Adyton Resources Corporation (TSX Venture: ADY) (“Adyton”) is

pleased to provide an update on the current diamond drilling

program at its 100% owned Gameta Gold Project on Fergusson Island,

located within Papua New Guinea’s renowned “Rim of Fire”.

The assay results reported in this release

continue to confirm or exceed the results of historical RC drilling

and increase the confidence in the existing geological model.

Recent results have confirmed the existence of a higher-grade zone

of gold mineralisation. Encouragingly, ADD006 intersected

18.1m @ 4.88 g/t Au (from 60.7m), which is significantly

higher than intersections returned by nearby historical RC drill

holes (refer Figure 2).

Frank Terranova, Chairman, President and

Chief Executive Officer of Adyton commented, “These

results confirm and exceed the historical RC drilling results on

Gameta. The dual objective of expanding as well as increasing the

confidence in the Gameta Resource estimate remains on track. The

Adyton team is greatly encouraged by the drilling results received

to date and has initiated preliminary technical studies to further

identify the scope for possible accelerated production scenarios on

Fergusson Island. We look forward to reporting further results as

they are received”.

HIGHLIGHTS:

- High-grade gold assay results continue at the 100%

owned Gameta Gold Project

- Drilling program at Gameta extended. Work at 100% owned

Wapolu Gold Project accelerated

- Further drill results expected imminently with all

Gameta holes expected by 30 June 2021

- Significant results included:

- ADD006

- 18.10m (60.7 – 78.8m) @ 4.88 g/t

AuIncl 3.0m (75 - 78m) @ 14.21 g/t

AuIncl 1.0m (76 - 77m) @ 32.2 g/t Au

- ADD004

- 4.1m (65 – 69.1m) @ 0.87 g/t Au

- ADD005

- 6.50m (3 – 9.5m) @ 1.45 g/t AuIncl

1.5m (8 - 9.5m) @ 2.58 g/t Au

- ADD007

- 4.70m (1 – 5.7m) @ 1.43 g/t Au

- ADD008

- 3.0m (18 – 21m) @ 4.4 g/t Au

- 3.1m (92 – 95.1m) @ 0.81 g/t Au

The above results are a continuation of the recently announced

holes (TSX-V announcement dated 5 May 2021) which included 18.30m@

2.65 g/t Au, 27.20m @ 4.38 g/t Au, and 5m @ 2.01 g/t Au

The current results confirm or exceed historical RC drilling

results and are expected to support an increase in the confidence

in the existing Inferred Resource for the Gameta Project. Holes

ADD005 and 007 confirmed the outcropping at surface nature of the

mineralisation leading to confidence in existing resource models,

and ADD004 and ADD008 were drilled on the margin of the existing

resources to close off the ore boundaries in these areas as part of

various parameters relating to technical studies being

commenced.

The recent drilling results have led to an

extension to the initial drilling program with a further 6 holes

for circa 400 metres, testing extensions to the existing Resource

at Gameta. This release reports on the drill assay results from

five diamond drill (“DD”) holes, and when combined with previously

reported assay results, Adyton has received assay results from

eight of the forty planned holes totalling circa 3,400 metres.

In addition, a limited, targeted 400m diamond drill program has

been accelerated for the 100% owned Wapolu project also located

circa 30km north-west of Gameta on Fergusson Island to provide core

samples for technical studies (geotechnical and metallurgical) and

to confirm previous historical RC drilling.

Geological Overview:

Fergusson Island is one of the D’Entrecasteaux

Islands, which are in the western end of the Woodlark extension

(Woodlark Basin).

Adyton has three separate exploration projects

on Fergusson Island:

- The Gameta Gold Project, which

currently has a 360,000-ounce gold (oz Au) inferred mineral

resource (1).

- The Wapolu Project, which currently

has a 140,000 oz Au inferred mineral resource(1).

- Oredi Creek has widespread

epithermal gold mineralisation associated with a fault zone with

rock chips up to 1.4 g/t Au and a drill intersection of 70m @ 0.5

g/t Au from previous drilling programs. Importantly, this project,

although early stage, adds significant strategic value to the

Adyton landholding position on Fergusson Island.

The geological setting is dominated by

Miocene-Recent crustal thinning created by extension (stretching)

of the crust. This thinning has resulted in doming of metamorphic

core complexes separated from an over-thrusted sub-seafloor oceanic

mantle by a decollement (Detachment Fault Zone or DFZ), overlaying

ultramafic rocks of the obducted block.

Gold mineralisation is hosted in the DFZ and

within the footwall dioritic gneiss and appears to be both

fracture- and dyke-related, plus sulphide-hosted.

The mineralisation model for Gameta and Wapolu

suggests that gold is associated with hydrothermal fluids and is

concentrated in shallow-dipping deposits within or immediately

adjacent to the DFZ, which bounds the metamorphic core complexes.

This general setting is analogous to such deposits as Misima in PNG

and Mesquite and Picacho in California.

The gold occurs in association with fine

sulphides as disseminations and in epithermal quartz veins in

lensoid zones parallel to the DFZ. (2)

Drill Program Overview:

The current diamond drilling program at the

Gameta Project is testing continuity of mineralisation within the

DFZ and below into the gneissic footwall, as well as increasing

confidence on previous RC drilling programs from the mid-1990’s

within the existing inferred resource envelope (refer

Figure 1).

A graphic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6baf199-646e-4c5f-9179-b6356fa50d32

The drilling is focussed on the northern third (“the northern

ore zone”) of the known resources with a strike extent of over 700m

being tested (note the resource zone itself occurs over a strike

interval of 2,000m).

Testing is targeting the shallower open pitable

material, with drilling generally less than 120m and aims to

provide confirmatory data to support the results from historical RC

drilling programs ahead of an expected resource upgrade in Q3

2021.

Some extensional drilling is also part of the

program, testing below and down dip from known resources.

Current drilling:

To date, 30 holes have been completed for 2,700m

of diamond drilling. The original proposed program of 3,000m will

be extended by 400m to 3,400m to allow some infill drilling of the

higher-grade ore zones. It is expected that the extended program

will be complete by mid-June.Results have been returned from Holes

ADD001 to 008, with significant high-grade gold intercepts being

recorded on holes ADD001, 002, 003 (TSX-V Announcement 05 May 2021)

and 006 (reported in this release).

Holes ADD004, 005, 007 and 008 which are also

reported in this release confirm the geological interpretation,

further increasing confidence in existing geological models.

Hole ADD006 (Az

2200,

-700 dip, EOH

99.4m)(2),(3) was

proposed to test continuity of mineralisation between two

historical RC drill holes. Drilling from surface to 55.6m hanging

wall colluvium and altered ultramafics were cored. The drilling

target (the mineralised detachment shear zone) was intersected

between 55.6 – 76m, after which the hole passed into footwall

felsic / mafic gneiss being terminated at 99.4m

The whole target interval was mineralised, including an interval

of one metre at 32 g/t Au, which is extremely encouraging that we

are seeing significant Au grades within the main target area. The

hole reported a significant intersection of:

- ADD006

- 18.10m (60.7 – 78.8m) @ 4.88 g/t

AuIncl 3.0m (75 - 78m) @ 14.21 g/t

AuIncl 1.0m (76 - 77m) @ 32.2 g/t Au

ADD006 was drilled on the same

section as ADD005 (Az

2200,

-650 dip, EOH

105.5m)(2),(3) and

ADD008 (Az

2200,

-800 dip, EOH

108.2m)(2),(3).

ADD005 confirmed that the ore zone extended to

surface, and ADD008, whilst not intersecting the

strongly mineralised zone (it did intersect a shallower zone of

mineralisation between 18 – 21m, and a deeper interval between 92 –

95.1m) provided invaluable geological information to be used in the

next resource estimate. In particular, the understanding that the

target zone does appear to “pinch and swell” in certain areas, most

likely to do with structural controls.

A graphic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b9c8842-5096-41b3-8894-48c2433adb66

Figure 3 presents a details

view of cross section 27 which is located 100m to the north of #25,

Holes ADD007 (Az

2200,

-650 dip, EOH 60.0m) and

ADD004 (Az

2200,

-850 dip, EOH 99.8m)

reported in this release were drilled on the same section as the

previously reported ADD001 and ADD003 (see TSX-V Announcement dated

05 May 2021).

ADD007 intersected mineralisation at surface

confirming that the ore zone outcrops at surface in this area, and

continued into the footwall gneiss before being terminated at

60m.

ADD004 whilst not intersecting the mineralised

shear zone, did intersect a thick puggy clay zone indicating that a

fault may have been intersected, and a further follow up test hole

was completed from this drill pad but drilling in the opposite

direction to test for any continuation of mineralisation beyond the

fault.

A graphic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e3e44ea9-57d0-4898-95d9-4f32701fb2b1

Extension of Gameta drill program and

targeted drill program for the Wapolu Project

Based on the highly encouraging drill results

received to date from the Gameta drill program, the drill program

will be expanded to include an additional 6 diamond drill holes

totalling approximately 400m. The additional drill holes will test

extensions to the existing Gameta resource.

The Company has also decided to undertake a 400m

diamond drill program at the its 100% owned Wapolu project, also

located on Fergusson Island and which currently has a 140,000 oz Au

inferred mineral resource(1) The objectives of the Wapolu program

will be to provide geotechnical and metallurgical samples and to

confirm the results of historical RC drilling.

As part of the initial drilling program,

preliminary technical studies have also commenced to further

identify scope for accelerated production scenarios at the Gameta

Project.

ON BEHALF OF THE BOARD OF ADYTON RESOURCES

CORPORATION

Frank Terranova, Chairman, President and Chief Executive

Officer

For further information please contact:

Frank Terranova, Chairman, President and Chief Executive

Officer

E-mail: fterranova@adytonresources.com

Phone: +61 7 3854 2389

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

(1) Notes Regarding Inferred Mineral Resource

Estimates

- The Fergusson Island Project currently has a mineral resource

prepared in accordance with National Instrument 43-101 - Standards

of Disclosure for Mineral Projects (“NI 43-101”) dated December 17,

2020, which has outlined an initial inferred mineral resource of:

(i) at Gameta, 7.2 million tonnes at an average grade of 1.55 g/t

Au, for contained gold of 360,000 ounces, assuming a cut-off grade

of 0.8 g/t Au; and (ii) at Wapolu, 3.1 million tonnes at an average

grade of 1.42 g/t Au, for contained gold of 140,000 ounces,

assuming a cut-off grade of 0.8 g/t Au.

- See the NI 43-101 technical report entitled “NI 43-101

Technical Report on the Fergusson Gold Property, Milne Bay

Province, Papua New Guinea” (the “Fergusson Island Technical

Report”) dated February 1, 2021 and prepared for XIB by Mark Berry

(MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Ian Ryan

Roy (MAIG), each an independent mining consultant and “qualified

person” as defined in NI 43-101, available under Adyton’s profile

on SEDAR at www.sedar.com.

- The Feni Island Project currently has a mineral resource

prepared in accordance with NI 43-101 dated December 17, 2020,

which has outlined an initial inferred mineral resource of 19.9

million tonnes at an average grade of 1.01 g/t Au, for contained

gold of 650,000 ounces, assuming a cut-off grade of 0.8 g/t

Au.

- See the NI 43-101 technical report entitled “NI 43-101

Technical Report on the Feni Gold-Copper Property, New Ireland

Province, Papua New Guinea” (the “Feni Technical Report”) dated

February 1, 2021 and prepared for XIB by Mark Berry (MAIG), Simon

Tear (MIGI PGeo), Matthew White (MAIG) and Ian Ryan Roy (MAIG),

each an independent mining consultant and “qualified person” as

defined in NI 43-101, available under Adyton’s profile on SEDAR at

www.sedar.com.

(2) Information regarding drill holes and

exploration results reported in this release

|

Hole ID |

East |

North |

RL (m) |

Length (m) |

Az (deg) |

Dip (deg) |

From (m) |

To (m) |

Interval (m) |

Au g/t |

|

ADD004 |

256,971 |

8,959,148 |

15 |

99.8 |

220 |

-85 |

65 |

69.1 |

4.1 |

0.87 |

|

ADD005 |

256,955 |

8,958,983 |

36 |

105.5 |

220 |

-65 |

3 |

9.5 |

6.5 |

1.45 |

|

ADD006 |

257,025 |

8,959,057 |

17 |

99.4 |

220 |

-70 |

60.7 |

78.8 |

18.1 |

4.88 |

|

Including |

75 |

78 |

3 |

14.21 |

|

Including |

76 |

77 |

1 |

32.2 |

|

ADD007 |

256,909 |

8,959,077 |

21 |

60.0 |

220 |

-55 |

1 |

5.7 |

4.7 |

1.43 |

|

ADD008 |

257,056 |

8,959,088 |

15 |

108.2 |

220 |

-80 |

18 |

21 |

3 |

4.4 |

|

|

|

|

|

|

|

|

92 |

95.1 |

3.1 |

0.81 |

(Coordinates in UTM Zone 56, Southern Hemisphere (WGS84)

- All drilling has been carried out by Diamond Drilling, in PQ

and HQ core size.

- ADD005, ADD006 and ADD007 to the extent known has been drilled

perpendicular to / across the mineralised zone (the Detachment

Fault Zone DFZ) and were drilled within the existing inferred

resource zone, primarily to increase confidence in grade and

continuity from previous RC drilling programs carried out in the

1990’s.

- Holes ADD004, and 008 were drilled on the eastern margin of the

resource zone, to determine boundaries in the existing resource

model.

- Core recovery has generally been very good >95%.

- Sampling has been carried out on split core, with half being

sent for assay and half core remaining in the core trays.

- Nominal sampling intervals are 1.0m.

- Assays are not capped.

(3) Information regarding QA / QC procedures

in relation to exploration results reported in this

release

Gold assays have been carried out by Lead collection 50g charge

Fire Assay with AAS finish at Intertek Laboratories, Lae,

PNG, an accredited laboratory to ISO/IEC 17025 (2005) for

quantitative gold determination.

All assays have been subject to quality control measures

appropriate for diamond drilling where certified reference

materials / standards have been included in each batch of samples

submitted as part of the quality assurance / quality control

process.

Qualified Person

The scientific and technical information

contained in this press release has been prepared, reviewed, and

approved by Rod Watt, BSc Hons (Geo), FAusIMM, Chief Geologist and

a director of Adyton, who is a "Qualified Person" as defined by

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects ("NI 43-101"). Adyton Resources Corp press release dated

May 05, 2021: “The technical information in this press release has

been reviewed and approved by Rod Watt, who is a fellow of the

Australian Institute of Mining and Metallurgy (AusIMM)

and a Qualified Person as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

(NI 43-101). Mr. Watt consents to the inclusion of his

name in this release. Mr Watt verified the data disclosed in

this press release in accordance with industry standard best

practices, including sampling, analytical, and test data underlying

the information or opinions contained therein.

Forward looking statements

This press release includes “forward-looking

statements”, including forecasts, estimates, expectations, and

objectives for future operations that are subject to several

assumptions, risks, and uncertainties, many of which are beyond the

control of Adyton. Forward-looking statements and information can

generally be identified by the use of forward-looking terminology

such as "may", "will", "should", "expect", "intend", "estimate",

"anticipate", "believe", "continue", "plans" or similar

terminology. Forward looking statements in this news release

include plans for additional drill testing, the intention to

prepare additional technical studies, the timing of additional

drill results, and the preparation of a resource upgrade in Q3

2021. The forward-looking information contained herein is provided

for the purpose of assisting readers in understanding management's

current expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other

purposes. Forward-looking information are based on management of

the parties' reasonable assumptions, estimates, expectations,

analyses and opinions, which are based on such management's

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances, but which may

prove to be incorrect. Such factors, among other things, include:

impacts arising from the global disruption caused by the Covid-19

coronavirus outbreak, changes in general macroeconomic conditions;

changes in securities markets; changes in the price of gold or

certain other commodities; change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, industrial accidents, unusual or unexpected

formations pressures, cave-ins and flooding); discrepancies between

actual and estimated metallurgical recoveries; inability to obtain

adequate insurance to cover risks and hazards; the presence of laws

and regulations that may impose restrictions on mining; employee

relations; relationships with and claims by local communities and

indigenous populations; availability of and changes in the costs

associated with mining inputs and labour; the speculative nature of

mineral exploration and development (including the risks of

obtaining necessary licenses, permits and approvals from government

authorities); and title to properties. Investors are cautioned that

any such statements are not guarantees of future performance and

that actual results or developments may differ materially from

those projected in the forward-looking statements. Such

forward-looking information represents management’s best judgment

based on information currently available. No forward-looking

statement can be guaranteed, and actual future results may vary

materially. Readers are cautioned not to place undue reliance on

forward looking statements or information. Adyton Resources

Corporation undertakes no obligation to update forward-looking

information except as required by applicable law.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the

development of gold and copper resources in world class mineral

jurisdictions. It currently has a portfolio of highly prospective

mineral exploration projects in Papua New Guinea on which it is

exploring for copper and gold. The Company’s mineral exploration

projects are located on the Pacific Ring of Fire which hosts

several world class copper and gold deposits.

A graphic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d65b11d9-2221-4864-ae02-51cf881572c2

Adyton was formed by a reverse takeover transaction completed

with XIB I Capital Corporation on February 17, 2021 and commenced

trading on the TSX Venture Exchange under the symbol “ADY” on

February 24, 2021.

Adyton is also quoted on the Frankfurt Stock Exchange under the

code 701:GR.

For more information about Adyton and its projects, visit

www.adytonresources.com.

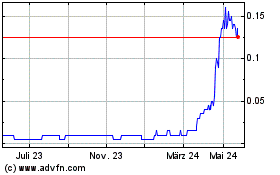

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

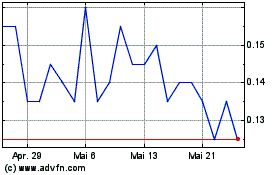

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025