Shareholders and will keep the market informed about relevant developments, in compliance with applicable laws.

For more information, contact

Braskem's Investor Relations Department by calling +55 (11) 3576-9531 or emailing braskem-ri@braskem.com.br.

São Paulo, November

9, 2023.

Pedro van Langendonck Teixeira

de Freitas

Chief Financial and Investor

Relations Officer

Braskem S.A.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: November 9, 2023

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This Material Fact may contain forward-looking statements. These statements are not historical facts, but rather are based on the current

view and estimates of the Company's management regarding future economic and other circumstances, industry conditions, financial performance

and results, including any potential or projected impact regarding the geological event in Alagoas and related legal procedures on the

Company's business, financial condition and operating results. The words “project,” “believe,” “estimate,”

“expect,” “plan”, “objective” and other similar expressions, when referring to the Company, are used

to identify forward-looking statements. Statements related to the possible outcome of legal and administrative proceedings, implementation

of operational and financing strategies and investment plans, guidance on future operations, the objective of expanding its efforts to

achieve the sustainable macro objectives disclosed by the Company, as well as factors or trends that affect the financial condition, liquidity

or operating results of the Company are examples of forward-looking statements. Such statements reflect the current views of the Company's

management and are subject to various risks and uncertainties, many of which are beyond the Company’s control. There is no guarantee

that the events, trends or expected results will actually occur. The statements are based on various assumptions and factors, including,

but not limited to, general economic and market conditions, industry conditions and operating factors, availability, development and financial

access to new technologies. Any change in these assumptions or factors, including the projected impact from the joint venture and its

development of technologies, from the geological event in Alagoas and related legal procedures and the unprecedented impact on businesses,

employees, service providers, shareholders, investors and other stakeholders of the Company could cause effective results to differ significantly

from current expectations. For a comprehensive description of the risks and other factors that could impact any forward-looking statements

in this document, especially the factors discussed in the sections, see the reports filed with the Brazilian Securities and Exchange Commission

(CVM). This Notice to the Market does not constitute any offer of securities for sale in Brazil. No securities may be offered or sold

in Brazil without being registered or exempted from registration, and any public offer of securities carried out in Brazil must be made

through a prospectus, which would be made available by Braskem and contain detailed information on Braskem and its management, as well

as its financial statements.

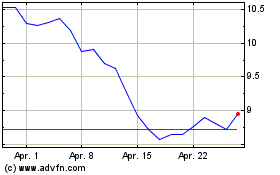

Braskem (NYSE:BAK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

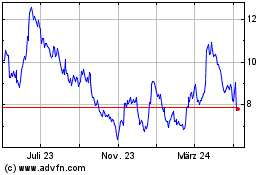

Braskem (NYSE:BAK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024