KinerjaPay Corp. (OTC QB: KPAY) Announces Partnership with 62hall – Forecasts 66% Growth by Q2 2017

16 September 2016 - 1:00PM

InvestorsHub NewsWire

KinerjaPay Corp. (OTC

QB: KPAY) Announces Partnership with 62hall – Forecasts 66%

Growth by Q2 2017

Miami, FL -- September 16, 2016 -- InvestorsHub NewsWire --

EmergingGrowth.com, a leading independent small cap

media portal with an extensive history of providing unparalleled

content for the Emerging Growth markets and companies, reports on

KinerjaPay Corp. (OTCQB:

KPAY).

62hall has over 700 online stores under its brand.

Over 1400 Products, and 1,000 types of Services

KinerjaPay Corp. (OTCQB:

KPAY) is new to EmergingGrowth.com.

KinerjaPay Corp. (OTCQB:

KPAY), an ecommerce / digital payment company which allows

consumers to “Pay, Play and Buy,” just announced a partnership with

62hall which has over 700 white label online stores under its brand

which offer over 140,000 products and more than 1,000 types of

services.

The goal of the partnership is to reach 1 million products and

10,000 types of various services by 2016 year end.

Currently KinerjaPay Corp. (OTCQB:

KPAY), has 60,000 current members and is forecasting 100,000

members by Q2 2017.

In

addition, management is forecasting around 2,000 daily transactions

on its e-commerce platform, which will initially generate around

$5.00 in revenue per user. However, KinerjaPay Corp. (OTCQB:

KPAY) expects to see revenue per user rise to $15.00, as 2017

progresses.

KinerjaPay Corp. (OTCQB:

KPAY) is also the first e-commerce website in Indonesia to

accept Bitcoin as a form of currency, through its partnership

with Bitcoin

Indonesia. Through the

partnership, KinerjaPay Corp. (OTCQB:

KPAY) will not only allow Bitcoin holders to convert virtual

currency to Indonesian Rupiah in order to make digital payments,

but the company is also planning a Bitcoin mining platform for

consumers.

KinerjaPay Corp’s partnership with

Bitcoin Indonesia opens the door to Bitcoin Indonesia’s

150,000 Account holders and potential customers.

Overall, KinerjaPay Corp. (OTCQB:

KPAY) stands to benefit from its three-prong business model,

consisting of digital payment solutions, e-commerce marketplace,

and gaming rewards/loyalty program. Considering the global digital

payment industry is forecast to see revenues expand to $1.08

trillion and the relatively untapped Indonesian digital payment

market, KinerjaPay Corp. (OTCQB:

KPAY) is prime to benefit in a region where more prominent U.S.

digital payment options are not as popular.

Other Emerging Growth

News

MGT Capital Investments,

Inc.

MGT

Capital Investments (NYSE:

MGT), Inc. has been a phenomenon since May this year when the

stock climbed from the .20’s to almost $6.00 per share before

settling between the $3-4 dollar mark. EmergingGrowth.com first covered the story on May

9th.

link:

http://emerginggrowth.com/john-mcafee-returns-to-public-markets-as-mgt-capital-agrees-to-acquire-securityprivacy-technology/

EG

than followed up two day later with a spotlight on John McAfee

Himself. Link: http://emerginggrowth.com/emerginggrowth-com-spotlight-on-john-mcafee-rockstar-ceo/

It’s all about being at the right place at

the right time. Check out KinerjaPay (OTCQB:

KPAY)

Fannie Mae

Let’s

talk Finance, Let’s talk Payments. Fannie Mae (OTCQB:

FNMA), is a government-sponsored enterprise that was chartered

by Congress in 1938 to support liquidity, stability and

affordability in the secondary mortgage market, where existing

mortgage-related assets are purchased and sold.

After

four straight down trading sessions, the company saw an uptick to

the tune of almost 10% on news and an 8K from the day prior.

Sell on the news?

Look at KinerjaPay (OTCQB:

KPAY). Payment Processing, where it’s lacking the

most.

Amarin Corporation

Amarin Corporation (NASDAQ:

AMRN) noticed a 20% drop on Monday following their announcement

their REDUCE-IT Cardiovascular Outcomes Study of

Vascepa.

The

stock had it’s ups and downs on heavy volume since the end of July,

raning 56% from $2.19 through 3.43 per share. The

candlesticks resemble a bit of stabilization around the $2.70

mark.

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap

media portal with an extensive history of providing unparalleled

content for the Emerging Growth markets and companies.

Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

All information contained herein as

well as on the EmergingGrowth.com website is obtained from sources believed to

be reliable but not guaranteed to be accurate or all-inclusive. All

material is for informational purposes only, is only the opinion

of EmergingGrowth.com and should not be construed as an offer or

solicitation to buy or sell securities. The information may include

certain forward-looking statements, which may be affected by

unforeseen circumstances and / or certain risks. This report

is not without bias. EmergingGrowth.com has motivation by means of either

self-marketing or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://www.emerginggrowth.com/disclosure-5729/

Please consult an investment

professional before investing in anything viewed within.

When EmergingGrowth.com is long shares it will sell those shares. In

addition, please make sure you read and understand the Terms of

Use, Privacy Policy and the Disclosure posted on

the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: EmergingGrowth1@gmail.com

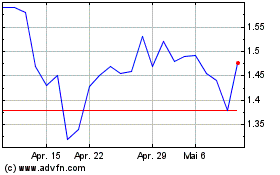

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024