Here’s How UC Asset LP Is Planning To

Change The Professional Office Space Landscape; Two Strategies In

Play

March 18, 2021 -- InvestorsHub NewsWire -- Via Digital

Journal -- Finding under the radar investment opportunities,

and acting on them, can deliver exponential rewards. Here's one

catching our attention- UC Asset LP (OTCQX: UCASU), a limited partnership company that invests in

real estate, primarily in the Atlanta area.

The stock is trading at $2.05 per share and trades between 0 and

200 shares per day. That's not a bad thing, necessarily. Remember,

this is a genuine under-the-radar stock, so by accruing shares

patiently, the opportunity to book exponential gains is in play

once new investors tune in to the UCASU story. Notably, shares have

traded as high as $2.40 this year and also touched the sub-dollar

levels at $0.32 per share. Now trending back toward its highs, the

question begs- what's causing the move?

Well, several things. The company raised $8.6 million to date

and added another $300,000 in March 2020 through a private

placement deal. That's a perfectly decent balance sheet for an

emerging company. Better still, though, from an operations

perspective, net equity in the company surged to 39%, helped by a

healthy compounding growth rate of 8.58% from 2016 to 2019. Also

attractive is the improvement to its balance sheet, where proactive

moves helped UCASU strengthen its portfolio and boosted cash

reserves in late 2020 by selling $2.5 million in properties that

generated roughly $1 million in gross profit.

A report of its 2020 financial results is expected later this

month. Here's what's in play:

Cash And Strategy Combine

As noted, UCASU plans to report full 2020 financial results

this month. Investors were provided Q4 2020 results that included

the profitable sale of a large tract of land outside Dallas for

$1.3 million and the sale of some of its Atlanta residential

property for its full asking price of $1.35 million. Those sales

are helping to build a respectable war chest for future

acquisitions.

In fact, by mid-year, UCASU expects to accrue between $4-7

million in cash that it plans to use to purchase new assets in the

post-pandemic economy. The focus is shifting away from purely

residential, and plans are in place to enhance its focus on

commercial and mixed-use development.

And as the plans develop, the company's property portfolio may

still be growing. That's despite general consumer market weakness

and noting that residential real estate markets remained strong,

even bullish, as remote working and learning created a new type of

demand from buyers looking for larger spaces and/or relocation from

city centers.

Moreover, businesses learned that Zoom meetings and other

similar platforms can often replace large office space. That's bad

news for landlords but potentially great news for companies like

UCASU that are targeting a niche opportunity through mixed-use

property purchases.

This is where the company is being innovative and intelligent.

By building its cash reserves, UCASU expects to position itself in

a position to maximize opportunities in a commercial market that

may soon see a day of reckoning. In other words, mainstream media

isn't covering the undercurrent of a radically disrupted real

estate market. However, UCASU is paying attention, and they believe

they developed a strategy to deliver both short and long-term

rewards. Here's how:

The pandemic has hidden a big secret...many landlords across the

country are not getting paid rent by their tenants. Evictions have

been put on hold by the government, and despite financial relief to

renters, that money is not always making it to the landlord's

in-box. These government regulations have all but quieted the usual

market pressures associated with the residential real estate trade.

However, these forbearances also played a role in investment

property values that have yet to see meaningful pressure lower.

Thus, the timing was good for UC Asset, who in April of last year

began to diversify out of residential investments and into

opportunities to provide mortgage support to commercial property

owners whose cash flow has been disrupted by the pandemic. A

business model was born.

Real Estate Innovation And Investment

Starting that ball rolling, in June of 2020, UC Asset closed its

first commercial property support investment in a rental property.

And with the pandemic still raging, agreements to continue

rent/mortgage forbearance in the commercial markets limited new

investment opportunities through 2020. Obviously, it's hard to pay

a mortgage with no income. Thus, UCASU came to the rescue. But now,

they are assessing post-pandemic demand for that product.

Clearly, with vaccinations ramping, it's a reasonable assumption

to expect that these temporary supports will not continue

indefinitely. Thus, 2021 is likely to return to more normalized

business and ignite interest in commercial investment

opportunities.

When that happens, cash can be king. While no company intends to

add harm to an already bad situation, the market's reality suggests

that when forbearance agreements are terminated, the economic

pressures to owners caused by the pandemic will surface. Then, they

will have to face the pent-up cost of back debt, make capital

investments to retool properties to meet new health protocols, and

try to recoup thousands of dollars in back-rent or start the

tireless eviction process on potentially hundreds of

families.

Moreover, a Zacks report suggests that approximately $430

billion in commercial real estate debt comes due in 2021, which may

cause property owners to seek new investors or liquidate their

properties. Both instances fit into UC Asset's newly formed

business strategy. In fact, UCASU is developing two investment

strategies.

Filling A Much Needed Niche In Commercial Real

Estate

As noted, UCASU is finding an innovative and potentially

lucrative niche to fill. Two strategies can get that done. The

first is through exposure to providing commercial real estate

mortgage support. An example of how it works came in June when

UCASU purchased its first commercial property support investment in

a rental property with a market value of $850k.

When the deal was made, the current owner earned a profit from

the property before the pandemic but had not collected rent for

five months. Unfortunately, he still has a remaining mortgage

balance of over $400k. In the deal with UCASU, that owner will

receive a cash payment to compensate for its existing equity. In

return, UC Asset will take over the mortgage and is entitled to

purchase the property for $1 after its mortgage is paid off. The

deals will vary in terms, and no two are likely the same. However,

despite the complexity, both UCASU and commercial property owners

are eager to make a deal. Thus, UCASU can be a proverbial savior to

property owners.

As profitable as that opportunity can be, UC Asset management is

also positioning to take advantage of other market opportunities.

They recognize that its commercial mortgage support program has a

limited investment window, and the penetration into the market has

been slow. And with lenders, landlords, and government mandates

postponing a picture of actual demand, UCASU knows they face other

competitive pressures.

Thus, a second strategy is born. Here, UCASU wants to help

revitalize neighborhoods through its SHOC (shared home office

concept) program that includes a commitment to invest in

underserved communities around Atlanta. Their initiative took a

step forward in September when UCASU announced plans to revitalize

clusters of distressed residential properties in neighborhoods

close to major airports. Then, they renovate them into

cost-efficient home offices and market them as shared

accommodations on platforms such as Airbnb (ABNB) in a bid to serve

business travelers who prefer renting a shared home-office compared

to staying at a conventional hotel.

It's a genius idea at a time when the world has changed. And by

the end of December, UC Asset announced an initial capital

commitment of $1 million to pilot its SHOC strategy. In an update,

management said its goal is to form a $10 million portfolio of

shared home office properties over the next year. Returns from

those properties could be substantial. And demand, especially from

people not yet comfortable in large group settings, may surpass

available offices.

So far, the company has successfully invested in individual

residential properties near Atlanta's main airport. Those purchases

put the SHOC strategy in play. Moreover, with these SHOC locations

revitalizing neighborhoods and at the same time offering a place to

work, UCASU believes that community stakeholders and local boards

will embrace the projects. Clearly, the timing is right for a model

of this type and fits nicely into a post-pandemic business

landscape.

UCASU may not be out to change the world's view of how a

100-story office building should look. Instead, they are making

headway to show that better options can exist...and if they make

millions of dollars along the way, that's fine, too. UC Asset LP

may indeed be a sector game-changer.

Disclaimers: Soulstring Media Group is responsible for the

production and distribution of this content. Soulstring Media Group

is not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The

information made available by Soulstring Media Group is not

intended to be, nor does it constitute, investment advice or

recommendations. The contributors may buy and sell securities

before and after any particular article, report and publication. In

no event shall Soulstring Media Group be liable to any member,

guest or third party for any damages of any kind arising out of the

use of any content or other material published or made available by

Soulstring Media Group, including, without limitation, any

investment losses, lost profits, lost opportunity, special,

incidental, indirect, consequential or punitive damages. Past

performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. This email and its release to syndicated outlets

has been produced and co-independently produced. Soulstring Media

was not compensated, nor does it intend to be, for creating and

syndicating this content. All content is prepared from publicly

available information and is deemed accurate at the time of article

preparation. Soulstring Media Group strongly urges

you conduct a complete and independent investigation of the

respective companies and consideration of all pertinent risks.

Readers are advised to review SEC periodic reports: Forms 10-Q,

10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule

13D.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in

micro-cap and growth securities is highly speculative and carries

an extremely high degree of risk. It is possible that an investors

investment may be lost or impaired due to the speculative nature of

the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Allie Ellis

Email: Send

Email

City: Miami Beach

State: Florida

Country: United States

Website: https://www.greenlightstocks.com

Other stocks on the move -

VRCFF,

FDMSF, and

NOKPF

SOURCE: Digital

Journal

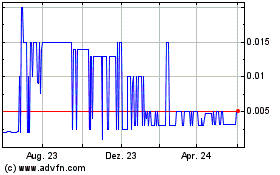

Nok Airlines Public (CE) (USOTC:NOKPF)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

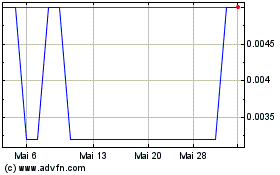

Nok Airlines Public (CE) (USOTC:NOKPF)

Historical Stock Chart

Von Nov 2023 bis Nov 2024