SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

São

Paulo, May 16, 2023.

To

Securities and Exchange Commission

of Brazil (CVM)

At.: Superintendent

of Company Relations (SEP)

Company Oversight

Department 1 (GEA-1)

Re: Official Letter 153/2023/CVM/SEP/GEA-1

- Braskem - Request for clarification on media report

Dear Sirs,

We refer to Official

Letter 153/2023/CVM/SEP/GEA-1 ("Official Letter"), dated May 15, 2023, in which you requested clarifications from Braskem S.A.

("Braskem" or "Company"), as transcribed below:

“Dear

Sirs,

1.

We refer to news report published on May 12, 2023, in the Folha de São Paulo news portal entitled: "Braskem's controllers

reject Arab offer", informing the following:

The proposal to buy

Braskem made by the Apollo fund and by the Arab state-owned Adnoc did not pass through the sieve of Novonor (former Odebrecht) nor through

the leadership of Petrobras. Shareholders have already sent messages to the Arabs and the Apollo fund that they are evaluating other possibilities.

For the controlling

shareholders, the final value of the offer would yield shareholders something between R$27 and R$30 per share. This is because the proposed

value of R$47 per share is not the net value of the operation.

In detail, only R$

20 per share will be paid in cash. The rest (R$27) will be paid as follows: R$20 per share with perpetual debentures (debt securities)

issued by the bidders corrected at 4% per year; and another R$7 per share in cash but depending on Braskem's performance in the new management.

In the evaluation

of the shareholders, the value of the debentures in the negotiation period would be eroded by Selic (13.75% per year) and to receive

the extra R$7, the company's stock would need to be at R$70, something considered impractical.

1

Therefore, the two

main shareholders - Novonor (which holds a little more than 50% of the shares) and Petrobras (38%) - don't even want to sit at the negotiation

table.

2.

In view of the above, we request a statement from the Company about the veracity of the report and, if it is, explain why the Company

believed this was not a Material Fact and also provide any other information deemed important on the subject.”

In this regard,

Braskem reinforces that it does not conduct any negotiations of its shareholder Novonor about the sale of its equity interest, reason

why it questioned its shareholder, who informed the following:

“In response to

the requested clarifications, Novonor informs that, since our last manifestations and until the present moment, it has not received any

proposal from potential interested parties that implies material or binding evolution in the discussions it has been holding with the

Banks holding the Fiduciary Alienation of its indirectly participation in Braskem S.A.

We remain at your disposal

for any further clarifications.”

Being

what we had for the moment, we subscribe, making ourselves available for further clarifications if necessary.

São Paulo, May 16, 2023.

Pedro van Langendonck Teixeira de Freitas

Chief Financial and Investor Relations

Officer

Braskem S.A.

2

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: May 16, 2023

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

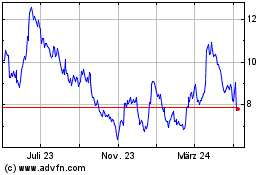

Braskem (NYSE:BAK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

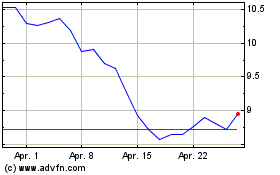

Braskem (NYSE:BAK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024