Yen Falls As Asian Stock Markets Traded Higher

15 Dezember 2023 - 2:19AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Friday, as Asian stock markets traded higher,

following the dovish comments from the U.S. Fed, signaling a series

of interest rate cuts next year, continued to aid sentiment.

The Fed left interest rates unchanged and hinted at three rate

reductions in 2024, citing easing inflation and slowing economic

growth.

In economic news, data from Jibun Bank showed that the

manufacturing sector in Japan continued to contract in December,

and at a faster pace, with a flash Performance of Manufacturing

Index score of 47.7. That's down from 48.3 in November. The survey

also showed that the services index improved to 52.0 in December

from 50.8 in November.

On Thursday, the yen rose against its major rivals. In the Asian

trading now, the yen fell to 2-day lows of 156.50 against the euro,

181.74 against the pound and 164.22 against the Swiss franc, from

yesterday's closing quotes of 155.93, 181.11 and 163.48,

respectively. If the yen extends its downtrend, it is likely to

find support around 160.00 against the euro, 186.00 against the

pound and 169.00 against the franc.

The yen edged down to 142.47 against the U.S. dollar, from

Thursday's closing value of 141.87. On the downside, 149.00 is seen

as the next support level for the yen.

Against the Australia and the New Zealand dollars, the yen

slipped to 95.44 and 88.44 from yesterday's closing quotes of 95.01

and 88.03, respectively. The yen may test support near 96.00

against the aussie and 91.00 against the kiwi.

The yen dropped to a 2-day low of 106.23 against the Canadian

dollar. At yesterday's close, the yen was trading at 105.81 against

the loonie. The next possible downside target for the yen is seen

around the 110.00 region.

Looking ahead, PMI reports from various European economies and

U.K. for December and Eurozone foreign trade and labor cost reports

for November are due to be released in the European session.

In the New York session, Canada housing starts for November,

wholesale sales data for October, U.S. industrial and manufacturing

production for November, U.S. S&P Global manufacturing PMI

reports for December and U.S. Baker Hughes rig count data are

slated for release.

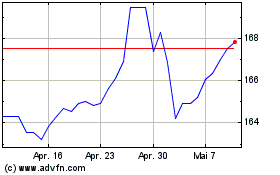

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Jun 2024 bis Jul 2024

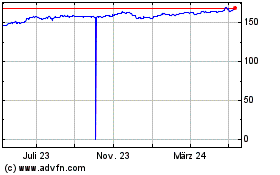

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Jul 2023 bis Jul 2024