false

--12-31

0000075340

false

0000075340

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2023

P&F INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

1-5332 |

22-1657413 |

| (State or Other Jurisdiction |

(Commission File No.) |

(IRS Employer |

| of Incorporation) |

|

Identification Number) |

445 Broadhollow Road, Suite 100, Melville,

New York 11747

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code:

(631) 694-9800

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, $1.00 Par Value |

|

PFIN |

|

NASDAQ Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

This Current Report on Form 8-K is being filed

in connection with the closing on December 20, 2023 of the transactions contemplated by that certain Agreement and Plan of Merger (the

“Merger Agreement”), by and among P & F Industries, Inc., a Delaware corporation (the “Company”),

Tools AcquisitionCo, LLC, a Delaware limited liability company (“Parent”), and Tools MergerSub, Inc., a Delaware corporation

and a wholly owned subsidiary of Parent (“Merger Sub”) and a wholly owned subsidiary of Parent (“Merger Sub”).

Pursuant to the terms and conditions set forth in the Merger Agreement, on December 20, 2023, Merger Sub merged with and into the Company

(the “Merger”), with the Company continuing as the surviving corporation (the “Surviving Corporation”).

As a result of the Merger, the Company became a wholly owned subsidiary of Parent..

| Item 1.02. |

Termination of a Material Definitive Agreement. |

Concurrently with the consummation of the Merger,

the Company terminated the Second Amended and Restated Loan and Security Agreement, dated April 5, 2017, by and among the Company, Florida

Pneumatic Manufacturing Corp. (“Florida Pneumatic”), Hy-Tech Machine, Inc. (“Hy-Tech”), ATSCO Holdings

Corp. (“ATSCO”), Jiffy Air Tool, Inc. (formerly known as Bonanza Holdings Corp.) (“Jiffy”), Bonanza

Properties Corp. (“Bonanza”), Continental Tool Group, Inc. (“Continental”), Countrywide Hardware,

Inc. (“Countrywide”), Embassy Industries, Inc. (“Embassy”), Exhaust Technologies, Inc. (“Exhaust”),

Green Manufacturing, Inc. (“Green Manufacturing”), Pacific Stair Products, Inc. (“Pacific Stair”), WILP Holdings,

Inc. (“WILP”), Woodmark International, L.P. (“Woodmark”), and Capital One, National Association

(“Capital One”), as amended (the “Credit Agreement”). All amounts owed under the Credit Agreement

were repaid, satisfied and discharged in full.

| Item 2.01. |

Completion of Acquisition or Disposition of Assets. |

On December 20, 2023, Parent consummated its acquisition

of the Company pursuant to the terms of the Merger Agreement.

At the effective time of the Merger, each share

of the common stock, par value $1.00 per share, of the Company (the “Company Common Stock”) issued and outstanding

immediately prior to the effective time (other than shares held by the Company or held, directly or indirectly, by Parent or Acquisition

Sub, which were cancelled automatically or that are owned by stockholders who have perfected and not withdrawn a demand for appraisal

rights pursuant to Delaware law, which were converted into the right to receive such consideration as they shall be due in accordance

with Delaware law) was automatically canceled and converted into the right to receive $13.00 in cash, without interest and subject to

any applicable withholding taxes (the “Per-Share Amount”). As of the effective time of the Merger, (a) each option

to purchase shares of Company Common Stock that is outstanding immediately prior to the effective time of the Merger (a “Company

Option”), whether vested or unvested, was canceled and terminated in exchange for the right to receive an amount in cash, without

interest, equal to the product of (x) the total number of shares of Company Common Stock subject to, and outstanding under, such Company

Option and (y) the excess of the Per-Share Amount over the applicable per share exercise price, subject to any applicable withholding

or other taxes or other amounts required by applicable law to be withheld; provided, that if the per share exercise price of Company

Common Stock underlying a Company Option was equal to or greater than the Per-Share Amount, such Company Option was canceled without any

cash payment or other consideration being made in respect thereof; and (b) any vesting conditions or restrictions applicable to each restricted

share of Company Common Stock outstanding immediately prior to the effective time of the Merger (a “Company Restricted Share”)

lapsed, and each holder of Company Restricted Share became entitled to receive an amount in cash equal to the product of (x) the total

number of shares of Company Common Stock subject to such Company Restricted Share and (y) the Per-Share Amount, subject to any applicable

withholding or other taxes or other amounts required by applicable law to be withheld. The merger price was funded by ShoreView through

equity financing from Shoreview Capital Partners IV, L.P. (the “Equity Financing”) and debt financing from RCS SBIC

Fund II, L.P., Northstar Mezzanine Partners VIII L.P. and Northstar Mezzanine Partners SBIC, L.P. (the “Debt Financing”).

The foregoing description of the Merger Agreement

and the Merger are qualified in their entirety by reference to the full text of the Merger Agreement, a copy of which is attached as Exhibit

2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”)

on October 13, 2023, and is incorporated herein by reference.

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

In connection with the closing of the Merger,

the Company notified the Nasdaq Stock Market (“NASDAQ”) on December 20, 2023 that the Merger became effective and requested

that NASDAQ file with the Securities and Exchange Commission (the “SEC”) an application on Form 25 to delist and deregister

the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Trading of the

Company Common Stock on NASDAQ was suspended during the day on December 20, 2023. The Form 25 will become effective ten days after its

filing. After the Form 25 becomes effective, the Company will file a Form 15 with the SEC to terminate its reporting obligations under

the Exchange Act.

| Item 3.03. |

Material Modifications to Rights of Security Holders. |

The information set forth in Items 2.01 and 5.03(a) and (b) is incorporated

herein by reference.

As of the effective time of the Merger, the Company’s

shareholders immediately prior to such effective time ceased to have any rights as shareholders of the Company (other than their right

to receive the applicable merger consideration).

| Item 5.01. |

Changes in Control of Registrant. |

The information set forth in Item 2.01 and Item

5.02(d) is incorporated herein by reference.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d) As of the effective time of the Merger, pursuant

to the terms of the Merger Agreement, Peter Zimmerman, Thomas D’Ovidio, Madeleine Shumaker, David Wakefield and Tim Ristoff became

the members of the board of directors of the Company, replacing the prior members of the board.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws. |

At the effective time of the Merger, the certificate

of incorporation of the Company and the by-laws of the Company were each amended and restated in their entirety as set forth in Exhibits

3.1 and 3.2 hereto, respectively, which are incorporated by reference herein.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

On December 19, 2023, the Company held a special

meeting of stockholders (the “Special Meeting”) to consider certain proposals related to the Merger Agreement. More

information on each of these proposals is contained in the Company’s definitive proxy statement for the Special Meeting filed with

the SEC on November 17, 2023.

As of November 13, 2023, the record date for the

Special Meeting, there were 3,194,699 shares of common stock outstanding and entitled to vote, each of which was entitled to one vote

on each proposal at the Special Meeting. At the Special Meeting, holders of 2,764,227 shares of common stock, representing approximately

86.5% of the outstanding shares of common stock entitled to vote, were present in person or by proxy, which constituted a quorum to conduct

business.

At the Special Meeting, the following proposals

were considered and voted on, each of which was approved by the requisite vote of the Company’s stockholders. The vote for each

proposal was as follows:

1. Proposal to approve and adopt the Merger Agreement (the “Merger

Agreement Proposal”)

Holders of Company Common Stock:

| |

|

|

|

|

| For |

|

Against |

|

Abstain |

| 2,762,243 |

|

588 |

|

1,396 |

Holders of Company Common Stock (other than Richard A. Horowitz):

| |

|

|

|

|

| For |

|

Against |

|

Abstain |

| 1,317,325 |

|

552 |

|

1,309 |

2. Proposal to approve, by non-binding advisory

vote, compensation that will or may become payable by the Company to its named executive officers in connection with the Merger.

Holders of Company Common Stock:

| |

|

|

|

|

| For |

|

Against |

|

Abstain |

| 2,421,251 |

|

301,711 |

|

41,263 |

Because the Merger Agreement Proposal was approved,

a proposal to adjourn the Special Meeting to a later date or dates to solicit additional proxies if there were insufficient votes to approve

and adopt the Merger Agreement Proposal at the time of the Special Meeting was not needed and, therefore, no vote was taken on that proposal.

On December 20, 2023, the Company issued a press

release in connection with the completion of the Merger. The full text of the press release is attached hereto as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

P & F INDUSTRIES, INC. |

| |

|

|

| Date: December 20, 2023 |

|

|

| |

|

|

| |

By: |

/s/ Thomas D’Ovidio |

| |

|

Thomas D’Ovidio

Vice President, Assistant Treasurer and Assistant Secretary |

Exhibit 3.1

STATE OF DELAWARE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

P &

F INDUSTRIES, INC.

ARTICLE 1

NAME

The name of the Corporation

is “P & F Industries, Inc.”

ARTICLE 2

ADDRESS OF REGISTERED AGENT

The address of the Corporation’s

registered office in the State of Delaware is at 251 Little Falls Drive, Wilmington, Delaware 19808, County of New Castle. The name of

its registered agent at such address is Corporation Service Company.

ARTICLE 3

PURPOSE

The purpose of the Corporation

is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware

(the “DGCL”).

ARTICLE 4

CAPITAL STOCK

4.1 Designation

and Amount. The total number of shares of stock which the Corporation has authority to issue is One Hundred (100) shares of Common

Stock with a par value of $0.01 per share.

4.2 Common

Stock.

(a) Rights

of the Common Stock. The holders of the Common Stock shall share ratably in proportion to the number of shares of Common Stock held

by each such holder in any dividend paid or declared by the Corporation with respect to the Common Stock; provided, however, that in the

case of dividends or distributions of shares of Common Stock, such dividends or distributions may be made by payment of shares of Common

Stock to holders of Common Stock. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation,

the remaining assets of the Corporation shall be distributed ratably among the holders of the Common Stock in proportion to the number

of shares held by each such holder.

(b) Voting

Rights. Except as otherwise provided by the DGCL, by this Certificate of Incorporation or any amendments thereto, all of the voting

power of the Corporation shall be vested in the holders of the Common Stock, and each holder of Common Stock shall have one (1) vote

for each share of Common Stock held by such holder on all matters voted upon by the stockholders of the Corporation. There shall be no

cumulative voting. The number of authorized shares of Common Stock may be increased or decreased (but not below the number of shares thereof

then outstanding) by the affirmative vote of the holders of shares of capital stock of the Corporation representing a majority of the

votes represented by all outstanding shares of capital stock of the Corporation entitled to vote.

ARTICLE 5

EXISTENCE

The Corporation is to have perpetual existence.

ARTICLE 6

BYLAWS

In furtherance and not in

limitation of the powers conferred by the laws of the State of Delaware, subject to any vote required by this Certificate of Incorporation,

the Board of Directors is expressly authorized and empowered to adopt, amend or repeal the Bylaws of the Corporation in any respect not

inconsistent with the laws of the State of Delaware or this Certificate of Incorporation; provided, however, that the fact that such power

has been conferred upon the Board of Directors shall not divest the stockholders of the power and authority, nor limit the power of stockholders

to adopt, amend or repeal the Bylaws as provided therein.

ARTICLE 7

MEETINGS OF STOCKHOLDERS

Meetings of stockholders may

be held within or without the State of Delaware, as the Bylaws of the Corporation may provide. The books of the Corporation may be kept

outside the State of Delaware at such place or places as may be designated from the time to time by the board of directors or in the Bylaws

of the Corporation. Election of directors need not be by written ballot unless the Bylaws of the Corporation so provide.

ARTICLE 8

EXCULPATION

To the fullest extent permitted

by law, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach

of fiduciary duty as a director. If the DGCL hereafter is amended to authorize the further elimination or limitation of the liability

of directors, then the liability of directors of the Corporation shall be eliminated or limited to the fullest extent authorized by the

DGCL, as so amended. Any repeal or modification of this Article 8 shall not increase the personal liability of any director

of the Corporation for any act or occurrence taking place prior to such repeal or modification or otherwise adversely affect any right

or protection of a director of the Corporation existing at the time of such repeal or modification.

ARTICLE 9

INDEMNIFICATION

9.1 Right

to Indemnification. Each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any

threatened, pending or completed action, investigation, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter

a “proceeding”), by reason of the fact that he or she is or was a director of the Corporation or is or was serving

at the request of the Corporation as a director of another corporation or as a director or manager of a limited liability company, partnership,

joint venture, trust or other enterprise, including service with respect to an employee benefit plan (hereinafter an “indemnitee”),

whether the basis of such proceeding is an alleged action in an official capacity as a director or manager or in any other capacity while

serving as a director or manager, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the DGCL,

as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits

the Corporation to provide broader indemnification rights than permitted prior thereto), against all cost, expense, liability and loss

(including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred

or suffered by such indemnitee in connection therewith and such indemnification shall continue as to an indemnitee who has ceased to be

a director or manager and shall inure to the benefit of the indemnitee’s heirs, executors and administrators; provided, however,

that, except as provided in Section 9.3 with respect to proceedings to enforce rights to indemnification, the Corporation

shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding

(or part thereof) was authorized by the board of directors of the Corporation.

9.2 Right

to Advancement of Expenses. Any person entitled to indemnification pursuant to Section 9.1 shall also be reimbursed by

the Corporation for all expenses incurred in defending or preparing to defend any proceeding for which such right to indemnification is

applicable, in advance of its final disposition (hereinafter an “advancement of expenses”); provided, however,

that, if the DGCL requires, an advancement of expenses shall be made only upon delivery to the Corporation of an undertaking by or on

behalf of such director to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there

is no further right to appeal (hereinafter a “final adjudication”) that such indemnitee is not entitled to be indemnified

for such expenses under this Article 9 or otherwise.

9.3 Right

of Indemnitee to Bring Suit. The rights to indemnification and to the advancement of expenses conferred in Sections 9.1 and

9.2 shall be contract rights between the Corporation and each director. Any repeal or modification of this Article 9 shall

not affect any rights or obligations then existing with respect to any state of facts or proceeding then existing. If a claim under Section 9.1

or 9.2 is not paid in full by the Corporation within sixty (60) days after a written claim has been received by the Corporation,

except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty (20) days, the indemnitee

may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in

part in any such suit, or in a suit brought by the Corporation to recover an advancement of expense pursuant to the terms of an undertaking,

the indemnitee shall be entitled to be paid also the expense of prosecuting or defending such suit. In (a) any suit brought by the

indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to enforce a right to an advancement

of expenses) it shall be a defense that, and (b) in any suit by the Corporation to recover an advancement of expenses pursuant to

the terms of an undertaking the Corporation shall be entitled to recover such expenses upon a final adjudication that, the indemnitee

has not met the applicable standard for indemnification set forth in the DGCL. Neither the failure of the Corporation (including its board

of directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such suit that

indemnification of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set

forth in the DGCL, nor an actual determination by the Corporation (including its board of directors, independent legal counsel or its

stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption that the indemnitee has

not met the applicable standard of conduct or, in the case of such a suit brought by the indemnitee, be a defense to such a suit. In any

suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder, or by the Corporation

to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that the indemnitee is not entitled

to be indemnified, or to such advancement of expenses, under this Article 9 or otherwise shall be on the Corporation.

9.4 Non-Exclusivity

of Rights. The rights to indemnification and to the advancement of expenses conferred in this Article 9 shall not be exclusive

of any other right which any person may have or hereafter acquire under any statute, this Certificate of Incorporation, any bylaw, agreement,

vote of stockholders or disinterested directors or otherwise.

9.5 Witnesses.

To the extent that any director of the Corporation is by reason of such position, or a position with another entity at the request of

the Corporation, a witness in any proceeding, he shall be indemnified against all costs and expenses actually and reasonably incurred

by him or on his behalf in connection therewith.

9.6 Insurance.

The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation

or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the

Corporation would have the power to indemnify such person against such expense, liability or loss under this Article 9 or

the DGCL.

9.7 Indemnification

of Employees and Agents of the Corporation. The Corporation may, to the extent authorized from time to time by the Board of Directors,

grant rights to indemnification, and to the advancement of expenses to any officer, employee or agent of the Corporation, or to any person

serving at the request of the Corporation as an officer, employee or agent of another corporation or of a partnership, joint venture,

trust or other enterprise, including service with respect to an employee benefit plan, to the fullest extent of the provisions of this

Article 9 with respect to the indemnification and advancement of expenses of directors of the Corporation.

9.8 Priority.

The Corporation hereby acknowledges that the directors (collectively, the “Shoreview Directors”) that are employees

of Shoreview Capital Partners IV, L.P. or one if its affiliates (collectively, “Shoreview”) may have certain rights

to indemnification, advancement of expenses and/or insurance provided by Shoreview and certain affiliates that, directly or indirectly,

(a) are controlled by, (b) control or (c) are under common control with Shoreview (collectively, the “Fund Indemnitors”).

The Corporation hereby agrees (i) that it is the indemnitor of first resort (i.e., its obligations to the Shoreview Directors are

primary and any obligation of the Fund Indemnitors to advance expenses or to provide indemnification for the same expenses or liabilities

incurred by the Shoreview Directors are secondary), (ii) that it shall be required to advance the full amount of expenses incurred

by the Shoreview Directors and shall be liable for the full amount of all expenses, judgments, penalties, fines and amounts paid in settlement

to the extent legally permitted and as required by the terms of this paragraph and the bylaws of the Corporation from time to time (or

any other agreement between the Corporation and the Shoreview Directors), without regard to any rights the Shoreview Directors may have

against the Fund Indemnitors, and, (iii) that it irrevocably waives, relinquishes and releases the Fund Indemnitors from any and

all claims against the Fund Indemnitors for contribution, subrogation or any other recovery of any kind in respect thereof. The Corporation

further agrees that no advancement or payment by the Fund Indemnitors on behalf of the Shoreview Directors with respect to any claim for

which the Shoreview Directors have sought indemnification from the Corporation shall affect the foregoing and the Fund Indemnitors shall

have a right of contribution and/or be subrogated to the extent of such advancement or payment to all of the rights of recovery of the

Shoreview Directors against the Corporation. The Corporation and the Shoreview Directors agree that the Fund Indemnitors are express third

party beneficiaries of the terms of this paragraph.

ARTICLE 10

CORPORATE OPPORTUNITIES

10.1 To

the fullest extent permitted by law, the Corporation, on behalf of itself and its subsidiaries, hereby renounces and waives any interest

or expectancy of the Corporation and its subsidiaries in, or in being offered an opportunity to participate in, directly or indirectly,

the following specified classes of business opportunities (the “Specified Opportunities”) that may become available

to a Non-Employee-Director (as defined below):

(a) any

business or corporate opportunity offered to or originated by a Non-Employee Director that is not expressly offered to such person solely

in his or her capacity as a director of the Corporation; and

(b) any

business or corporate opportunity that is offered to the Corporation or any of its subsidiaries by any investment bank, broker, auction

process or other similar means unless such opportunity is solely offered to the Corporation and not to any other person or entity.

10.2 To

the fullest extent permitted by law, (a) the Corporation, on behalf of itself and its subsidiaries, waives any claim that it may

have that any Specified Opportunity constituted a corporate opportunity that should have been presented to the Corporation or any of its

affiliates by a Non-Employee Director even if such Specified Opportunity relates to the current or anticipated business of the Corporation

or any of its subsidiaries; (b) a Non-Employee Director shall have no fiduciary duty to offer any Specified Opportunity to the Corporation,

any of its subsidiaries or otherwise; and (c) a Non-Employee Director may in an individual capacity, or on behalf of another person

or entity, pursue, refer, or take advantage of, any Specified Opportunity. For purposes of this paragraph, a “Non-Employee Director”

means a director of the Corporation that is not then an employee of the Corporation or any of its subsidiaries.

10.3 Neither

the repeal nor modification of this Article 10 nor the adoption of any other amendment to this Certificate of Incorporation

inconsistent with this Article 10 shall eliminate or reduce the effect of this Article 10 in respect of any business

opportunity first identified or any other matter occurring, or any cause of action, suit or claim that, but for this Article 10,

would accrue or arise, prior to such repeal, modification or adoption. Any person or entity purchasing or otherwise acquiring any interest

in any shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article 10.

ARTICLE 11

BUSINESS COMBINATIONS

The Corporation expressly elects not to be governed

by Section 203 of the DGCL.

ARTICLE 12

AMENDMENTS

The Corporation reserves the

right to alter, amend, change, repeal or rescind any provision contained in this Certificate of Incorporation in the manner now or hereafter

prescribed herein and by the laws of the State of Delaware, and all powers, preferences, rights and privileges conferred upon stockholders,

directors or other persons herein are granted subject to this reservation.

* * *

Exhibit 3.2

FINAL

FORM

SECOND AMENDED AND RESTATED

BYLAWS

OF

P & F INDUSTRIES, INC.

ARTICLE I

Offices

Section 1. The

registered office of the Corporation shall be 251 Little Falls Drive, City of Wilmington, State of Delaware 19808 or such other place

as may be specified from time to time by vote or written consent of the Board of Directors of the Corporation (collectively, the “Board”,

and each individually, the “Directors”). The initial registered agent shall be Corporation Service Company or such

other agent as may be specified from time to time by vote or written consent of the Board. The Corporation also may have offices at such

other places, within or without the State of Delaware, as the Board determines from time to time or the business of the Corporation requires.

ARTICLE II

Meetings of Stockholders

Section 1. Place

of Meetings. Except as otherwise provided in these Bylaws (these “Bylaws”), all meetings of the stockholders shall

be held on such dates and at such times and places, within or without the State of Delaware, as shall be determined by the stockholders

and as shall be stated in the notice of the meeting or in waivers of notice thereof. If the place of any meeting is not so fixed, it shall

be held at the registered office of the Corporation in the State of Delaware.

Section 2. Annual

Meeting. The annual meeting of stockholders for the election of the members of the Board and the transaction of such other proper

business as may be brought before the meeting, including those matters which are expressly reserved for the approval of the stockholders

as set forth in the Certificate of Incorporation of the Corporation (as amended from time to time, the “Charter”),

may be held on such date after the close of the Corporation’s fiscal year, or at such time, as the stockholders may from time to

time determine.

Section 3. Special

Meetings. Special meetings of the stockholders, for any purpose

or purposes, including those matters which are expressly reserved for the approval of the stockholders as set forth in the Charter, may

be called by any officer of the Corporation, upon the written request of a majority of the Directors or holders of not less than fifty

percent (50%) of the Corporation’s outstanding shares entitled to vote at such meeting. The request shall state the date, time,

place and purpose or purposes of the proposed meeting.

Section 4. Notice

of Meetings. Except as otherwise required or permitted by law, whenever the stockholders are required or permitted to take any action

at a meeting, written notice thereof shall be given, stating the place, date and hour of the meeting and, unless it is the annual meeting,

by or at whose direction it is being issued. The notice also shall designate the place where the stockholders list is available for examination,

unless the list is kept at the place where the meeting is to be held. Notice of a special meeting also shall state the purpose or purposes

for which the meeting is called. A copy of the notice of any meeting shall be delivered personally or shall be mailed, not less than ten

(10) and not more than sixty (60) days before the date of the meeting, to each stockholder entitled to vote at the meeting. If mailed,

the notice shall be deemed given when deposited in the United States mail, postage prepaid, directed to each stockholder at such stockholder’s

address as it appears on the records of the Corporation, unless such stockholder shall have filed with the Secretary of the Corporation

a written request that such notices be mailed to some other address, in which case it shall be directed to such other address. Notice

of any meeting of stockholders need not be given to any stockholder who shall attend the meeting, other than for the express purpose of

objecting at the beginning thereof to the transaction of any business because the meeting is not lawfully called or convened, or who shall

submit, either before or after the time stated therein, a signed waiver of notice. Unless the Board, after an adjournment is taken, shall

fix a new record date for an adjourned meeting or unless the adjournment is for more than thirty (30) days, notice of an adjourned meeting

need not be given if the place, date and time to which the meeting shall be adjourned are announced at the meeting at which the adjournment

is taken.

Section 5. Quorum.

Except as otherwise provided by law or by the Charter, at all meetings of stockholders the holders of a majority of the shares of the

Corporation entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business.

Section 6. Voting.

Except as otherwise provided by law or by the Charter, at any meeting of the stockholders every stockholder of record having the right

to vote thereat shall be entitled to one (1) vote for every share of stock standing in his or her name as of the record date and

entitling him or her to so vote. A stockholder may vote in person or by proxy. Except as otherwise provided by law or by the Charter,

any corporate action to be taken by a vote of the stockholders, other than the election of Directors, shall be authorized by the affirmative

vote of a majority of the shares present or represented by proxy at the meeting and entitled to vote on the subject matter. Directors

shall be elected as provided in Section 3 of Article III of these Bylaws. Written ballots shall not be required

for voting on any matter unless ordered by the chairman of the meeting.

Section 7. Proxies.

Every proxy shall be executed in writing by the stockholder or by his or her authorized representative, or otherwise as provided in the

General Corporation Law of the State of Delaware as amended from time to time (the “General Corporation Law”).

Section 8. List

of Stockholders. At least ten (10) days before every meeting of stockholders, a complete list of the stockholders entitled to

vote at the meeting, arranged in alphabetical order, and showing their addresses and the number of shares registered in their names as

of the record date shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business

hours, for a period of at least ten (10) days prior to the meeting, either at a place within the city where the meeting is to be

held, which place shall be specified in the notice of the meeting, or, if not so specified, at the place where the meeting is to be held.

The list shall also be produced and kept at the time and place of the meeting during the whole time thereof, and may be inspected by any

stockholder who is present.

Section 9. Conduct

of Meetings. At each meeting of the stockholders, the Secretary, or in his or her absence, any person appointed by the Secretary,

shall act as chairman of the meeting. The Secretary or, in his or her absence, any person appointed by the Secretary shall keep the minutes

thereof.

Section 10. Consent

of Stockholders in Lieu of Meeting. Unless otherwise provided in the Charter, any action required to be taken or which may be taken

at any annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if a consent

or consents in writing, setting forth the action so taken, shall be signed, in person or by proxy, by the holders of outstanding stock

having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares

entitled to vote thereon were present and voted in person or by proxy and shall be delivered to the Corporation as required by law. Prompt

notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders

who have not consented in writing.

Section 11. Attendance

Other than in Person. Unless otherwise provided in the Charter, any stockholder may participate in any annual or special meeting of

stockholders by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting

can hear each other, and such participation shall constitute presence in person at the meeting. Any such participation shall be deemed

to have been authorized by the Board pursuant to the General Corporation Law.

ARTICLE III

Board of Directors

Section 1. Number

of Directors. Except as otherwise provided in the Charter, the number of Directors which shall constitute the Board shall be such

number, not less than the minimum number allowed under the General Corporation Law, as shall initially be Peter Zimmerman, Thomas D’Ovidio,

and Madeleine Shumaker and hereafter may be determined from time to time by vote or written consent of the holders of a majority of the

shares then entitled to vote at a meeting of the stockholders of the Corporation. There are no specific qualifications to serve on the

Board. The number of Directors may be reduced or increased from time to time by vote or written consent of the holders of a majority of

the shares then entitled to vote at a meeting of the stockholders of the Corporation.

Section 3. Election

and Term. Except as otherwise provided by law, by the Charter or by these Bylaws, the Directors shall be elected at the annual meeting

of the stockholders and the persons receiving a plurality of the votes cast shall be so elected. Subject to his or her earlier death,

resignation or removal as provided in Sections 4 and 5 of this Article III, each Director shall hold office

until his or her successor shall have been elected and shall have qualified.

Section 4. Removal.

A Director may be removed at any time, with or without cause, by the holders of a majority of the shares then entitled to vote at a meeting

of the stockholders of the Corporation.

Section 5. Resignations.

Any Director may resign at any time by giving written notice of his or her resignation to the Corporation. A resignation shall take effect

at the time specified therein or, if the time when it shall become effective shall not be specified therein, immediately upon its receipt,

and, unless otherwise specified therein, the acceptance of a resignation shall not be necessary to make it effective.

Section 6. Vacancies. Except

as otherwise provided in the Charter, any vacancy in the Board arising from an increase in the number of Directors or otherwise may be

filled by the vote or written consent of a majority of the shares then entitled to vote at a meeting of the stockholders of the Corporation.

Section 7. Place

of Meetings. Except as otherwise provided in these Bylaws, all meetings of the Board shall be held at such places, within or without

the State of Delaware, as the Board determines from time to time.

Section 8. Annual

Meeting. The annual meeting of the Board for the purpose of organization and the transaction of other business, shall be held either

without notice immediately after the annual meeting of stockholders and in the same place, or as soon as practicable after the annual

meeting of stockholders on such date and at such time and place as the Board determines from time to time.

Section 9. Regular

Meetings. Regular meetings of the Board shall be held on such dates and at such times and places as the Board determines from time

to time. Notice of regular meetings need not be given, except as otherwise required by the General Corporation Law.

Section 10. Special

Meetings. Special meetings of the Board, for any purpose or purposes, may be called by the any member of the Board or his or her designee,

and shall be called by the any officer of the Corporation upon the written request of (i) a majority of the Directors or (ii) the

holders of a majority of the shares then entitled to vote at a meeting of the stockholders of the Corporation. The request shall state

the date, time, place and purpose or purposes of the proposed meeting.

Section 11. Notice

of Meetings. Notice of each special meeting of the Board (and of each annual meeting which is not held immediately after, and in the

same place as, the annual meeting of stockholders) shall be given, not later than twenty-four (24) hours before the meeting is scheduled

to commence, by an officer of the Corporation and shall state the place, date and time of the meeting. Notice of each meeting may be delivered

to a Director by hand or given to a Director orally (either by telephone or in person) or mailed, sent by electronic mail or sent by facsimile

transmission to a Director at his or her residence or usual place of business, provided, however, that if notice of less than seventy-two

(72) hours is given it may not be mailed. If mailed, the notice shall be deemed given when deposited in the United States mail, postage

prepaid; if sent by electronic mail, the notice shall be deemed given when directed to an electronic mail address at which the Director

has consented to receive notice; and if sent by facsimile transmission, the notice shall be deemed given when transmitted with transmission

confirmed. Notice of any meeting need not be given to any Director who shall submit, either before or after the time stated therein, a

signed waiver of notice or who shall attend the meeting, other than for the express purpose of objecting at the beginning thereof to the

transaction of any business because the meeting is not lawfully called or convened. Notice of an adjourned meeting, including the place,

date and time of the new meeting, shall be given to all Directors not present at the time of the adjournment, and also to the other Directors

unless the place, date and time of the new meeting are announced at the meeting at the time at which the adjournment is taken.

Section 12. Quorum.

Except as otherwise provided by law or in these Bylaws, at all meetings of the Board, a majority of the Board shall constitute a quorum

for the transaction of business, and the vote of a majority of the Directors present at a meeting at which a quorum is present shall be

the act of the Board. A majority of the Directors present, whether or not a quorum is present, may adjourn any meeting to another place,

date and time.

Section 13. Conduct

of Meetings. At each meeting of the Board, the members of the Board shall choose a member of the Board to act as chairman of the meeting.

The Secretary or, in his or her absence, any person appointed by the chairman of the meeting shall act as secretary of the meeting and

keep the minutes thereof. The order of business at all meetings of the Board shall be as determined by the chairman of the meeting.

Section 14. Order

of Business. At all regular meetings of the Board, business shall be transacted in the order and within the time limitations determined

by the Board. Unless otherwise determined by the Board, each regular meeting shall have a duration of not greater than ninety (90) minutes.

Section 15. Committees

of the Board. Unless otherwise provided in these Bylaws, the stockholders, by vote or written consent of a majority of the shares

then entitled to vote at a meeting of the stockholders of the Corporation, may designate committees, each consisting of one or more Directors

or other persons. Each committee (including the members thereof) shall serve at the pleasure of the stockholders. Each committee shall

keep minutes of its meetings and shall report its actions following each such meeting to the Board. The stockholders may designate one

or more Directors as alternate members of any committee, who may replace any absent or disqualified member or members at any meeting of

the committee. In addition, in the absence or disqualification of a member of a committee, if no alternate member has been designated

by the stockholders, the member or members present at any meeting and not disqualified from voting, whether or not they constitute a quorum,

may unanimously appoint another member of the Board to act at the meeting in the place of the absent or disqualified member. Except as

otherwise provided herein, each committee shall have and may exercise all of the powers and authority delegated to it in writing by the

Board pursuant to and as limited by these Bylaws, without further action by the Board.

Section 18. Advisory

Committees of the Board. The Board, by resolution adopted by a majority of the Board, may designate one or more advisory committees.

Each advisory committee (including the members thereof) shall serve at the pleasure of the Board and shall keep minutes of its meetings

and report the same to the Board. None of the advisory committees shall have the powers or the authority of the Board and the respective

powers and authority of each such committee shall be limited by those specific duties delegated in writing to it by the Board in the management

of the business and affairs of the Corporation.

Section 19. Operation

of Committees. A majority of all the members of a committee shall constitute a quorum for the transaction of business, and the vote

of a majority of all the members of a committee present at a meeting at which a quorum is present shall be the act of the committee.

Section 20. Consent

to Action. Any action required or permitted to be taken at any meeting of the Board or of any committee thereof may be taken without

a meeting if all members of the Board or committee, as the case may be, consent thereto in writing, and the writing or writings are filed

with the minutes of proceedings of the Board or committee.

Section 21. Attendance

Other Than in Person. Members of the Board or any committee thereof may participate in a meeting of the Board or committee, as the

case may be, by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting

can hear each other, and such participation shall constitute presence in person at the meeting.

Section 22. Rights

of Stockholders. The authority of the Board shall in all respects be subject to those matters which, as set forth in the Charter,

shall require the approval of the stockholders.

ARTICLE IV

Officers

Section 1. Executive

and Other Officers. The officers of the Corporation shall be elected by the Board and may consist of such officers and assistant officers

as may be deemed necessary or desirable by the board of directors. Any officer may devote less than all of his or her working time to

his or her activities. Any number of offices may be held by the same person. In its discretion, the Board may choose not to fill any office

for any period as it may deem advisable.

Section 3. Term

Removal. Subject to his or her earlier death, resignation or removal, each officer shall hold his or her office until his or her successor

shall have been elected or appointed and shall have qualified. Any officer may be removed at any time, with or without cause, by the holders

of a majority of the shares of the Corporation.

Section 4. Resignations.

Any officer may resign at any time by giving written notice of his or her resignation to the Corporation. A resignation shall take effect

at the time specified therein or, if the time when it shall become effective shall not be specified therein, immediately upon its receipt,

and, unless otherwise specified therein, the acceptance of a resignation shall not be necessary to make it effective.

Section 5. Vacancies.

If an office becomes vacant for any reason, the Board may fill the vacancy, and each officer so elected or appointed shall serve for the

remainder of his or her predecessor’s term and until his or her successor shall have been elected or appointed and shall have qualified.

ARTICLE V

Provisions Relating to Stock Certificates and

Stockholders

Section 1. Certificates.

Certificates for the Corporation’s capital stock shall be in such form as required by law. Each certificate shall be signed in the

name of the Corporation by two officers of the Corporation. Any or all of the signatures on a certificate may be a facsimile. In case

any officer, transfer agent or registrar who shall have signed or whose facsimile signature shall have been placed on any certificate

shall have ceased to be such officer, transfer agent or registrar before the certificate shall be issued, the certificate may be issued

by the Corporation with the same effect as if he or she were such officer, transfer agent or registrar at the date of issue.

Section 2. Replacement

Certificates. The Corporation may issue a new certificate of stock in place of any certificate theretofore issued by it, alleged to

have been lost, stolen or destroyed, and the Board may require the owner of the lost, stolen or destroyed certificate, or such person’s

legal representative, to make an affidavit of that fact and to give the Corporation a bond sufficient to indemnify the Corporation against

any claim that may be made against it on account of the alleged loss, theft or destruction of the certificate or the issuance of such

new certificate.

Section 3. Transfers

of Shares. Transfers of shares shall be registered on the books of the Corporation maintained for that purpose after due presentation

of the stock certificates therefor, appropriately endorsed or accompanied by proper evidence of succession, assignment or authority to

transfer.

Section 4. Record

Date. For the purpose of determining the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment

thereof, or to express consent to corporate action in writing without a meeting, or for the purpose of determining stockholders entitled

to receive payment of any dividend or other distribution or the allotment of any rights, or for the purpose of any other action, the Board

may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the

Board, and which record date shall not be more than sixty (60) or less than ten (10) days before the date of any such meeting, shall

not be more than ten (10) days after the date on which the Board fixes a record date for any such consent in writing, and shall not

be more than sixty (60) days prior to any other action.

ARTICLE VI

Indemnification

Section 1. Indemnification.

Unless otherwise determined by the stockholders, the Corporation shall, to the fullest extent permitted by the General Corporation Law

(including, without limitation, Section 145 thereof) or other provisions of the laws of Delaware relating to indemnification of directors,

officers, employees and agents, as the same may be amended and supplemented from time to time, indemnify any and all such persons whom

it shall have power to indemnify under the General Corporation Law or such other provisions of law.

Section 2. Statutory

Indemnification. Without limiting the generality of Section 1 of this Article VII, to the fullest extent permitted,

and subject to the conditions imposed, by law, and pursuant to Section 145 of the General Corporation Law unless otherwise determined

by the stockholders:

(a) the

Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed

action, suit or proceeding whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation)

by reason of the fact that such person is or was a Director, officer, employee or agent of the Corporation, or is or was serving at the

request of the Corporation as a Director, officer, employee or agent of another corporation, partnership, joint venture, trust or other

enterprise against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by him or her in connection with such action, suit or proceeding if such person acted in good faith and in a manner he or she

reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding,

had no reasonable cause to believe his or her conduct was unlawful; and

(b) the

Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed

action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or

was a Director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a Director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including

attorneys’ fees) actually and reasonably incurred by him or her in connection with the defense or settlement of such action or

suit if such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of

the Corporation, except as otherwise provided by law.

Section 3. Indemnification

by Resolution of Stockholders or Agreement. Without limiting the generality of Section 1 or Section 2 of this

Article VII, to the fullest extent permitted by law, indemnification may be granted, and expenses may be advanced, to the

persons described in Section 145 of the General Corporation Law or other provisions of the laws of Delaware relating to indemnification

and advancement of expenses, as from time to time may be in effect, by (i) a resolution of stockholders, or (ii) an agreement

providing for such indemnification and advancement of expenses, provided that no indemnification may be made to or on behalf of any person

if a judgment or other final adjudication adverse to the person establishes that such person’s acts were committed in bad faith

or were the result of active and deliberate dishonesty and were material to the cause of action so adjudicated, or that such person personally

gained in fact a financial profit or other advantage to which such person was not legally entitled.

Section 4. General.

It is the intent of this Article VII to require the Corporation, unless otherwise determined by the Board, to indemnify the

persons referred to herein for judgments, fines, penalties, amounts paid in settlement and expenses (including attorneys’ fees),

and to advance expenses to such persons, in each and every circumstance in which such indemnification and such advancement of expenses

could lawfully be permitted by express provision of Bylaws, and the indemnification and expense advancement provided by this Article VII

shall not be limited by the absence of an express recital of such circumstances. The indemnification and advancement of expenses provided

by, or granted pursuant to, these Bylaws shall not be deemed exclusive of any other rights to which a person seeking indemnification or

advancement of expenses may be entitled, whether as a matter of law, under any provision of the Charter, these Bylaws, by agreement, by

vote of stockholders or disinterested Directors of the Corporation or otherwise, both as to action in his or her official capacity and

as to action in another capacity while holding such office.

Section 5. Indemnification

Benefits. Indemnification pursuant to these Bylaws shall inure to the benefit of the heirs, executors, administrators and personal

representatives of those entitled to indemnification.

ARTICLE VII

General Provisions

Section 1. Seal.

The Corporation may have a corporate seal which shall be in such form as is required by law and approved by the Board.

Section 2. Fiscal

Year. The fiscal year of the Corporation shall be determined by the Board.

Section 3. Voting

Shares in Other Corporations. Unless otherwise directed by the Board, shares in other corporations which are held by the Corporation

shall be represented and voted only by an officer of the Corporation or by a proxy or proxies appointed by him or her.

ARTICLE VIII

Amendments

Section 1. These

Bylaws may be adopted, amended or repealed only by the Board.

ARTICLE IX

Conflict of Interest

Section 1. All

stockholders, directors and officers shall refrain at all times from any direct or indirect act, whether related to their obligations

hereunder, that might result in a conflict or the appearance of a conflict of interest. A conflict of interest is any activity, interest,

investment or association that interferes with and/or adversely affects (or may interfere with and/or may adversely affect) the stockholder’s,

director’s and/or officer’s judgment and best efforts on the Corporation’s behalf.

Section 2. The

Corporation may enter into contracts or transact business with one or more of its stockholders, directors or officers, or with any corporation,

association, partnership, limited liability company, trust company, organization or other concern in which any one or more of its stockholders,

directors or officers is a director, officer, trustee, partner, member, manager, shareholder, beneficiary or stockholder or otherwise

is interested and may enter into other contracts or transactions in which any one or more of its stockholders, directors or officers in

any way is interested, provided such contracts or other transactions comply with federal, state and local laws and regulations.

Section 3. In

the absence of fraud, no such contract or transaction shall be invalidated or in any way affected because any of the Corporation’s

stockholders, directors or officers have or may have interests which are or might be adverse to the Corporation’s interest, provided

that the nature and extent of such interest is disclosed to the Corporation in advance or shall be and have been known to the Board of

Directors.

Section 4. No

person or entity shall be automatically disqualified from participating with the Corporation as a stockholder, director or officer by

reason of any such adverse interest. Any stockholder, director or officer interested in any corporation or other concern of any kind referred

to above with which the Corporation proposes to contract or to transact any business or who has an interest, pecuniary or otherwise, in

any such contract or transaction, shall not participate in the vote to authorize any such contract or transaction, but may participate

in the discussion thereof.

Section 5. In

the absence of fraud, no stockholder, director or officer having an interest adverse to the Corporation shall be liable to the Corporation,

any creditor thereof or any other person for any loss incurred by it under or by reason of such contract or transaction nor shall any

such stockholder, director or officer be accountable for any gains or profits realized thereon.

* * *

ADOPTED DECEMBER 20, 2023

Exhibit 99.1

P&F INDUSTRIES, INC. ANNOUNCES COMPLETION

OF ACQUISITION BY SHOREVIEW INDUSTRIES

MELVILLE, N.Y., December 20, 2023 -- P&F Industries, Inc. ("P&F"

or the "Company") (NASDAQ: PFIN) today announced the completion of its sale to ShoreView Industries (“ShoreView”).

Under the terms of the transaction, P&F shareholders will receive $13.00 per share in cash. With the completion of the transaction,

P&F’s common stock has ceased trading and will no longer be listed on the NASDAQ Global Select Market.

Richard Horowitz, Chairman of the Board, Chief Executive Officer and

President, said, “The closing of this transaction represents the beginning of a new chapter for P&F, and we are excited for

what the future holds. We are proud of the leadership position we have built and believe we are well prepared to advance our business

and continue delivering high value tools for our customers with the expertise of the Shoreview team.”

Tom D'Ovidio, Partner at ShoreView. “We are pleased to complete

the transaction and are moving forward in partnership with the P&F team to accelerate P&F’s growth.”

Advisors

Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal counsel

to the Special Committee. East Wind Securities initiated the transaction and is serving as exclusive financial advisor to P&F and

Ruskin Moscou Faltischek, P.C. is serving as legal advisor to P&F.

Sidley Austin LLP is serving as legal advisor to ShoreView.

ABOUT P&F INDUSTRIES, INC.

P&F Industries, Inc., through its wholly owned subsidiaries, is

a leading manufacturer and importer of air-powered tools and accessories sold principally to the aerospace, industrial, automotive, and

DIY markets. P&F's products are sold under its own trademarks, as well as under the private labels of major manufacturers and retailers.

ABOUT SHOREVIEW

Founded in 2002, ShoreView is a Minneapolis-based private equity firm

that has raised over $1.3 billion of committed capital across four funds. ShoreView partners with family and entrepreneur-owned companies

across many sectors, including engineered products, distribution, industrial services, business services, healthcare, and niche consumer

products. Shoreview structures various acquisition, recapitalization, and build-up transactions, typically in businesses with revenues

ranging between $20 million and $300 million.

If you are interested in speaking with ShoreView about add-on or platform

investment opportunities, please contact Garrett Davis at garrett@shoreview.com.

Contacts

Joseph A. Molino, Jr.

Chief Operating Officer

631-694-9800

www.pfina.com

v3.23.4

Cover

|

Dec. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 20, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

1-5332

|

| Entity Registrant Name |

P&F INDUSTRIES, INC.

|

| Entity Central Index Key |

0000075340

|

| Entity Tax Identification Number |

22-1657413

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

445 Broadhollow Road

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Melville

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11747

|

| City Area Code |

631

|

| Local Phone Number |

694-9800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $1.00 Par Value

|

| Trading Symbol |

PFIN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

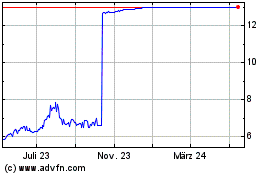

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024