Clear Blue Technologies International Inc. (TSXV: CBLU) (FRANKFURT:

OYA), the Smart Off-Grid™ Company, announces its financial results

for the second quarter of 2024 (“Q2 2024”) ending June 30, 2024. A

complete set of Financial Statements and Management’s Discussion

& Analysis (“MD&A”) has been filed at www.sedarplus.ca. All

dollar amounts are denominated in Canadian dollars.

On a Trailing Four Quarter (“TFQ”) basis:

- Revenue was

$6,212,370, a 278% increase from $1,644,227 in the corresponding

previous period, due to strong revenue growth across all four of

Clear Blue’s product lines;

- Recurring

revenue was $779,149 a 21% increase from $646,416 in the

corresponding previous period;

-

Gross Profit increased to $2,652,969 compared to $606,008 in the

comparable period, a 338% increase;

-

Gross margin percentage was 43% an increase over 37% with the

comparative TFQ period;

-

Non-IFRS Adjusted EBITDA* for the period was ($1,685,811) as

compared to ($3,639,495) for the previous period, a 54%

improvement.

For Q2 F2024:

-

Revenue was $1,014,690, a 35% increase from $752,325 in Q2

2023;

-

Recurring revenue comprised $169,106 of the quarter’s revenue

compared to $139,056 in Q2 2023, a 22% increase;

-

Gross Profit for Q2 2024 was $245,564 compared to $309,007 for Q2

2023, a 21% decrease. Gross Margin percentage for the quarter was

24%, decreased from 41% in the comparative quarter of 2023 due to

an unexpected one-time solar panel anti-dumping charge which the

Company is appealing and believes will be rescinded. Without this,

our Gross Margin for the quarter would have been 33%;

-

Non-IFRS Adjusted EBITDA was ($721,262) versus ($664,964) in Q2

2023, an 8% improvement from the comparative period of 2023;

-

As of June 30, 2024, bookings increased to $3,237,789, an increase

of 31%, when compared to $2,469,846 as of December 31, 2023.

F2024 Financial Outlook Since

the end of 2022, and in a turbulent business environment, Clear

Blue's core fundamentals have changed considerably. Management

believes Clear Blue’s H2 2024 will follow its 2023 trajectory,

wherein Q3 and Q4 represented the majority of the revenue for the

year. As all of Clear Blue’s one-time revenue is a capital budget

expense for our customers, annual budget and procurement cycles

tend to drive the majority of our shipments for Q3 and Q4.

Clear Blue's expanded product portfolio has

greatly increased our market reach and diversified our customer

base, driven by growing demand across a wider array of

applications. Our customers continue to advance their capital

project fundraising efforts with several of our long-term partners

approaching financing closings in Q3 or early Q4. Over the past two

years, management has contributed more than $2.5 million dollars,

making them the largest cash contributors to the enterprise,

alongside steadfast investor support. As the world leverages AI to

deliver the next evolution of performance against climate change,

Clear Blue’s large depository of data will enable us to cement our

competitive advantage in providing the most reliable solar power at

the lowest cost. This bodes well for significant order volumes and

strong growth for Clear Blue in the second half of 2024 and into

2025.

Please join our earnings call Tuesday morning at

11:00 am EDT to hear more about what we believe will be an exciting

fall:

Registration Link

https://us06web.zoom.us/webinar/register/WN_0FQ2Z2BiRW2jpcm6Rq9KJg

For more information,

contact:

Miriam Tuerk, Co-Founder and CEO+1 416 433

3952investors@clearbluetechnologies.com

www.clearbluetechnologies.com/en/investors

Nikhil Thadani, Sophic Capital+1 437 836

9669Nik@SophicCapital.com

About Clear Blue Technologies

International

Clear Blue Technologies International, the Smart

Off-Grid™ company, was founded on a vision of delivering clean,

managed, “wireless power” to meet the global need for reliable,

low-cost, solar and hybrid power for lighting, telecom, security,

Internet of Things devices, and other mission-critical systems.

Today, Clear Blue has thousands of systems under management across

37 countries, including the U.S. and Canada. (TSXV: CBLU) (FRA:

0YA) (OTCQB: CBUTF)

*Clear Blue’s Adjusted EBITDA is calculated on

the basis of Earnings before Interest, Depreciation, Amortization

expenses, and various non-cash items (including inventory

write-off, translation, and Stock-Based Compensation) and from

time-to-time certain one-time costs considered appropriate by

management.

Legal Disclaimer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release. Such securities have not been, and

will not be, registered under the U.S. Securities Act, or any state

securities laws, and, accordingly, may not be offered or sold

within the United States, or to or for the account or benefit of

persons in the United States or “U.S. Persons”, as such term is

defined in Regulation S promulgated under the U.S. Securities Act,

unless registered under the U.S. Securities Act and applicable

state securities laws or pursuant to an exemption from such

registration requirements.

Forward-Looking Statement

This press release contains certain

"forward-looking information" and/or "forward-looking statements"

within the meaning of applicable securities laws. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only Clear Blue’s beliefs

regarding future events, plans or objectives, many of which, by

their nature, are inherently uncertain and outside of Clear Blue's

control. Generally, such forward-looking information or

forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or may contain

statements that certain actions, events or results "may", "could",

"would", "might" or "will be taken", "will continue", "will occur"

or "will be achieved". The forward-looking information contained

herein may include, but is not limited to, information concerning

financial results and future upcoming contracts.

By identifying such information and statements

in this manner, Clear Blue is alerting the reader that such

information and statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Clear Blue to be

materially different from those expressed or implied by such

information and statements.

An investment in securities of Clear Blue is

speculative and subject to several risks including, without

limitation, the risks discussed under the heading "Risk Factors" in

Clear Blue's listing application dated July 12, 2018. Although

Clear Blue has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information and forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

In connection with the forward-looking

information and forward-looking statements contained in this press

release, Clear Blue has made certain assumptions. Although Clear

Blue believes that the assumptions and factors used in preparing,

and the expectations contained in, the forward-looking information

and statements are reasonable, undue reliance should not be placed

on such information and statements, and no assurance or guarantee

can be given that such forward-looking information and statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information

and statements. The forward-looking information and forward-looking

statements contained in this press release are made as of the date

of this press release. All subsequent written and oral forward-

looking information and statements attributable to Clear Blue or

persons acting on its behalf is expressly qualified in its entirety

by this notice.”

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release. Such securities have not been, and

will not be, registered under the U.S. Securities Act, or any state

securities laws, and, accordingly, may not be offered or sold

within the United States, or to or for the account or benefit of

persons in the United States or “U.S. Persons”, as such term is

defined in Regulation S promulgated under the U.S. Securities Act,

unless registered under the U.S. Securities Act and applicable

state securities laws or pursuant to an exemption from such

registration requirements.

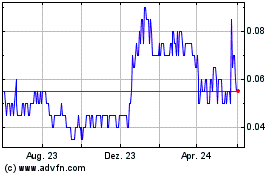

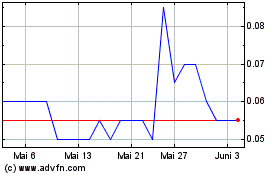

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024