0000040729false00000407292024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 7, 2024

Date of Report (Date of earliest event reported)

Commission file number: 1-3754

Ally Financial Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 38-0572512 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

Ally Detroit Center

500 Woodward Avenue, Floor 10

Detroit, Michigan 48226

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | ALLY | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 7, 2024, Ally Financial Inc. (Ally) held its annual meeting of stockholders (Annual Meeting). The results of voting on matters brought before stockholders are shown below.

Proposal 1 — Election of directors

| | | | | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker

Non-Votes |

| Franklin W. Hobbs | 243,732,242 | | | 12,446,334 | | | 200,044 | | | 16,321,903 |

| Kenneth J. Bacon | 249,272,623 | | | 6,930,489 | | | 175,508 | | | 16,321,903 |

| William H. Cary | 254,226,883 | | | 1,971,990 | | | 179,747 | | | 16,321,903 |

| Mayree C. Clark | 246,263,560 | | | 9,924,828 | | | 190,232 | | | 16,321,903 |

| Kim S. Fennebresque | 218,195,182 | | | 36,105,243 | | | 2,078,195 | | | 16,321,903 |

| Thomas P. Gibbons | 255,573,955 | | | 609,464 | | | 195,201 | | | 16,321,903 |

| Melissa Goldman | 254,798,749 | | | 1,409,883 | | | 169,988 | | | 16,321,903 |

| Marjorie Magner | 246,111,184 | | | 10,077,934 | | | 189,502 | | | 16,321,903 |

| David Reilly | 255,005,943 | | | 1,193,249 | | | 179,428 | | | 16,321,903 |

| Brian H. Sharples | 255,101,769 | | | 1,099,134 | | | 177,717 | | | 16,321,903 |

| Michael G. Rhodes | 255,393,070 | | | 806,229 | | | 179,321 | | | 16,321,903 |

Proposal 2 — Advisory vote on executive compensation

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| 233,755,681 | | 22,347,879 | | 275,060 | | 16,321,903 |

Proposal 3 — Ratification of the Audit Committee's engagement of Deloitte & Touche LLP as the Company's independent registered public accounting firm for 2024

| | | | | | | | | | | | | | |

| For | | Against | | Abstain |

| 261,634,102 | | 10,916,816 | | 149,605 |

Item 7.01 Regulation FD Disclosure.

On May 7, 2024, Ally’s Chief Executive Officer (CEO) provided remarks during Ally's Annual Meeting. A transcript of the CEO’s remarks is attached hereto as Exhibit 99.1. The information in this Item 7.01 and Exhibit 99.1 is being furnished and is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section.

Item 9.01 Exhibits.

| | | | | |

Exhibit No. | Description of Exhibits |

| |

| 99.1 | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ally Financial Inc. (Registrant) | |

| | | | |

| | | | |

| Dated: | May 9, 2024 | | /s/ Jeffrey A. Belisle | |

| | | Jeffrey A. Belisle | |

| | | Corporate Secretary | |

CEO Remarks - 2024 Annual Meeting

Good morning, everyone. I want to thank you all for being here today at Ally’s 2024 annual meeting and the first under my leadership. It is an honor to address you as the new CEO of Ally Financial.

I have long admired Ally from a distance; becoming Ally’s CEO is an amazing and rare opportunity and I’m thankful to have the chance to serve.

I joined the company on April 29th, about one week ago, and since then I’ve been surrounded by teammates who have been so welcoming and helpful as I settle into my new chair.

While I’ve only been here a short time, it is abundantly clear that our purpose driven culture is deeply engrained in all facets of our organization. It is our “Do it Right” mantra and LEAD core values that guide our decisions and actions on how to best serve our customers, employees and communities.

I have tremendous respect for Ally’s “Do it Right” culture and legacy – it’s built on trust, integrity, and excellence.

Our foundation is solid.

We have two market leading franchises in Dealer Financial Services and Ally Bank, and a comprehensive suite of products and offerings that are customer centric, differentiated, and innovative.

Our balance sheet is strong.

90% of our funding is made up of consumer deposits, making it a stable and efficient profile. We have total available liquidity1 that is nearly 6 times our uninsured deposit balances, and strong capital levels with $3.8 billion of excess above required minimums.

It is our culture of customer obsession and strong balance sheet foundation that gives me confidence that we are well positioned to continue delivering strong, sustainable returns.

Last month marked 10 years since Ally’s IPO and while there are many wins to celebrate, I’ll just name a few that impress me as incoming CEO and excite me about the future at Ally. Since 2014:

•We’ve added 4 million consumer customers

•Increased retail deposits by nearly $100 billion; and

•Successfully transitioned from a captive automotive finance company to a leading, independent full spectrum lender.

The multi-year transformation this team has executed is remarkable and positions Ally to be a structurally more profitable company going forward.

As we embark on this journey together, I am filled with gratitude and a deep sense of responsibility. The operating environment is evolving rapidly, and it’s important that we continue to adapt and remain innovative to stay ahead.

During the onboarding process I plan to lean into Ally’s culture of collaboration and innovation.

I’ll start by listening and learning as I look forward to building strong relationships with my teammates.

Each and every one of our teammates plays a crucial role in our success, and I am committed to empowering our talented team, made up of diverse perspectives, to unleash their full potential.

As such, we will continue investing in our people, providing them with the tools and resources they need to thrive.

We must also remain steadfast in our commitment to our LEAD core values.

We must always prioritize the evolving needs of our customers, earning their trust and loyalty each and every day.

We must remain committed and focused on giving back to the communities in which we live and work. In 2023, our engaged workforce volunteered over 60,000 hours, a record for us. We also matched our employees’ donations of time and dollars resulting in nearly $2 million being invested into our communities.

And the Ally Charitable Foundation provided nearly $7 million to multiple causes, including $1.5 million to support three key initiatives here in Detroit in collaboration with Local Initiatives Support Corporation.

Maintaining a culture of disciplined risk management is also critical to our long-term success. Integrity, transparency, and accountability are non-negotiables.

1 Total available liquidity defined as cash and cash equivalents, FHLB unused pledged borrowing capacity, unencumbered highly liquid securities, and FRB Discount Window pledged capacity.

Ensuring we have robust controls in place and continuing to ‘See Around Corners’ are critical to delivering strong operational and financial results…and are required to grow.

We will leverage technology and our deep-rooted digital DNA to enhance the customer experience and drive efficiency.

We’ll build on the momentum we’ve created with a brand that matters. In 2023 our brand value grew 32% and we reached all-time highs in brand awareness, consideration, and trust. Ours is a brand that truly serves customers and communities by doing it right.

Before I wrap up, I would like to thank the board of directors for placing your trust in me to lead Ally, and for your guidance and support.

I’d also like to thank the Executive Council for their support during these early days, and a special thank you to Doug for making this a seamless transition.

To every one of my Ally teammates, thank you for your trust, your commitment, and your passion. Together, we will write the next chapter in our company’s evolution.

And lastly, I’d like to thank you, our shareholders for your continued support of Ally. I am incredibly optimistic about our future. We are going to remain focused on driving long-term shareholder value through consistent execution of our strategic priorities.

Forward-Looking Statements and Additional Information

The foregoing remarks and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the foregoing remarks or related communication.

The foregoing remarks and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as statements about the outlook for financial and operating metrics and performance and future capital allocation and actions. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future.

Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings.

Unless the context otherwise requires, the following definitions apply. The term “loans” means the following consumer and commercial products associated with our direct and indirect financing activities: loans, retail installment sales contracts, lines of credit, and other financing products excluding operating leases. The term “operating leases” means consumer- and commercial-vehicle lease agreements where Ally is the lessor and the lessee is generally not obligated to acquire ownership of the vehicle at lease-end or compensate Ally for the vehicle’s residual value. The terms “lend,” “finance,” and “originate” mean our direct extension or origination of loans, our purchase or acquisition of loans, or our purchase of operating leases as applicable. The term “consumer” means all consumer products associated with our loan and operating-lease activities and all commercial retail installment sales contracts. The term “commercial” means all commercial products associated with our loan activities, other than commercial retail installment sales contracts. The term “partnerships” means business arrangements rather than partnerships as defined by law.

v3.24.1.u1

Document and Entity Information Document

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity File Number |

1-3754

|

| Entity Registrant Name |

Ally Financial Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

38-0572512

|

| Entity Address, Address Description |

Ally Detroit Center

|

| Entity Address, Address Line One |

500 Woodward Avenue

|

| Entity Address, Address Line Two |

Floor 10

|

| Entity Address, City or Town |

Detroit

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48226

|

| City Area Code |

866

|

| Local Phone Number |

710-4623

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

ALLY

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000040729

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionDescription of the kind of address for the entity, if needed to distinguish more finely among mailing, principal, legal, accounting, contact or other addresses.

| Name: |

dei_EntityAddressAddressDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

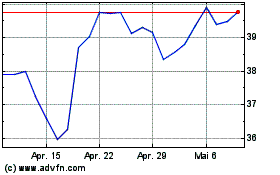

Ally Financial (NYSE:ALLY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

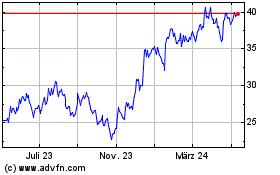

Ally Financial (NYSE:ALLY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024