REVENUE UP +10.7% VS. THE 1ST SEMESTER OF 2022: GROUP

OCCUPANCY RATE IMPROVING WITH THE EXCEPTION OF NURSING HOMES IN

FRANCE

LOWER OPERATING PERFORMANCE: EBITDAR OF €336 MILLION WITH A

MARGIN OF 13.2%, DOWN -5.4 POINTS ON H1 2022 AND -1.6 POINT ON H2

2022; BECAUSE OF A RISING PAYROLL TO MEET QUALITY REQUIREMENTS,

COUPLED WITH AN INFLATIONARY ENVIRONMENT

OPERATING INCOME -13 M€ AND NET INCOME -371 M€ INCLUDING -231

M€ OF FINANCE COST

EBITDAR FOR FULL-YEAR 2023 AT THE LOWER END OF THE RANGE

PUBLISHED IN JULY: (€705/750M), AND AN EXPECTED IMPROVEMENT IN S2

2023 COMPARED WITH S1 2023

CASH POSITION IN LINE WITH SAFEGUARD PLAN FORECASTS

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231011505763/en/

The ORPEA Group (Paris:ORP) publishes its consolidated

results for the first half ended 30 June 20231.

Laurent Guillot, Chief Executive Officer, said:

“2023 marks the first year of the Group's entire overhaul, and

saw the operational implementation of the Refoundation plan.

Concrete steps forward have been made:

- To improve the quality of care and support,

with, for example, local teams strengthened around a managerial

trio in each facility, and an increase in the staff ratio of over

10%. - To rebuild social dialogue, build loyalty and train our

teams, I am thinking in particular of the two collective agreements

reached, the new profit-sharing agreement and the 10-million-euro

envelope devoted to training. - To engage ORPEA into a path towards

becoming a purpose-driven company by defining our core values,

exemplified on a daily basis by our employees. - To restructure the

company financially, clean up its balance sheet and enable

long-term investors such as Caisse des Dépôts, CNP, MAIF and MACSF

to acquire a majority stake, the Nanterre Commercial Court approved

the Accelerated Safeguard Plan last July.

However, although the Group's occupancy rate is up (excluding

retirement homes in France), the decision to invest in our teams

and the increase in our costs in an inflationary environment have

not been fully offset by price rises, leading to a reduction in our

operating margin in the first half. These choices will gradually

bear fruit. ORPEA is a company built on the strength of its 76,000

professionals, who are committed to working with our residents,

patients and beneficiaries on a daily basis. I would like to extend

my warmest thanks to all of them.”

Consolidated revenue for the first half of 2023 was up +10.7%

on 2022. This largely organic growth is the result of an overall

increase in occupancy rates, with the exception of nursing homes in

France, an increase in accommodation capacity, and the effects of

price increases, particularly marked in Central Europe. Despite

these favorable trends, the results published today show a decline

in profitability due to higher costs resulting from the high

inflation context and, in the short term, to the company's

determination to refocus on its fundamentals immediately. Thus, the

acceleration in recruitment and various initiatives to attract and

retain staff over the long term partly explain an EBITDAR of €336

million, down -21% on H1 2022 (margin on sales of 13.2%, down -538

bps on H1 2022 and around -160 bps on H2 2022).

Group Net income for the first half of 2023 came to - €371

million, with interest expenses well above those for the first half

of 2022, the increase being mainly due to the unfavorable trend in

interest rates and higher credit margins on the financing put in

place in June 2022. Thanks to the Accelerated Safeguard Plan, a

significant portion of these financial expenses, corresponding to

ORPEA SA's unsecured debt, will be converted into equity.

Furthermore, following the agreement reached with the main banking

partners on 17 March 2023, the margin on the financing put in place

in June 2022 will be significantly revised downwards (2.0% instead

of 4.75% on average).

With respect to the outlook for 2023 as a whole and for

2024-2025, the Company is currently carrying out internal reviews

at the level of all its operating entities, in order to be able to

produce and communicate to the market updated forecasts prior to

the launch of the Equitisation Capital Increase. For 2023, based on

work completed to date, the Company currently estimates EBITDAR at

the lower end of the estimate (€705 million - €750 million)

published in its July 13 press release.

With regard to the financial restructuring process, the

Company points out that the Accelerated Safeguard Plan, which was

approved by the Nanterre Specialized Commercial Court on 24 July by

way of a cross-class cram down (link), provides for the

implementation - once the last condition precedent has been lifted2

- of three capital increases, which will result in a massive

dilution for existing shareholders. In the absence of reinvestment,

existing shareholders would hold around 0.04% of the share capital,

with a theoretical value of less than €0.02 per share. The next

steps leading to the implementation of this process include the

communication of the updated Business Plan, the ruling by the Paris

Court of Appeal on the appeals lodged against the waiver granted by

the AMF, and the publication of the prospectuses. Details of the

planned capital increases and how existing shareholders can

participate are available at the following link.

- & -

Context of the establishment of the

HY2023 consolidated financial statements

Following on from the Accelerated Safeguard procedure opened in

favor of ORPEA SA to implement all the agreements negotiated with

the stakeholders concerned by the financial restructuring project,

the Nanterre Specialized Commercial Court approved the Accelerated

Safeguard Plan on 24 July. The Plan is based on the lock-up

agreement signed on 14 February 2023 between the Company and a

group of long-term French investors comprising Caisse des Dépôts,

CNP Assurances, MAIF and MACSF (the "Groupement"), and five

institutions holding the Company's unsecured debt (the

"SteerCo"). It is also based on an agreement with the main

banking partners (the "G6") providing for the adjustment of

the documentation of the June 2022 Syndicated Credit Facility and

the provision of an additional financing of €400 million coupled

with an additional bridge financing of €200 million until the

projected second capital increase.

Taking into account:

- the Group's cash position of €630 million at 4 October 2023,

including drawdowns of €300m on the additional financing made

available by the Group's main banking partners after 30 June 2023

(D1B loan of €200 million in August and D2 loan of €100 million at

the end of September)

- The company’s cash flow forecasts, based on the following

structuring assumptions over the next 12 months : - successive

capital increases, including €1.55 billion in cash planned from the

fourth quarter onwards, - conversion into capital of unpaid

interest due and accrued on ORPEA SA's unsecured debt, - payment of

interest due and unpaid on completion of the Groupement Capital

Increase,

the Company considers, at the date of closing of the accounts,

that it has cash resources compatible with its projected

commitments and is thus in a position to meet its cash requirements

over the next 12 months.

Consequently, the financial statements have been established for

the six months ended 30 June 2023 on a going concern basis.

1. Half-year consolidated income

statement

(*) EBITDAR = Recurring EBITDA before rental expenses, including

provisions related to the “External costs” and “Personnel costs”

line items

(**) EBITDA = Recurring operating profit before depreciation and

amortization, including provisions relating to the “External costs”

and “Personnel costs” line items.

(***) EBITDA excl. ifrs 16 corresponds to EBITDA less lease

payments falling within the scope of IFRS 16. The amount of rents

not deducted from EBITDA under IFRS 16 amounted to €203 million in

the 1st half of 2022 and €219 million in the 1st half of 2023 (the

increase being mainly due to the Group's development). EBITDA

excluding the impact of IFRS 16 amounted to €212 million for the

1st half of 2022 and €102 million for the 1st half of 2023.

Revenue for the 1st semester of 2023 amounted to €2,539

million, an increase of +10.7%, of which +9.1% was organic. The

Group's overall level of activity has risen, with an average

occupancy rate of 82.7%, up +1.4 point on the first half of 2022.

Activity momentum was favorable internationally and at clinics in

France. Over the first half of 2023, the average occupancy rate for

retirement homes in France was down compared with the average level

recorded in 2022 (85.6%) and with the level recorded at the end of

2022 (84.6%).

EBITDAR came to €336 million in the first half of 2023,

giving a margin of 13.2%, compared with 18.6% for the same period

last year.

This decline, totaling -538 bps compared with the same period

last year and -157 bps compared with the second half of 2022, is

mainly due to the increase in payroll costs, with a view to

strengthening quality, and to the persistence of an inflationary

environment affecting other expense items (energy procurement, food

and medical products). Personnel costs as a proportion of revenues

rose from 63.3% in the first half of 2022 to 66.8% in the first

half of 2023, an increase of +351 bp.

EBITDA amounted to €321 million, representing a margin of

12.6% of revenue.

Pre-IFRS 16 EBITDA amounted to €102 million, giving a

margin of 4.0%, down 523 bps on the same period last year.

Operating income before non-recurring items came to a

negative -€13 million, compared with +€82 million in the first half

of 2022.

Net financial result came to -€231 million, compared with

-€96 million in the first half of 2022. This change reflects the

rise in interest rates and margins associated with the June 2022

refinancing, as well as the increase in gross financial debt.

Result before tax was -€329 million, and net result

group share for the first half of 2023 was -€371 million, in

the absence of deferred tax assets on losses recognized in the

first half of 2023.

2. Main aggregates of the consolidated

balance sheet at 30 June 2023

At 30 June 30 2023, the book value of net tangible assets

amounted to €5.2 billion. It should be reminded here that the

Company has changed the accounting method applied to property

assets accounted for under IAS 16, which are now excluded from the

scope of the standard. Secondly, in line with what was indicated

when the financial statements were published at the end of 2022 and

in its 2022 Universal Registration Document, at the end of 2023 the

Company will publish an estimate of the market value of the real

estate assets held, incorporating all the calculation parameters

(rate of return, risk-free rate, operating performance trajectory

of each facility). As an indication, an increase of +0.10% in the

rate of return on real estate assets, excluding any other factor,

would lead to a decrease of around -€95 million in the value of

real estate assets held as estimated at the end of 2022.

Intangible assets and goodwill amounted to €1.6

billion and €1.4 billion respectively.

Cash and cash equivalents at the end of June 2023 stood

at €518 million, and at 4 October 2023 at €630 million.

Net financial debt (IFRS view, excl. IFRS 16) amounted to

€9.3 billion (excluding IFRS 16 rental debt), up +€501 million over

the period.

For debts carried by subsidiaries of ORPEA SA subject to

financial covenants, the Company has obtained waivers from the

affected creditors to the effect that these covenants will not

apply from 31 December 31 2022, and will be removed once the

Accelerated Safeguard Plan has been implemented. As a result, a

single leverage covenant (net debt/EBITDA pre IFRS 16 < 9.0x)

will apply from June 2025.

At June 30, 2023, as the implementation of the Accelerated

Safeguard Plan remains subject to confirmation by the Paris Court

of Appeal of the exemption granted to the Groupement from the

obligation to launch a public offer for all ORPEA shares, gross

debt classified as current liabilities amounted to €8.3 billion,

including €6.5 billion of financial debt with a contractual

maturity of more than one year.

The contractual maturity schedule of gross financial debt

by type (excluding IFRS 16 rental debt and before accounting

reclassification of a portion of debt due in more than one year as

current debt3) at 30 June 2023 is summarized below:

Taking a pro-forma view of the implementation of the financial

restructuring, with the conversion into capital of the principal

amount of €3.8 billion and the drawdown of the Additional Financing

in the amount of €400 million maturing in 2026 (Loans D1A and D1B),

the maturity schedule of the principal amount of gross financial

debt at June 30, 2023 would be as follows:

This pro-forma schedule takes into account the impact of the

Agreement signed with the main banking partners (G6), which is

inherent to the Accelerated Safeguard Plan, and which will come

into force on the settlement-delivery date of the Groupement

Capital Increase.

Consolidated shareholders' equity stood at a negative

-€1.85 billion at 30 June 2023, mainly due to the net loss for

fiscal year 2022 and the impact of the change in accounting method

in 2022 applied to property developments accounted for under IAS

16.

3. H1 2023 statement of cash flow

(excl. IFRS impact)

Net current operating cash flow came to a negative -€13 million,

after deducting operating capex (maintenance and IT

investments).

Development capex, mainly real estate, amounted to €192

million.

With regard to other asset movements, real estate disposals

amounted to €54 million, while net financial investments (including

additional equity investments in the Netherlands) totaled -€18

million.

Non-current items mainly comprise costs associated with the

Group's financial restructuring and crisis management.

Net financial expenses paid amount to €60m. It should be noted

that the financial restructuring plan includes the following

provisions:

- accrued interest on the ORPEA SA legal entity's unsecured debt,

i.e approximately €66 million in for the first half of 2023 will be

paid for €11 million (30% of the total amount of accrued interest

up to the day before the opening date of the accelerated safeguard

procedure) will be paid after settlement-delivery of the

Equitisation Capital Increase and the balance converted into

capital;

- interest payments in respect of drawings on tranches A, B and C

of the June 2022 syndicated loan, i.e. €115 million, will be paid

after settlement-delivery of the Groupement Capital Increase.

On this basis net cash flow before financing came to -€289

million.

After taking into account the effects of changes in the scope of

consolidation, net financial debt (excluding IFRS) stood at €9,161

million at June 30, 2023, up +€301 million on December 31,

2022.

At June 30, 2023, the cash position stood at 518 M€.

4. Financial agenda: update of

2023-2025 Business Plan and Q3 2023 sales

In order to be able to communicate updated 2023-2025 forecasts

to the market before the launch of the Equitisation Capital

Increase, the Company is currently carrying out internal reviews at

all its operating entities.

The updated outlook will be published in early November, at the

same time as the Company's 3rd-quarter sales figures.

With specific regard to the outlook for the full year 2023, the

Company currently estimates that EBITDAR should be at the lower end

of the €705 million - €750 million range it published in its July

13 press release.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 21 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, MSCI Small Cap Europe and CAC Mid 60

indices.

DISCLAIMER This document contains forward-looking

statements that involve risks and uncertainties, including

information incorporated by reference, regarding the Group’s

expected growth and profitability in the future that may

significantly impact the expected performance indicated in the

forward-looking statements. These risks and uncertainties relate to

factors that the Company can neither control nor accurately

estimate, such as future market conditions. Any forward-looking

statements made in this document express expectations for the

future and should be regarded as such. Actual events or results may

differ from those described in this document due to a number of

risks or uncertainties described in Chapter 2 of the Company's 2022

Universal Registration Document, which is available on the

Company's website, on the website of the French financial markets

authority, AMF (www.amf-france.org).

DEFINITIONS

HALF-YEAR CONSOLIDATED FINANCIAL STATEMENTS

AT END JUNE 2023

- Consolidated income statement

- Consolidated balance sheet

- Operating result

reconciliation

- Information about Alternative

Performance Measures excl. IFRS 16

- Cash Flow

reconciliation

1 The statutory auditors are currently carrying out a limited

review of the interim financial statements.

2 The final condition precedent is the clearing of the appeals

lodged against the waiver of the Caisse des Dépôts-led consortium's

obligation to launch a takeover bid for ORPEA shares, granted on

May 26, 2023. The decision, by the Paris Court of Appeal, is

expected by early November at the latest.

3 After accounting reclassification, current debt principal

amounts to €8.2bn, of which almost €6.5bn of debt with contractual

maturities in excess of one year, which would be in default and/or

cross-default at June 30, 2023 in the event of the R1/R2 waivers

signed during the first half of 2023 being called into question (in

the event that the financial restructuring is ultimately not

implemented due to an unsatisfied condition precedent).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231011505763/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel: 01

44 71 94 94 ORPEA@newcap.eu

Press Relations ORPEA Isabelle Herrier-Naufle

Press Relations Director Tel: 07 70 29 53 74 i.herrier-naufle@orpea.net Image7 Charlotte

Le Barbier // Laurence Heilbronn 06 78 37 27 60 - 06 89 87 61 37

clebarbier@image7.fr lheilbronn@image7.fr

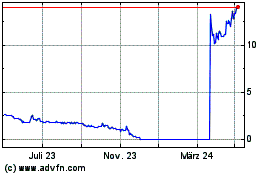

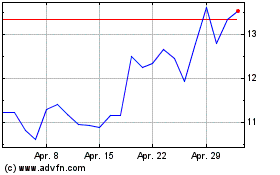

Orpea (EU:ORP)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Orpea (EU:ORP)

Historical Stock Chart

Von Jun 2023 bis Jun 2024