SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

BRASKEM S.A.

Corporate Taxpayer ID (CNPJ):

42.150.391/0001-70

Company Registry: 29.300.006.939

Publicly Held Company

MATERIAL FACT

PRODUCTION & SALES

REPORT

FOURTH QUARTER 2023 AND

2023

São Paulo, February

19, 2024 – Braskem S.A. (“Braskem” or “Company”) reports to its shareholders and the market its Production

& Sales Report for the fourth quarter and fiscal year of 2023. Note that the information herein is based on preliminary data and

that figures were not revised by the Company's independent auditor.

For more information, contact

Braskem’s Investor Relations Department by calling +55 (11) 3576-9531 or emailing braskem-ri@braskem.com.br.

Contents

| 1. OPERATIONAL OVERVIEW 4T23 |

2 |

| 2. PERFORMANCE BY SEGMENT |

2 |

| 2.1 BRAZIL/SOUTH AMERICA |

2 |

| 2.2 UNITED STATES & EUROPE |

5 |

| 2.3 MEXICO |

6 |

| 3. PETROCHEMICAL SPREADS |

8 |

| 1. | OPERATIONAL OVERVIEW 4T23 |

During 4Q23, most petrochemical

spreads in the international market increased compared to the previous quarter, albeit at historically low levels due to the industry's

cycle moment. The main positive highlights are: (i) the PE-ethane spread, which increased by 10% in the period due to the reduction in

the ethane price on the international market, impacting positively Mexico’s and partially Brazil's spreads; and (ii) the increase

in US propylene price, which benefited the profitability of producers with flexibility in purchasing propylene.

In relation to the operational

performance, the utilization rates of the Company's industrial units and the industry in general remained below the historical average

due to the imbalance between global supply and demand. Additionally, the utilization rate in Brazil was impacted by the scheduled maintenance

shutdown at the Bahia Petrochemical Complex. On the other hand, the recovery of production levels in Mexico was a positive highlight of

the quarter, which an unscheduled shutdown in the previous quarter had impacted.

In this scenario, the sales

volumes of the segments were impacted mainly by: (i) the effect of seasonality; (ii) the destocking process in the United States transformation

chain; and (iii) the inventory management in the US & Europe and Mexico segments.

Average utilization

rate of petrochemical crackers: reduction in relation to 3Q23 (-2 p.p.) and 4Q22 (-6 p.p.) is explained by: (i) the scheduled maintenance

shutdown in the petrochemical complex in Bahia, which lasted around 50 days; (ii) lower feedstock availability at the São Paulo

petrochemical complex due scheduled maintenance shutdown of the domestic supplier; and (iii) the production adjustment face to lower global

demand.

Compared to 2022, the

average utilization rate of petrochemical crackers was lower (-7 p.p.) mainly due to: (i) the production adjustment during the year in

the face of global demand lower growth; and (ii) the scheduled maintenance shutdown in Bahia in 4Q23.

Resin sales volume:

in the Brazilian market, resin sales were lower in relation to 3Q23 (-11%), mainly explained by: (i) the prioritization of sales with

higher added value; and (ii) the seasonality of the period. In relation to 4Q22, resin sales volume in the Brazilian market decreased

(-9%) due to the higher PE sales volume in the last quarter of 2022 due to higher demand in that period.

In the annual comparison,

resin sales volume in the Brazilian market was lower (-5%), mainly given the higher supply of products in the international market combined

with the prioritization of sales with higher added value.

The resin exports in

4Q23 were higher when compared to 3Q23 (+2%) and 4Q23 (+8%), mainly due to the PE and PP opportunities in South America.

In relation to 2022,

resin exports were lower (-3%) due to higher inventories in the global chain, impacting the product demand in the period.

Main

chemicals sales volume [1]:

in the Brazilian market, main chemicals sales were higher than in 3Q23 (+2%) due to normalization in the production of some customers

who conducted their scheduled shutdowns over the last few months. In relation to 4Q22, the reduction (-15%) is mainly explained by: (i)

the scheduled shutdowns of customers in 4Q23, especially by paraxylene customers; (ii) lower styrene demand; and (iii) lower gasoline

sales volume in the Brazilian market.

In the year 2023, the

main chemicals sales in the Brazilian market were inferior to 2022 (-17%) mainly due to: (i) the lower spreads for main chemicals in the

international market due to the imbalance between supply and global demand; and (ii) lower gasoline sales volume due lower product availability

for sale.

The exports decreased

(-9%) compared to 3Q23 due to the lower availability of products for sale caused by the scheduled maintenance shutdown in the petrochemical

complex in Bahia. In relation to 4Q22, the increase (+10%) is explained by higher gasoline sales volume in the international market due

to better opportunities in the international fuels market.

In the annual comparison,

main chemicals exports were higher (+7%) due to the increase in gasoline, benzene, and toluene sales volume due to better opportunities

in the international market.

[1] Main chemicals

refer to: ethylene, propylene, butadiene, cumene, gasoline, benzene, toluene and paraxylene due to the representation of these products

in the segment’s net revenue.

Average

utilization rate of green ethylene [2]: decrease in relation to 3Q23 (-46 p.p.) and

4Q22 (-34 p.p.) mainly due to ethanol supply restrictions in December caused by climate conditions in the region.

Compared to 2022, the

utilization rate of green ethylene decreased (-26 p.p.) due to the scheduled shutdown and the conclusion of the operations ramp-up process

of the expansion project by 30% of the production capacity of the green ethylene unit in Rio Grande do Sul complex.

Green PE

sales volume: increase compared to 3Q23 (+17%) mainly explained by: (i) the higher availability

of product for sale due to the Green PE inventory replenishment process, after completion of the green ethylene production capacity expansion

project; and (ii) the increase in demand in the period, related to the seasonality of some customers.

In relation to 4Q22 and the

year 2022, the sales volume of Green PE decreased (-10% and -13%), given the lower availability of product for sale due to the scheduled

maintenance shutdown and the conclusion of the ramp-up process of the 30% expansion project of the current production capacity of the

green ethylene unit in the Rio Grande do Sul complex.

[2] Due to the conclusion

of the project to expand in 30% green ethylene capacity at the Rio Grande do Sul unit, the calculation of the utilization rate for 4Q22

considers the production capacity of 200 kt/year, and for 3Q23 and 4Q23 considers the production capacity of 260 kt/year.

| 2.2 | UNITED STATES & EUROPE |

Average utilization

rate of PP plants: remained in line with 3Q23. Increased (+7 p.p.) when compared to 4Q22 mainly explained by: (i) lower utilization

rate in 4Q22 due to the adjustments of production volume to inventory levels and demand in the United States converters chain; and (ii)

PP inventory build-up during the quarter considering the scheduled maintenance shutdown at Oyster Creek in the United States expected

for 1Q24.

In the annual comparison,

the utilization rate remained in line with 2022.

PP sales volume: lower

when compared to 3Q23 (-6%) due to lower demand in the regions, mainly explained by: (i) the seasonality of the period; and (ii) the destocking

process in the converter chain in the United States. In relation to 4Q22, the PP sales volume remained in line.

Compared to 2022, PP sales volume

remained in line.

Average utilization

rate of PE plants: increased in relation to 3Q23 (+18 p.p.) mainly explained by the production resumption after the unscheduled shutdown

in 3Q23. In relation to 4Q22, the increase (+15 p.p.) is explained by the production normalization due to the higher availability of feedstock.

In 4Q23, the average ethane

supply by Pemex was around 35 thousand barrels per day, above the minimum volume established in the contract, and the average ethane import

through Fast Track was around 18 thousand barrels per day.

In 2023, the utilization

rate was higher (+4 p.p.) compared to 2022, explained mainly by higher ethane supply by Pemex during the year, representing an increase

of 16% (around 4,5 thousand barrels per day) compared to 2022.

PE sales volume: decreased

compared to 3Q23 (-17%) and remained in line with 4Q22, mainly due to inventory rebuilding and the seasonality of the period.

Compared to 2022, the increase

in sales volume (+5%) in 2023 is explained mainly by the higher availability of products for sale due to the higher utilization rate in

the period.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: February 19, 2024

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This Material Fact may contain forward-looking statements. These statements are not historical facts but rather are based on the current

view and estimates of the Company's management regarding future economic and other circumstances, industry conditions, financial performance,

and results, including any potential or projected impact regarding the geological event in Alagoas and related legal procedures on the

Company's business, financial condition, and operating results. The words “project,” “believe,” “estimate,”

“expect,” “plan,” “objective,” and other similar expressions, when referring to the Company, are used

to identify forward-looking statements. Statements related to the possible outcome of legal and administrative proceedings, implementation

of operational and financing strategies and investment plans, guidance on future operations, the objective of expanding its efforts to

achieve the sustainable macro-objectives disclosed by the Company, as well as factors or trends that affect the financial condition, liquidity

or operating results of the Company are examples of forward-looking statements. Such statements reflect the current views of the Company's

management and are subject to various risks and uncertainties, many of which are beyond the Company’s control. There is no guarantee

that the events, trends, or expected results will actually occur. The statements are based on various assumptions and factors, including,

but not limited to, general economic and market conditions, industry conditions and operating factors, availability, development, and

financial access to new technologies. Any change in these assumptions or factors, including the projected impact from the joint venture

and its development of technologies, from the geological event in Alagoas and related legal procedures, and the unprecedented impact on

businesses, employees, service providers, shareholders, investors, and other stakeholders of the Company could cause effective results

to differ significantly from current expectations. For a comprehensive description of the risks and other factors that could impact any

forward-looking statements in this document, especially the factors discussed in the sections, see the reports filed with the Brazilian

Securities and Exchange Commission (CVM). This Material Fact does not constitute any offer of securities for sale in Brazil. No securities

may be offered or sold in Brazil without being registered or exempted from registration, and any public offer of securities carried out

in Brazil must be made through a prospectus, which would be made available by Braskem and contain detailed information on Braskem and

its management, as well as its financial statements.

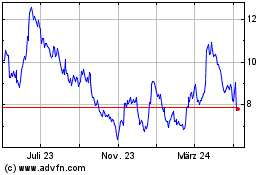

Braskem (NYSE:BAK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

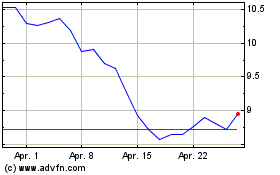

Braskem (NYSE:BAK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024