U.S. Dollar Firms As Jobless Claims Fall Unexpectedly

22 Februar 2024 - 1:16PM

RTTF2

The U.S. dollar climbed against its major counterparts in the

New York session on Thursday, as a drop in weekly jobless claims

suggested that the Federal Reserve is unlikely to rush to lower

rates.

Data from the Labor Department showed that initial jobless

claims fell to 201,000, a decrease of 12,000 from the previous

week's revised level of 213,000.

Economists had expected jobless claims to rise to 218,000 from

the 213,000 originally reported for the previous week.

With Federal Reserve officials signaling they are not in a hurry

to begin cutting interest rates, signs of strength in the labor

market may once again be seen as a positive for the markets.

The currency weakened in the European session, as the European

stock markets traded higher after strong earnings from U.S.

chipmaker Nvidia.

The greenback advanced to 1.0802 against the euro and 1.2611

against the pound, off its early nearly 3-week lows of 1.0888 and

1.2709, respectively. The currency is poised to find resistance

around 1.06 against the euro and 1.24 against the pound.

The greenback touched 150.64 against the yen, setting a 6-day

high. If the greenback rises further, it is likely to test

resistance around the 152.00 region.

Reversing from an early 10-day low of 0.8741 against the franc,

the greenback edged up to 0.8819. The currency is likely to locate

resistance around the 0.90 level.

The greenback recovered to 1.3507 against the loonie and 0.6544

against the aussie, from an early 9-day low of 1.3440 and nearly a

3-week low of 0.6595, respectively. The greenback may find

resistance around 1.36 against the loonie and 0.62 against the

aussie.

The greenback recovered to 0.6178 against the kiwi, from an

early more than 5-week low of 0.6218. The currency is seen finding

resistance around the 0.60 level.

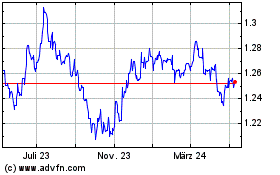

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2023 bis Apr 2024