Alphamin Resources Corp. (AFM:TSXV, APH:JSE AltX)( “Alphamin” or

the “Company”), is pleased to provide the following update for the

quarter ended June 2024:

- Record tin production of

4,027 tonnes, up 28% from the prior quarter

- Tin sales of 3,245

tonnes, with increased tin stocks from the expansion

expected to clear in Q3

-

EBITDA3 guidance of

US$54,2m, up 4% from the prior quarter

Operational and Financial Summary for

the Quarter ended June 20241

__________________________________________________________________________________________

1Information is disclosed on a 100% basis.

Alphamin indirectly owns 84.14% of its operating subsidiary to

which the information relates. Tin production includes tin produced

at Mpama South since 14 May 2024. 2Q2 2024 EBITDA and AISC

represent management’s guidance. 3This is not a standardized

financial measure and may not be comparable to similar financial

measures of other issuers.See “Use of Non-IFRS Financial Measures”

below for the composition and calculation of this financial

measure.

Operational and Financial Performance

The new Mpama South processing facility has been

producing tin concentrate to sales specification since 14 May 2024

and achieved commercial production on 17 May 2024. Accordingly,

AISC and EBITDA includes Mpama South from 17 May 2024. Tin sales

lagged production resulting in a limited contribution from the

expansion to EBITDA during the quarter. AISC guidance of

US$15,576/t is inclusive of the incremental Mpama South production

costs - the quarter-on-quarter increase in AISC is as a result of

the impact of the higher tin price on royalties, export charges,

net smelter returns and marketing fees.

Contained tin production of 4,027 tonnes for the

quarter ended June 2024 was 28% above the prior period. This

increase is a result of the Mpama South expansion. With only half

of the quarter benefiting from the expansion, we expect Q3 to

deliver a further increase in tin production.

Due to the expansion from mid-May 2024, ore

processed increased by 52% to 166,675 tonnes and the tin grade of

the feed ore reduced to 3,2%. This is in line with expectations as

the expansion targets a doubling of processing volumes and a

reduction in the overall tin grade to ~3%.

The Mpama South facility was originally targeted

to produce at a metallurgical recovery of 70% on the basis of a 2%

tin feed grade, which should result in a combined recovery of ~73%

going forward. The new plant outperformed during Q2 and achieved

recoveries in excess of 70% at an average feed grade of 2,2%.

Tin sales decreased by 21% to 3,245 tonnes – the

comparative quarter recorded exceptionally high sales volumes as

the quarter cleared the backlog from low Q4 2023 sales due to poor

road conditions. The current quarter’s delay in tin sales should

clear during Q3 2024.

EBITDA for Q2 2024 is estimated at US$54,2m (Q1

2024: US$52,1m). The EBITDA variance compared to the prior quarter

was impacted by a 21% reduction in tin sales volumes and benefited

from a positive tin price variance of 20%. The additional tin

production from the expansion should translate into higher sales

volumes from Q3 2024 and accordingly contribute to EBITDA. The lag

in tin sales compared to production in Q2 2024 impacted EBITDA by

approximately US$15m.

Alphamin’s unaudited consolidated financial

statements and accompanying Management’s Discussion and Analysis

for the quarter ended 30 June 2024 are expected to be released on

or about 23 August 2024.

Qualified Person

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering

(Mining), is a qualified person (QP) as defined in National

Instrument 43-101 and has reviewed and approved the scientific and

technical information contained in this news release. He is a

Principal Consultant and Director of Bara Consulting Pty Limited,

an independent technical consultant to the

Company._________________________________________________________________________________________

FOR MORE INFORMATION, PLEASE CONTACT:

Maritz

Smith CEO Alphamin

Resources

Corp. Tel:

+230 269 4166E-mail: msmith@alphaminresources.com

CAUTION REGARDING FORWARD LOOKING

STATEMENTS

Information in this news release that is not a

statement of historical fact constitutes forward-looking

information. Forward-looking statements contained herein include,

without limitation, statements relating to EBITDA and AISC guidance

for Q2 2024; timing regarding the clearance of the backlog in tin

sales; expectations regarding Mpama South plant recoveries and

expectations regarding a further increase in tin production in Q3

2024; expectations regarding an increase to processing volumes and

a reduction in the tin grade processed. Forward-looking statements

are based on assumptions management believes to be reasonable at

the time such statements are made. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Although Alphamin has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. Factors

that may cause actual results to differ materially from expected

results described in forward-looking statements include, but are

not limited to: ongoing processing recoveries at the Mpama South

plant and the availability of ore at expected quantities and

grades, uncertainties regarding global supply and demand for tin

and market and sales prices, uncertainties with respect to social,

community and environmental impacts, uninterupted access to

required infrastructure and third party service providers,

uncertainties regarding the state of inbound and outbound roads and

truck availabilities, adverse political events and risks of

security related incidents which may impact the operation or safety

of its people, uncertainties regarding the legislative requirements

in the Democratic Republic of the Congo which may result in

unexpected fines and penalties or the ability to continue with

normal operations, impacts of the global Covid-19 pandemic or other

health crises on mining operations and commodity prices as well as

those risk factors set out in the Company’s annual Management

Discussion and Analysis and other disclosure documents available

under the Company’s profile at www.sedarplus.ca. Forward-looking

statements contained herein are made as of the date of this news

release and Alphamin disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, except as required by

applicable securities laws.

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

USE OF NON-IFRS FINANCIAL PERFORMANCE

MEASURES

This announcement refers to the following

non-IFRS financial performance measures:

EBITDA

EBITDA is profit before net finance expense,

income taxes and depreciation, depletion, and amortization. EBITDA

provides insight into our overall business performance (a

combination of cost management and growth) and is the corresponding

flow driver towards the objective of achieving industry-leading

returns. This measure assists readers in understanding the ongoing

cash generating potential of the business including liquidity to

fund working capital, servicing debt, and funding capital

expenditures and investment opportunities.

This measure is not recognized under IFRS as it

does not have any standardized meaning prescribed by IFRS and is

therefore unlikely to be comparable to similar measures presented

by other issuers. EBITDA data is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

CASH COSTS

This measures the cash costs to produce and sell

a tonne of contained tin. This measure includes mine operating

production expenses such as mining, processing, administration,

indirect charges (including surface maintenance and camp and head

office costs), and smelting, refining and freight, distribution and

royalties. Cash Costs do not include depreciation, depletion, and

amortization, reclamation expenses, capital sustaining, borrowing

costs and exploration expenses. On mine costs, exclusive of stock

movement, are calculated on a cost per tonne produced basis, off

mine costs are calculated on a cost per tonne sold basis.

AISC

This measures the cash costs to produce and sell

a tonne of contained tin plus the capital sustaining costs to

maintain the mine, processing plant and infrastructure. This

measure includes the Cash Cost per tonne and capital sustaining

costs together divided by tonnes of contained tin produced. All-In

Sustaining Cost per tonne does not include depreciation, depletion,

and amortization, reclamation, borrowing costs, foreign exchange

gains and losses, exploration expenses and expansion capital

expenditures.

Sustaining capital expenditures are defined as

those expenditures which do not increase payable mineral production

at a mine site and excludes all expenditures at the Company’s

projects and certain expenditures at the Company’s operating sites

which are deemed expansionary in nature.

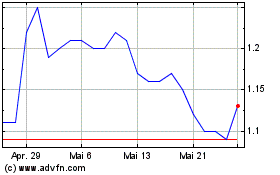

Alphamin Resources (TSXV:AFM)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Alphamin Resources (TSXV:AFM)

Historical Stock Chart

Von Feb 2024 bis Feb 2025